Peerless Info About Capital And Reserves In Balance Sheet

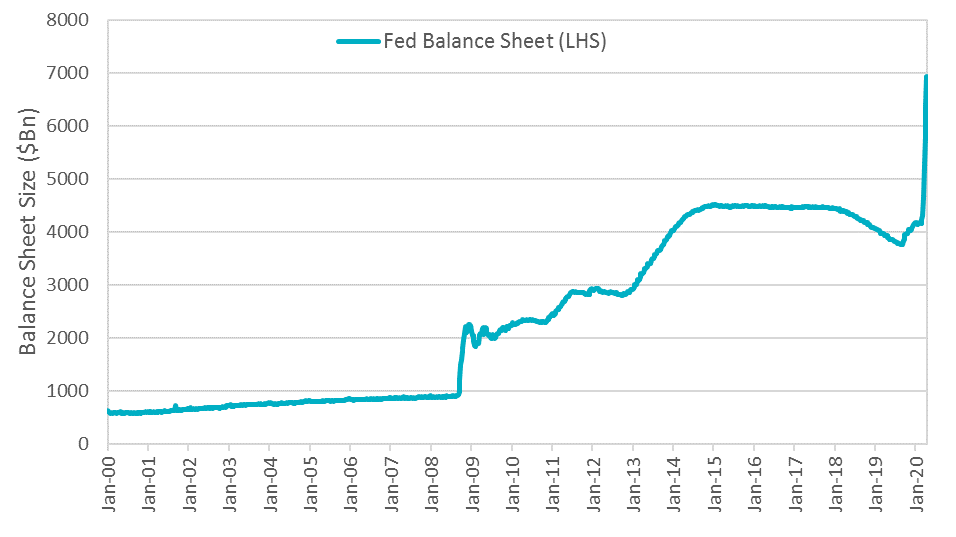

The federal reserve’s internal debate over the fate of its balance sheet reduction effort is set to quicken at its march policy meeting, with policymakers first setting the stage for how they’ll likely slow the drawdown, likely deferring a decision on when to stop the process altogether to a later date.

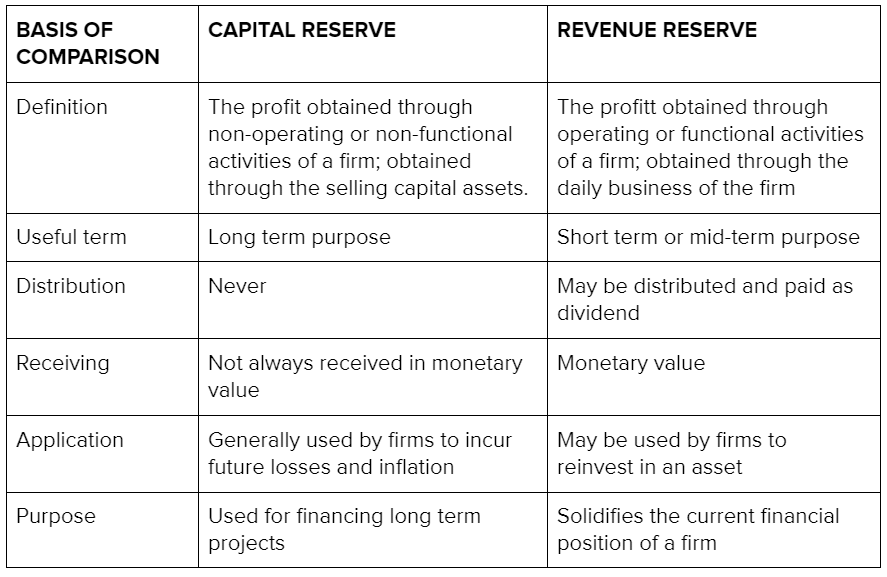

Capital and reserves in balance sheet. The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near $9 trillion reached in early 2022. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Schedule 4 also sets out a number of disclosure requirements.

