Best Of The Best Info About 4 Types Of Accounting Statements

Let us consider each of them in more detail.

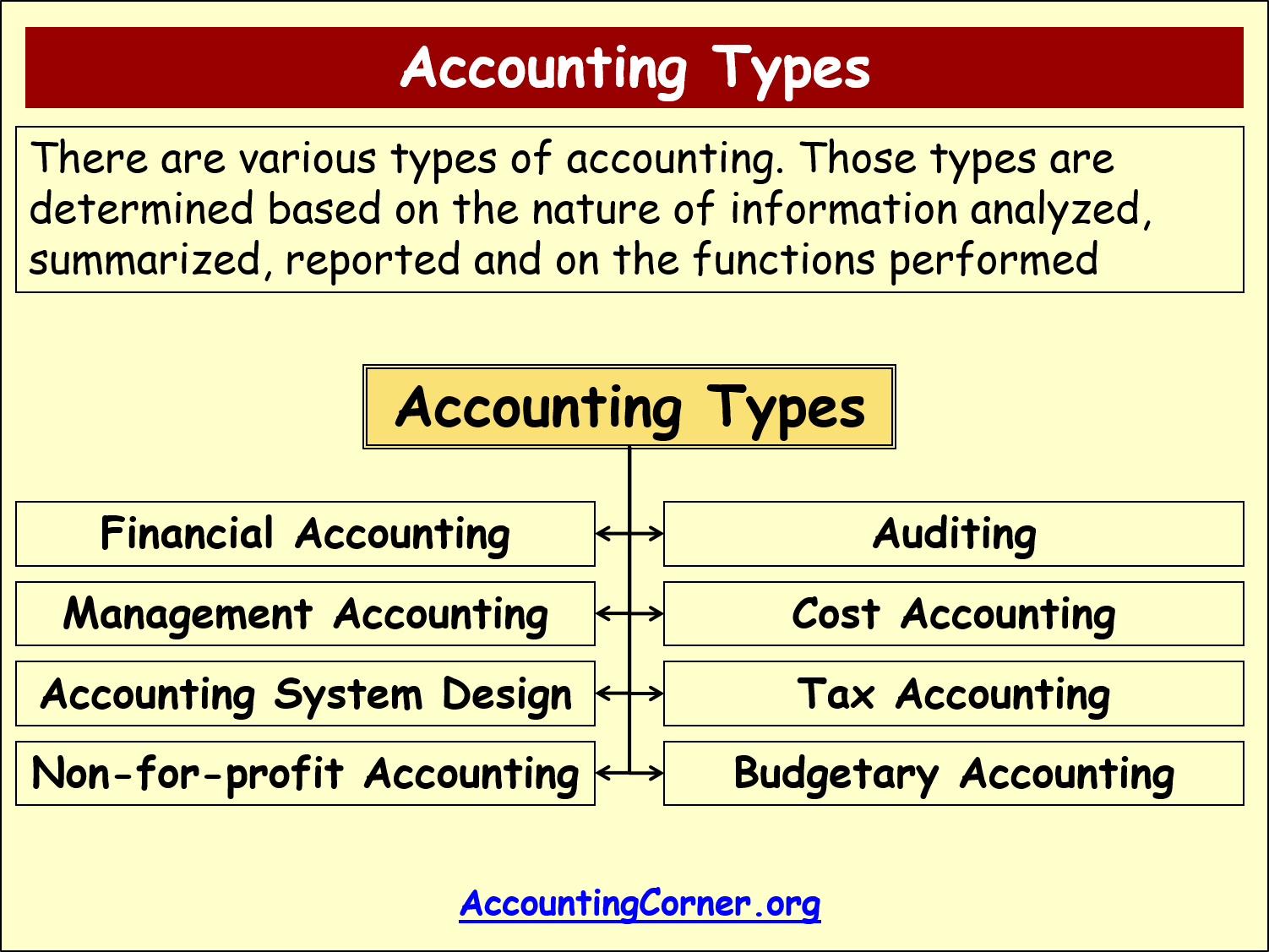

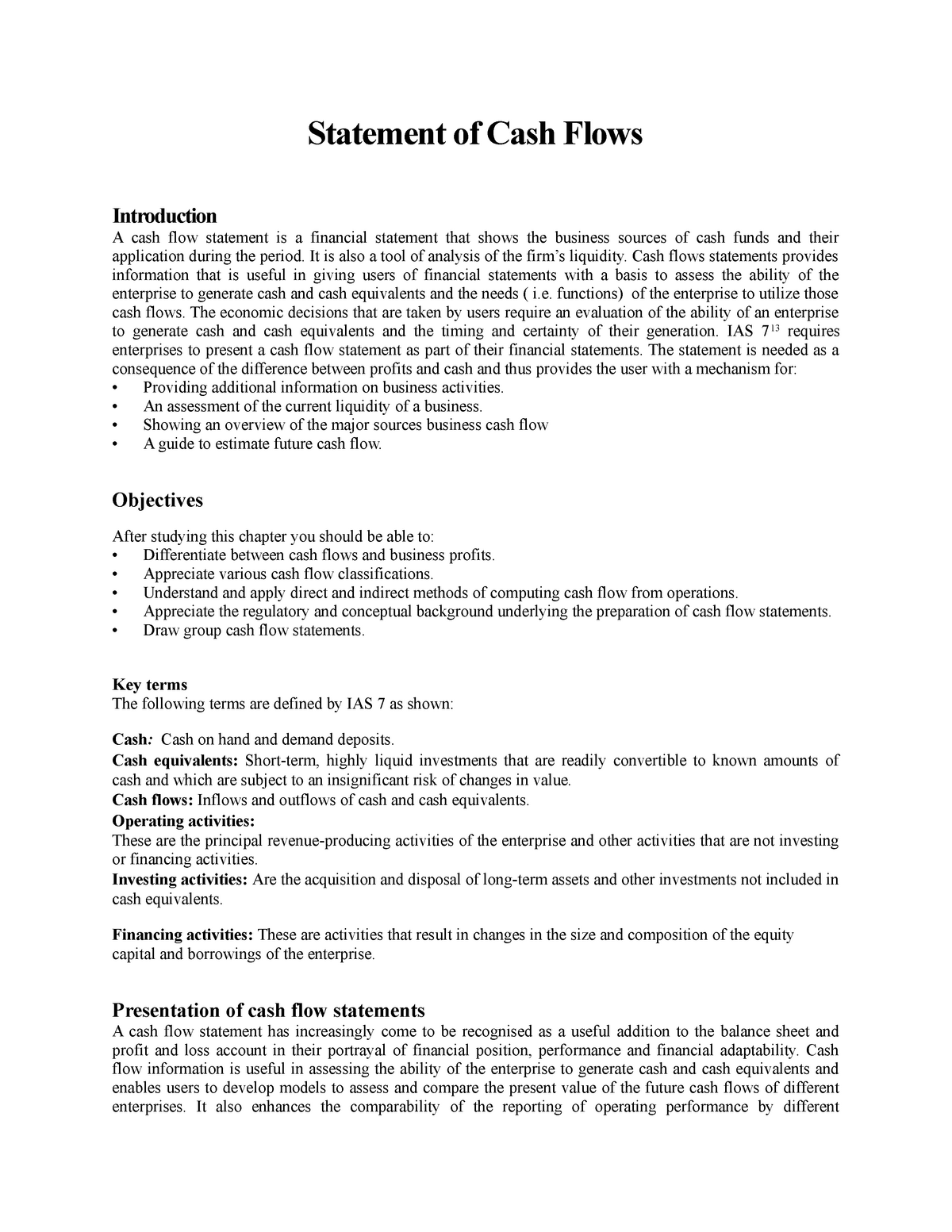

4 types of accounting statements. An income statement is considered the most important financial statement and is the first thing stakeholders, including investors, business. Financial statements provide a picture of the performance, financial position, and cash flows of a business. In this post, we’ll go over the different accounting types to help you understand which types of accountants your business might need.

