Recommendation Info About Restricted Cash Balance Sheet Presentation

The cash balance of a company should consist of only.

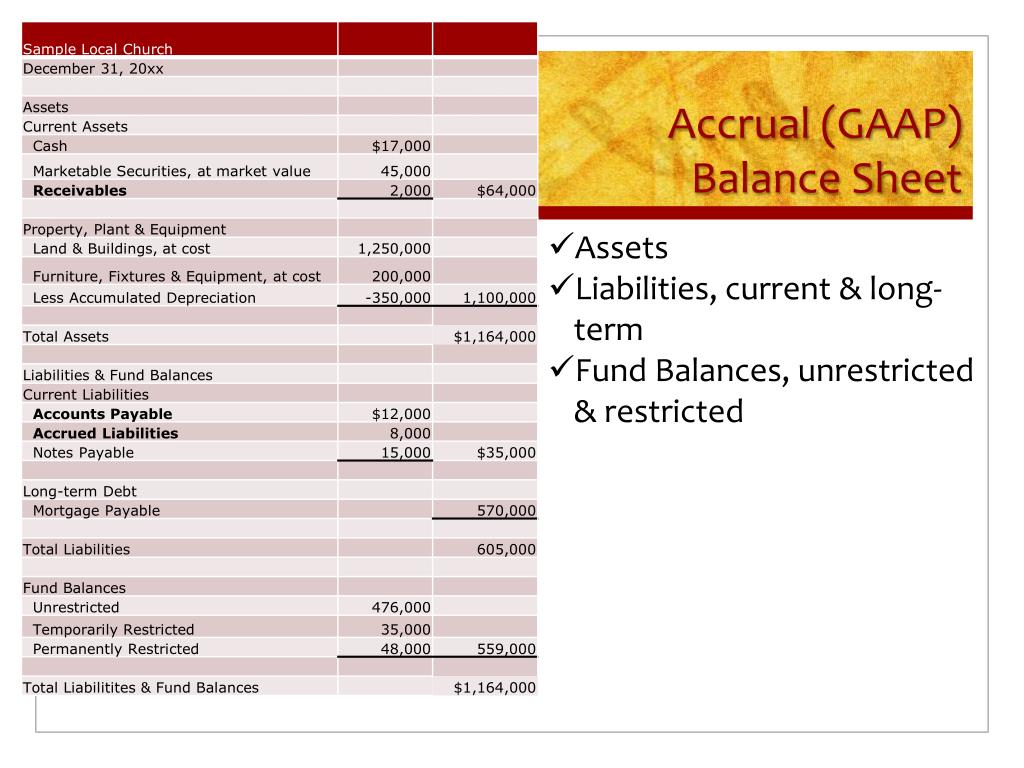

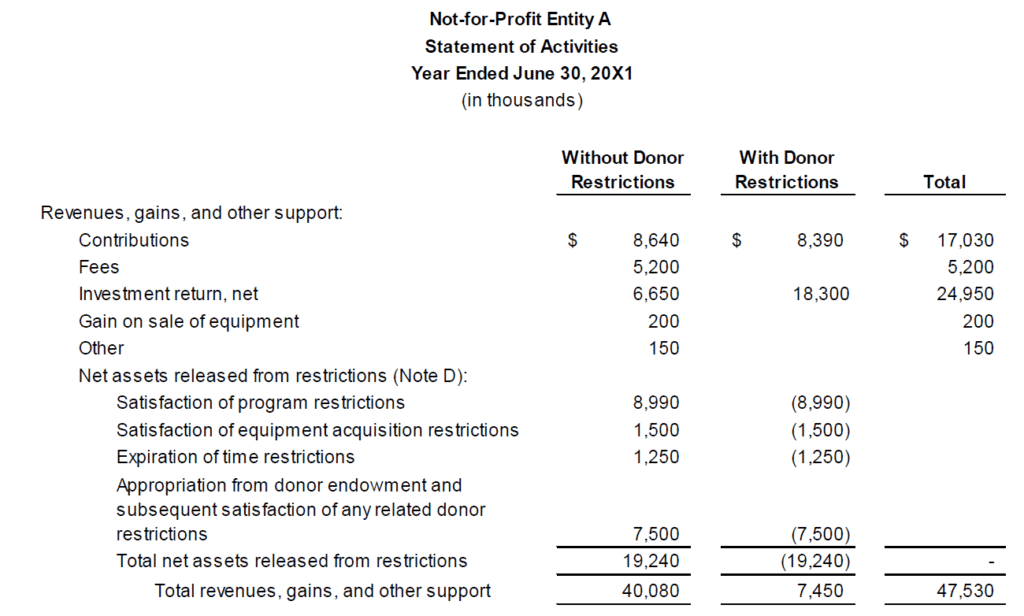

Restricted cash balance sheet presentation. Reporting entities are required to disclose (1) the nature of restrictions on cash balances and (2) how the statement of cash flows reconciles to the balance sheet when the balance sheet includes more than one line item of cash, cash equivalents, and restricted cash. If an entity has assets who’s use is restricted by donors, separate disclosure on the face of the balance sheets and in the footnotes should be provided. Should they present transfers between cash and restricted cash as operating, investing, or financing activities, or not?

