Awesome Info About Proforma Of Income Statement

Types of pro forma statement.

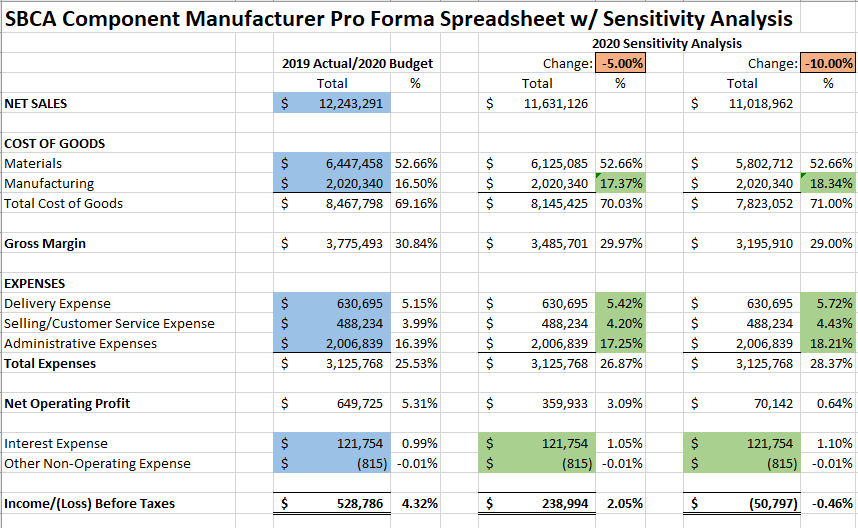

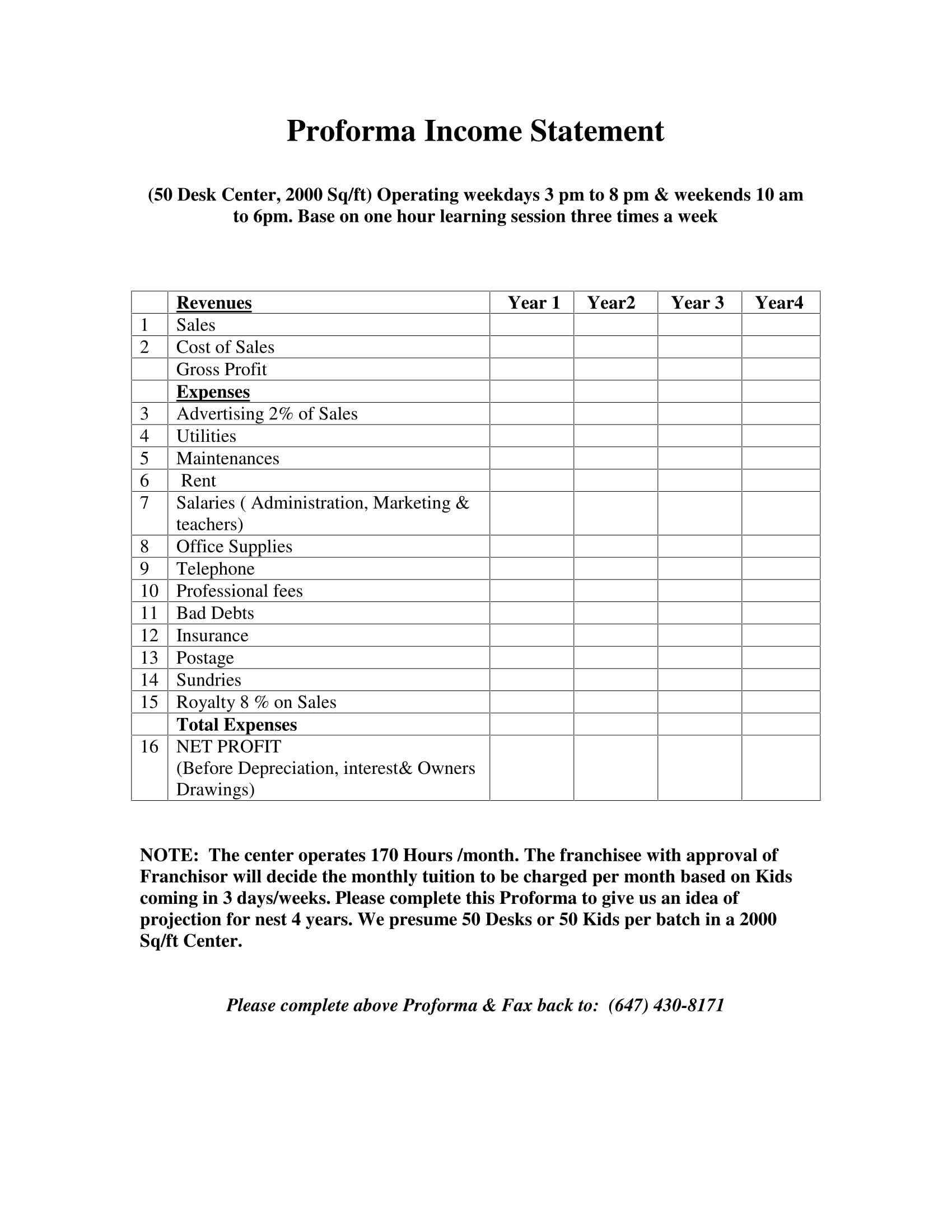

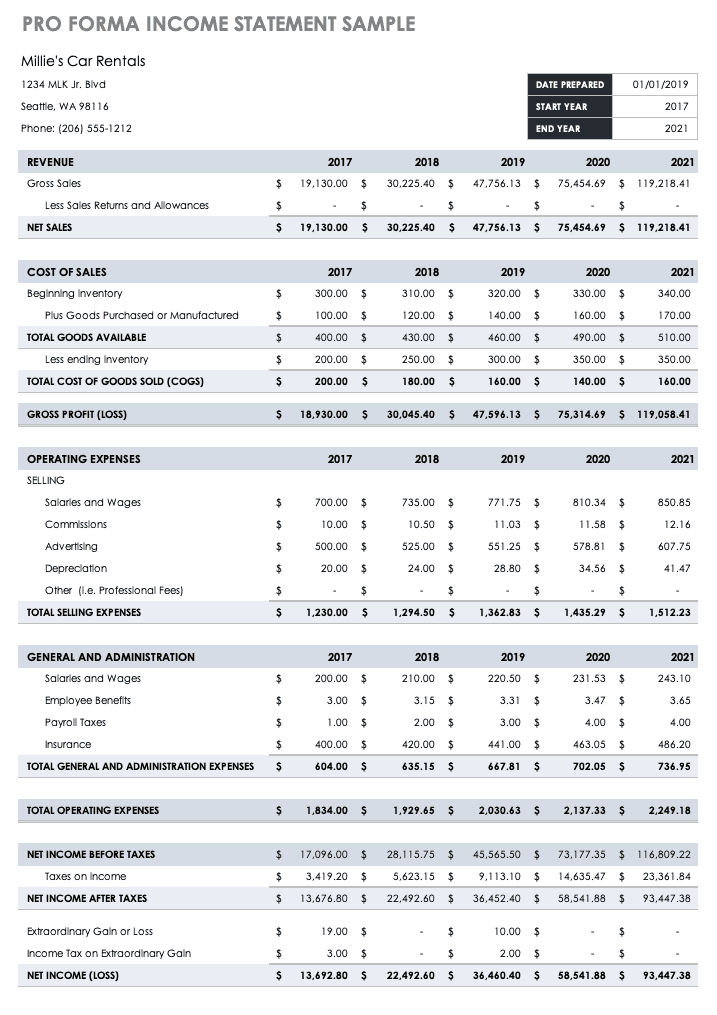

Proforma of income statement. In essence, it contains our financial goals. A pro forma income statement shows what potential sales revenue, expenses, taxes and depreciation might look like. What is a pro forma income statement?

