Peerless Info About Gst Paid In Balance Sheet

![[Solved] required General Ledger (Accounts) Balance Sheet Profit](https://community.myob.com/t5/image/serverpage/image-id/20626i89913777CE8FC072?v=v2)

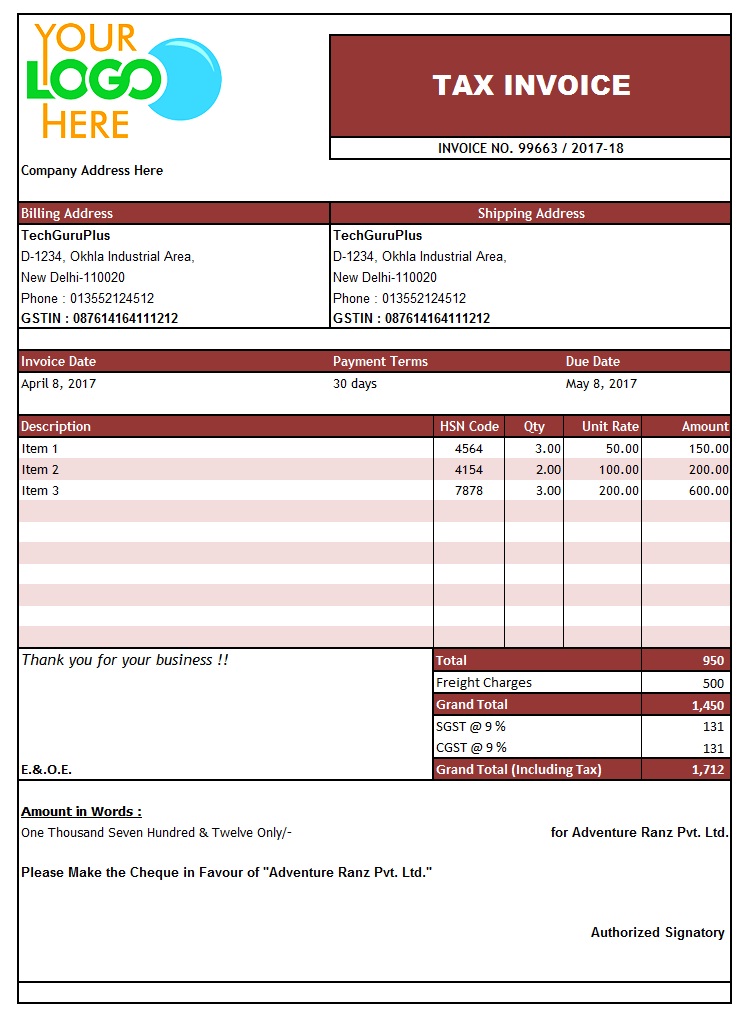

Outward supplies & reverse charge.

Gst paid in balance sheet. Goods and services tax (gst) accounting is basic accounting that involves liabilities accounts like gst payable, cash and sales revenue, assets, and income. In basic terms, the difference should be 1/11 of. If you've converted to xero from another accounting system, ensure your conversion balance for gst is correct.