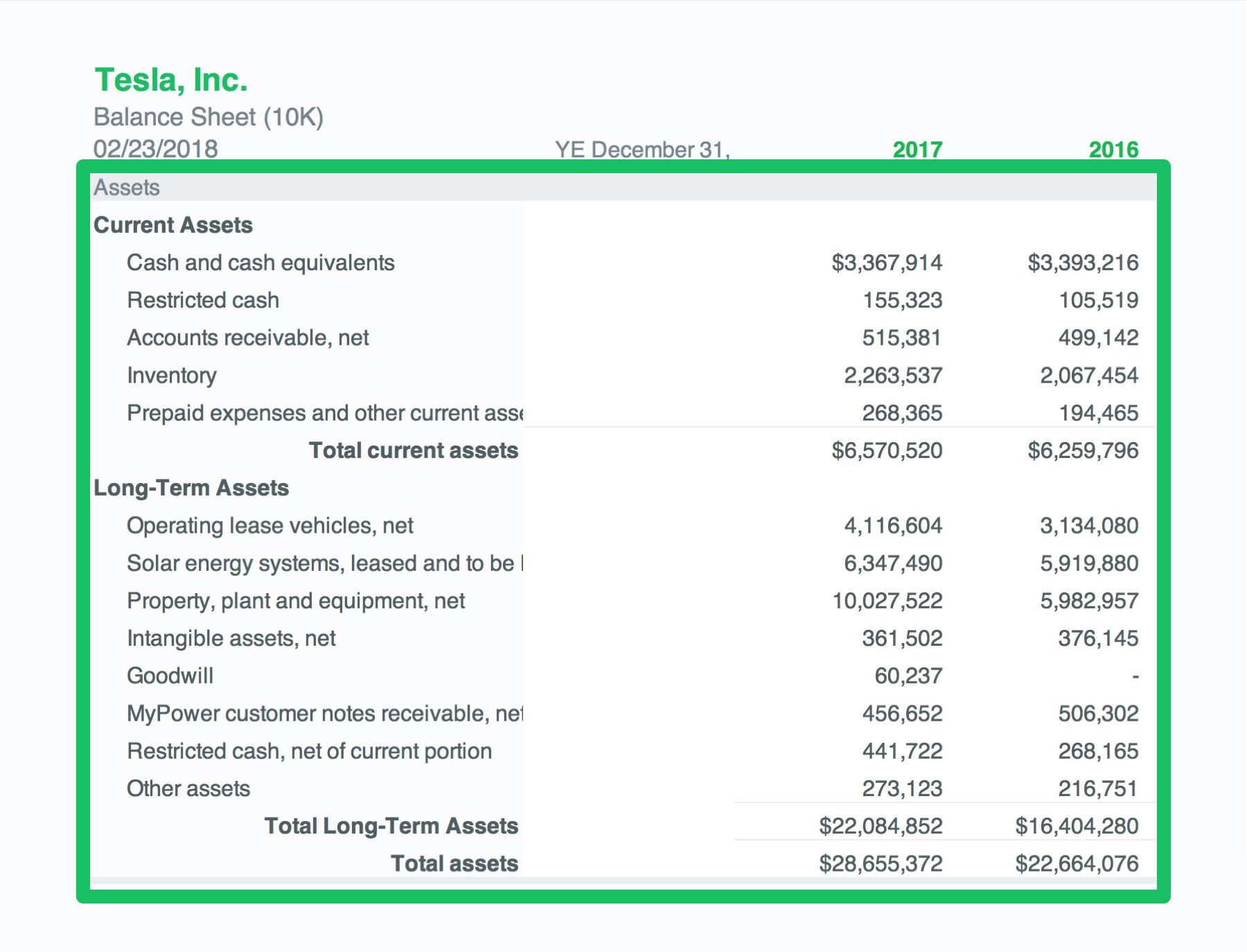

When cash, cash equivalents, restricted cash and restricted cash equivalents are disaggregated in the balance sheet, include a narrative or tabular reconciliation of the disaggregated amounts to the aggregated amount used in the statement of cash flows; Restricted cash appears separately from cash on the. The provisions of any