Dollars, not seasonally adjusted (qbpbstas) units: Read more at the business times. The balance sheet is based on the fundamental equation:

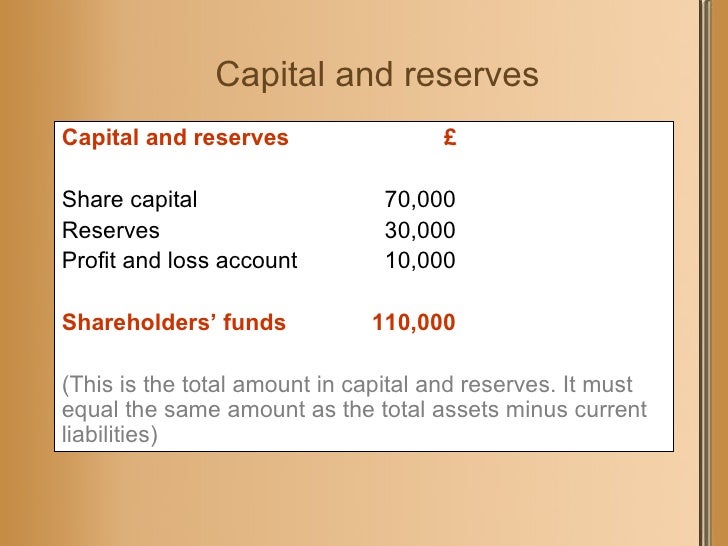

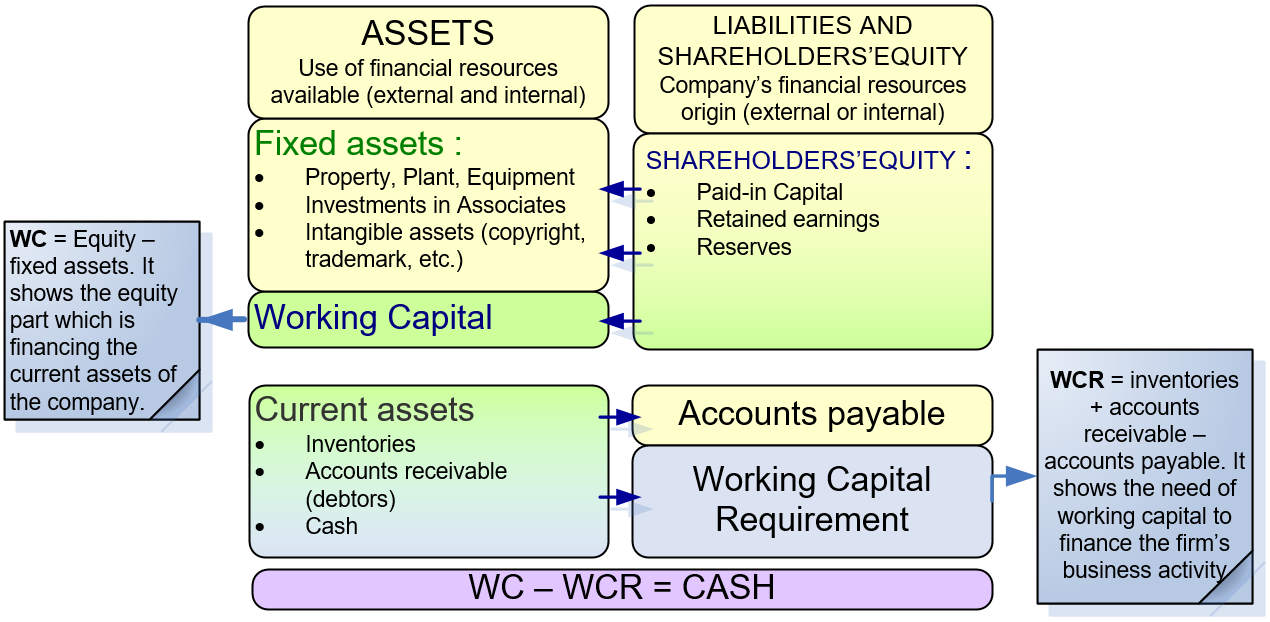

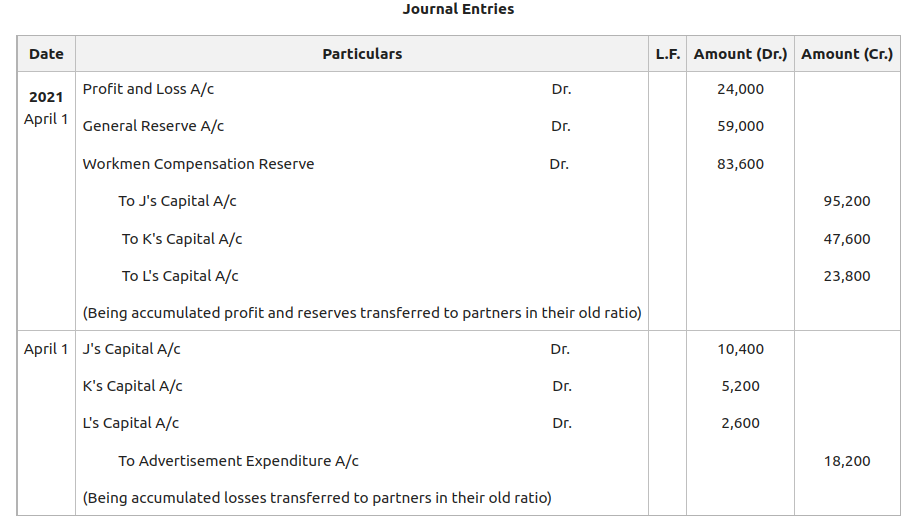

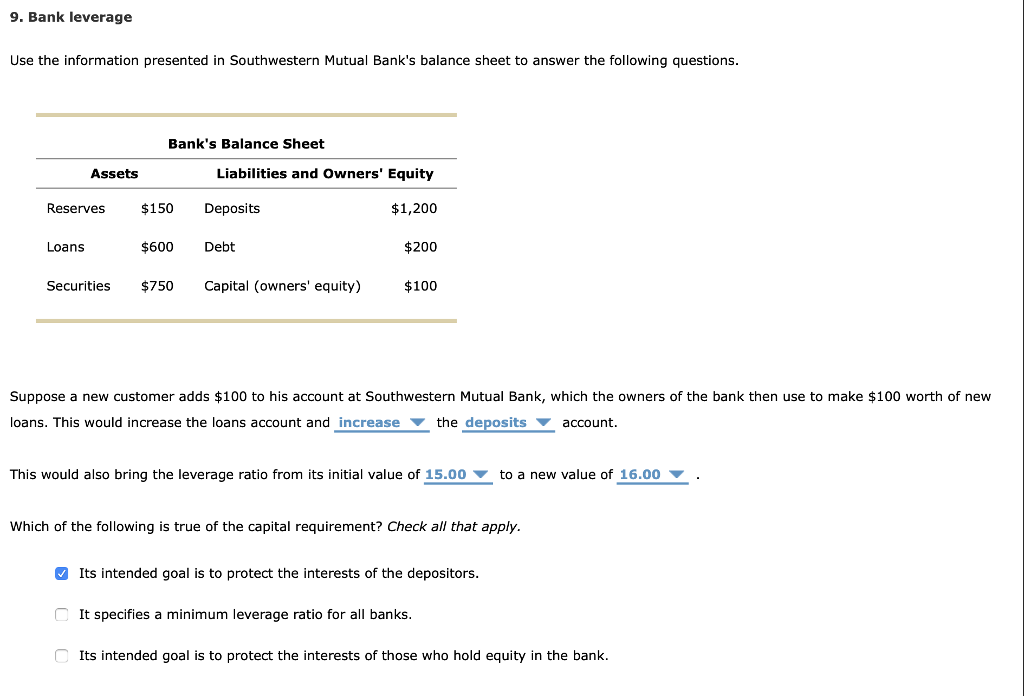

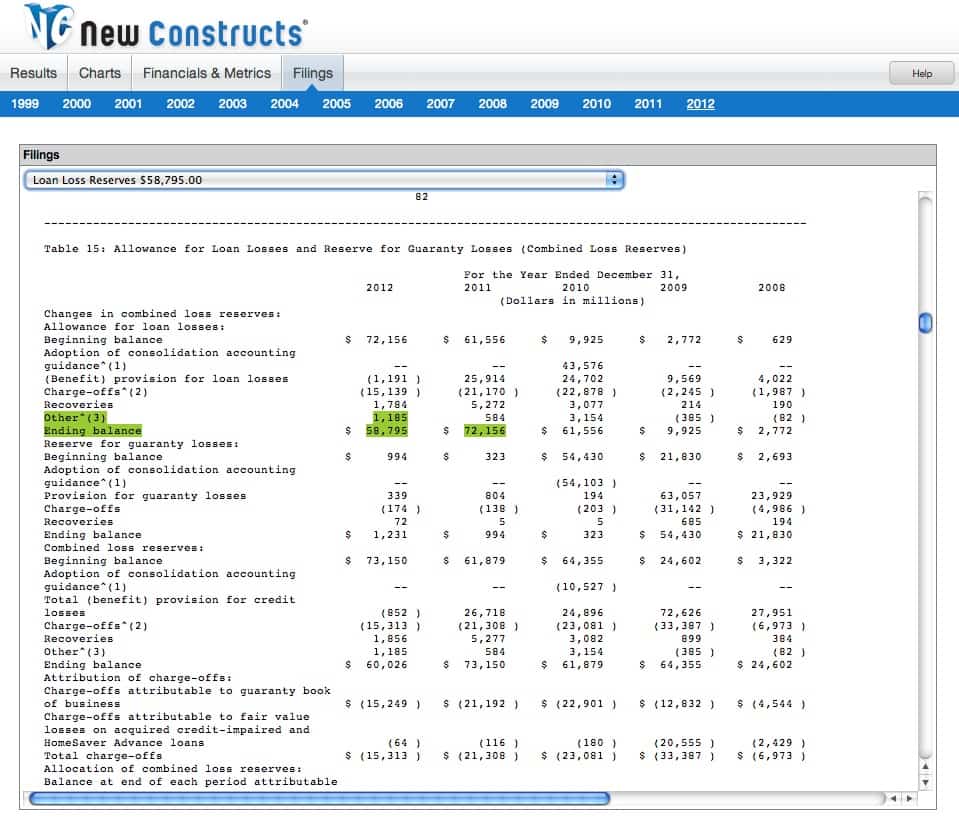

The reserves are funds set aside to pay future obligations. A capital reserve is an account on the balance sheet to prepare the company for unforeseen events like inflation, instability, or the need to expand the business or get into a new and urgent project. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

A capital reserve is a line item in the equity section of a company's balance sheet that indicates the cash on hand that can be used for future expenses or to offset any capital losses. These usually end up coming from the result of capital expenses such as excess stock. Fed minutes suggest officials are seeking smallest balance sheet possible.

