Fabulous Info About Comprehensive Income Items

Here are some common examples of items other comprehensive income includes:

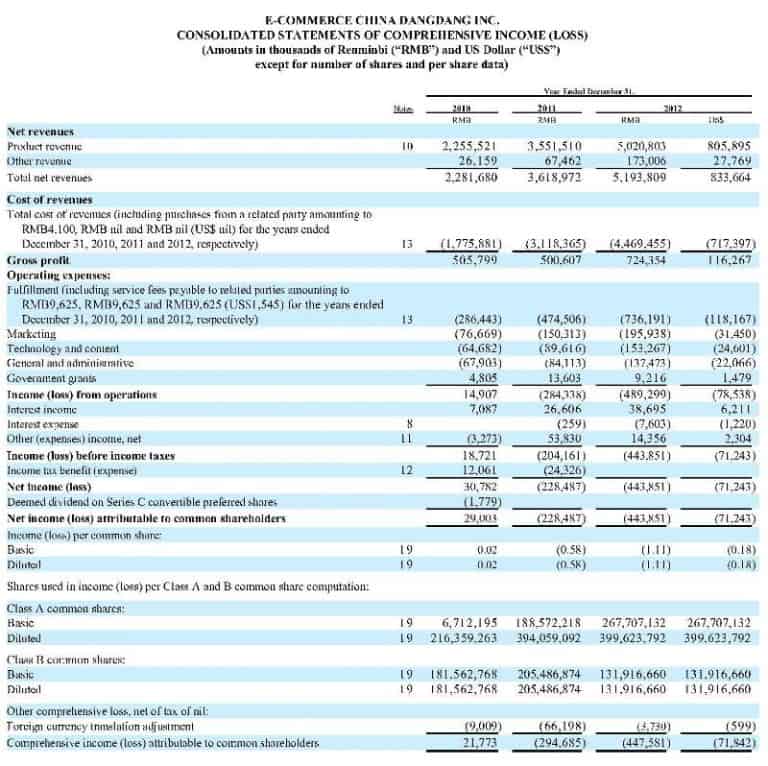

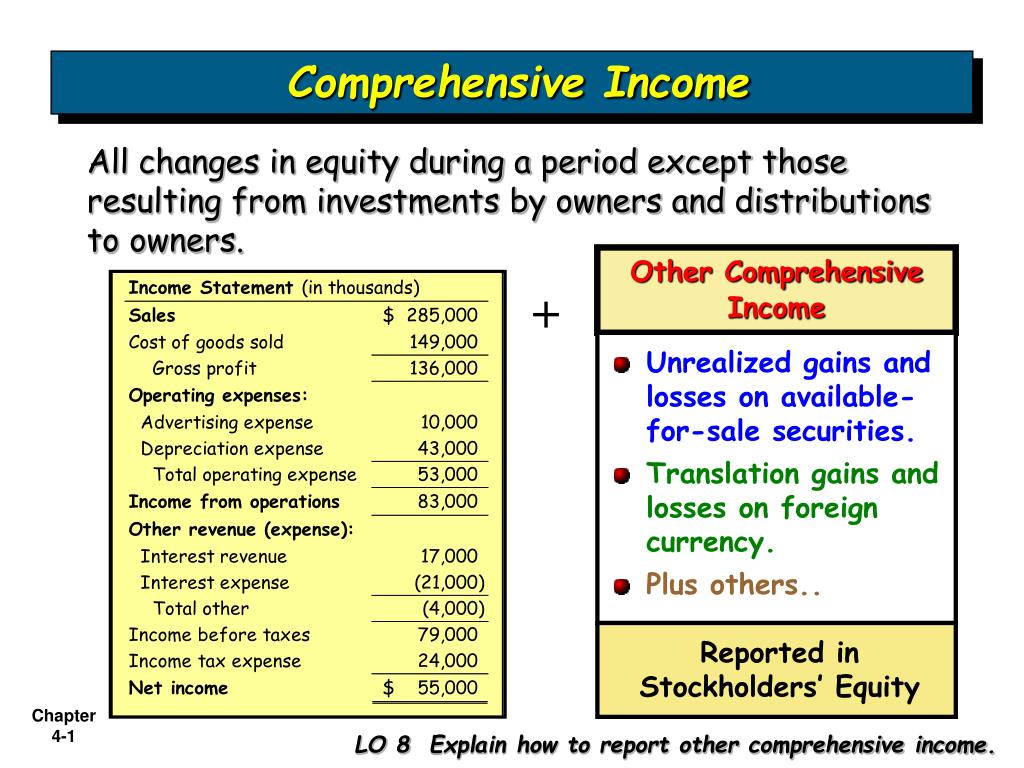

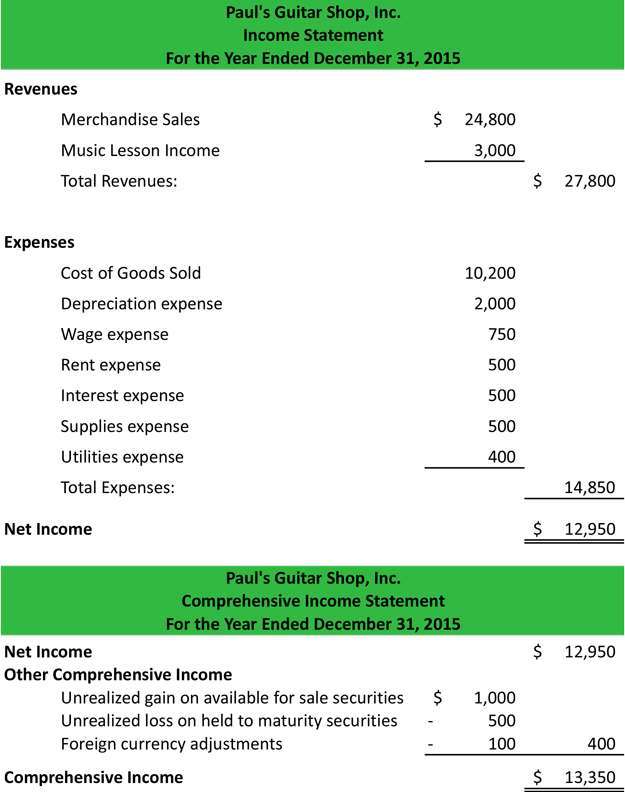

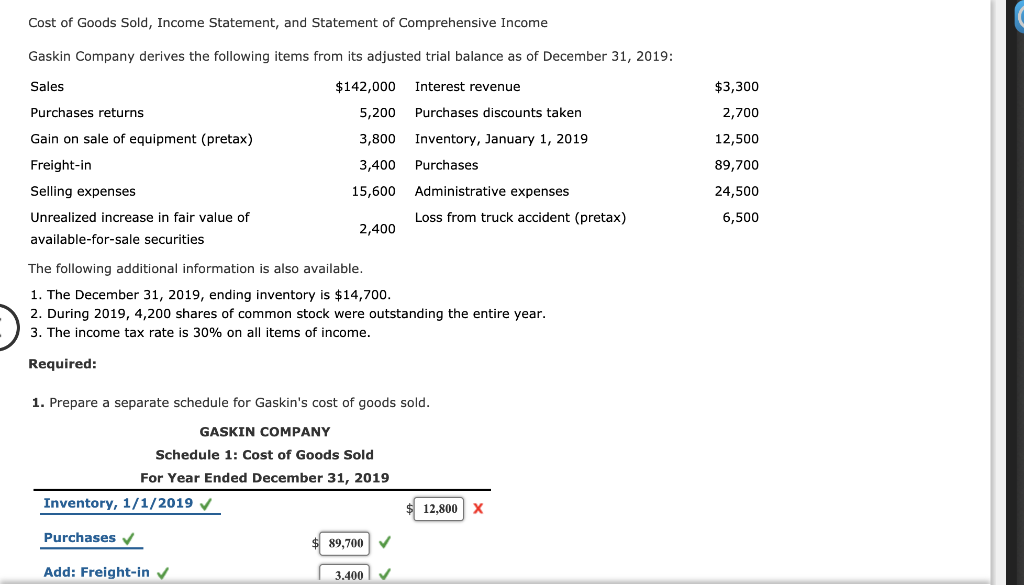

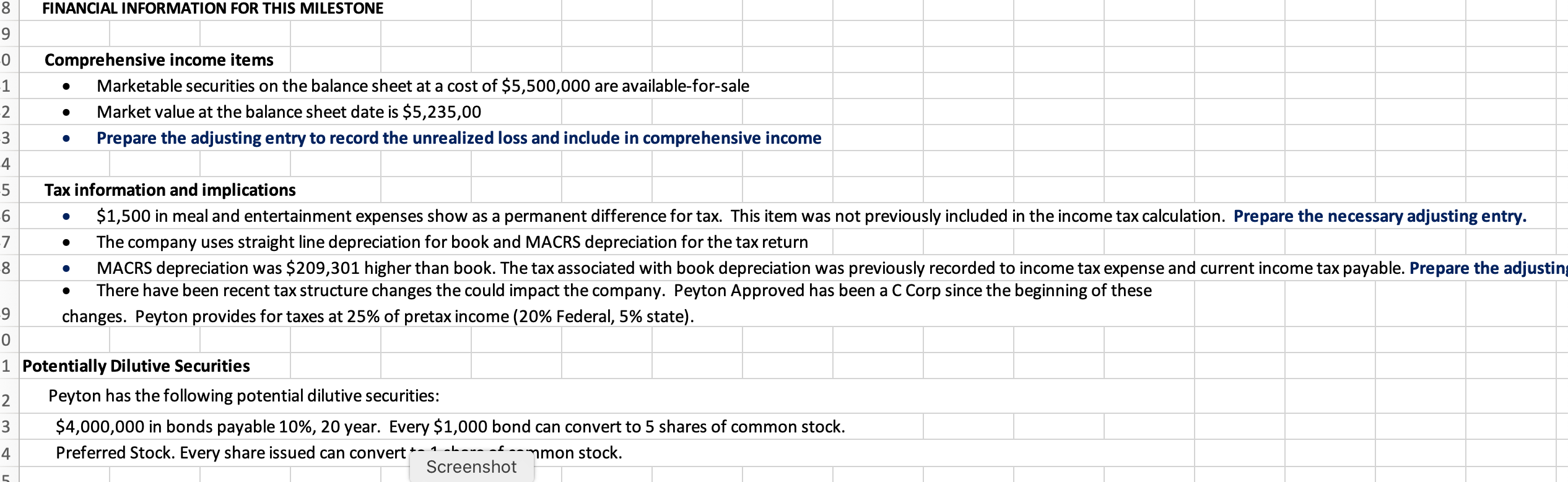

Comprehensive income items. Profit and losses from valuation. For the full year, the items that ran through comprehensive income included unrealized gains from derivatives instruments of $1 billion, unrealized. Unrealized income can be unrealized gains or losses on, for example, hedge/derivative financial instruments and foreign.

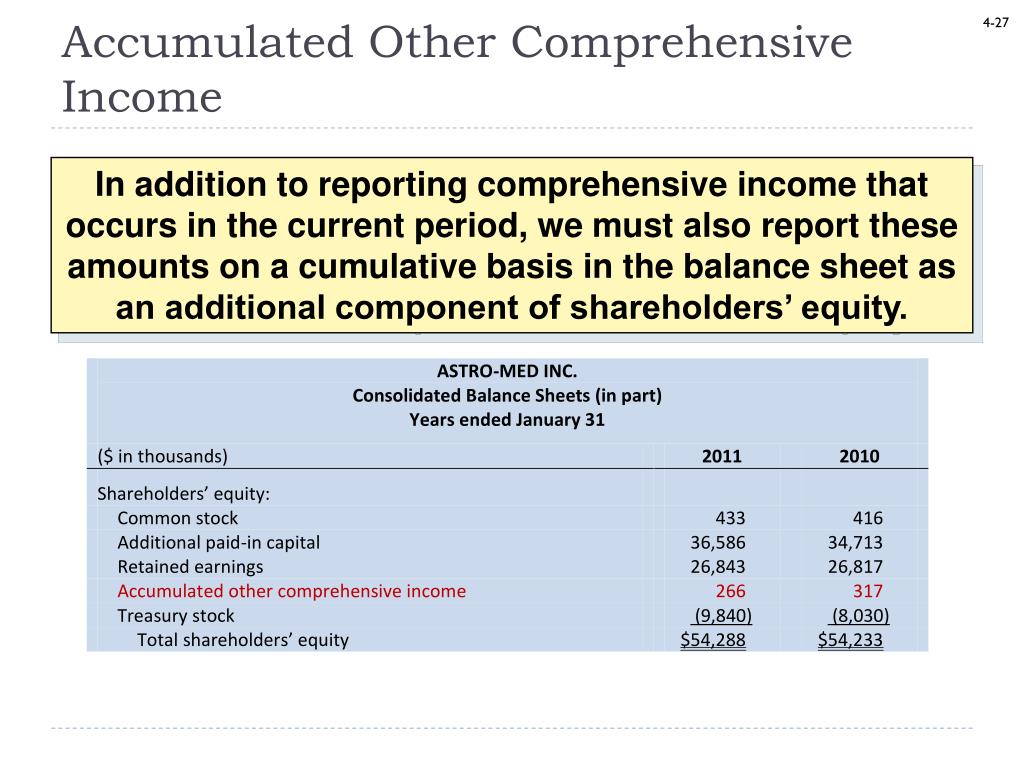

Presentation of items of other comprehensive income (amendments to ias 1 presentation of financial statements) introduces changes to the presentation of items of. Each item regarding retrospective restatement for changes in accounting policy or correction of prior period. Other comprehensive income consists of revenues, expenses, gains, and losses that, according to the gaap and ifrs standards, are excluded from net income on the.

Those items of oci that will not be. This refers to all items of comprehensive income directly. The statement of profit or.

