Lessons I Learned From Tips About Sba Business Financial Statement

Fundingcircle.com has been visited by 10k+ users in the past month

Sba business financial statement. Prior to closing, you’ll need to provide interim financial statements and/or tax returns. Small business development center 2 of 8 financial ratio how do i use this ratio? Investment as a business owner, you must have invested equity — such as time or money — into the business.

Best for lower credit scores: Download as pdf who needs to fill out form 413? However, participants with revenue between $2,000,000 and $10,000,000 must provide sba with reviewed financial statements prepared by a licensed.

Fundingcircle.com has been visited by 10k+ users in the past month Best fast small business loans. It operates as a snapshot of your business financials.

Measures net income or loss over a defined period of time. The regulations for sba's business loans and disaster loan programs require loan guarantors and individual. Formula to calculate ratio which financial statement(s) do i use to calculate this.

Business financial statements are documents that provide information about a business's financial performance, such as income, expenses, and profits. The balance sheet is the foundation of managing your finances. Financial statement of debtor.

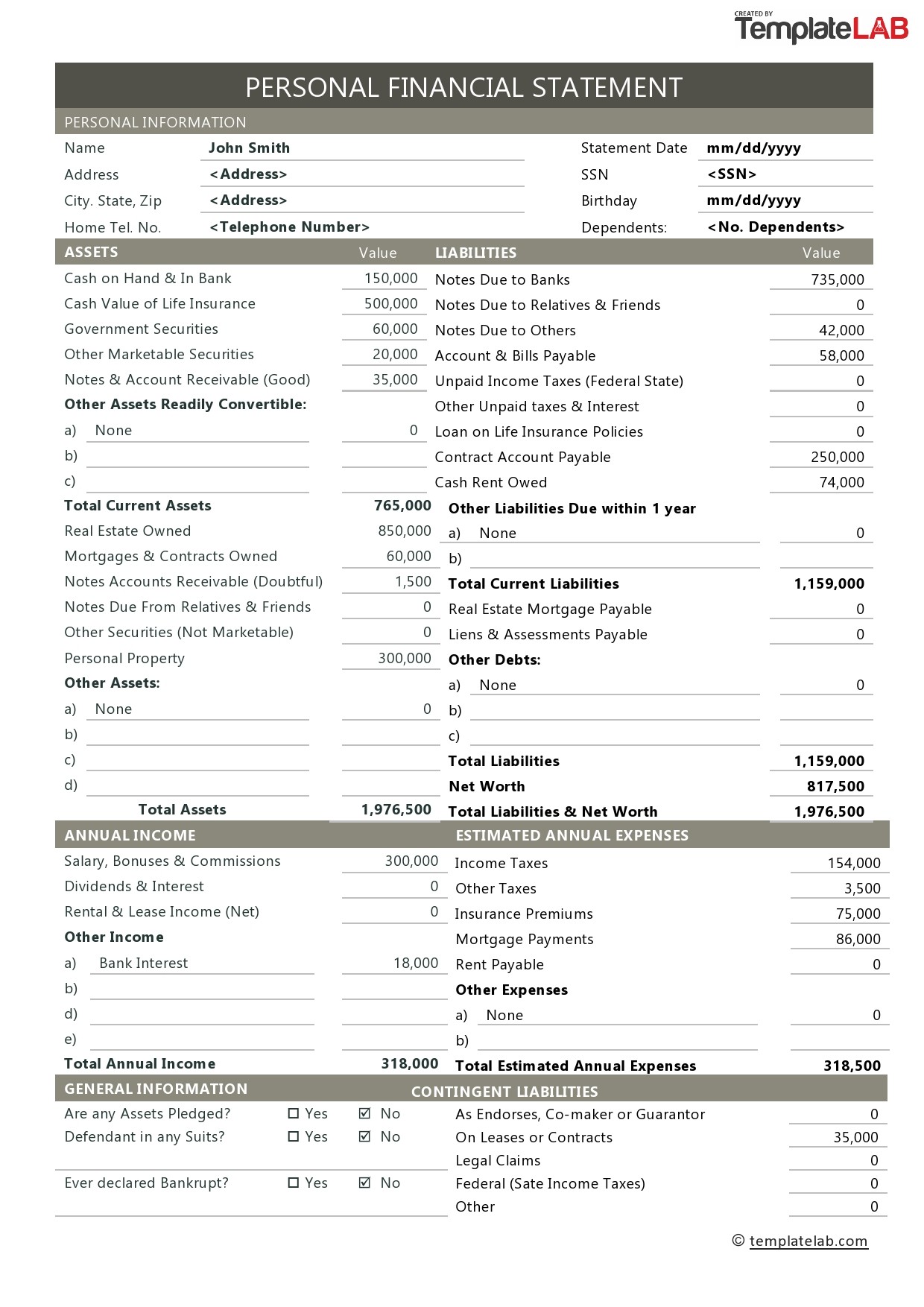

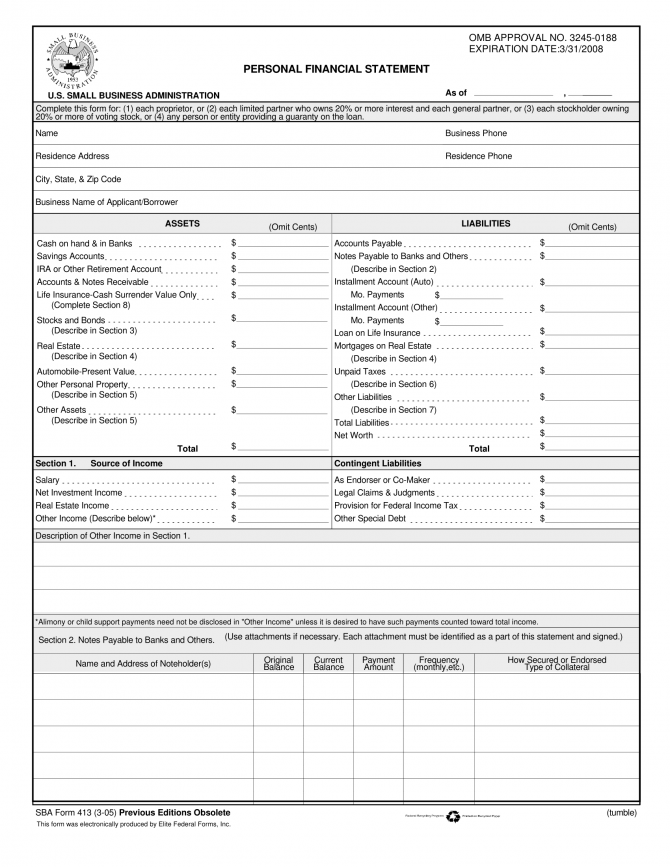

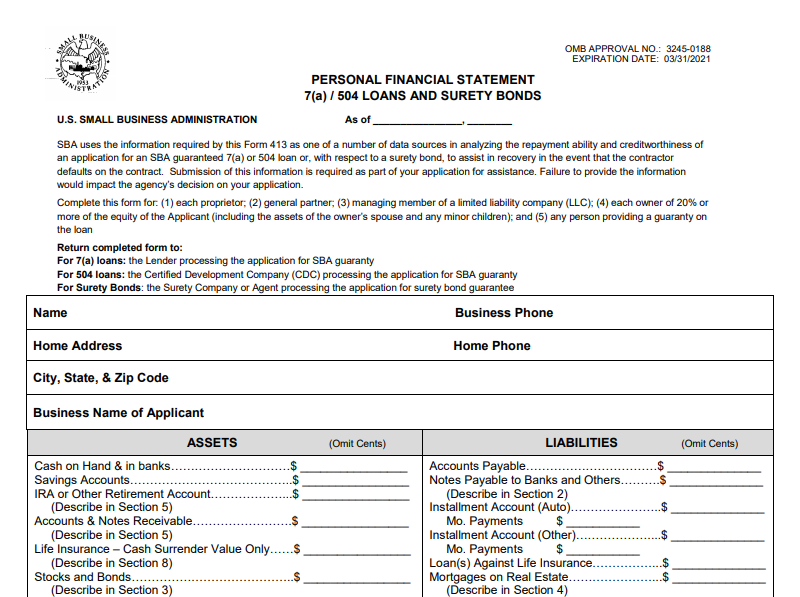

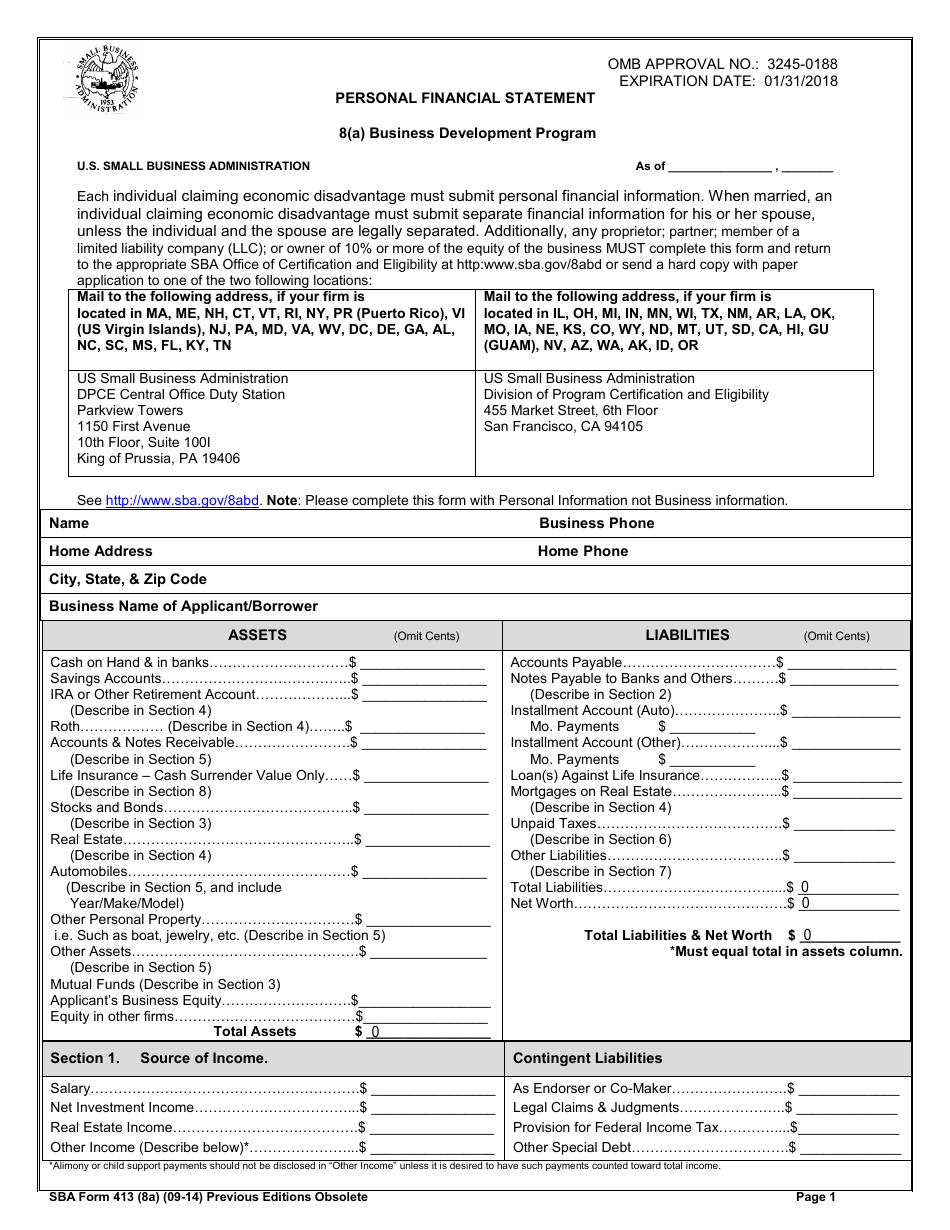

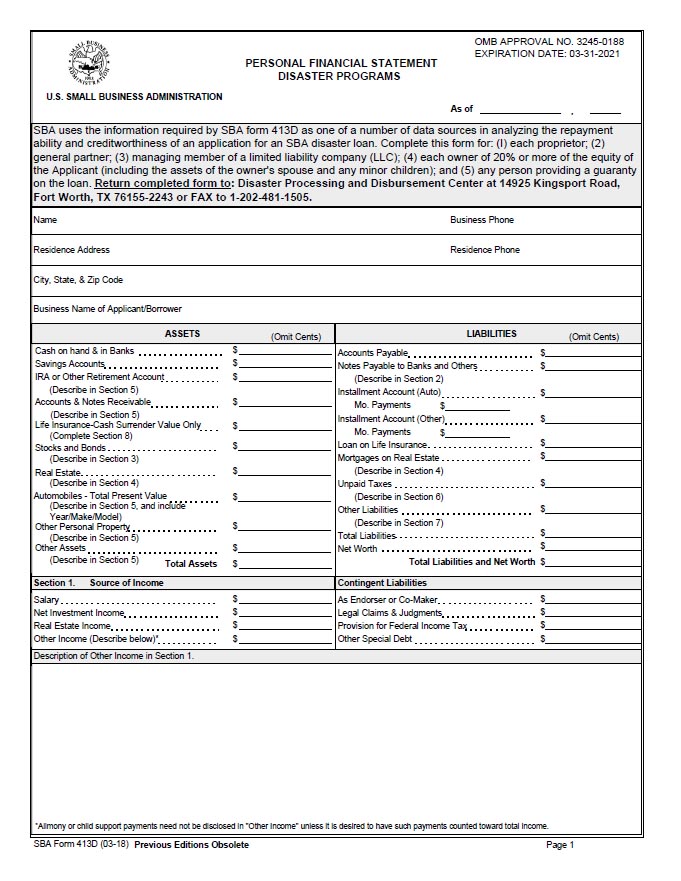

Loan approval requires owners to fill out many forms, and one of the most important is the sba’s personal financial statement, form 413. Businesses applying for an sba 7 (a) loan, sba 504 loan, or an sba disaster loan must include a personal. What interim financial statements need to be submitted for sba loans?

Sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. A calculation to show how. How the sba uses the personal financial statement.

Here’s how to fill out sba form 413, the personal financial statement. Sba’s regulations state that to be considered economically disadvantaged for purposes of the 8(a) business development program, an individual must have an. Financial statement of debtor (insert the word “none” where applicable to any of the following items) 1.

You’ll need it to apply for certain sba loans, including 7(a) loans and 504 loans. The sba requires the personal financial statement (sba form 413) because they use it to calculate your ability to. Form 770 is the financial statement of debtor that is used by sba servicing centers for actions that require current financial.

Under 13 cfr 107.630 of the code of federal regulations, each small business investment company (sbic) must file an audited annual financial report,. It helps you keep track of your capital and. Profit and loss statement (p&l):