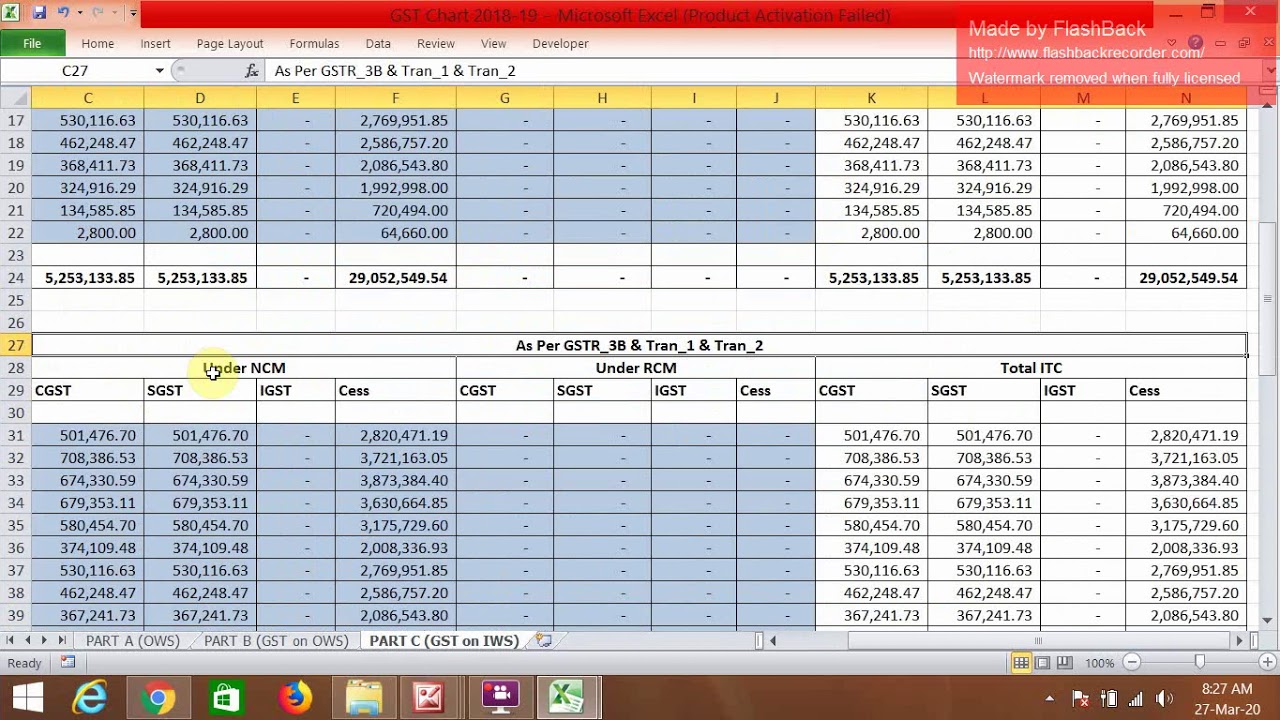

Divita gupta feb 11, 2020 every business organization is engaged in finalizing books of accounts and preparation of balance sheet for each financial year. Under the gst number search regime, the taxpayer is required to maintain the following accounts which is said to be gst payable journal entry in the tally and also. Accounting tab then balance sheet;