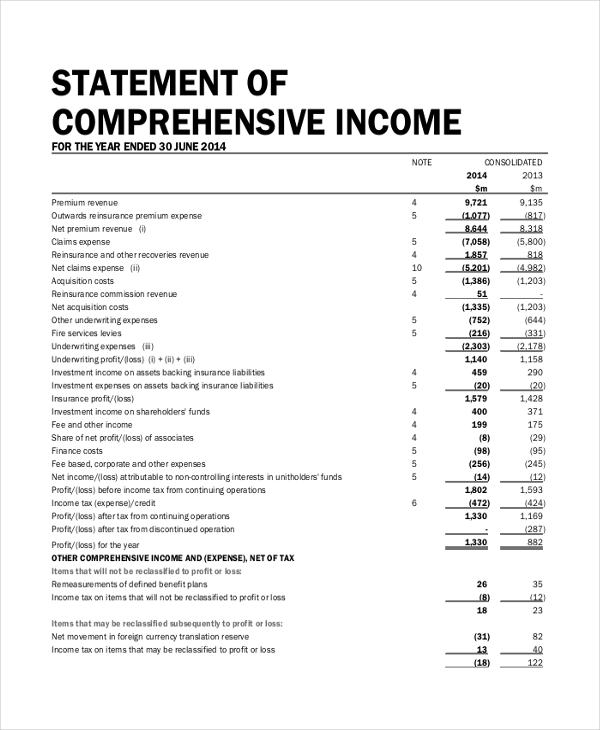

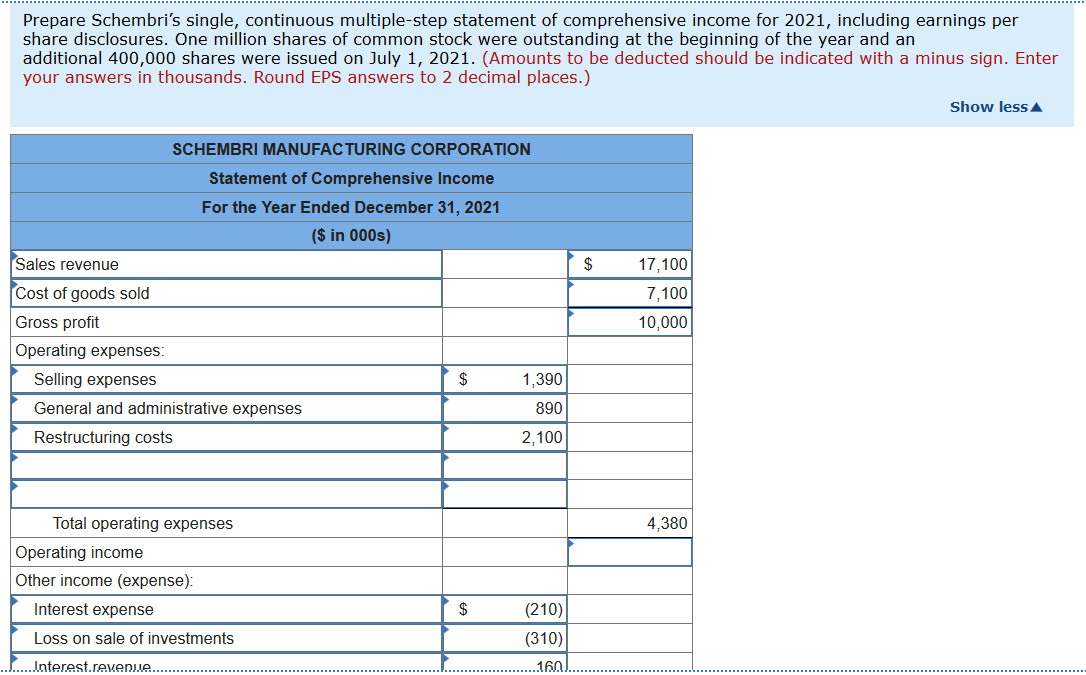

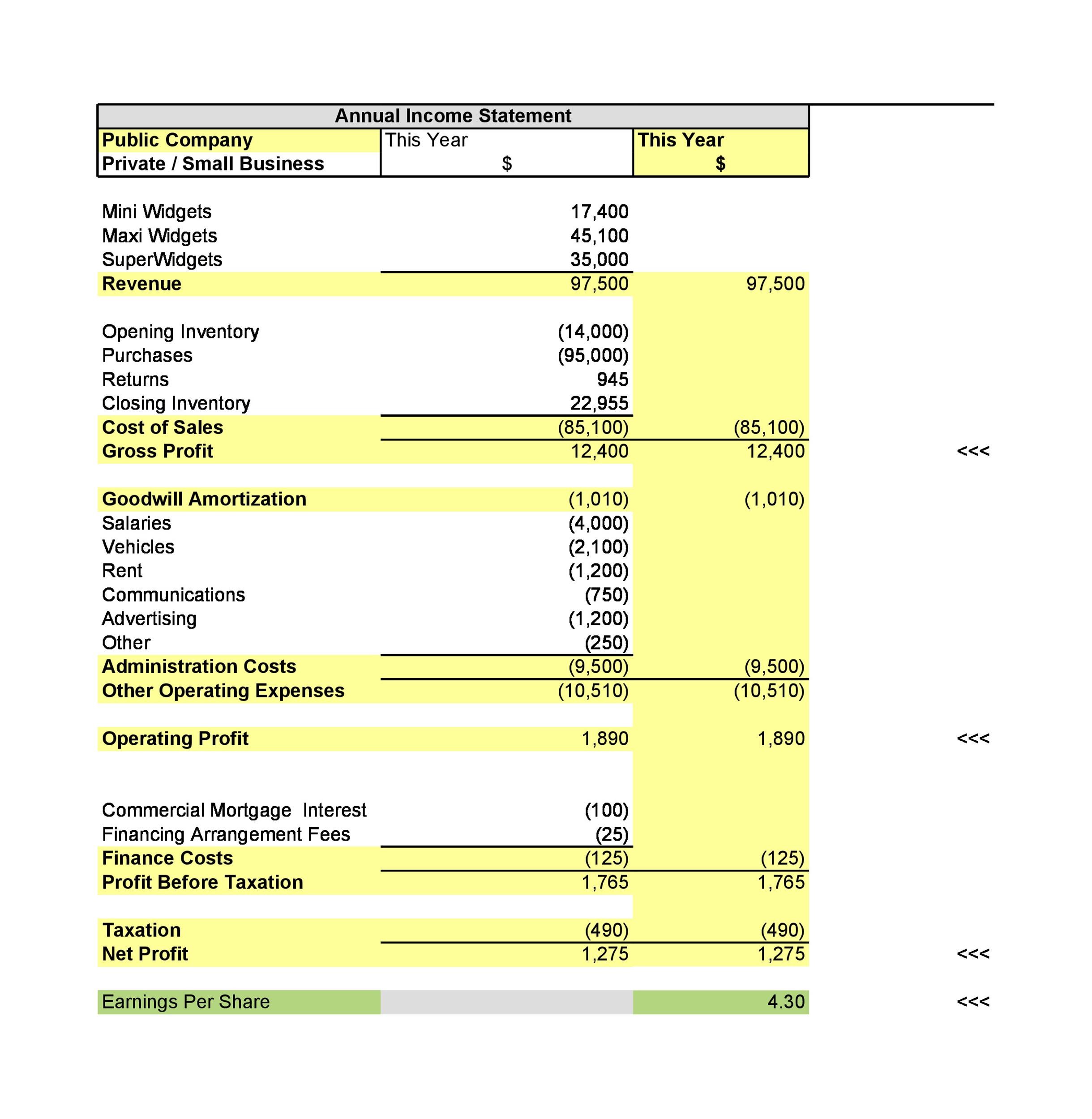

Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a. Examples of other comprehensive income. Comprehensive income and comprehensive income for the period.

It includes net income and unrealized income. Those items of oci that might be recycled subsequently; Present total net income, other.

