Outrageous Tips About Cash Basis Flow Statement

A cash basis income statement is an income statement that only contains revenues for which cash has been received from customers, and expenses for which cash expenditures have been made.

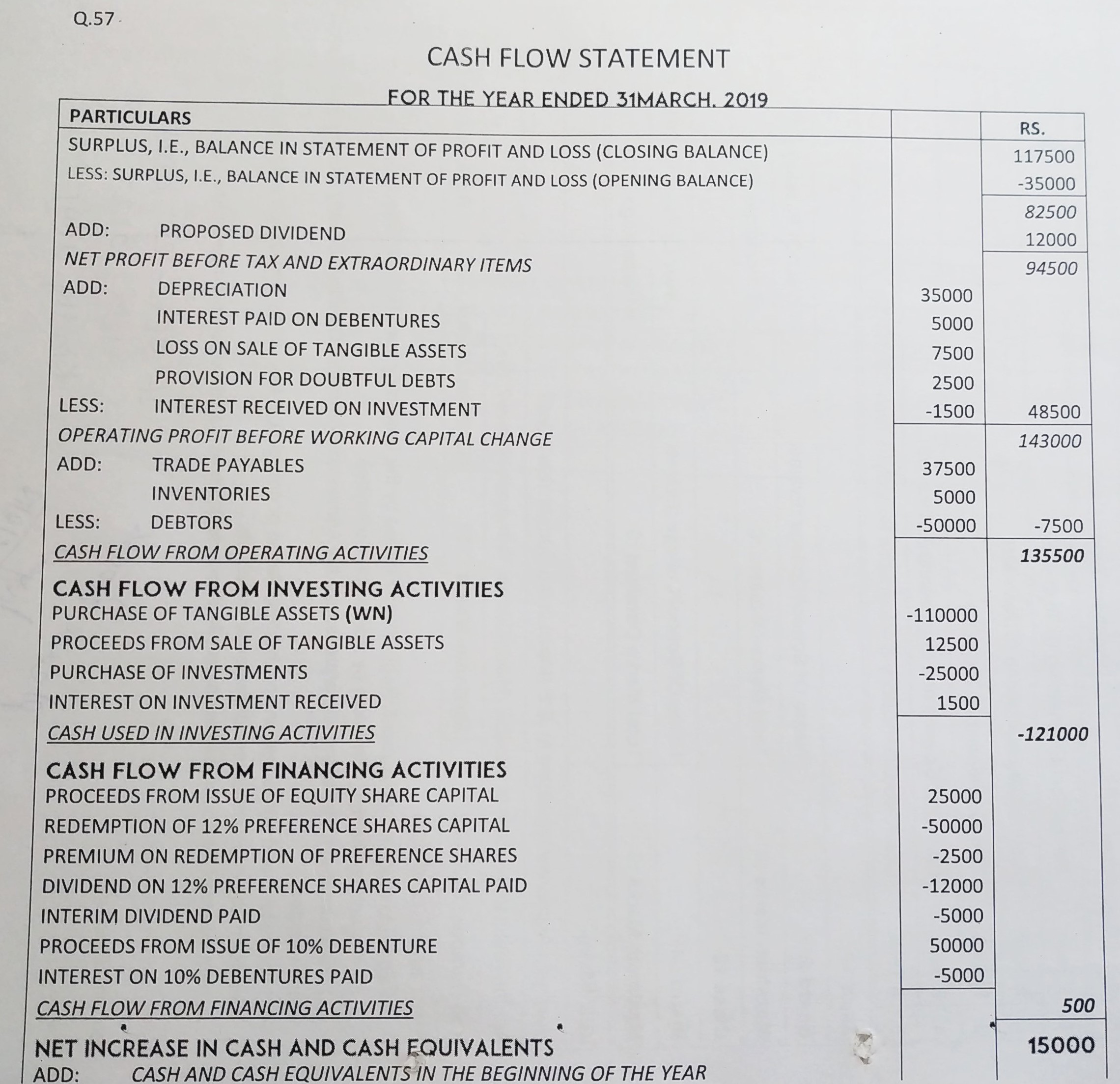

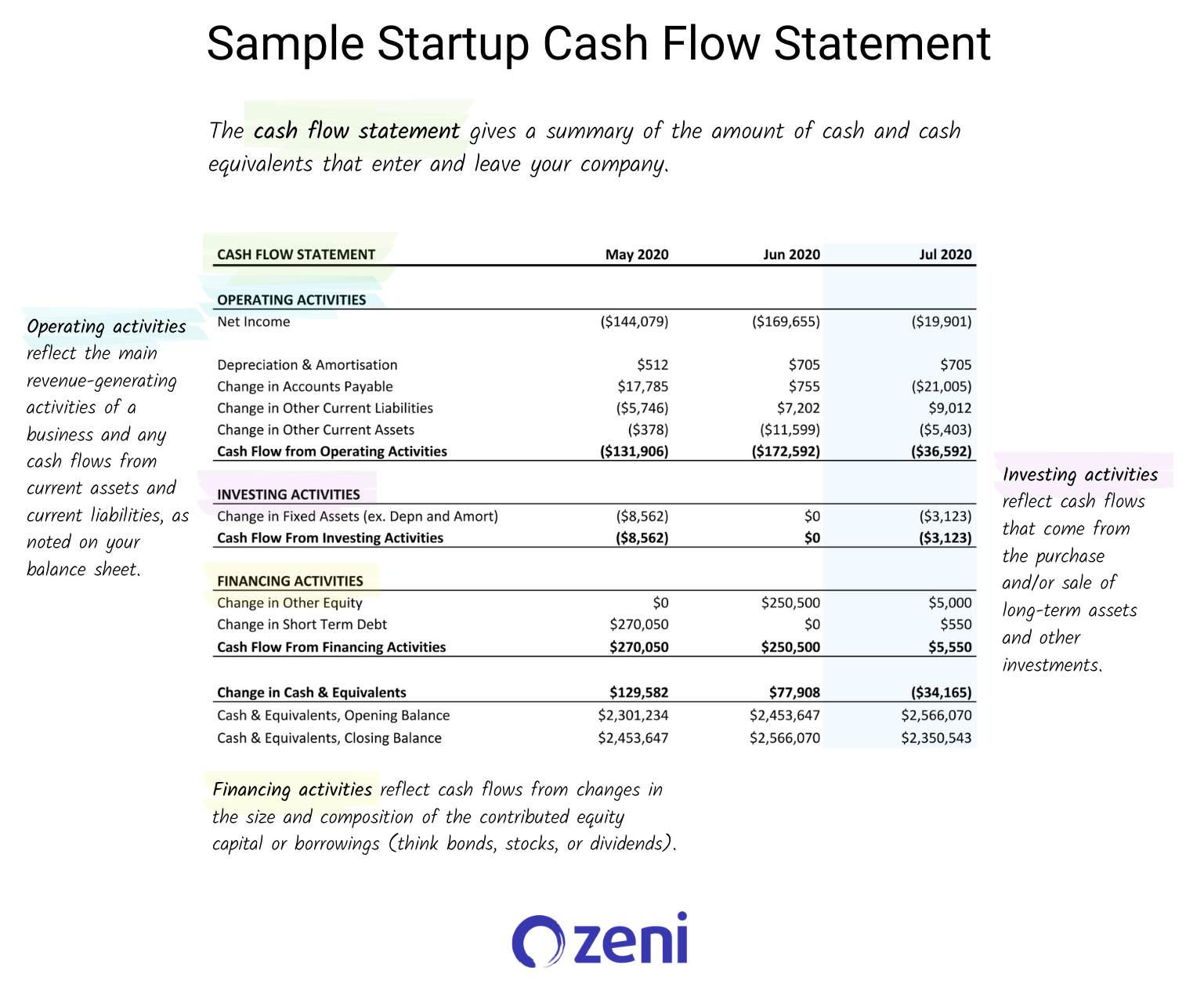

Cash basis cash flow statement. The two different accounting methods,. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

Reporting activity in the statement of cash flows is predicated on the cash method of accounting rather than the accrual method used for other financial statements. The three sections of a cash flow statement cash flow from operating activities is cash earned or spent in the course of regular business activity—the main way your.

