Smart Tips About Cash Received From Customers Operating Activities

![[Solved] Statement of cash flows A summary of cash flows for Parker](https://media.cheggcdn.com/media/502/502f943c-1fe6-40e5-bfe1-9f867a3f486f/phpoh3VTF.png)

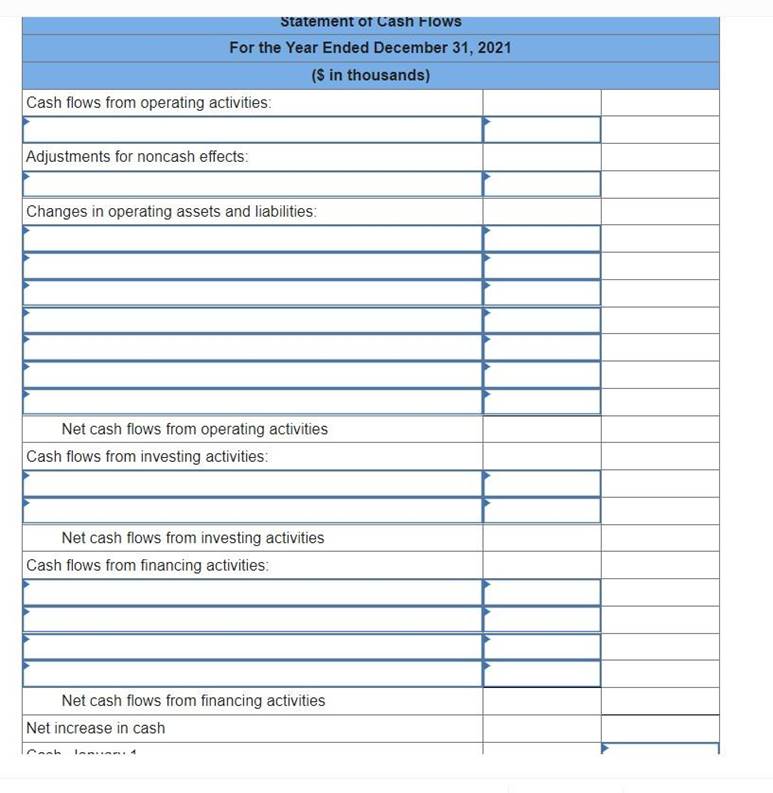

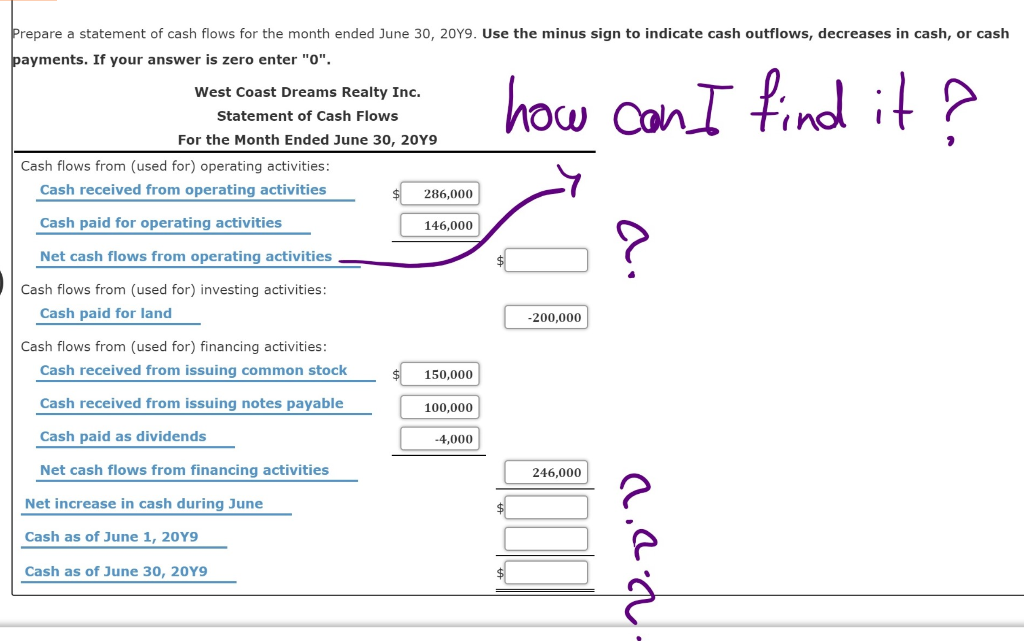

At the bottom of our cash flow statement, we see our total cash flow for the month:

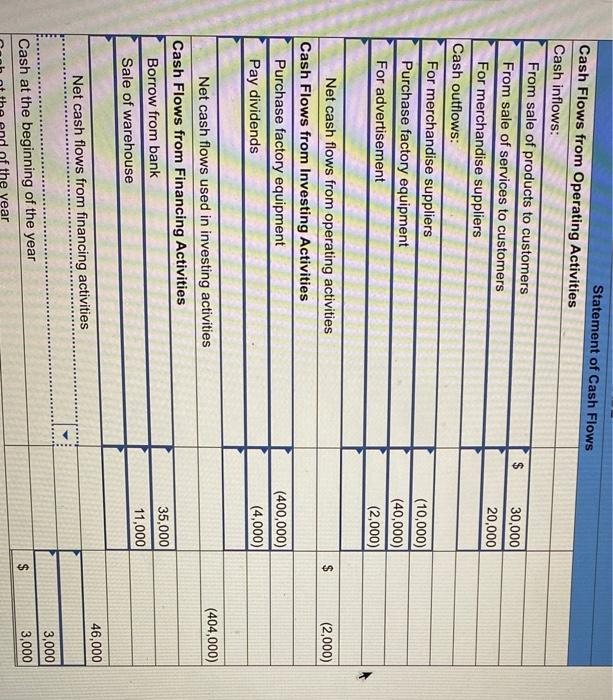

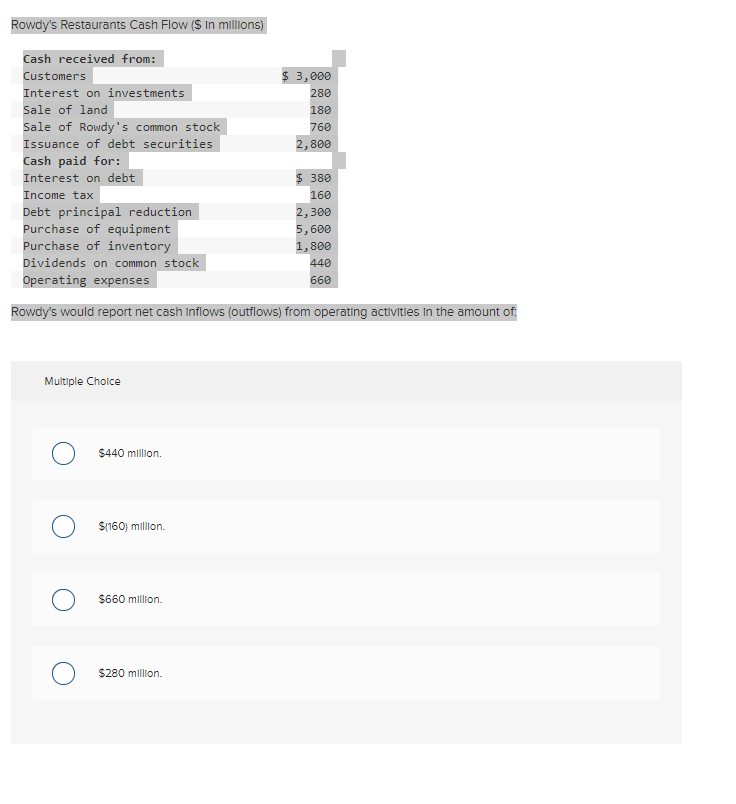

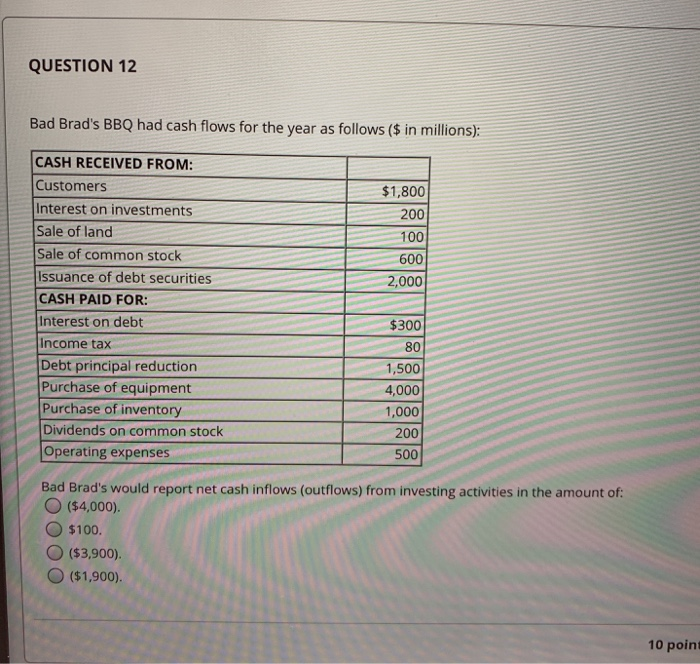

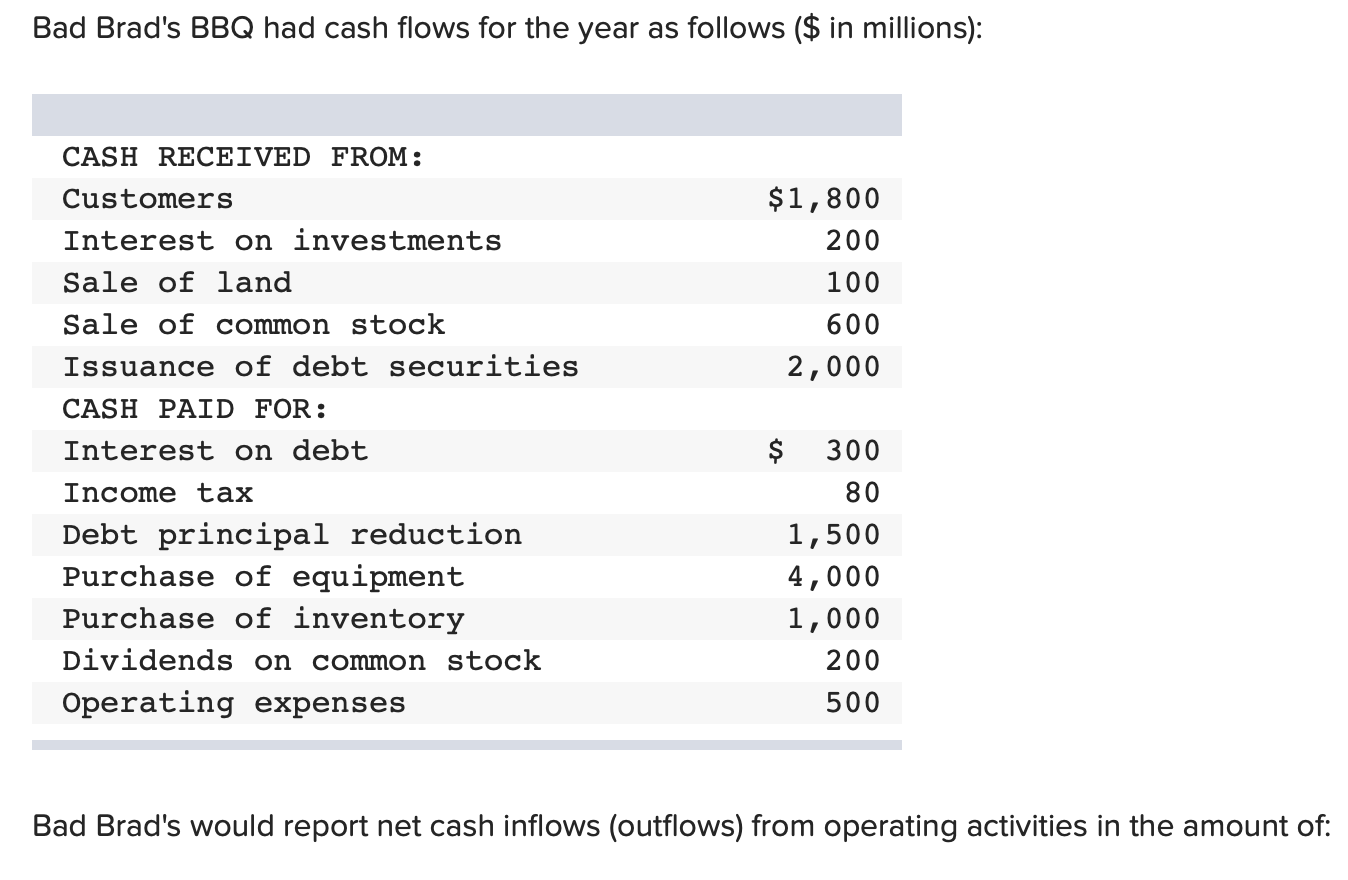

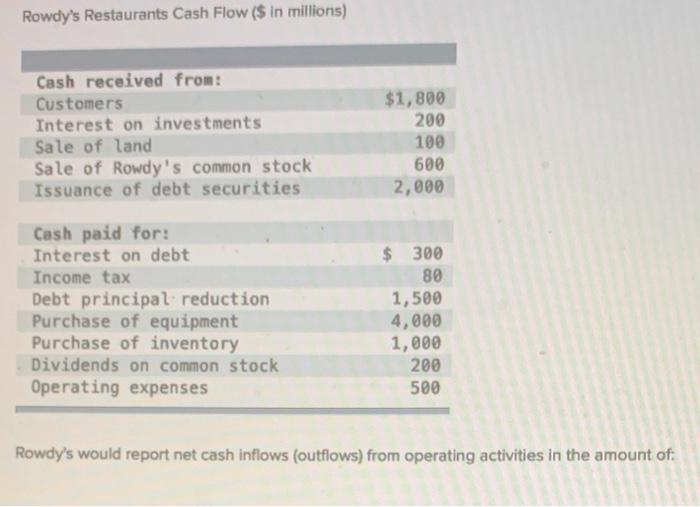

Cash received from customers operating activities. The operating cash disbursements or outflows generally include the following: Net cash flow from operating activities: Cash received from sales to customers :

Net cash from operating activities: (e) tax paid to government. Cash received from customers:

