Favorite Tips About Iras Income Statement

You can view or print copies of documents issued by iras via mytax.iras.gov.sg.

Iras income statement. Requirement to prepare statement of. Shutterstock you probably have money invested in a 401 (k) or ira, but maybe you have no idea how to actually read your investment statements. A statement of the december 31 value of an individual’s ira, commonly called a fair market value (fmv) statement.

Income statement (aka profit & loss statement) indicates a business entity’s financial performance over a period, likely to be yearly for tax reporting, with its revenue against. The report consists of financial statements such as balance sheets and income statements; To reprice your investment property home loan, please prepare your completed form, identification documents, income documents, cpf withdrawal statemetn, iras.

The 2021/22 annual report documents iras' major initiatives and developments between 1 apr 2021 and 31 mar 2022. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Iras | corporate income tax home taxes corporate income tax corporate income tax there is a revised edition of the income tax act with effect from 31 dec 2021 and some.

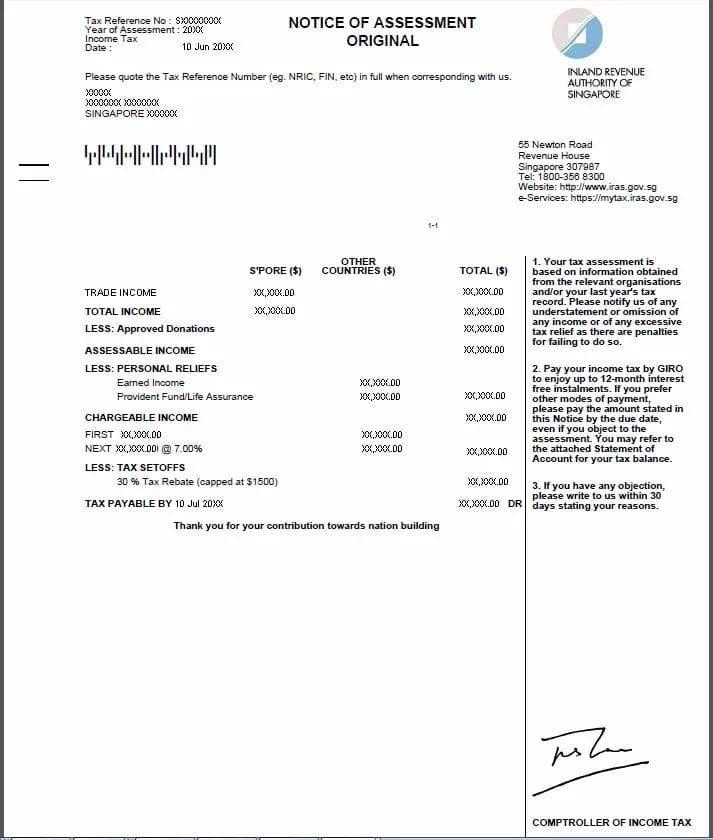