Assets have declined by about $1.3 trillion since june 2022. The balance sheet reserves of insurance companies are. There is a compulsion in the creation of capital reserve.

In simple terms, retained earnings are net profits that have. Normally initial cash injection (share capital) plus retained profits to date. Reserves on the balance sheet guide | accountant town a reserve is a portion of proprietorship which has been set aside for some specific purpose.

These usually arise as a result of stock in excess of par value. Other retained earnings include, among other things, earnings generated in the past by companies included in the consolidated. What reserves do you include in your balance sheet?

Additionally, the federal reserve’s balance sheet had expanded significantly due to asset purchases that were implemented initially to restore market functioning and subsequently to support the economic recovery. Capital on a balance sheet refers to any financial assets a company has. There are four main types of capital:

The balance sheet is a snapshot of the assets and liabilities of a. On the equity & liabilities side of the balance sheet, capital reserve appears under the head reserves & surplus. Capital can also include a company's facilities and equipment.

These arise as a result of past profits. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments.

:max_bytes(150000):strip_icc()/Balance-Sheet-Reserves_Final_4201025-resized-b426e3a4e56040f29fba29b238f53ec3.jpg)

:max_bytes(150000):strip_icc()/capitalreserve.asp-final-4ee04af3045840f6970764ff1432151e.png)

:max_bytes(150000):strip_icc()/ExxonOilreservesPDF-f07628dcc0c04b21a67b1fe1f0d06a4f.jpg)