Outrageous Info About Cash Flow Statement Increase In Accounts Receivable

This discussion aims to give a brief definition of accounts.

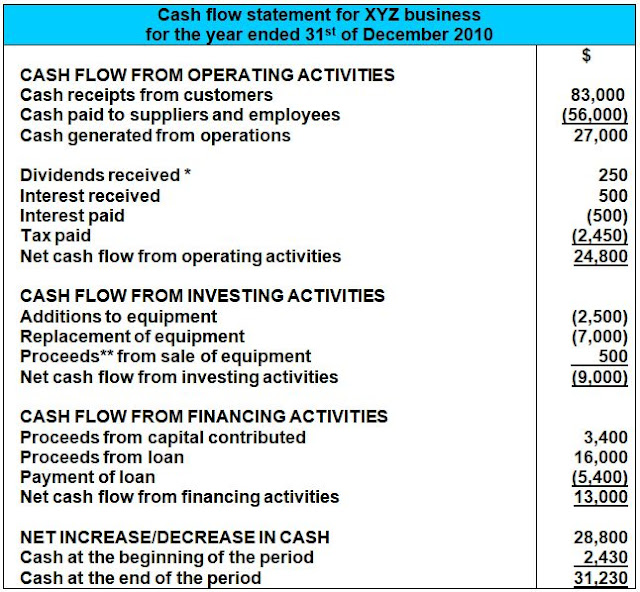

Cash flow statement increase in accounts receivable. For example, we have a $57,800 net income on the income statement for the period. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial.

An increase in accounts receivable can have a significant impact on cash flow, as it represents sales that have been made but not yet collected in cash. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. We’ll begin by defining ar, cash flow, and the cash flow statement.

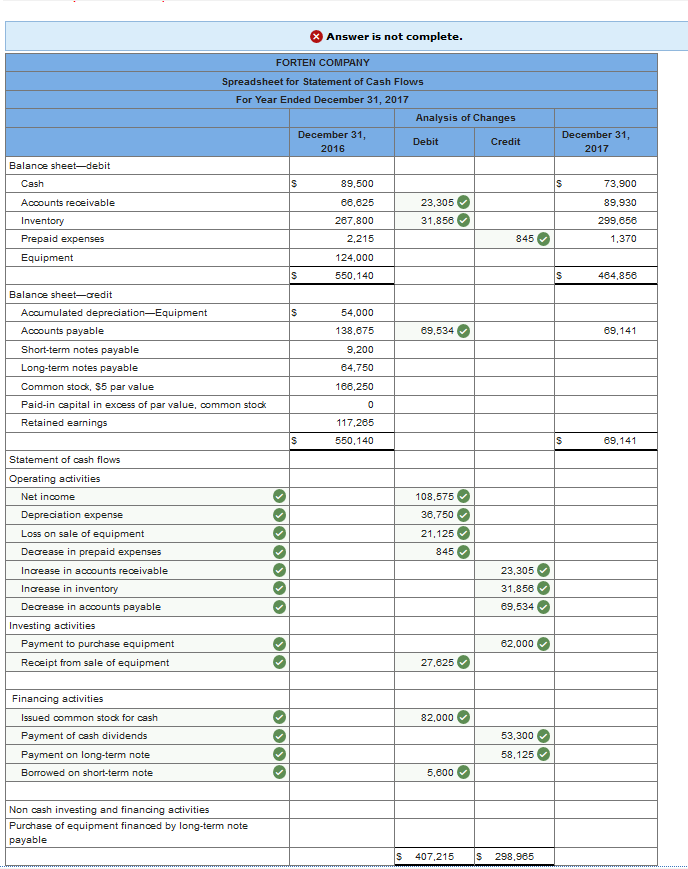

Over here, we have a net change in accounts receivable. There would need to be a reduction from net income on the cash flow statement in the amount of the $500 increase to accounts receivable due to this sale. An increase in accounts receivable indicates that sales on account were recorded (debit accounts receivable and credit sales) so it is part of accrual net income.

Written by jeff schmidt what is the statement of cash flows? Changes in accounts receivable. Converting accounts receivable into cash can give your company more liquidity, less risk of bad debt, and a greater ability to pivot in different directions.

Operating activities to provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key. The increase in accounts receivables is deducted from net profit and the decrease in accounts receivables is added to net profit. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

How to prepare a cash flow statement. So we have an increase in accounts receivable. The statement of cash flows can be challenging to prepare.

Plus, monitoring the accounts receivable is a part of an effective cash management process. Recall that net income (the last line on the income statement and the first line on the cash flow statement) captures revenues and. This increase in accounts receivable of $800 indicates that the company did not collect $800 of the revenues that were reported on february's income statement.

To reiterate, an increase in receivables represents a reduction in cash on the cash flow statement, and a decrease in it reflects an increase in cash. This is because preparing the entries requires analyses of the accounts as well as an understanding of the types of.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)