Build A Tips About Business Income Statements And Payment Summaries Sole Trader

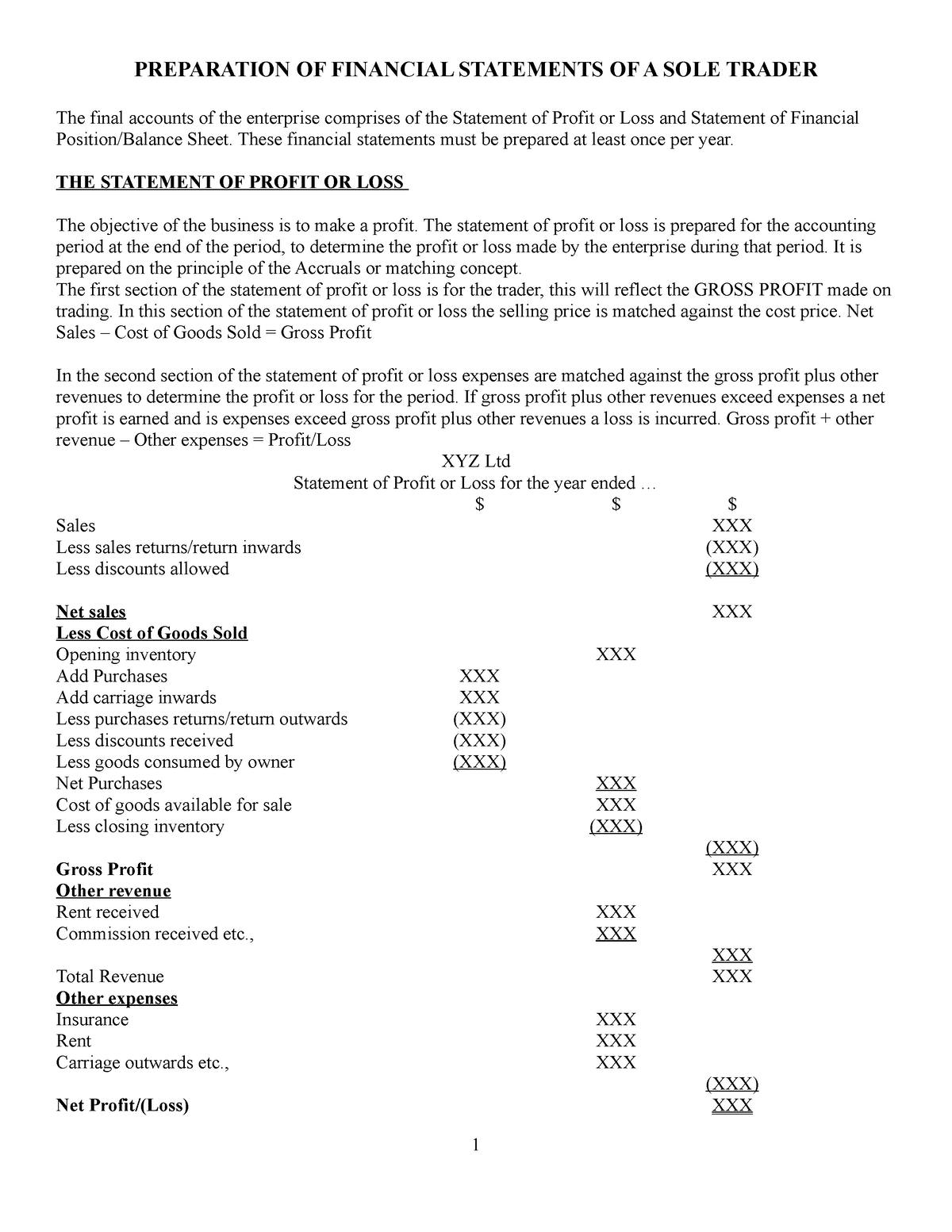

5.1 sole trader financial statements.

