Nice Info About Accounting For Deferred Tax Projected Balance Sheet Format In Excel

In the balance sheet, paragraph 29.23 of frs 102 requires that deferred tax liabilities are presented ‘within provisions for liabilities’ and deferred.

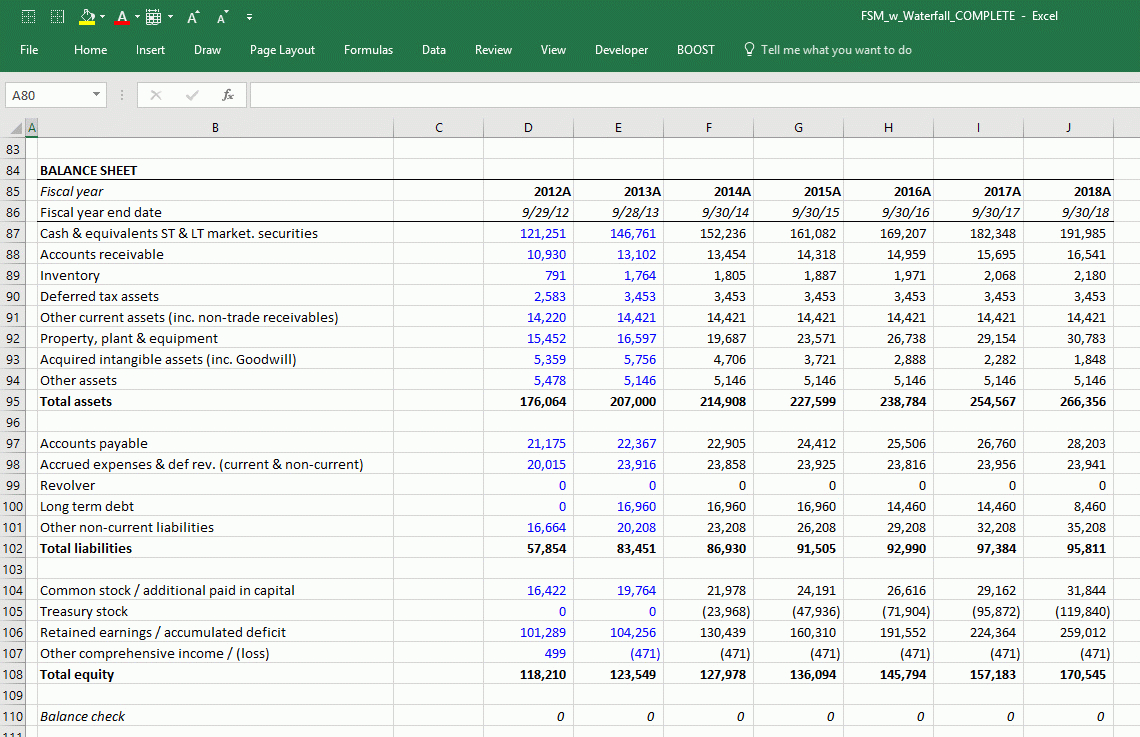

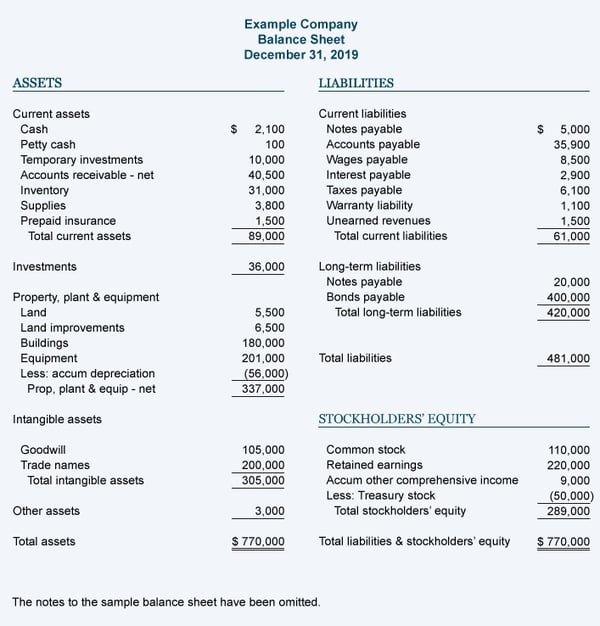

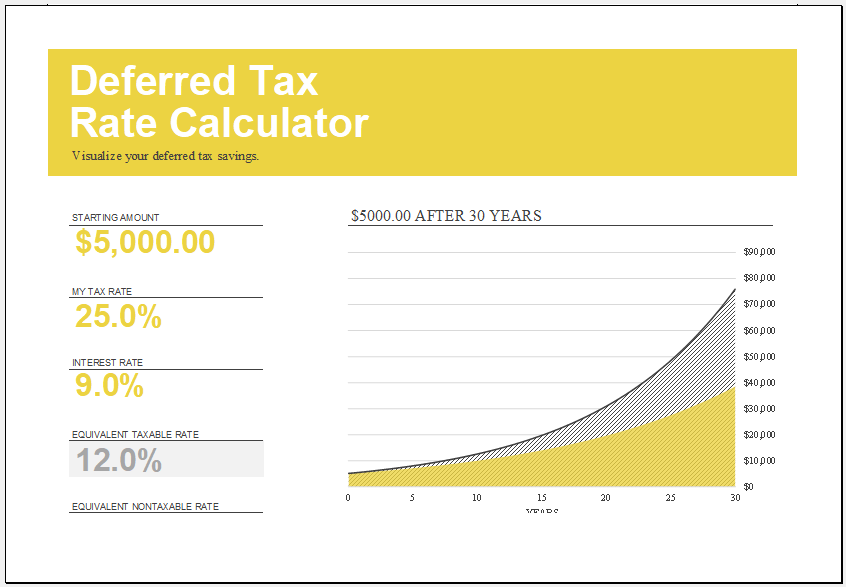

Accounting for deferred tax projected balance sheet format in excel. Microsoft excel worksheets and templates deferred tax rate calculator what is deferred tax? Accounting for a finance lease by a lessor; Financial statements of the business that include income statement, balance sheet,.

