Lessons I Learned From Info About Process Of Cash Flow Statement

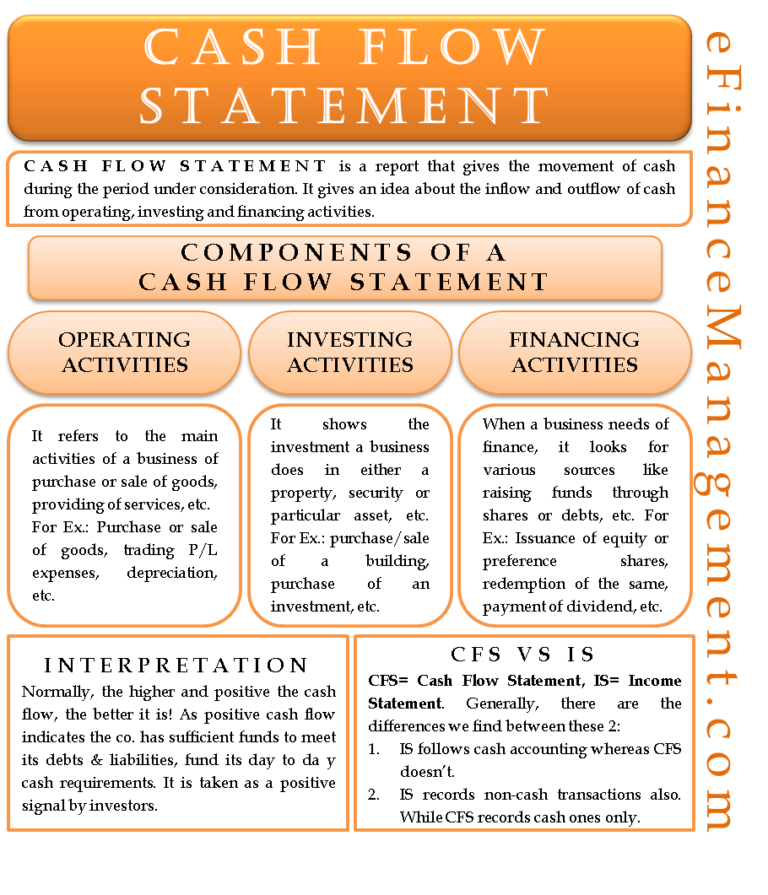

The cash flow statement is recognized as an indispensable part of the financial statements for its characteristics.

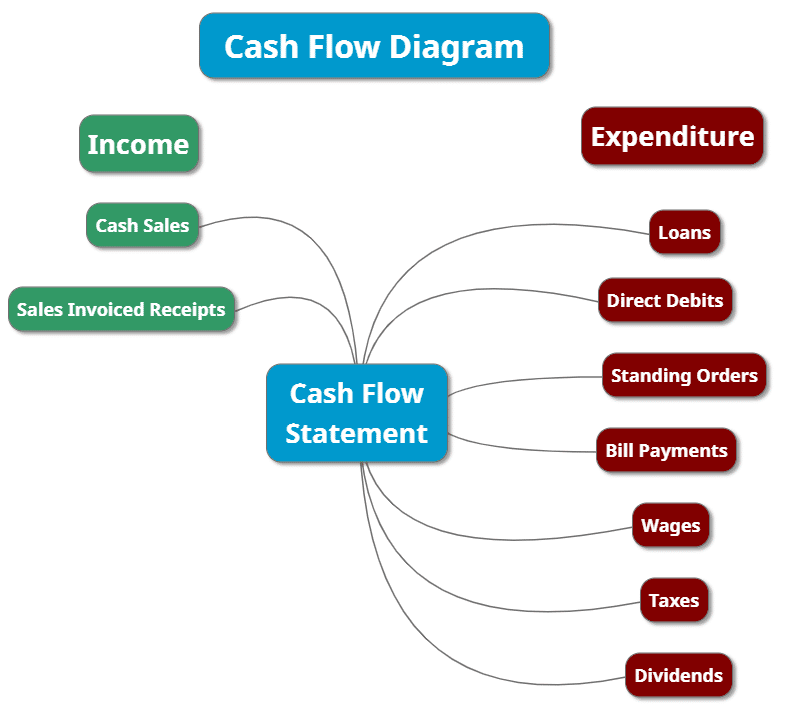

Process of cash flow statement. Cash flow statements look at operating expenses, business investments, and financing to make up the summary. A cash flow statement comprises three parts: Operating cash flow is cash generated from the normal operating processes of a business and can be found in the cash flow statement.

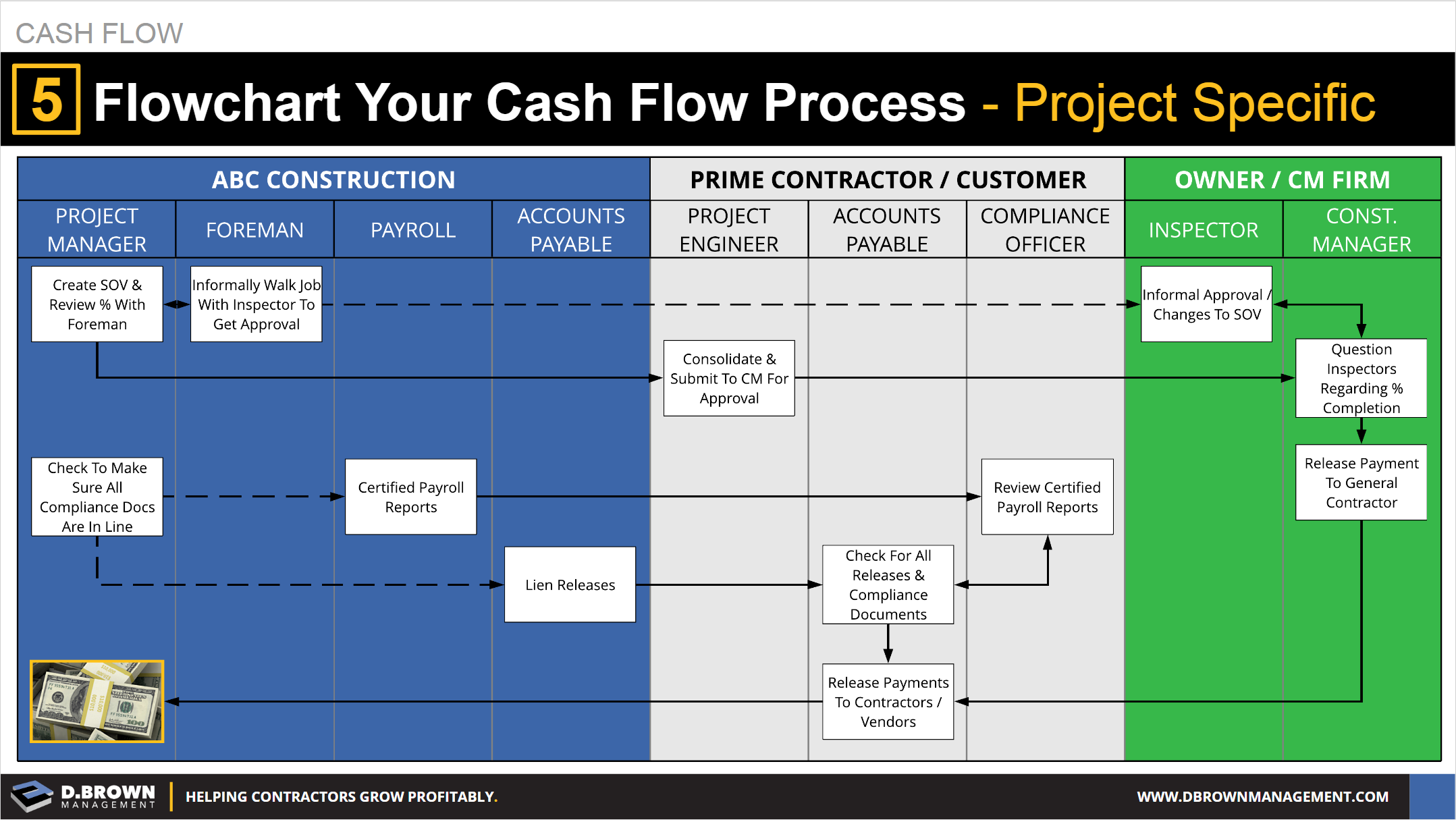

This report shows how much cash a company receives and spends on operating, investing, and financing activities. Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Calculate cash flow from operating activities one you have your starting balance, you need to calculate cash flow.

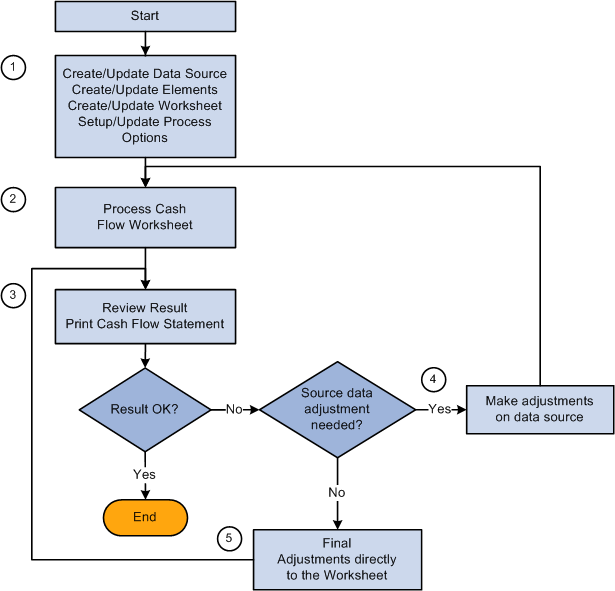

It assesses the capability of a business to generate sufficient cash to clear its debts and operating expenses. The statement of cash flows is one of. How to prepare cash flow statement?

Cash flow from operations, cash flow from investing, and cash flow from financing. By adam hayes updated july 31, 2023 reviewed by amy drury fact checked by melody kazel what is cash flow? The main components of the cash flow statement are:

The cash flow statement is the least important financial. The cash flow statement is required for a complete set of financial statements. A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time.

Cash flow statement sections 1. What is cash flow statement? It is an essential document for evaluating the sources and uses of cash for an organization.

How to create a cash flow statement 1. The cash flow statement gets prepared at the end of a financial year. A cash flow statement is a financial report that summarizes the incoming and outgoing of funds in a business.

As per their titles, they relate to the different uses of cash categorized by their purpose. The use of the cash flow statement in the form of cash and cash equivalent as the current asset and its direct influence on fixed assets and other current assets do exist. 16.1 explain the purpose of the statement of cash flows;

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. 16.2 differentiate between operating, investing, and financing activities; Some companies prepare cash flow statements annually—covering their full fiscal year—while others prepare them quarterly or even monthly.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Cash flow statements split your inflow and outflow of cash into three main categories: 16.4 prepare the completed statement of cash flows using the indirect method

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)