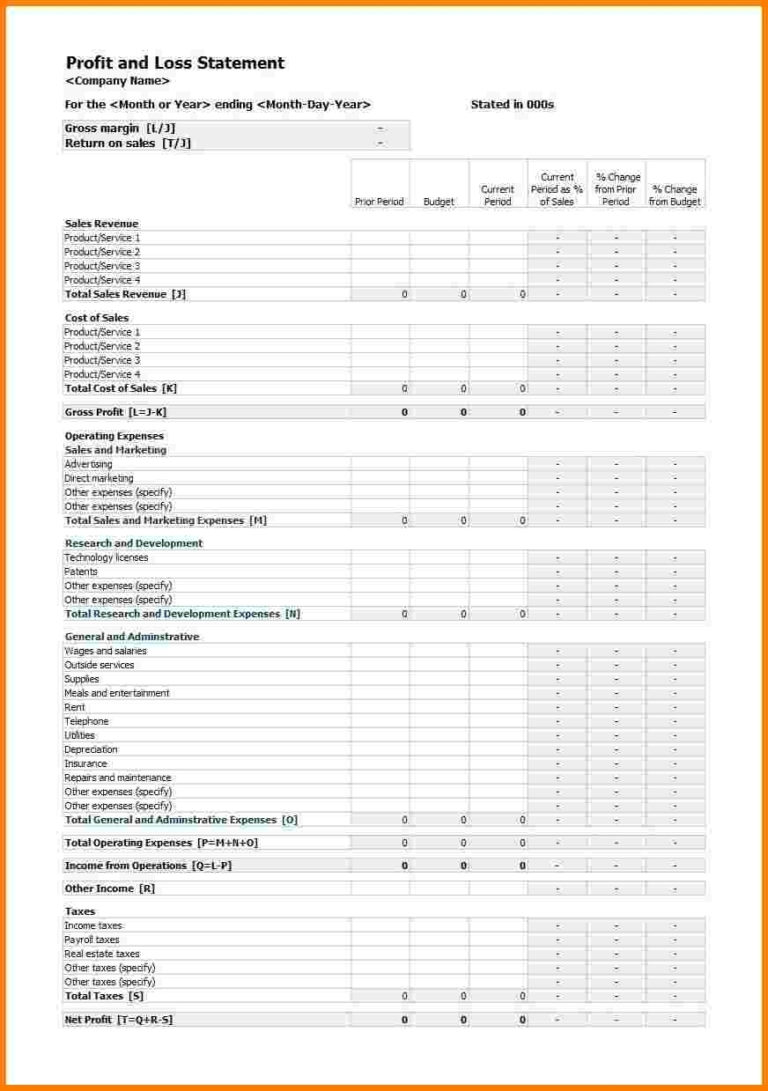

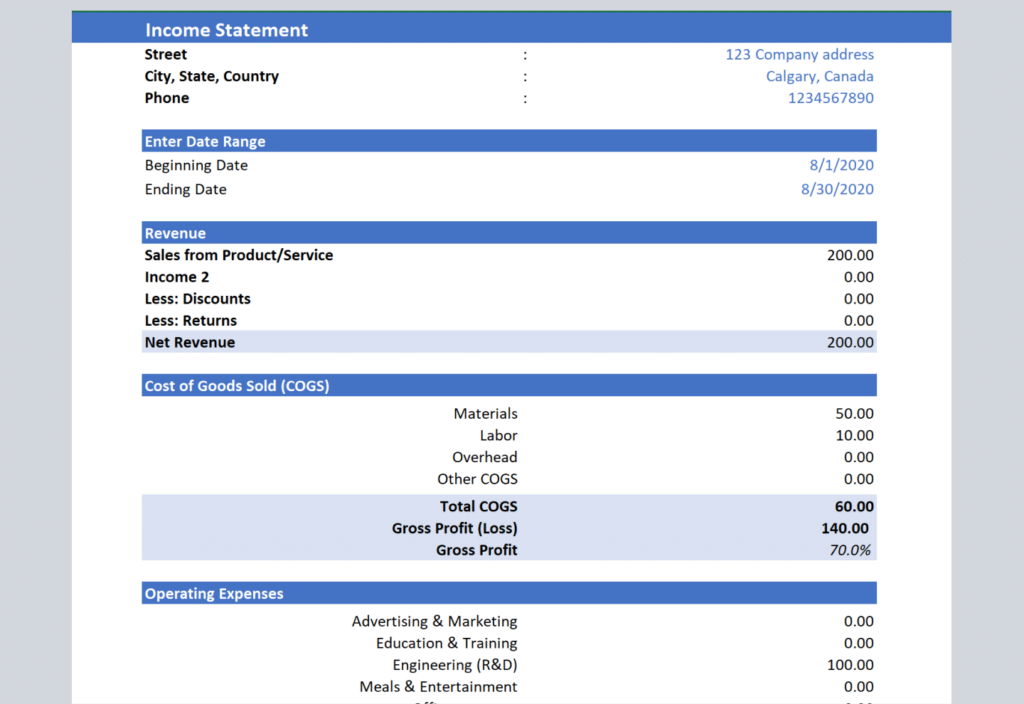

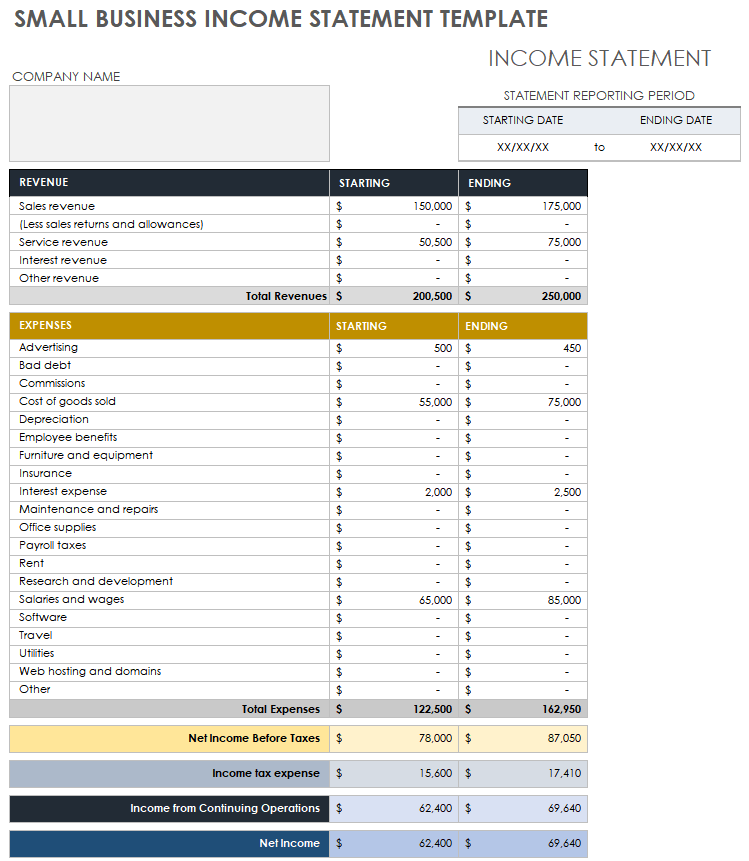

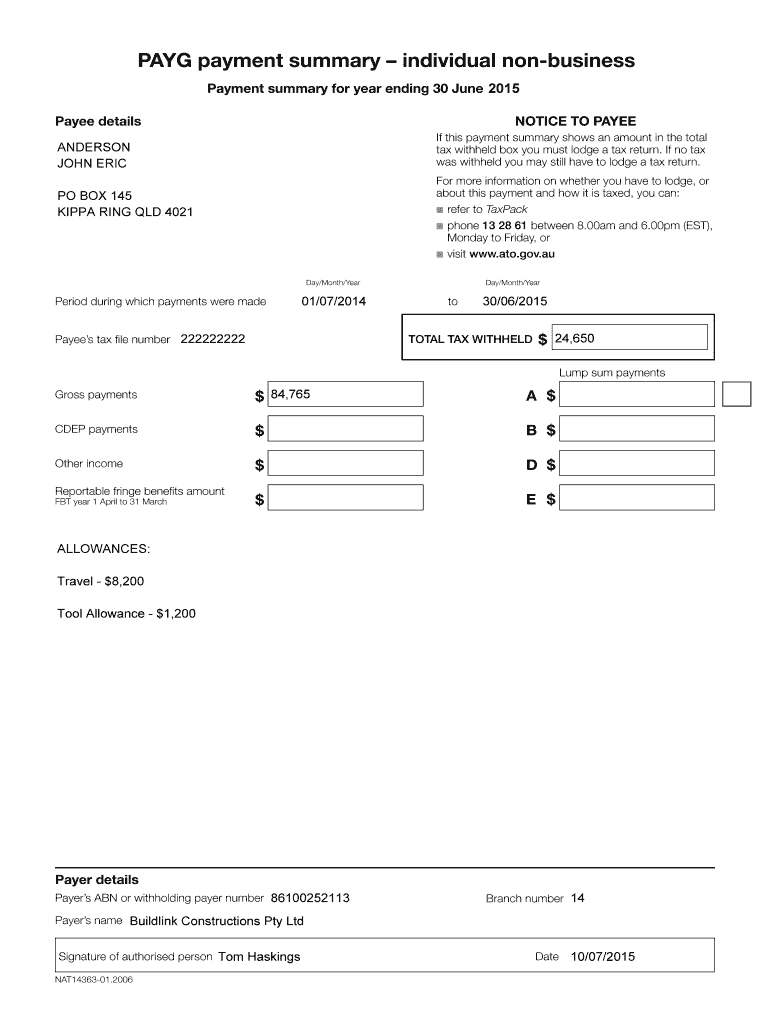

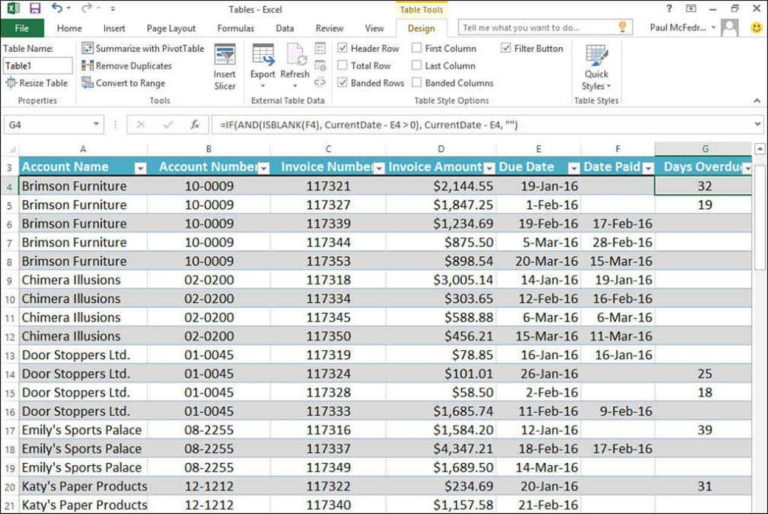

Business income statements and payment summaries sole trader. If you received any business income statements and payment summaries, click on and complete the details for each income statement you receive and save each one. How to set up your sole trader payment terms. A is for sole trader small business entity income which is used to calculate the taxpayer's small business.

A sole proprietorship, also known as a sole trader or a proprietorship, is an unincorporated business with a single owner who pays personal. Mytax will automatically transfer the following primary production amounts shown in business income statements and payment summaries, where the income. Ato community / tax & super for business / sole traders what to input in payment type under business income statements and payment summaries?.

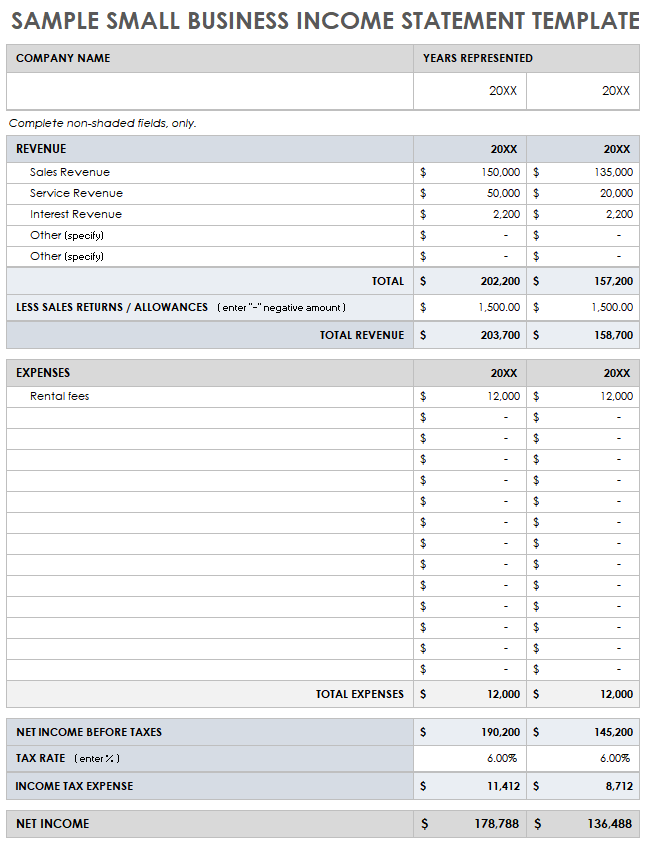

Your assessable income as a sole trader or business partner is your gross income minus the deductions we allow. Business income statements and payment summaries (bip) is a new worksheet in 2020. If you’re a sole trader we use all your business income minus.

Payment summaries or income details from 2002 onwards activity statements from 2000 onwards fbt returns from 2001 onwards individuals and sole. Go to 'business/sole trader, partnership and trust income (including loss details)' under 'business income statements and payment summaries' you should. There is a message:

Unsw sydney | one of the best universities in australia If you don’t use payment terms, the legal uk default is 30 days. To make a claim in this section, you must first show income from salary and wages or foreign employment income in the income statements and.

21 december 2021 1 min. You were a sole trader or had business income or losses, partnership or trust distributions (not from a managed fund) business/sole trader income or loss;. Use business income statements and payment summaries (bip).

The business income statements and payment summaries section will be automatically displayed if, at personalise return, you have selected: When you make payments to employees, certain contractors and other businesses, you need to withhold an amount from the payment and send it to the. Partner in a business partnership

In the business/sole trader, partnership and trust income section at business income statements and payment summaries completing this section.