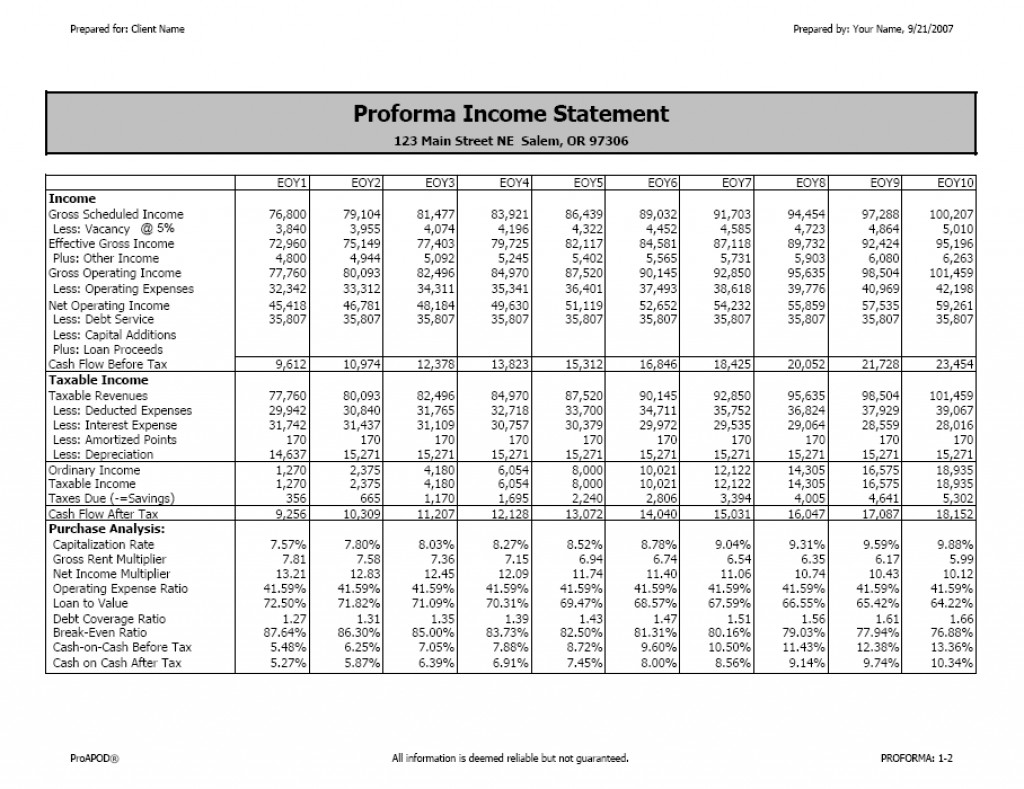

A pro forma income statement is an effective way to gain the attention of potential investors, convince them on your growth plans and seek funding. Free pro forma income statement & p&l template. Learn through our video guide, using the same template showcased in the video.

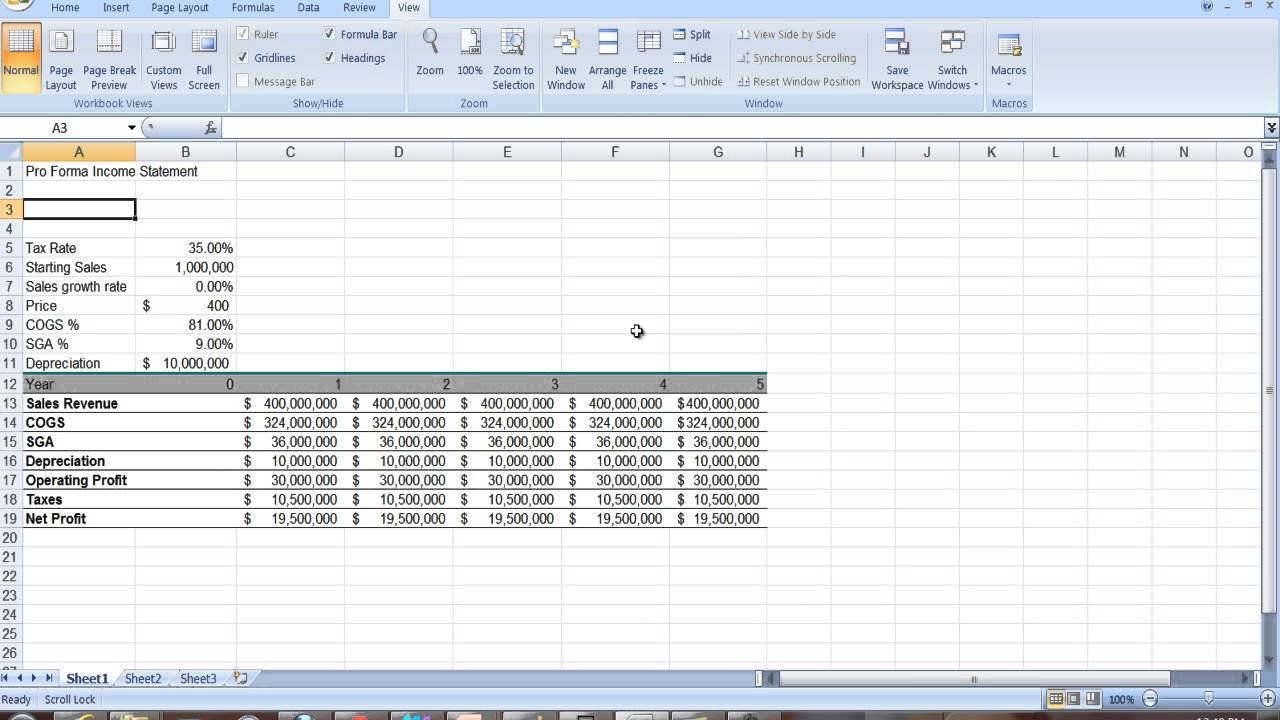

Pro forma statements are used to analyze the financial impact of a major business decision. Companies use it to see the real financial health on a monthly and annual basis. A pro forma income statement is simply a future version of an income statement.