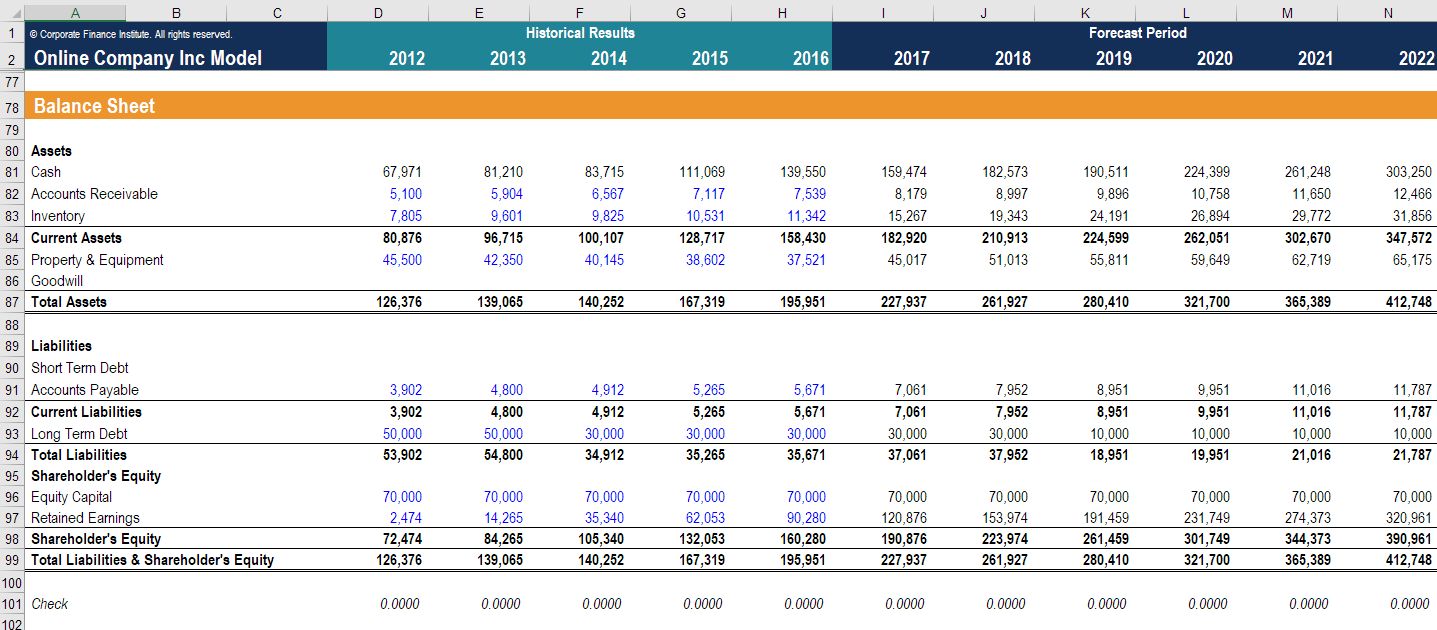

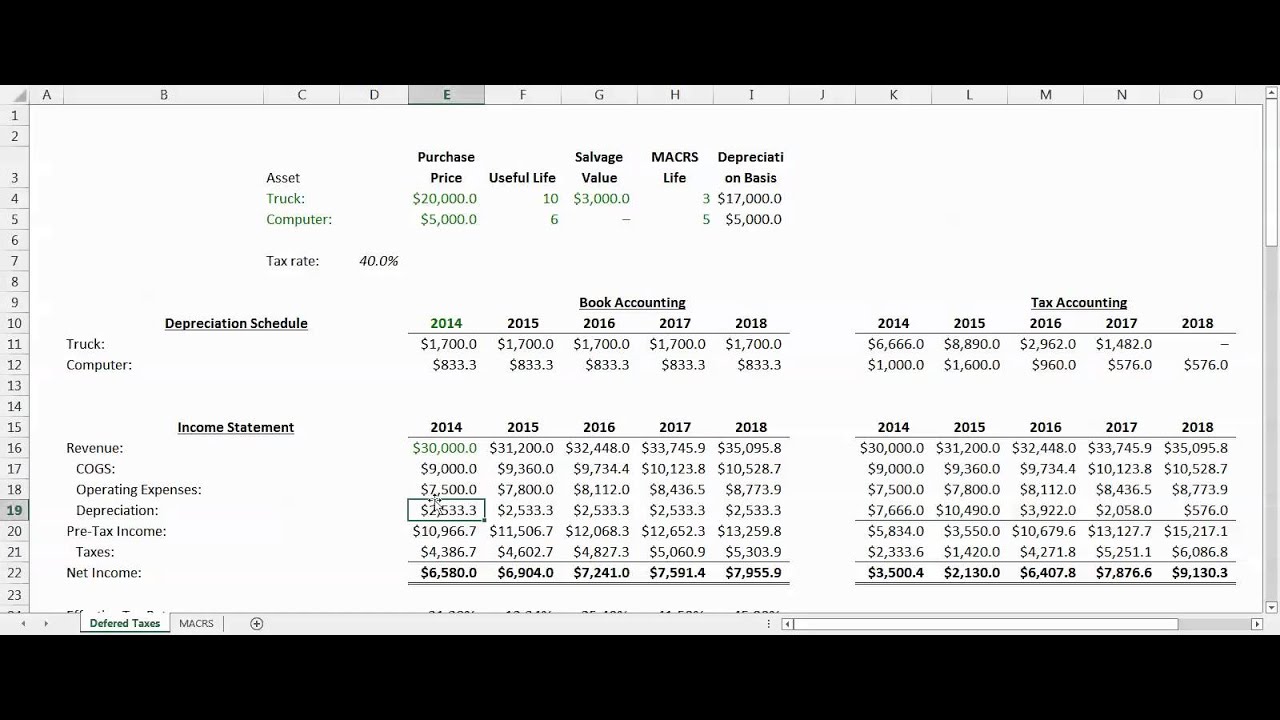

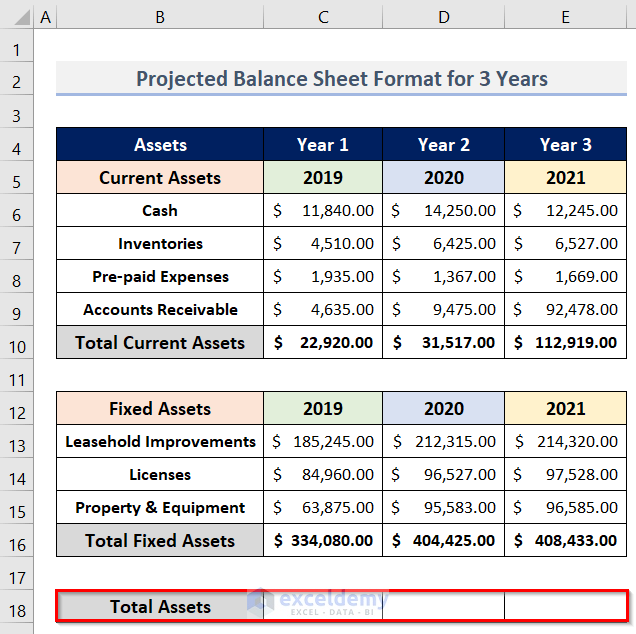

To start, you will need the following: This worksheet estimates the key financial figures for a company over five years. Dep as per companies act.

