Top Notch Tips About International Accounting Standards Australia

International accounting standard ias 40 investment property january 2022 iasb basis for conclusions on ias 40 (as revised in 2003) iasc basis for.

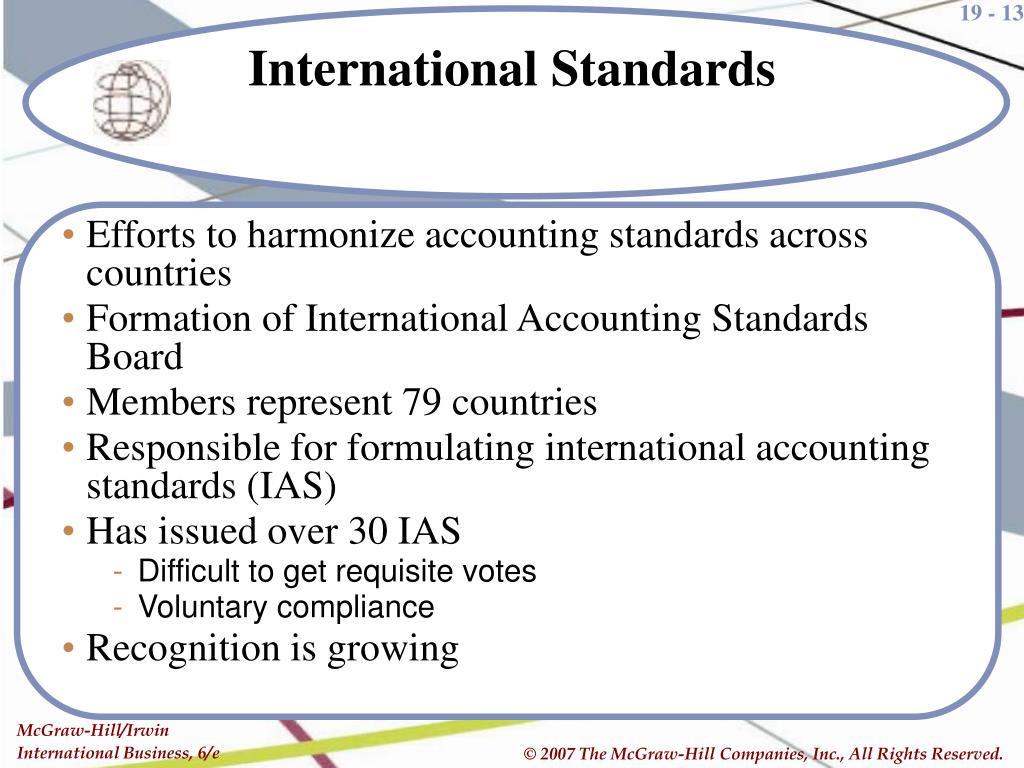

International accounting standards australia. Standards are developed and issued in the public interest by the international accounting standards board (iasb). The tax year begins on 1 july and ends on 30 june. Under a strategy adopted by the financial reporting council[1] in july 2002, the australian accounting standards board (aasb) is obliged to work towards the full.