restrictions should be described in a note to the financial statements.

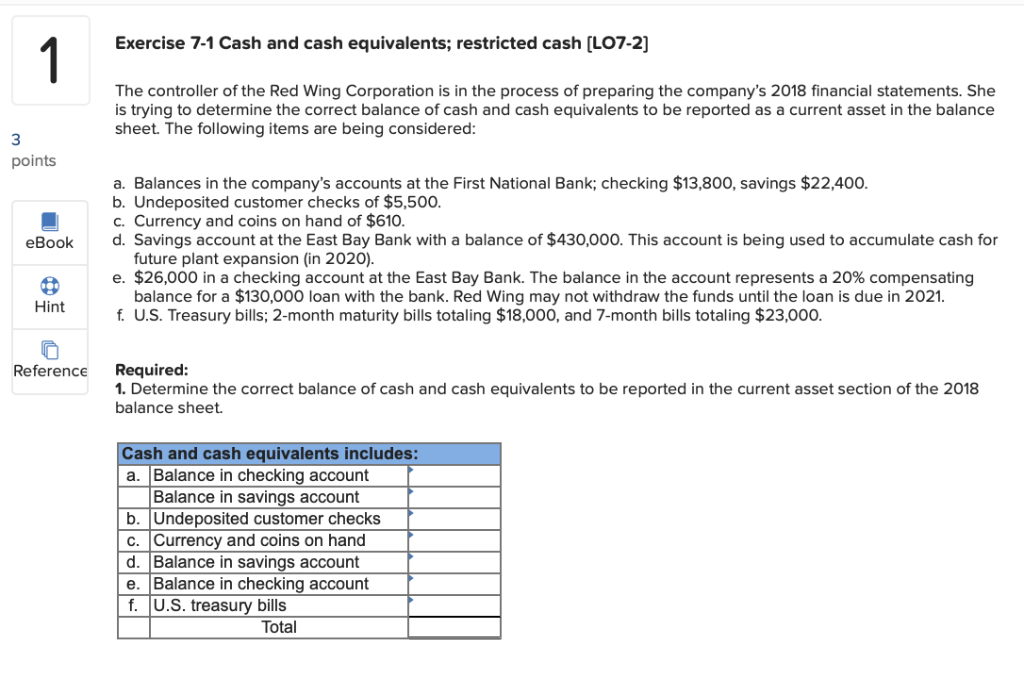

Reasons for cash being restricted include bank loan requirements, payment deposits, and collateral pledges. The nature of restrictions on cash and cash equivalent balances;. Report of independent auditors and financial statements for big national charity, inc.