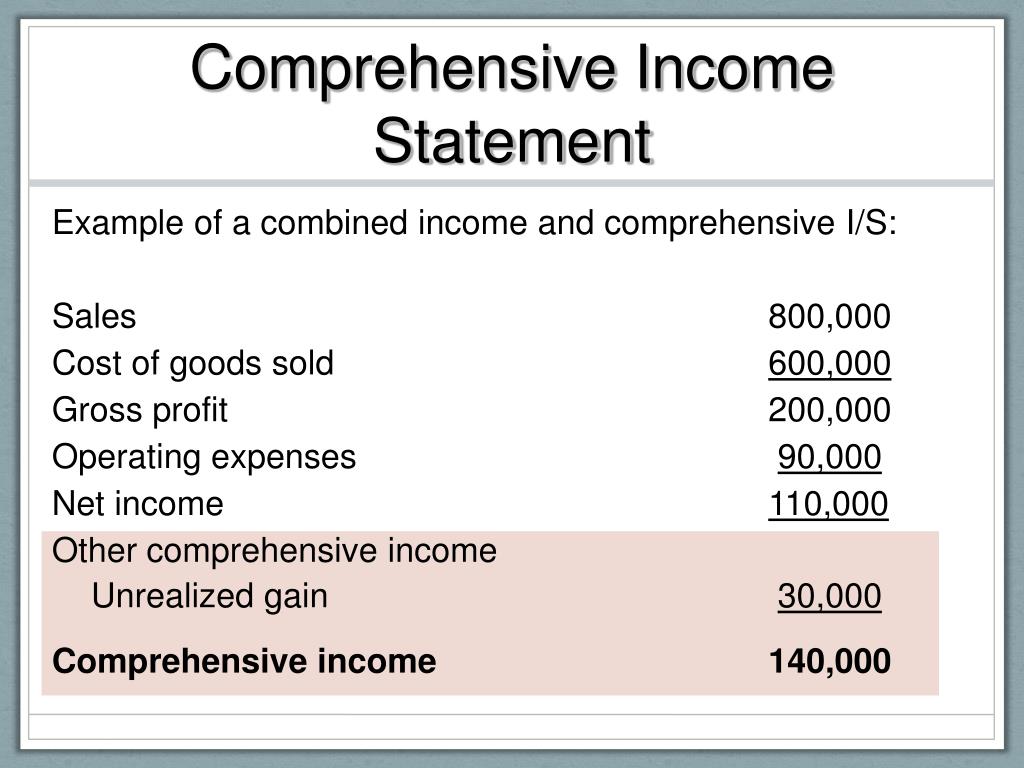

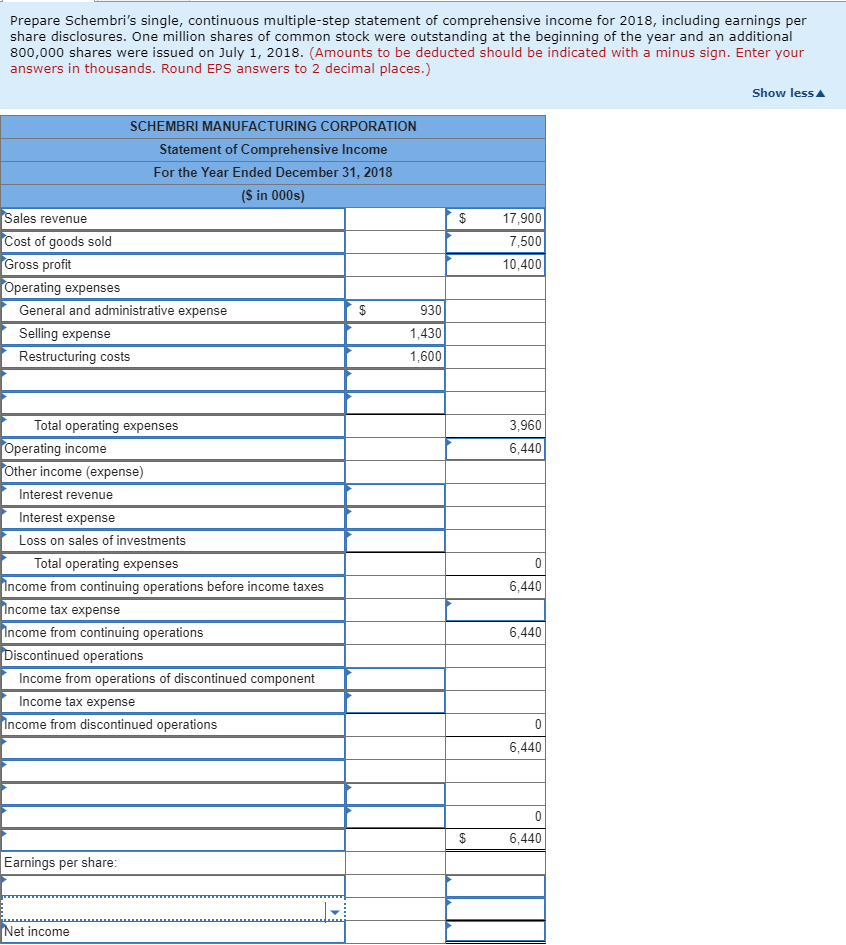

Reports net income, other comprehensive income, and comprehensive income in a single financial statement of comprehensive income. What is other comprehensive income? Payments in foreign currencies that have been adjusted 3.

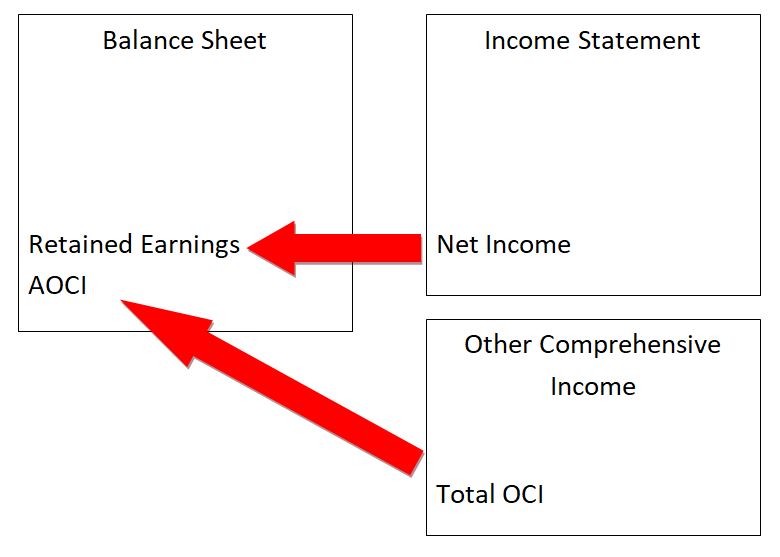

Comprehensive income includes net income and oci. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users. Updated may 28, 2021 reviewed by charlene rhinehart comprehensive income vs.

There are two major types of comprehensive income which are: Each item reported as other comprehensive income, net of tax; Total comprehensive income is the combination of profit or loss and other comprehensive income.

An overview in financial accounting, corporate income can. Entities have a choice of presenting this in a single statement or as two statements. All items of ‘other comprehensive income’ (oci);

Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an. The statement of comprehensive income contains those revenue and expense items that have not yet been realized.