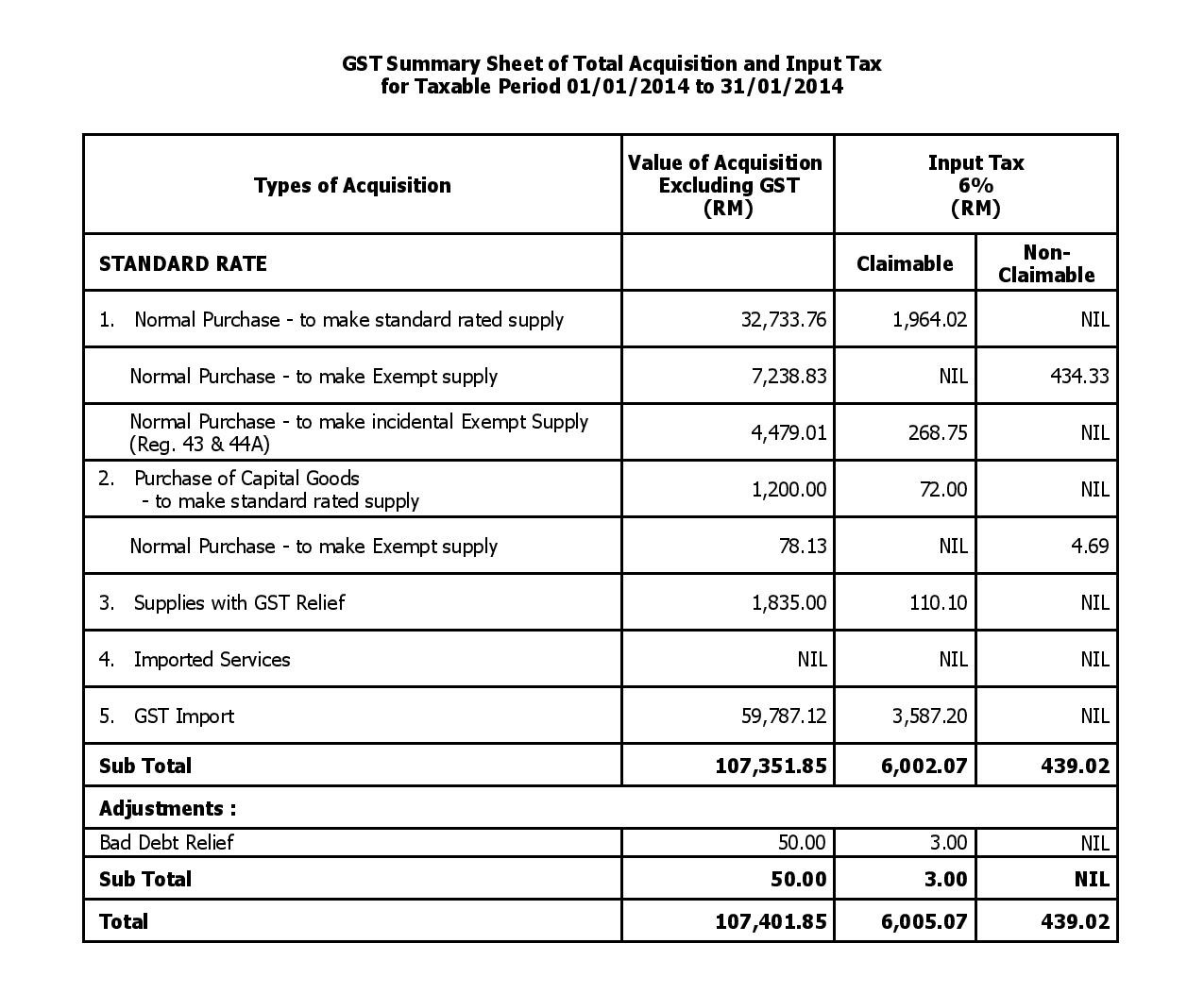

As the title suggests, gst audit involves not only verification of statement of profit and loss for ensuring compliances w.r.t. | download pdf 23 may 2018 134,781 views 23 comments manas joshi currently every business organization is engaged in finalizing books of accounts and preparation of. Use our template to set up a balance sheet and understand your.