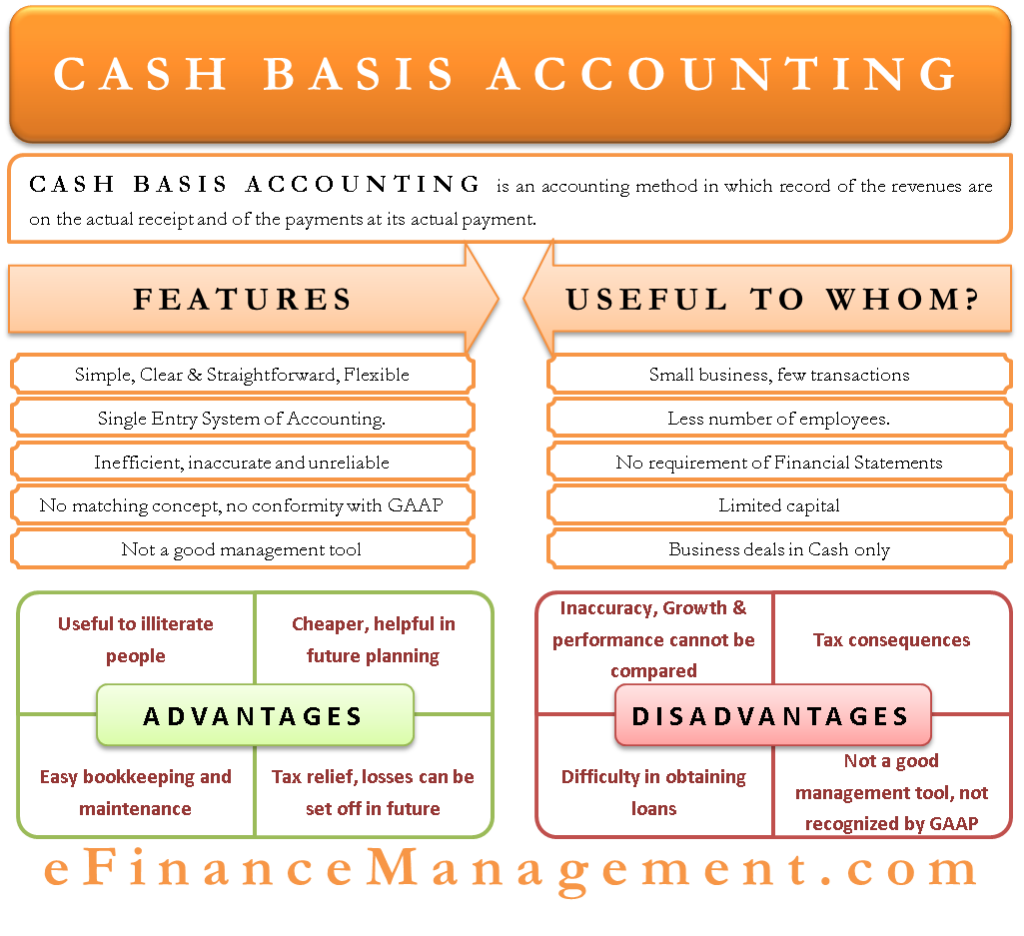

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Thus, it is formulated under the guidelines of cash basis accounting (which is not compliant with gaap or ifrs ). The statement of cash flows analyses changes in cash and cash equivalents during a period.

Whereas both the income statement and balance sheet reflect an accrual basis of accounting, the cash flow statement starts with net income and translates the economic activity of the firm from an accrual basis to a cash basis. The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. Cash flow from investing activities is cash earned or spent from investments your company makes, such as purchasing.

For cash basis, the only time a transaction is recorded is when cash is exchanged. Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Accrual basis does not require cash to change hands in order to record a.

Accordingly, all debits and credits to a bank account that has the general characteristics of an unrestricted demand deposit or a restricted deposit account should be reported as. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out. You sell someone a product, they pay you in cash, therefore you recognize revenue.

Record adjusted ebitda margin fourth. Essentially, the cash flow statement is concerned with the. An overview the main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are.

The three main components of a cash flow statement are cash flow from operations, cash flow from investing, and cash flow from financing. The cash flow statement is required for a complete set of financial statements. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

The income statement is the most common financial statement and shows a. In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in.

Michael rosenston accrual accounting vs. The statement of cash flows acts as a bridge between the income statement and balance sheet by. A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)