Pro forma income statements are important because of the information they can offer a company. Pro forma income statement is an effective way to get ready for unforeseeable business hurdles, increased taxes, growth plans, and acquisitions. From an accounting perspective, pro forma financial statements are revenue and cost reports of a business based on an assumption or a fictitious scenario.

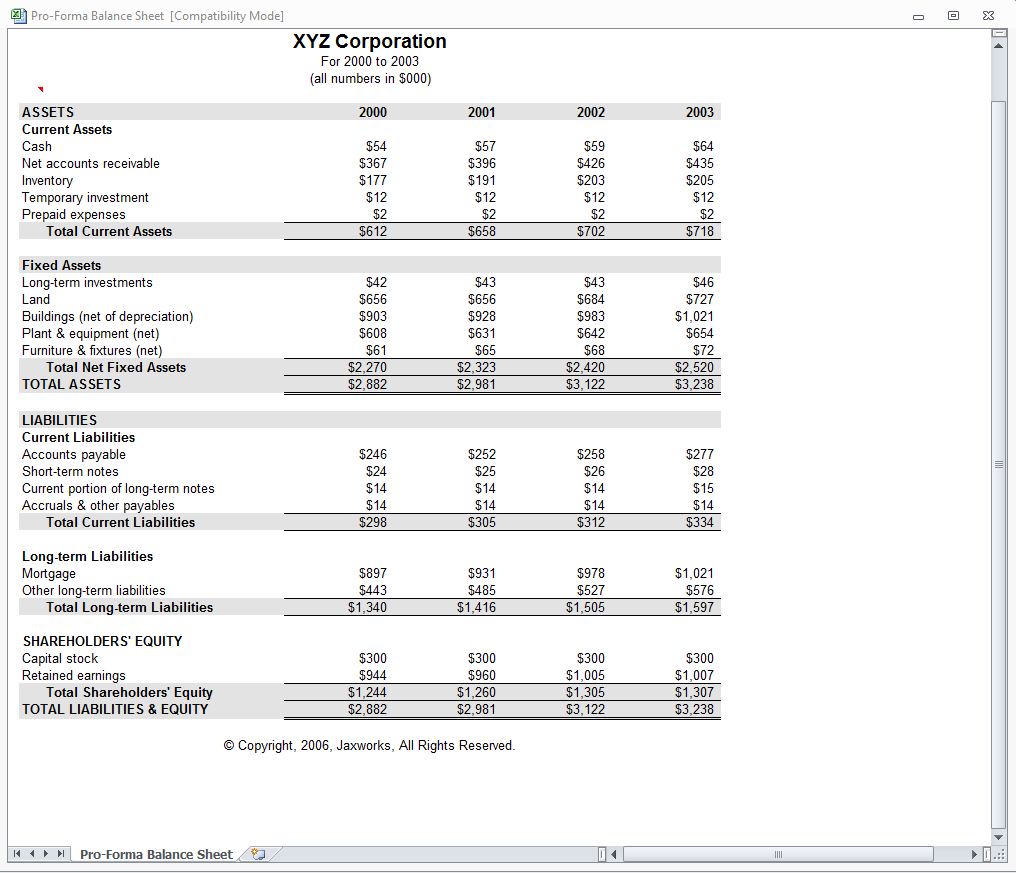

Potential investors need a pro forma income statement to assess a firm’s ability to generate increased sales and profits. A pro forma income statement, along with a pro forma cash flow and a pro forma balance sheet, form the primary financial projections for a business. A pro forma statement is an important tool for planning future operations

There are four main types of pro forma statements. Income statements depict a company’s financial performance over a reporting period. A pro forma income statement uses a calculation method designed to attract potential investors or to gauge potential earnings from certain business decisions, like mergers or acquisitions.

An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period. Pro forma income statement refers to the projected income statement by using assumptions and special projections by analysts. This type of financial statement has the following characteristics:

The pro forma income statement is a document that is a way to show your company's income if you exclude some costs. Pro forma statements try to predict the effects of. Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions.

A pro forma income statement is a document that shows a company's adjusted income if certain financial entries have been removed in a period of time. Generally speaking, to create a pro forma income statement, you’ll want to follow the below five steps. How to make a pro forma income statement.

Pro forma financials may not be. Since the term “pro forma” refers to projections or forecasts, it can apply to a variety of financial statements, including: Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.