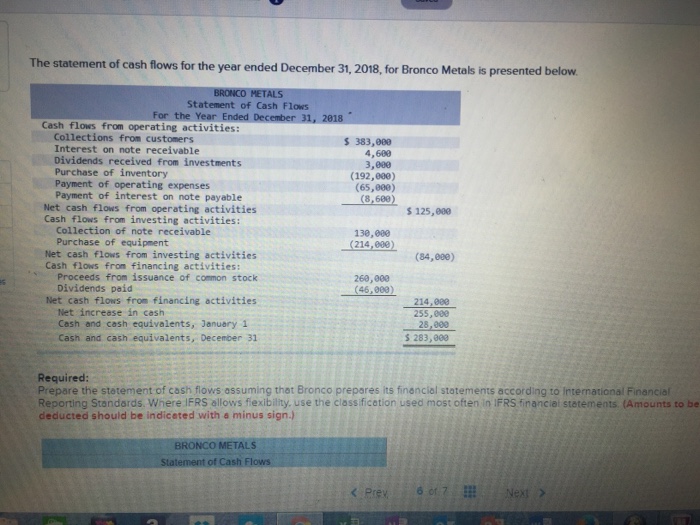

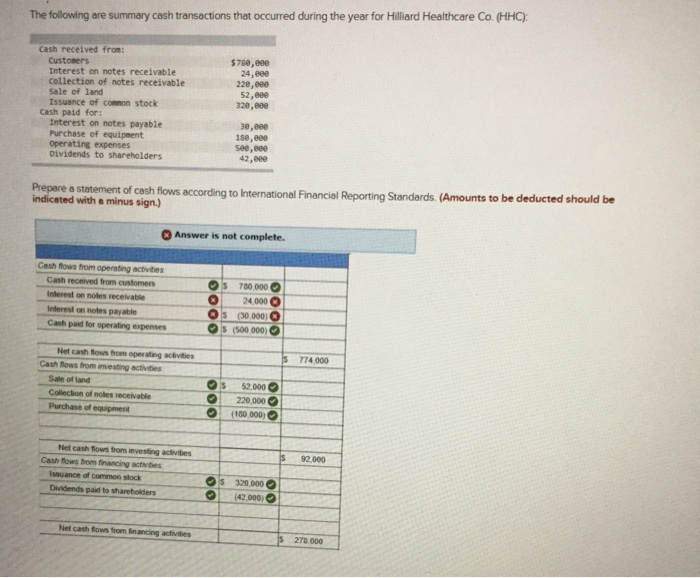

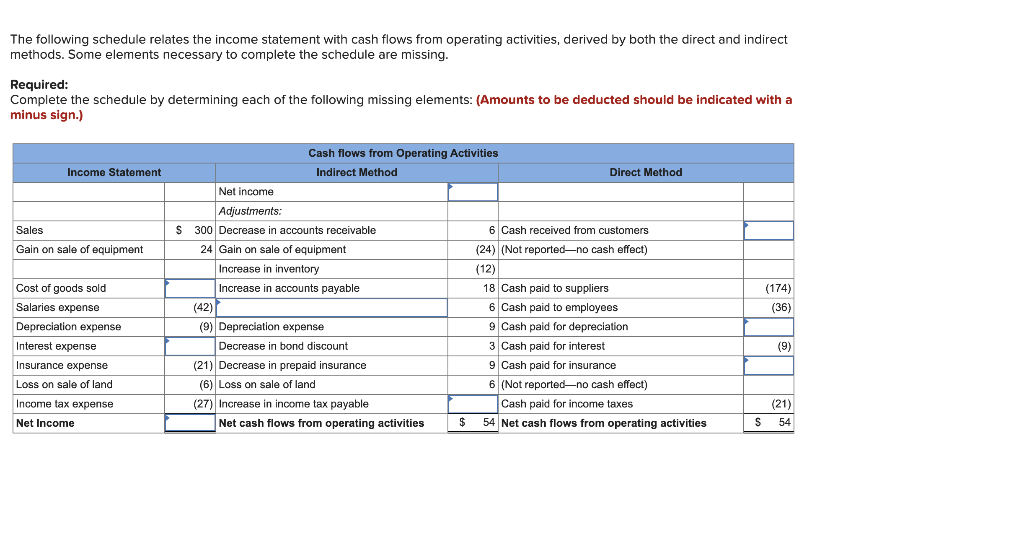

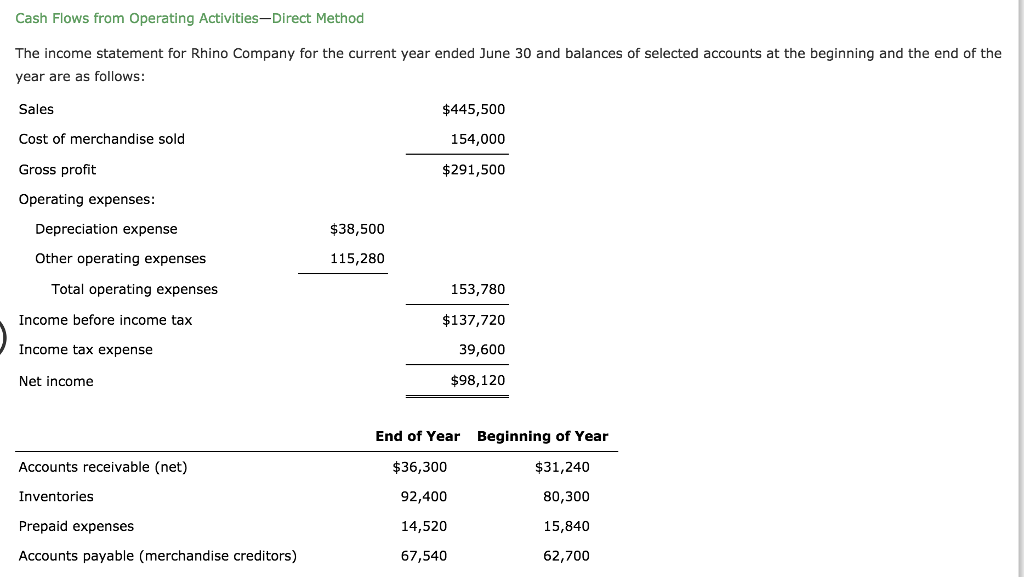

Using the direct method the cash flow from operating activities is calculated using cash receipts from sales, interest and dividends, and cash payments for expenses, interest and. Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. When a customer pays in cash (including via an electronic transfer made between accounts), you count that transaction as a cash increase in the operating activities cash flows.

This is the cash receipts from customers. Consumer bank capital one plans to acquire u.s. Cash flows from operating activities:

Interest paid (12,000) taxation paid (13,000) net cash from operating activities: Lower of cost or market 7m. For purchase of prepaid assets (4) −4,000:

Insurance proceeds not related to investing or financing activities; Examples of cash outflows from operating activities include: (c) cash paid to operating expenses (not depreciation, insurance, interest and tax).

That is, if your company is an online shoe retailer, then cash flow from operating activities tells you how much cash you’re. The direct method is intuitive as it means the statement of cash flow starts with the source of operating cash flows. Cash flow from operating activities.

The correct answer is b. $ 146,000 cash paid for expenses (81,000) cash paid to suppliers (47,500) $ 17,500: The ultimate purpose of any company that makes something is to eventually trade that something for money, and when that trade happens.

The statement effectively converts each line of the accruals based income statement into a cash based format. Salaries paid out to employees cash paid to vendors and suppliers cash collected from customers interest income and dividends received income tax paid and interest paid Cash flow for the month.

A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. Cash flow from operating activities (a.k.a. Receipts from customers for the sale of goods or supply of services;