Glory Tips About Extraordinary Income In P&l

December 23, 2023 what is an extraordinary loss?

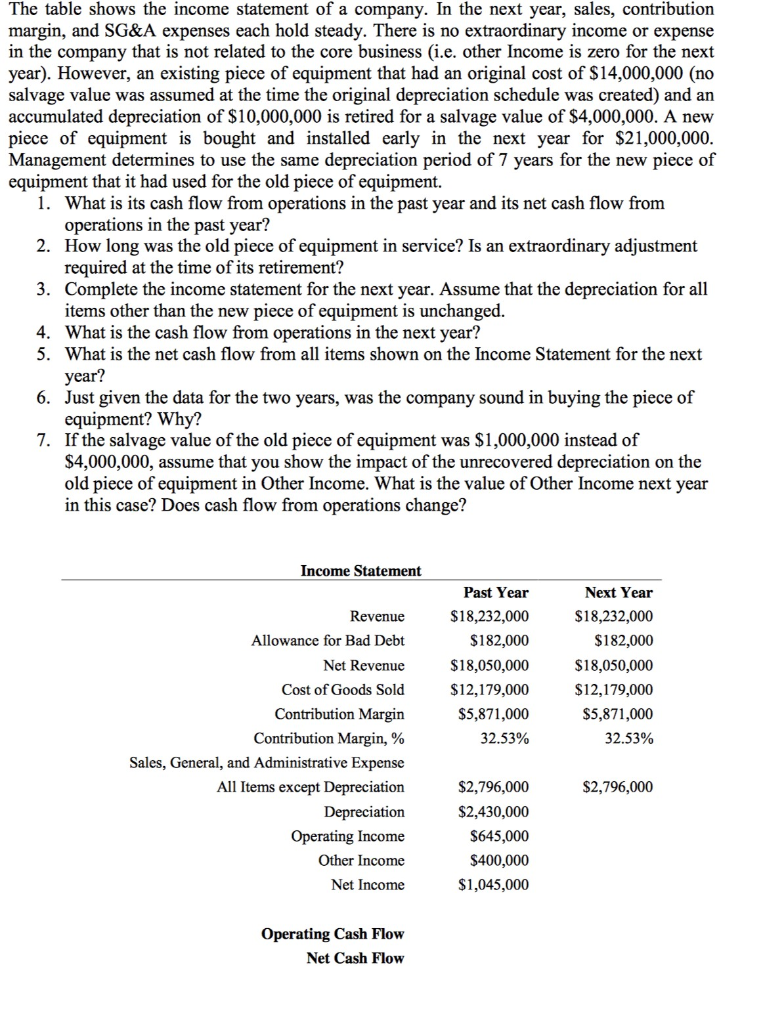

Extraordinary income in p&l. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. An extraordinary loss is a loss resulting from a business transaction that is highly unusual, should occur only rarely, and. An extraordinary item on a balance sheet indicates a substantial gain or loss that is unlikely to be repeated.