Deferred tax computation format. Accounting explained published on 08 january 2024 understanding deferred tax assets can be confusing for those without an. Excel is a powerful tool that can be used for calculating deferred taxes.

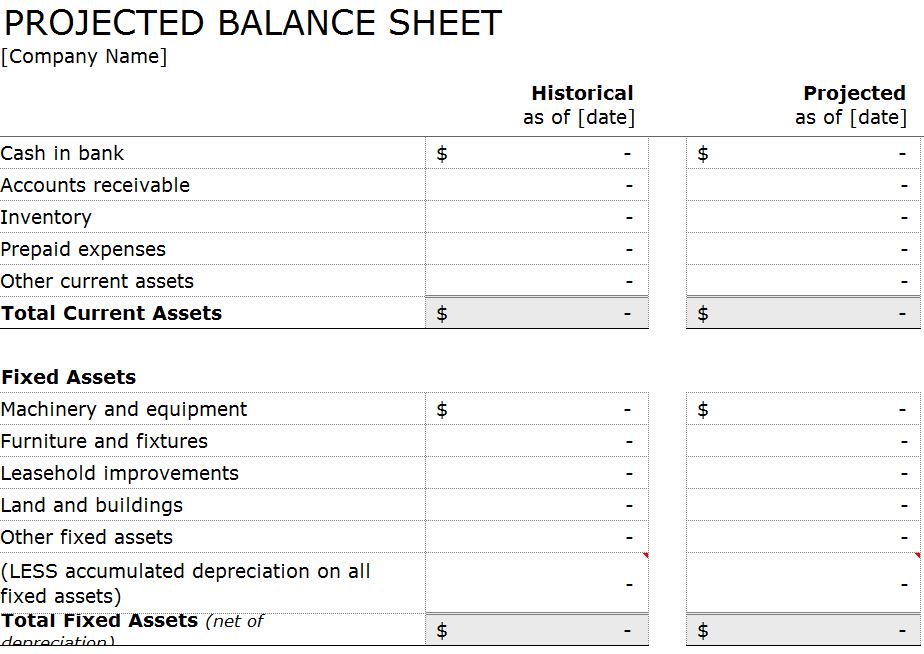

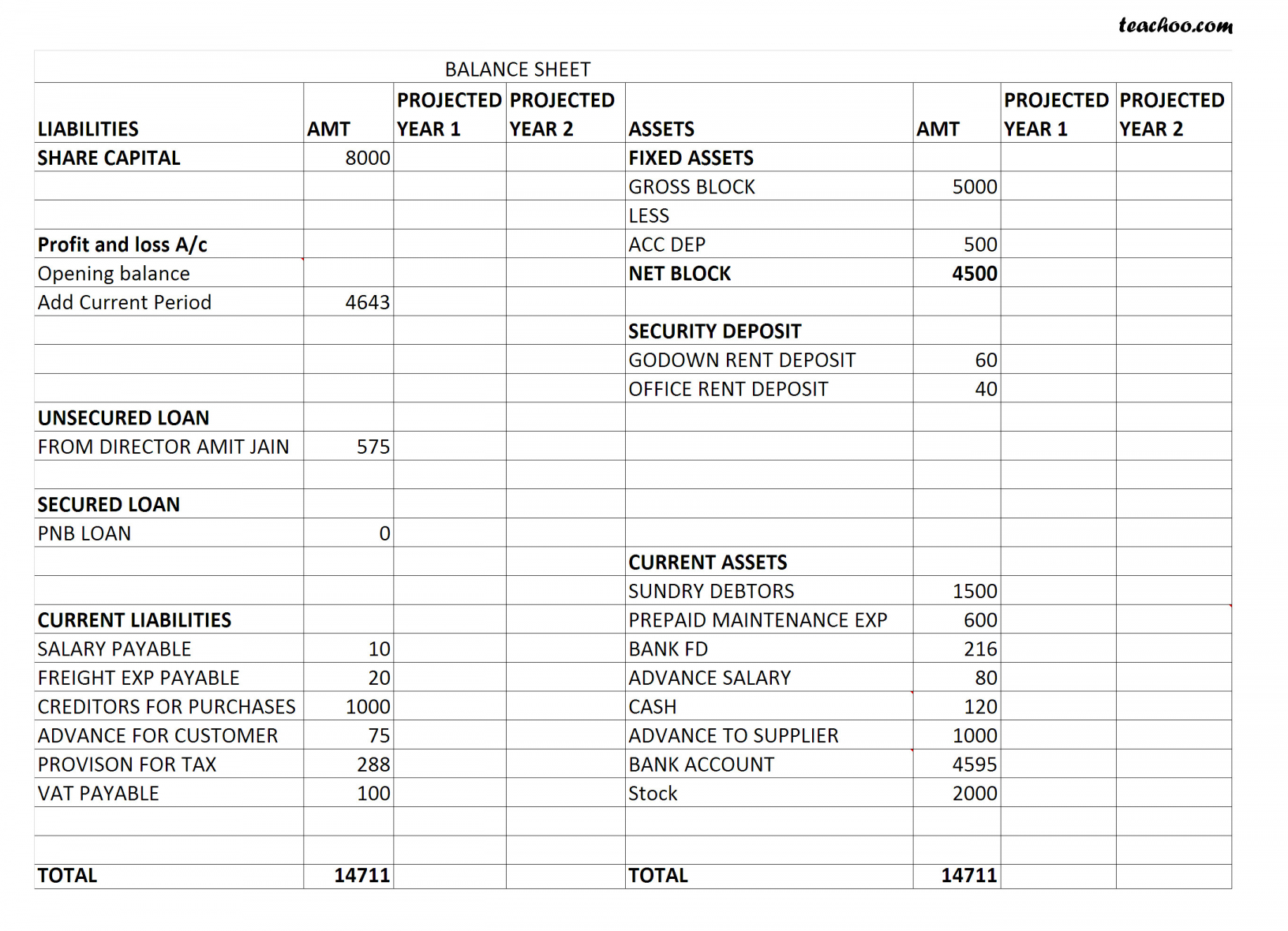

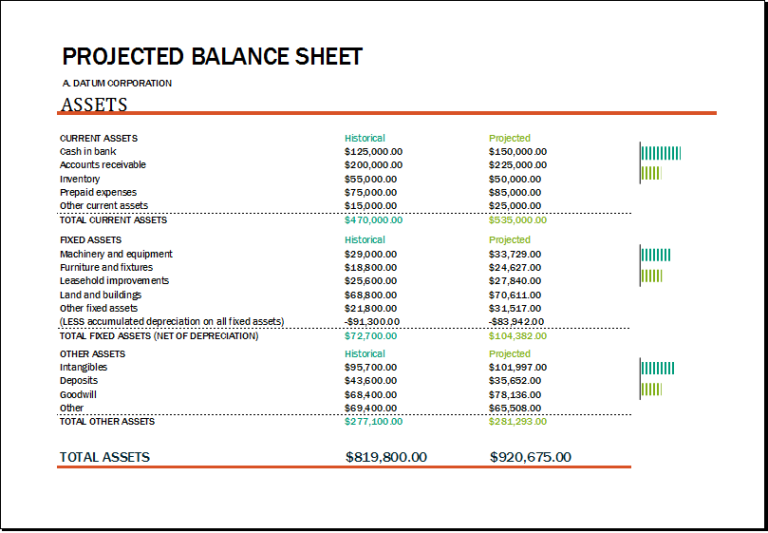

Projected balance sheet in excel #xls. The projections include abbreviated income and cash flow. So, the income statement is made up of three parts:

Creating a spreadsheet for accruals and deferrals in excel. Managing work budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023). Last updated at may 18, 2023 by teachoo.

Benefits of using excel for accruals and deferrals. Tools required for calculating deferred taxes in excel. Table of contents.

Deferred tax assets formula: Other files by the user. 5 year projections.

Create excel projected balance sheet format for 3 years manually. An accounting journal is an accounting worksheet that allows you to track each of the steps of the accounting process, side by side. In this method, we will make an excel projected balance sheet format for 3 years.

So, it contains all income and expenses for a certain period and calculates net.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)