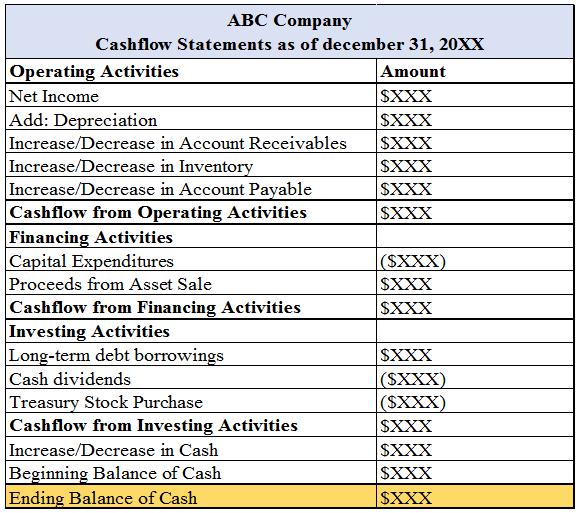

The statement of financial position (the balance sheet) These written records facilitate analyzing and comparing an organization’s financial position. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

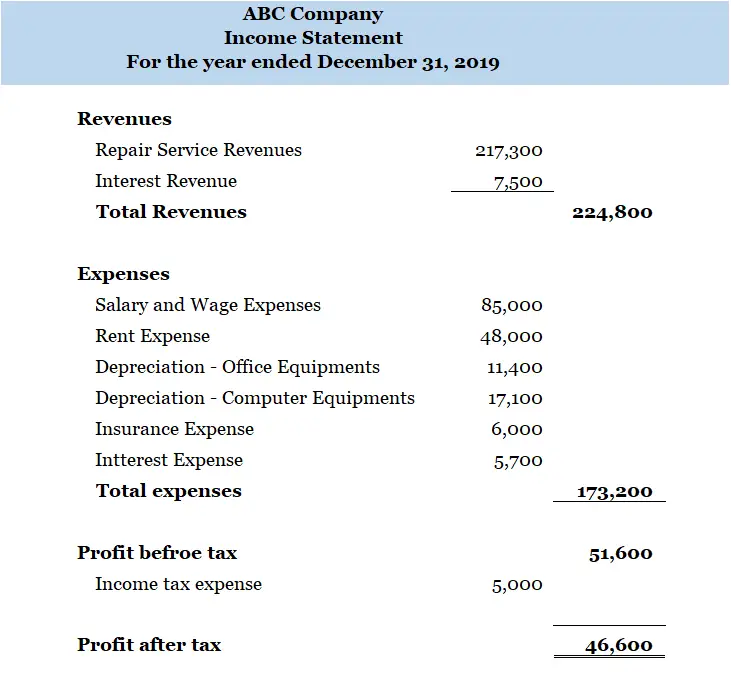

#1 profit and loss statements first, we have the profit and loss statement, which serves as a compass for companies, helping them manage profitability over predetermined timeframes. The balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. Income statements, balance sheets, cash flow statements, and more in this blog.

Financial statements consist of the following four components (each of these reports are covered in their own full lesson where we'll look at their format and go over a more detailed example): A good cash flow has more money coming in than going out. Income statement or, statement of profit & loss;

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. Explore the most important 4 types of financial statements: Assets can be classed as either current assets or fixed assets.

3.3 define and describe the initial steps in the accounting cycle; These three statements together show the assets and liabilities of a. Name the four basic financial statements.

Your financial statements list things like your expenses and income as well as transaction totals. There are four types of financial statements: The four basic financial statements that businesses and organizations use to track profits, expenses and other financial information work together to form a complete picture of a company's financial health.

3.1 describe principles, assumptions, and concepts of accounting and their relationship to financial statements; Also known as a profit and loss (p&l) statement, an income statement shows your company’s earnings and expenses over a period—i.e., the bottom line of your company. A cash flow statement also looks at how.

Financial statements are written reports that quantify the financial strength, performance and liquidity of a company. There are 4 commonly used financial statements: These include the balance sheet, income statement, and cash flow statements.

Financial statements dealing with cash flows are big indicators of how well a small business is doing. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. Know the proper headings (with their dating) for the balance sheet, income statement, and statement of retained earnings.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)