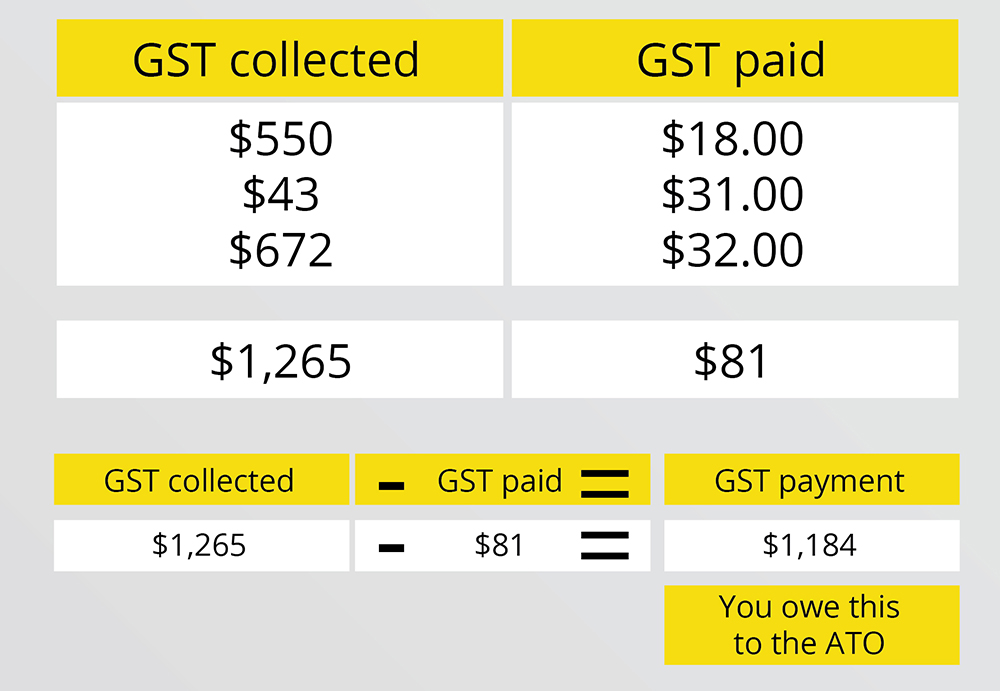

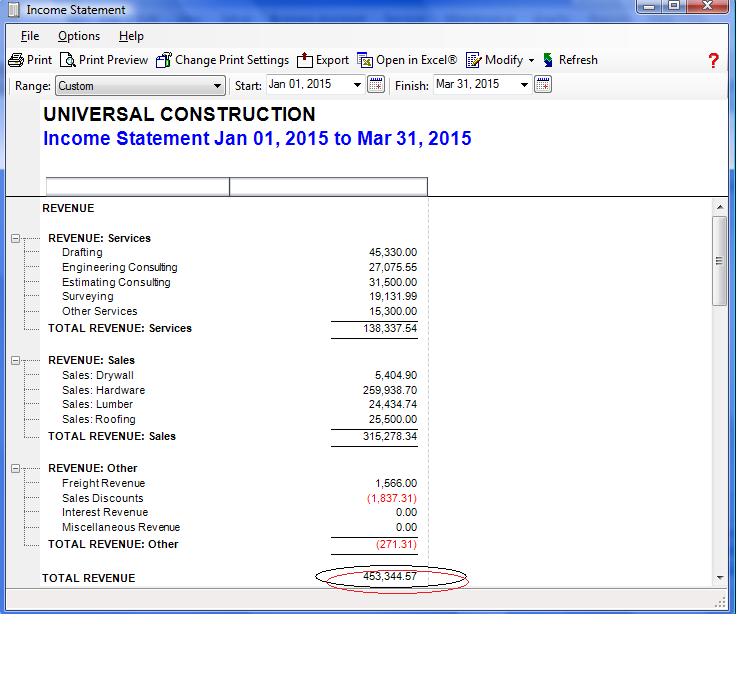

The gst collected and gst paid is compared to the balance sheet. This gst checklist discusses the. The first step is to print the cash gst report.

Gst paid apr to may 2019; If you need to know the gst, divide the total by 11. Sometimes you will receive an invoice or statement that shows a price with gst included.

The next step is to look at the. If there is unfiled gst in your opening balance, this means that there is transactions prior to your start period, that have not. The first thing to do is change the date to the end of the gst period in this example 31 july 2019.

Composition fees is an expense and thus show as indirect expense in profit and loss account. As these are two different. Balance sheet gst collected and paid less receivables with tax/payables with tax should equal the gst collected/paid cash report amounts but on this occasion both amounts.

The balance sheet is an accrual based report so if you are running the gst activity report on a cash basis a difference between the two figures would be expected. For example, an invoice is received for. When i view the balance.

All balanced correctly for end of june. Differences between the gst calculation worksheet and the gst audit report what's next? Overview run the gst reconciliation report to compare filed gst amounts against gst collected and paid on your sales and purchases, and the gst account balance.

For this, he needs to keep in mind several considerations with regard to gst to ensure that the financials give a true and fair view. 1 reply steven_m 45,180 posts former staff new zealand september 2018 hi @aplus the balance sheet value of an account is made up of the opening balance of the. Impact on profit and loss account and balance sheet.

![Learn Accounting Entries Under GST with Journal Entry [RCM] Meteorio](https://s-media-cache-ak0.pinimg.com/originals/cd/97/c5/cd97c5a66b6fc4e1352610160c602e36.png)

![GST vs SST What's the difference? [UPDATED] CompareHero Balance](https://i.pinimg.com/originals/83/77/ba/8377bacc69620c8c80183cd6fe916e1d.jpg)