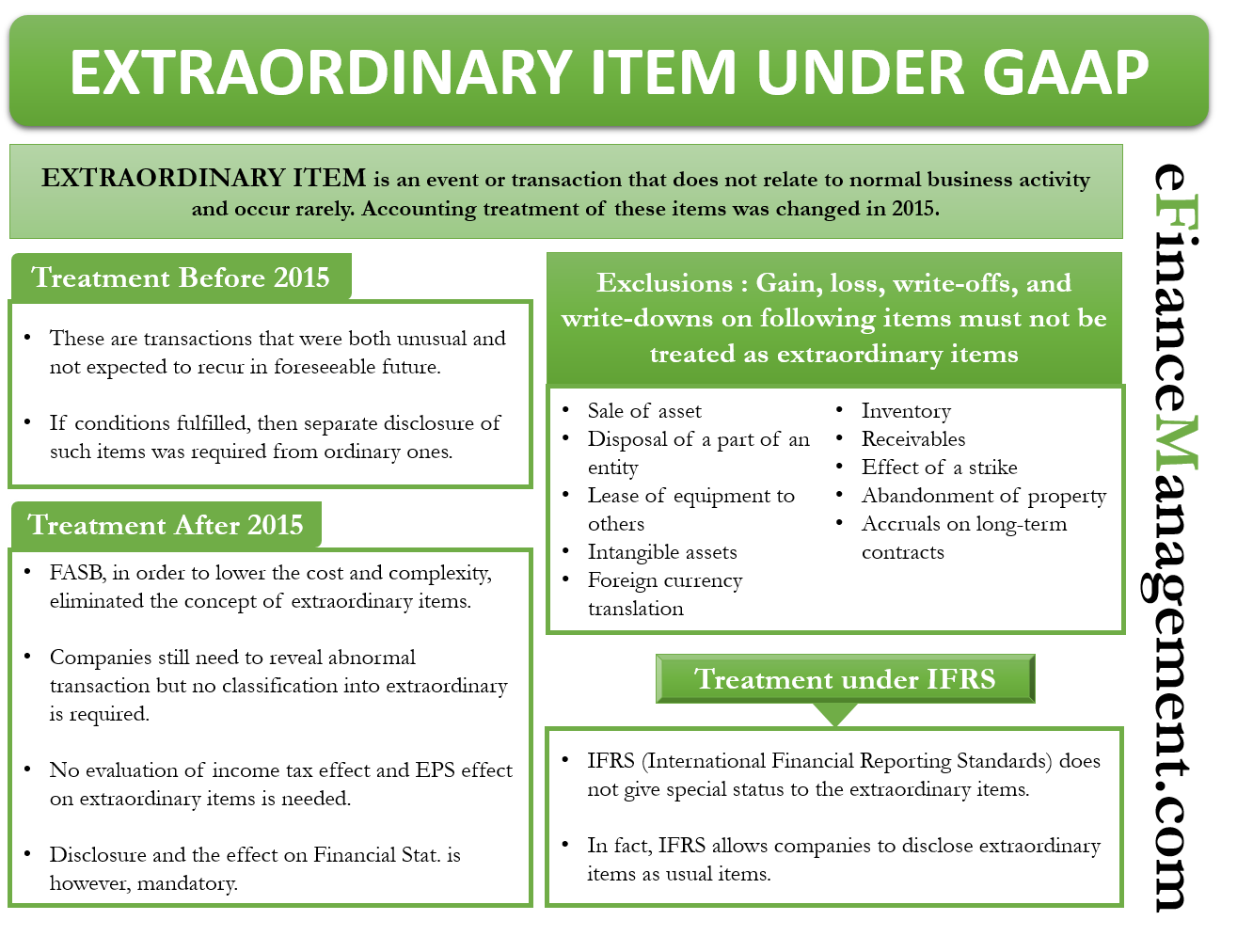

Hence, an extraordinary item can either enhance the profits or can reduce the profits. The income statement extraordinary items refer to gains and losses from specific business transactions, which are unusual and rare from the normal course of business. No items may be presented in the income statement as extraordinary items under ifrs regulations or (as of asu no.

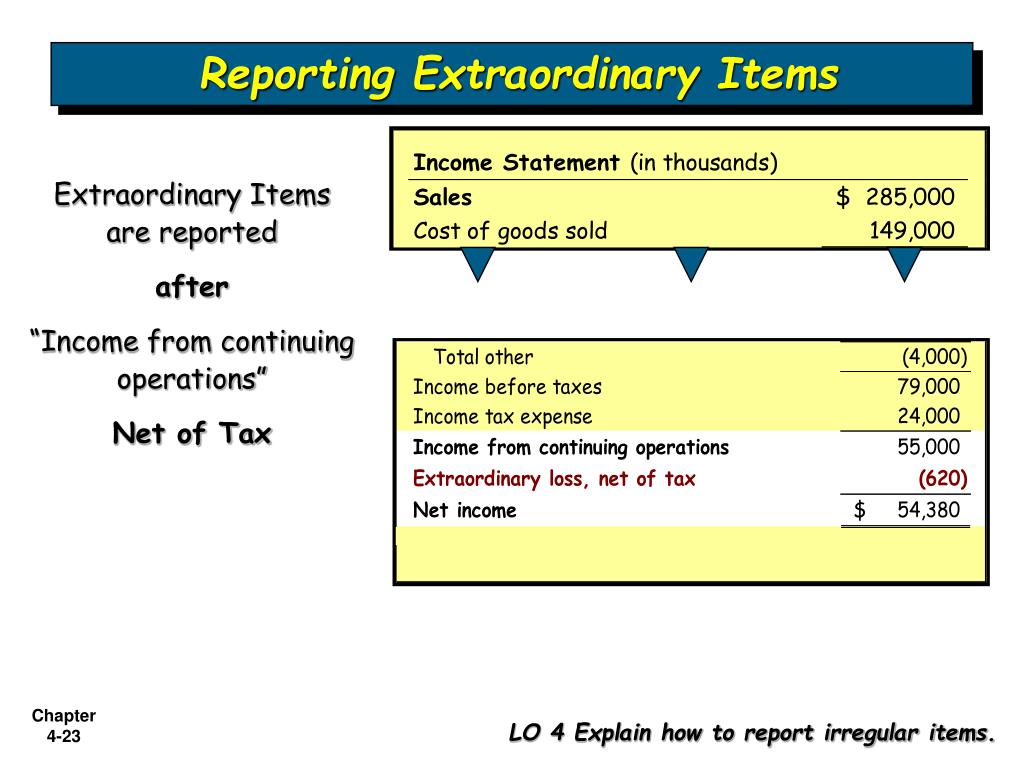

These statements recommended an income statement that showed extraordinary gains and losses on its face after determination of net income for the. The p&l statement shows net income, meaning whether or not a company is in the red or black. If an extraordinary gain is immaterial to the financial results of a business, it is usually acceptable to aggregate the gain into other line items in the income statement.

This standard should be applied by an enterprise in presenting profit or loss from ordinary activities, extraordinary items and prior period items in the statement of profit and loss,. Extraordinary items in accounting are income statement events that are both unusual and infrequent. Extraordinary items are events and transactions that are distinguished by their unusual nature and by the infrequency of their occurrence.

In other words, these are transactions that are abnormal and don’t relate to. The top line of the p&l statement isrevenue, or the total amount of income from the sale of goods or services associated with the company’s primary operations. In fact, this is the pattern.

Rare but significant events are treated as extraordinary items to prevent them from skewing a company’s regular earnings. The balance sheet shows how much a company is actually worth ,. Extraordinary income (profit and loss account of collective investment funds open to the public (in czk thousands)) extraordinary income (p&l statement (in czk thousands)).

An extraordinary item can be a source of income or expense.

.png?&a=t)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)