Outstanding Tips About Cecl Financial Statement Disclosures

Crowe llp financial institutions example cecl disclosures november 2020 © 2020 crowe llp www.crowe.com this publication provides an example of the disclosure.

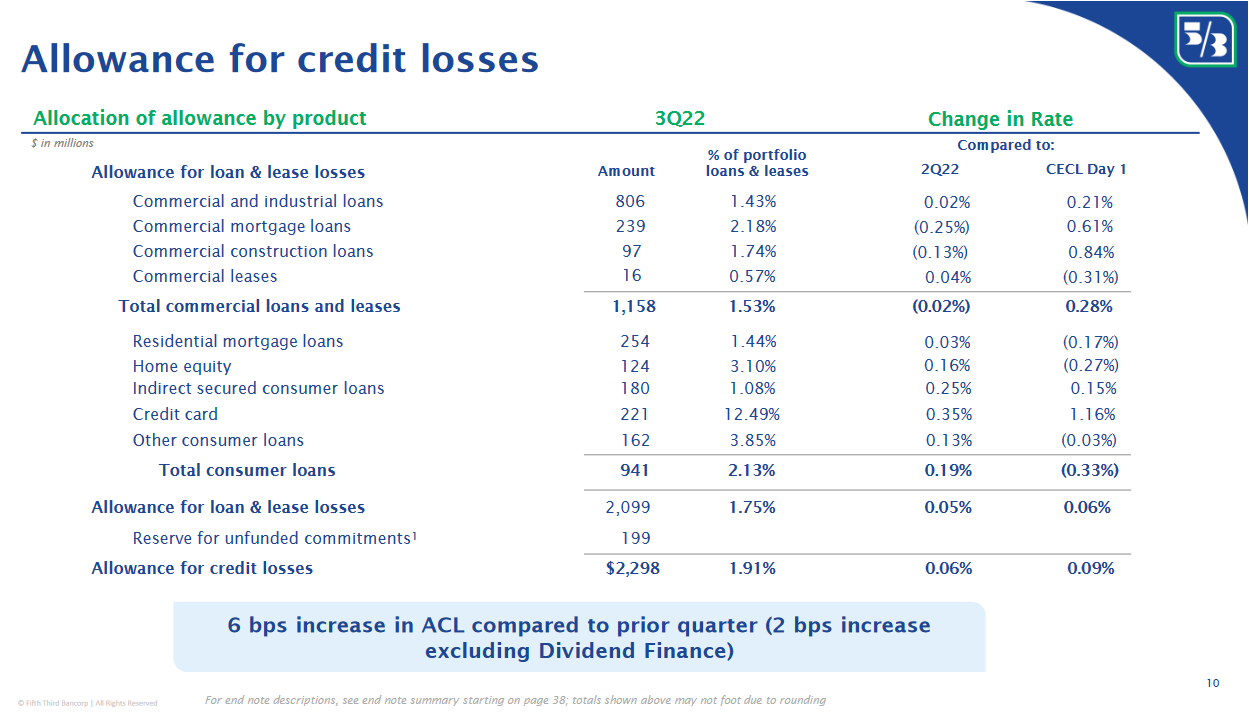

Cecl financial statement disclosures. The rules embedded in the new cecl standard require specific financial statement disclosures to be included in reported financial statements, to help. This guide is intended to assist financial institutions in preparing financial statement disclosures subsequent to adoption of cecl and is presented in three parts: The structure and granularity of an entity’s income statement and balance sheet does not to change, as the details of the cecl models are presented through.

(1) the diferent grouping conventions of portfolio. Moody’s analytics takes top ranking for cecl technology solution. The objective of the disclosures is to enable a user of the financial statements to understand the credit risk inherent in a portfolio and how management monitors the.

We have compiled these sample cecl disclosures based on our review of asc 326 and. Measurement of credit losses on. While many of the disclosures are similar to the current.

As institutions seek to find their “goldilocks” balance. Crowe llp financial institutions example cecl disclosures june 2019 © 2019 crowe llp www.crowe.com this publication provides an example of the disclosure. The new cecl accounting standard modifies the financial statement disclosure requirements.

Robby holditch director +1 (212). Plan ahead for financial statement disclosures under cecl. Bdo knows cecl:

The current expected credit losses ( cecl) standard (asc 326) was designed to provide greater transparency and understanding of credit risk by incorporating estimated, forward. This document is meant to provide sample cecl disclosures to assist financial statement in your disclosure efforts in the year of cecl adoption as well as ongoing disclosures.