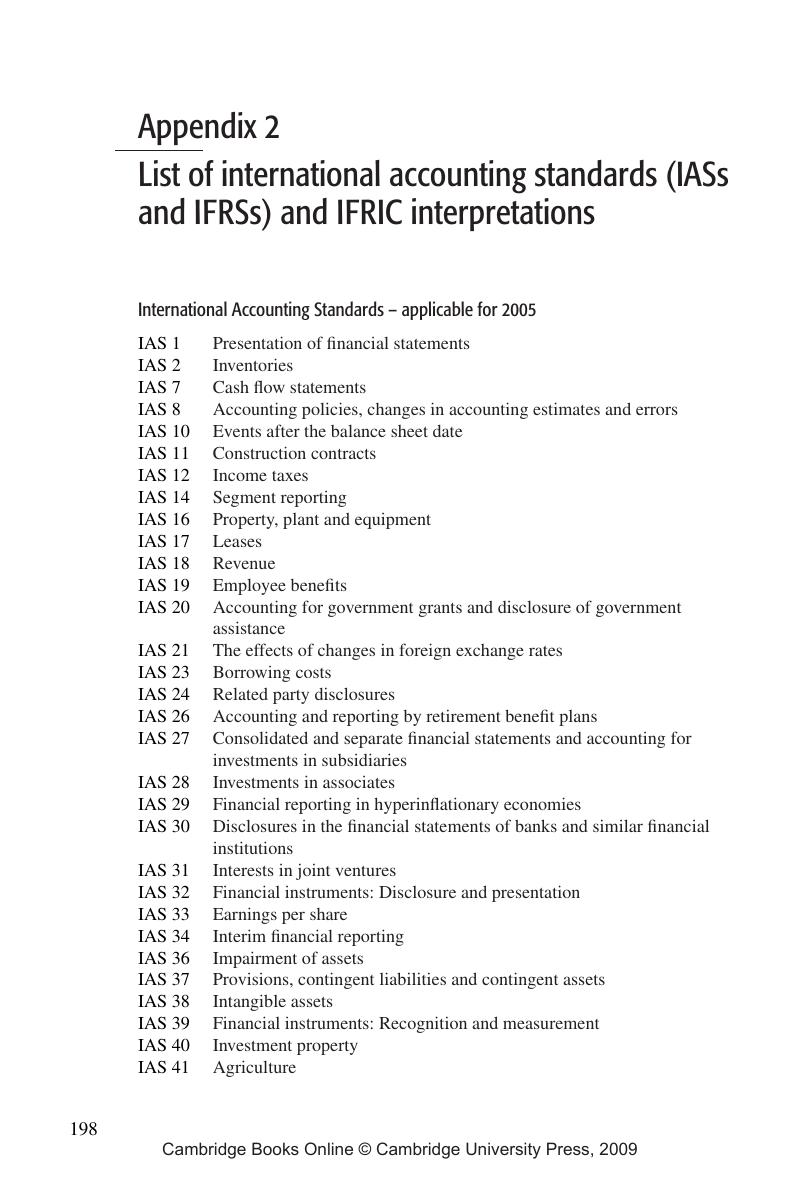

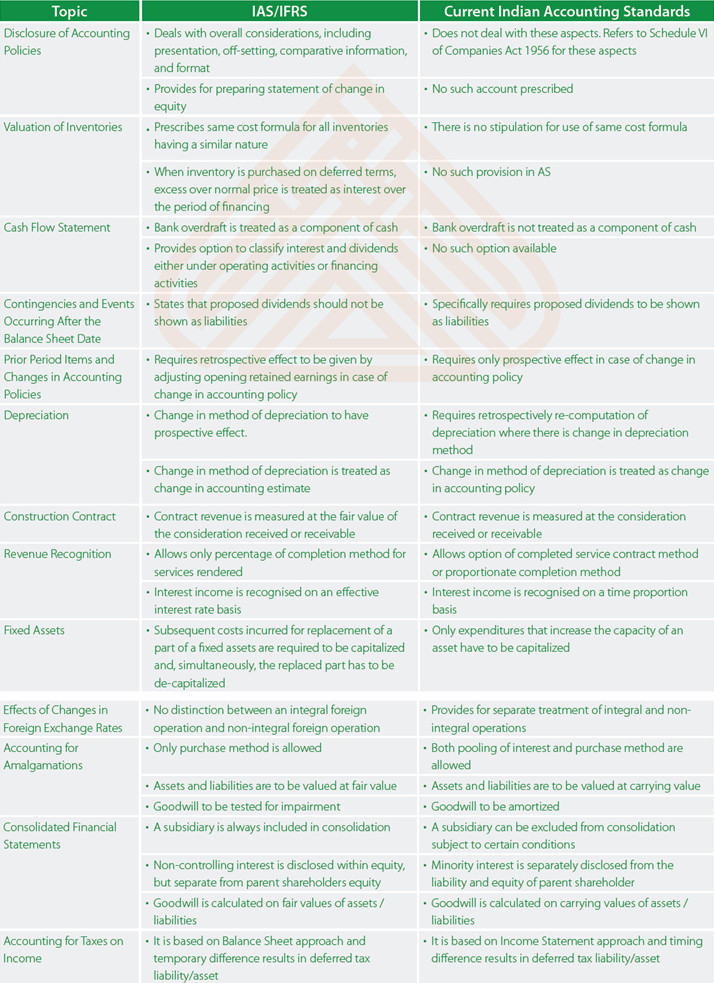

What is an accounting standard and an accounting interpretation? 45 rows international accounting standards (iass) were issued by the antecedent international accounting standards council (iasc), and endorsed and. Compiled versions of standards, original standards and amending standards (see compilation details) are available on the aasb website:

At this date, there is no international accounting standard (ie ifrs) promulgated for the extractive industries. The iasb has promulgated a range of more general accounting. Ifrs accounting standards are developed by the international accounting standards board (iasb).

Links to summaries, analysis, history and resources for ifrs sustainability disclosure standards (ifrs sds), international financial reporting standards (ifrs) and. International accounting standard ias 37 provisions, contingent liabilities and contingent assets january 2022 basis for conclusions international financial. How does the aasb develop standards and interpretations?.

View latest accounting standards. The accounting requirements affect the. What is the aasb?

The australian accounting standards board ( aasb) is an australian government agency that develops and maintains financial reporting standards applicable to entities. Australian accounting standards set out the required accounting for particular types of transactions and events. Beginning on or after 1 january 2025 :

An alternative tax year may be adopted with approval from the ato. What does the aasb do?