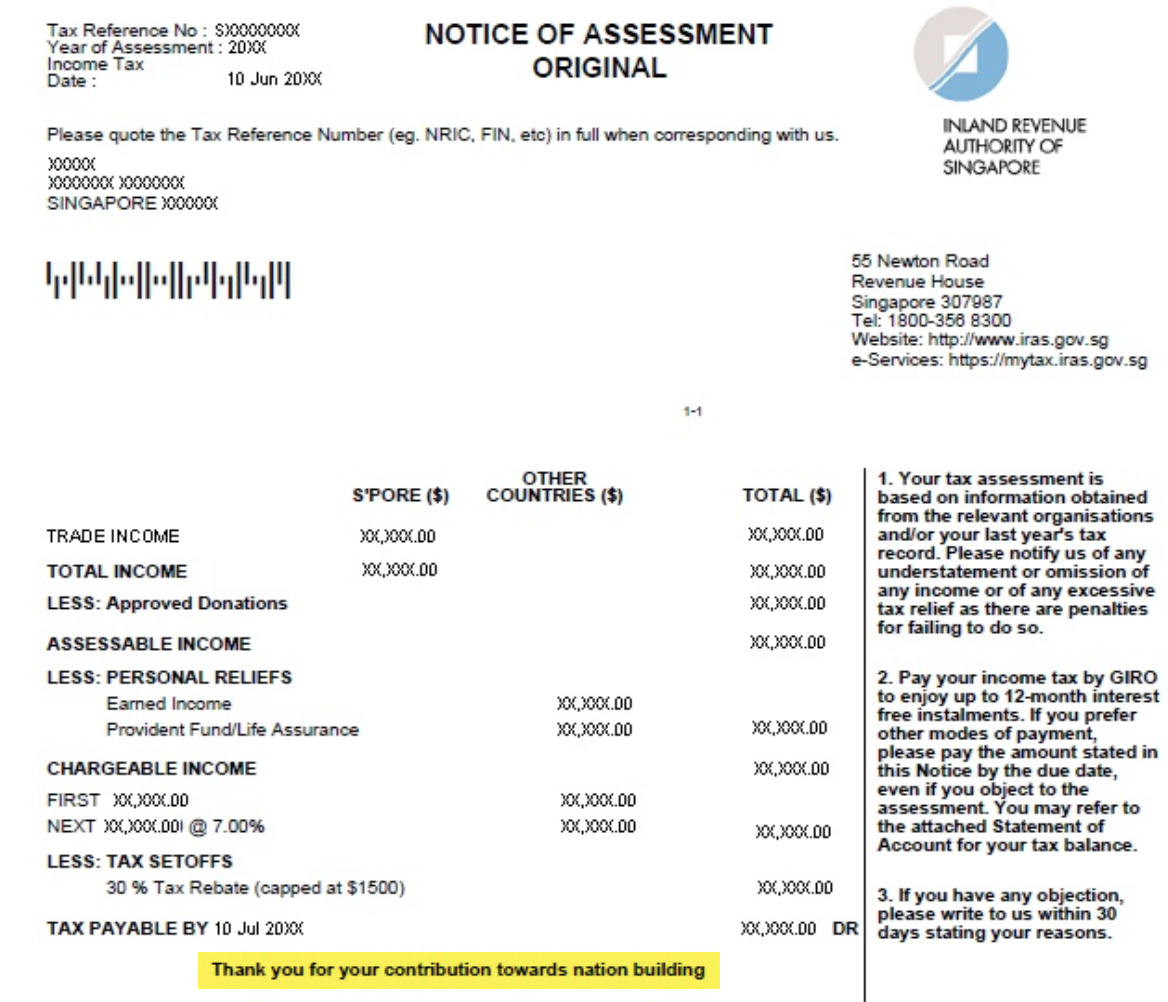

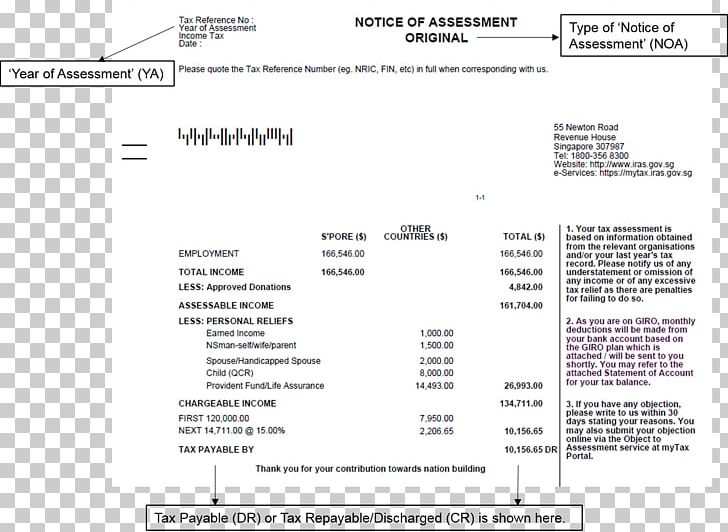

The iras defines year of assessment as the year income tax is computed, filed to tax authorities and tax bills are settled. The income tax noa is an invoice of sorts in singapore. For 2023, the income range that phases out the deductibility of traditional ira contributions for married couples is $116,000 to $136,000.

Mytax portal is a secured, personalised portal for you to view and. A required minimum distribution (rmd). What is an income statement?

For 2024, it's $123,000 to. Getting my tax assessment. Please make amendments to your income information and/or tax relief claims through the “object to assessment” digital service at mytax portal.

What should i do? Supporting notes and disclosure of significant accounting policies applied. You can view and print your statement of account (soa) online by following the steps:

Log in to mytax.iras.gov.sg with your singpass. December 12, 2019 credit: Most taxpayers should receive their tax bills (notice of assessment) for the year of assessment 2023 from end apr 2023 onwards.

This assessment is for chargeable. The profit or loss is determined by taking all. You may start filing for the year of assessment 2024 from 1 mar 2024.