One Of The Best Tips About Income Tax Department View 26as

It keeps records of tax paid and refunded against your.

Income tax department view 26as. The income tax department’s website provides an option to view form 26as by logging in using one’s pan (permanent account number). Discrepancy in tax deducted and tds credit. Form 26as is an annual tax record kept by the income tax department.

It holds tax credit details for each taxpayer based on their pan, recording both paid and deducted taxes. Click on ‘login‘ and enter your user id (pan or aadhar number). Tax collected at source, or.

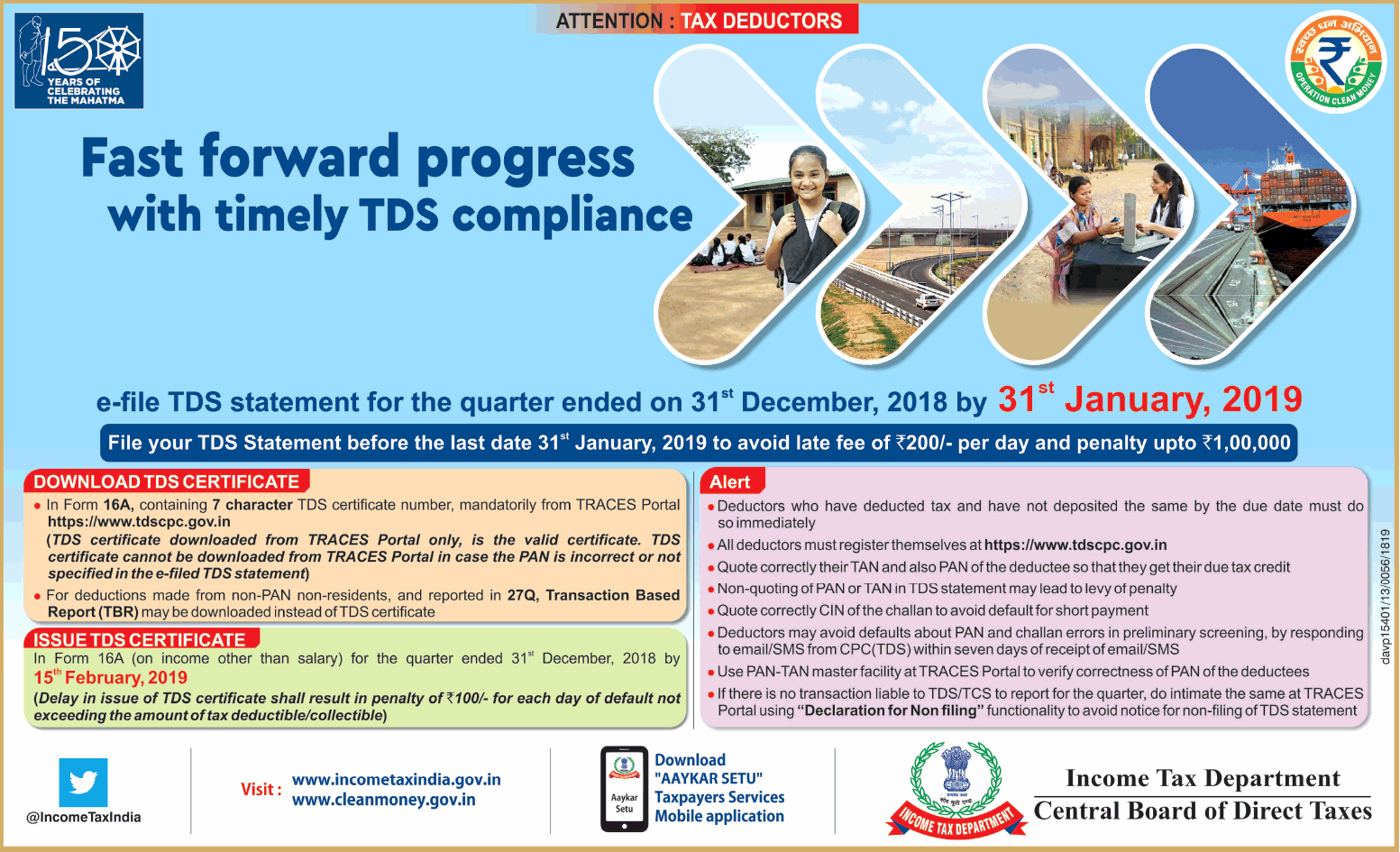

Who provides form 26as? Eligible outstanding direct tax demands have been remitted and extinguished. The requirement to manually file it returns required the download of form 26as.

The income tax department maintains the records for every taxpayer. Information (advance tax/sat, details of refund, sft transaction, tds u/s 194 ia,194 ib,194m, tds defaults) which were available in 26as will now be. If you are not registered with traces, please refer to our e.

Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your. Individuals can view their form 26as by visiting the official website of the income tax department and logging in with their pan number. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

It contains the details of the following: The tax credit statement, also known as form 26as, is crucial documentation for file taxes. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and.

Tax deducted at source, or. Every taxpayer can access their form 26as via the income tax department’s official website by using their permanent account number or pan. This article explores the evolving role of form 26as as a comprehensive tax credit statement.

The website provides access to the pan holders to view the details of tax credits in form 26as. It is a consolidated annual information statement for a particular financial year (fy).