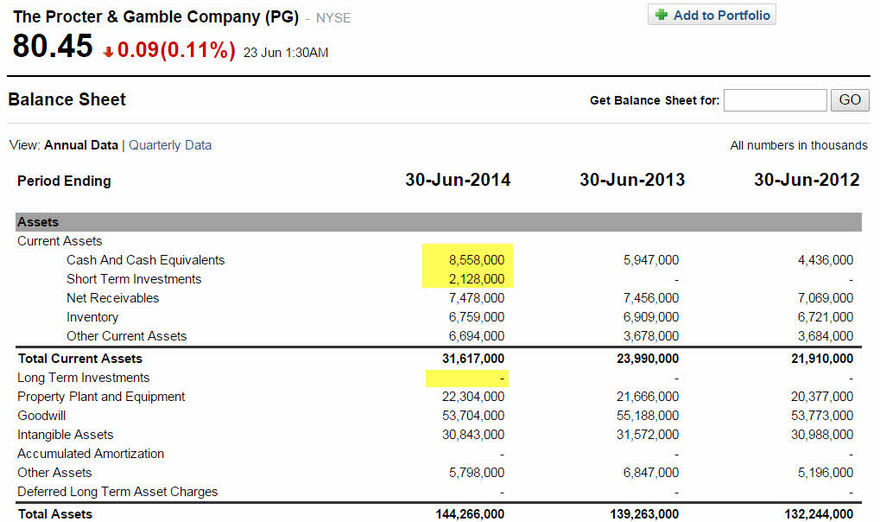

Restricted cash in balance sheet makes it easy for the analysts and investors and other stakeholders to understand why such funds are being kept aside, what is the cash status after keeping aside such money and whether these. Changes in restricted cash and restricted cash equivalents are shown in the statement of cash flows. Although fasb decided not to define restricted cash, entities will be required to disclose the nature of any restrictions on cash, cash equivalents and amounts generally described as restricted cash or restricted cash equivalents presented on the balance sheet and statement of cash flows.

Restricted cash is commonly found on the balance sheet with a description of why the cash is restricted in the accompanying notes to the financial statements. December 31, 20xx and 20xx In this article, we will delve into the definition of restricted cash, its purpose, examples, and the presentation of restricted cash on the balance sheet.

Cash and cash equivalents under ias 7 the standard ias 7 statement of cash flows defines cash. Recognised in profit or loss: As a reminder, the effective dates for nfps are as follows:

Restricted cash refers to money that is held for a specific purpose, meaning it's not available for immediate or general business use. Effective immediately the amendments are currently effective for all entities. Key impacts amounts generally described as restricted cash and restricted cash equivalents are required to be included in the total cash and cash equivalents in the statement of cash flows.

One has no compensating balance requirement, but the other calls for $200,000 to be. For example, suppose that sample company has two separate loans of $1,000,000 bearing interest at 12 percent. This asu requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents and amounts generally described as restricted cash or restricted cash equivalents.

We will also discuss the disclosure requirements related to restricted cash and highlight the importance of monitoring these funds. Restricted cash balance sheet accounting. Restricted cash is recorded separately from cash and cash equivalents on a company’s balance sheet, and the reason for the restriction is often disclosed in the accompanying notes to the financial statement.

The simple answer to this particular case is no, this is not the cash and cash equivalents. Presentation of restricted cash on balance sheet if the restricted cash balance is material, then this balance is shown separately from cash and cash equivalents on the balance sheet. Recognised [directly] in equity (only for oci components)

:max_bytes(150000):strip_icc()/Restricted-cash_final-aa54f0ce0256464d966180c8245909d2.png)

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)