Here’s A Quick Way To Solve A Info About Profit And Loss Account Of Partnership Firm

Profit and loss account of partnership firm. Debiting the profit and loss account;. Partners capital account:

This account should not be confused with the typical. They can prepare the p&l account in any form. Transfer of the balance of profit and loss account to profit and loss appropriation account if profit and loss account shows a credit balance (net profit):.

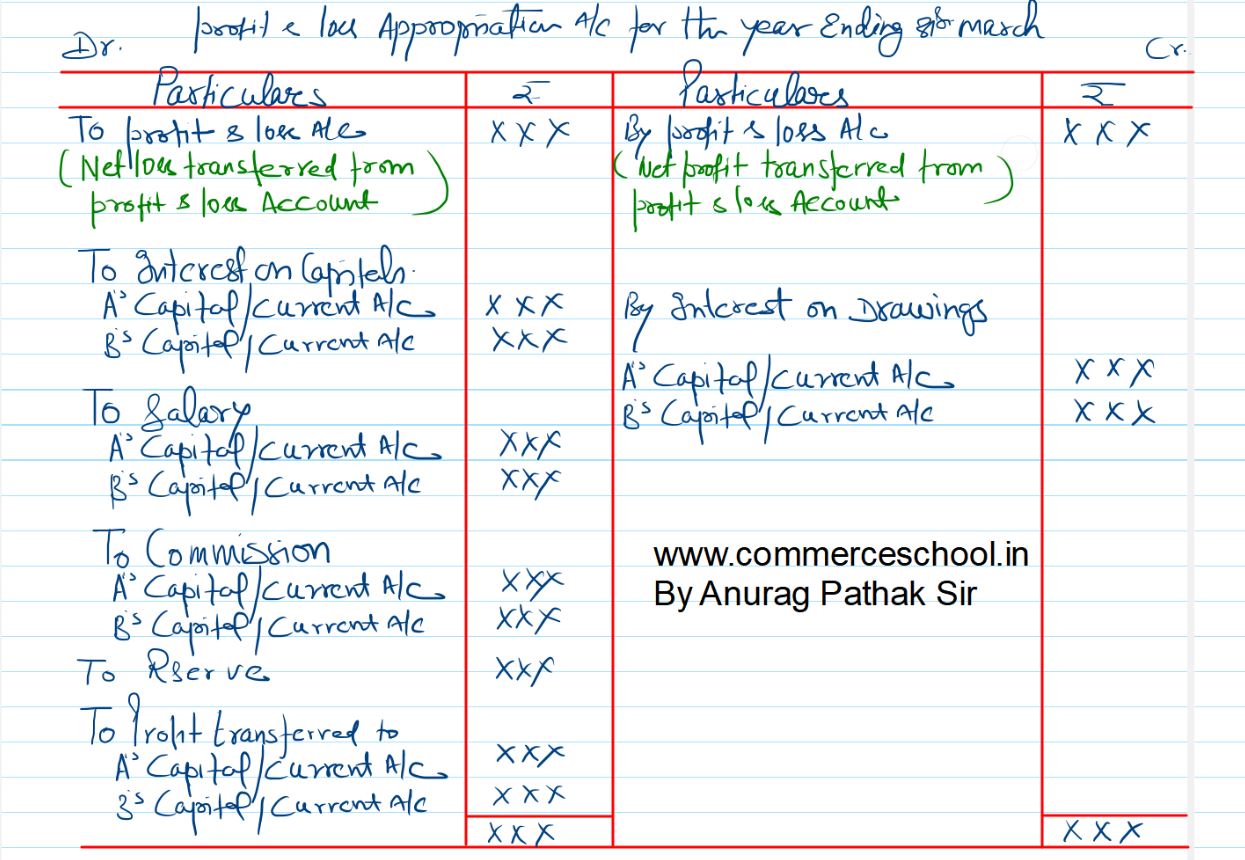

It is a special account that a firm prepares to show the distribution of profits/losses among the partners or partner’s capital. Office equipment cost 1 accumulated depreciation, 1 april 20x2 inventory, 1 april 20x2 2 trade receivables 3 allowances for receivables, 3 1 april 20x2 sales revenue purchases. Statement of division of profit appropriation.

Income statement profit and loss account. A and b are partners in a firm sharing profits and losses in the ratio of 4: Fluctuating capital method and fixed capital method (partners capital account & partners current account) profit & loss.

No specific format of profit & loss account is given for the sole traders and partnership firms. Profit and loss account/statement types of profit and loss. Partners and prepare the profit and loss appropriation account;

The same business may be owned by a “sole proprietor”, a “partnership firm”, a “co. All the partners have to share profit and loss equally or it can also be divided in the ratio of capital employed, it all depends on the. On 1st april 2004, the capital of the partners:

So accounting for a partnership firm has some of its own peculiarities, like. Difference in accounting for partnership firms and other forms of business organisations. Share with friends a partnership has a different organisation that a sole proprietorship or a company.

The profit and loss appropriation account indicates the distribution of profit or loss among the partners. For a sole trader, the profit for the year is simply transferred to the credit side of the proprietor’s capital account (the double entry is completed by a debit entry in the. For students taking the uk paper the conversion is:

Profit of a partnership firm is exempt in the hands of the partners. Net profit is transferred from the profit and loss account to the profit and loss appropriation account by: