Marvelous Info About Charitable Contributions On Income Statement

The more you give, the more you can deduct from your taxes!

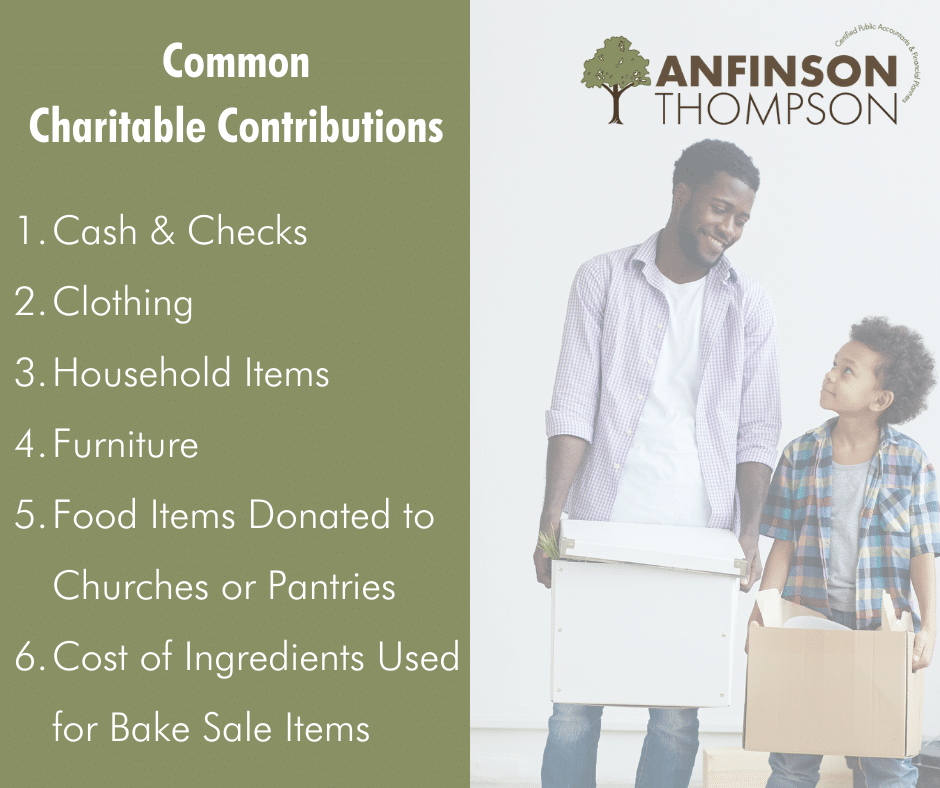

Charitable contributions on income statement. Typically, you can claim deductions of up to 60% of your adjusted gross income (agi) through charitable donations. It now appears that deductions for charitable contributions do not reduce qualified business income (qbi). However, the amount contributed is recorded on the balance sheet as a credit to cash.

You can deduct any amount of charitable giving up to 60% of your adjusted gross income (agi) for cash contributions made to qualified charities (more on that in. Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Donations and charities do not prepare the same financial statements as other entities.

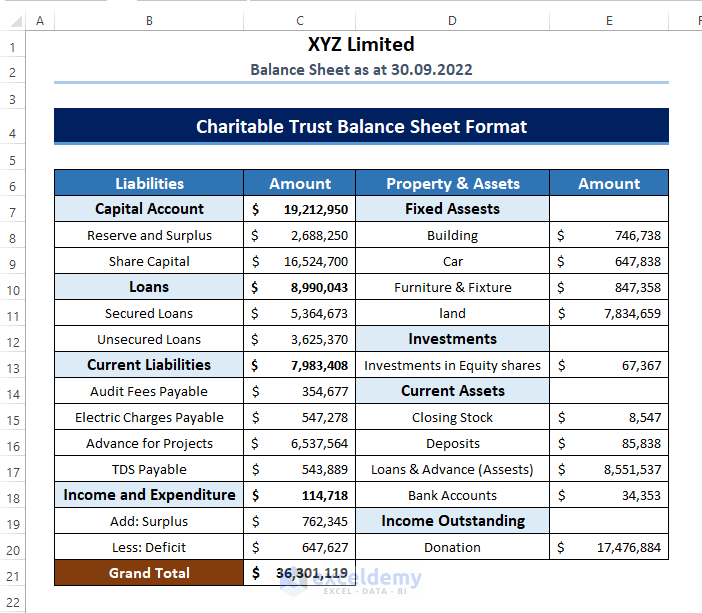

Nonprofits use this statement to share what their organization owns and what it owes. Select charitable contributions from the detail type dropdown list. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60% of a taxpayer's adjusted gross income (agi). Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Giving inventory may benefit the charity as well as.

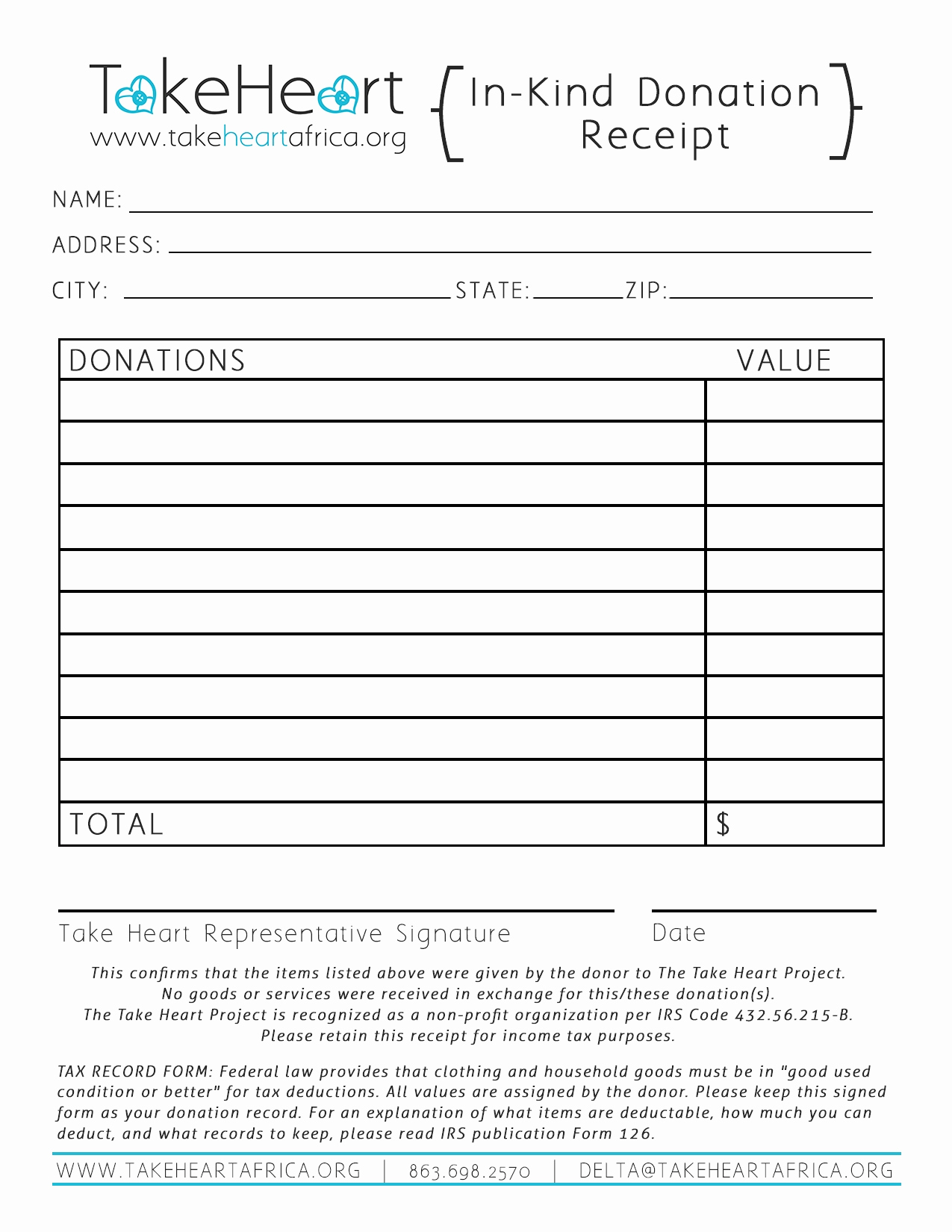

The organization must give you a written acknowledgement. See the instructions for form 1120 for more information. This publication explains how individuals claim a deduction for charitable contributions.

The idea is to give an overall picture of the nonprofit at a specific time. Donations by c corporations are limited to 10% of taxable income. And how those expenses relate to the work of carrying out your mission.

If you file on paper, you should receive your income tax package in the mail by this date. Once they get them, they contribute them to other causes or entities. You may receive deductions for donations of clothing and other household items.

The dinner has a fair market value of $25. Contributions that exceed that amount can carry over to the next tax year. Once you have created this account, the next step is to create a product/service item for donations.

To qualify, the contribution must be: The internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t itemize. However, this percentage may be restricted to 20%, 30%, or 50% depending on the nature of the contribution and the specific organization.

Charitable giving tax deduction limits are set by the irs as a percentage of your income. Statement of financial position the first and most desired financial statement is the statement of financial position. Proof of charitable contributions: