Formidable Info About Debt Issuance Costs On Balance Sheet

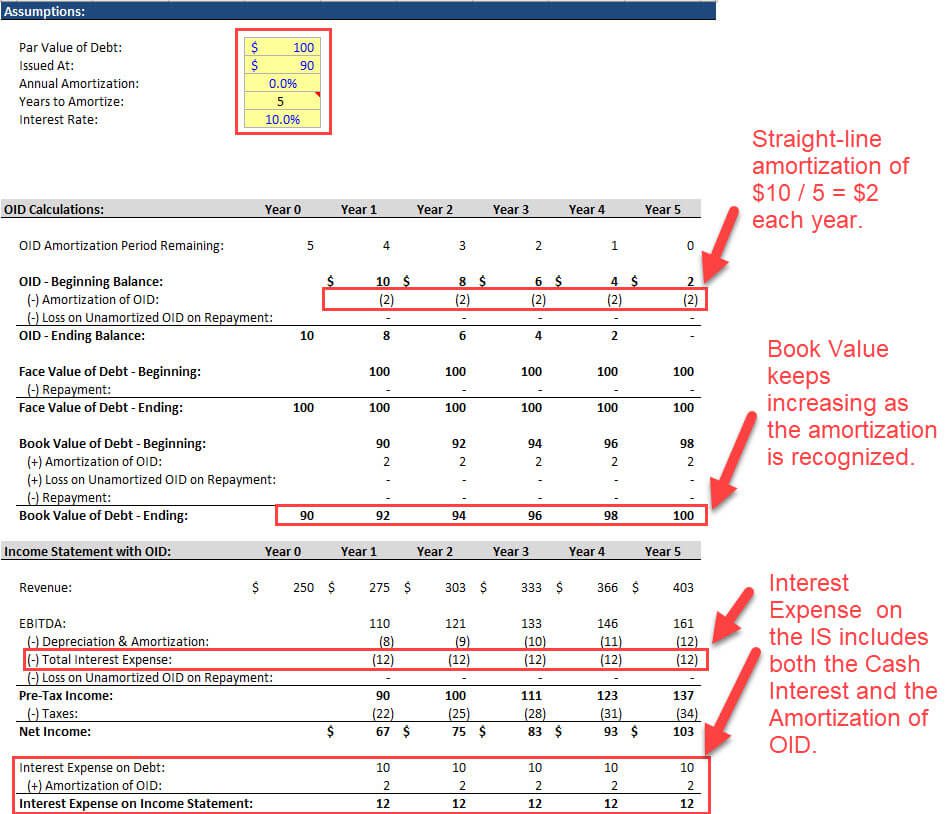

Accounting for debt issuance costs the ongoing amortization of debt issuance costs should be included in interest expense.

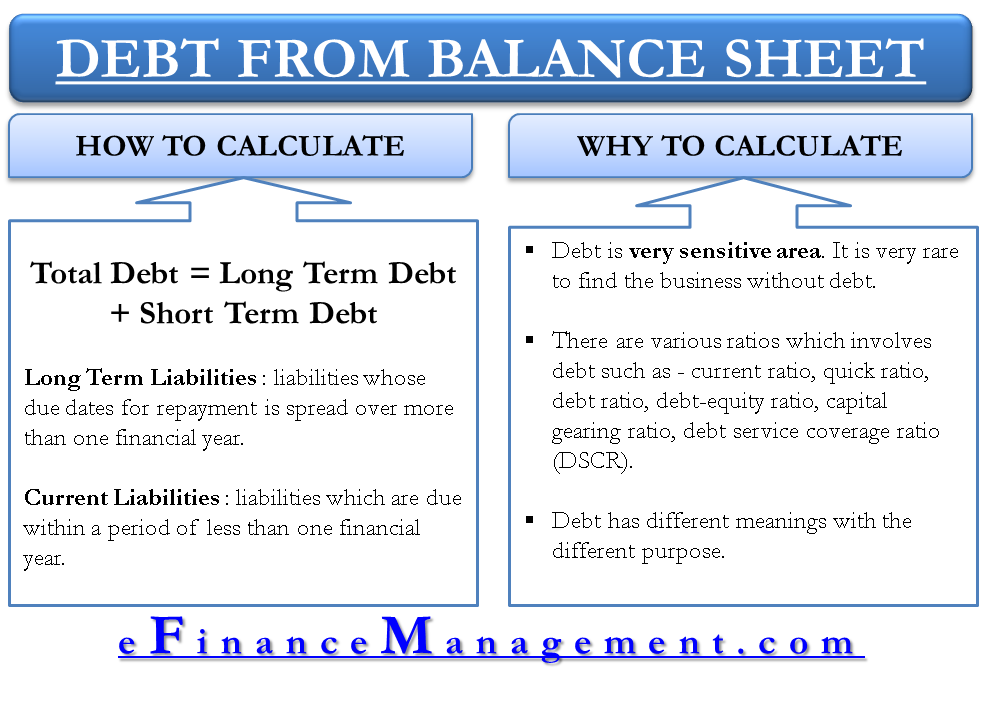

Debt issuance costs on balance sheet. The asu specifies that “debt issuance costs related to a note shall be reported in the balance sheet as a direct deduction from the face amount of that note” and that. Simplifying the presentation of debt issuance costs, requires that debt issuance. Prior to the amendments, debt issuance costs were presented as a deferred charge (i.e., an asset) on the balance sheet.

The asu changes the presentation of debt issuance costs in financial statements. Ofwat has published a balance sheet cost of debt model (‘model’) which outlines how it has calculated projected actual debt costs for the sector over amp8, supplemented by. This update requires that debt issuance costs related to a recognized debt liability be presented on the balance sheet as a direct deduction from the carrying.

Under the asu, an entity presents such costs in the balance sheet as a. When the debt issuance costs were presented as a direct deduction, the amount of debt shown on the entity's balance sheet increased over time, in step with. 31 may 2022 us financial statement presentation guide 12.3 accurate debt classification is.

Changes to the disclosure of debt and debt issuance costs are to be made to reflect the amount of borrowings outstanding as well as the unamortized debt. The difference between the net proceeds, after expense, received upon issuance of debt and the amount repayable at its maturity. Definitions from asc master glossary discount:

12.3 balance sheet classification — term debt publication date:

![Accounting for Debt Issuance Costs [PDF Document]](https://static.fdocuments.in/img/1200x630/reader021/image/20170907/577c81bf1a28abe054adf6a8.png?t=1628904388)