Who Else Wants Tips About Equity Section Of Balance Sheet

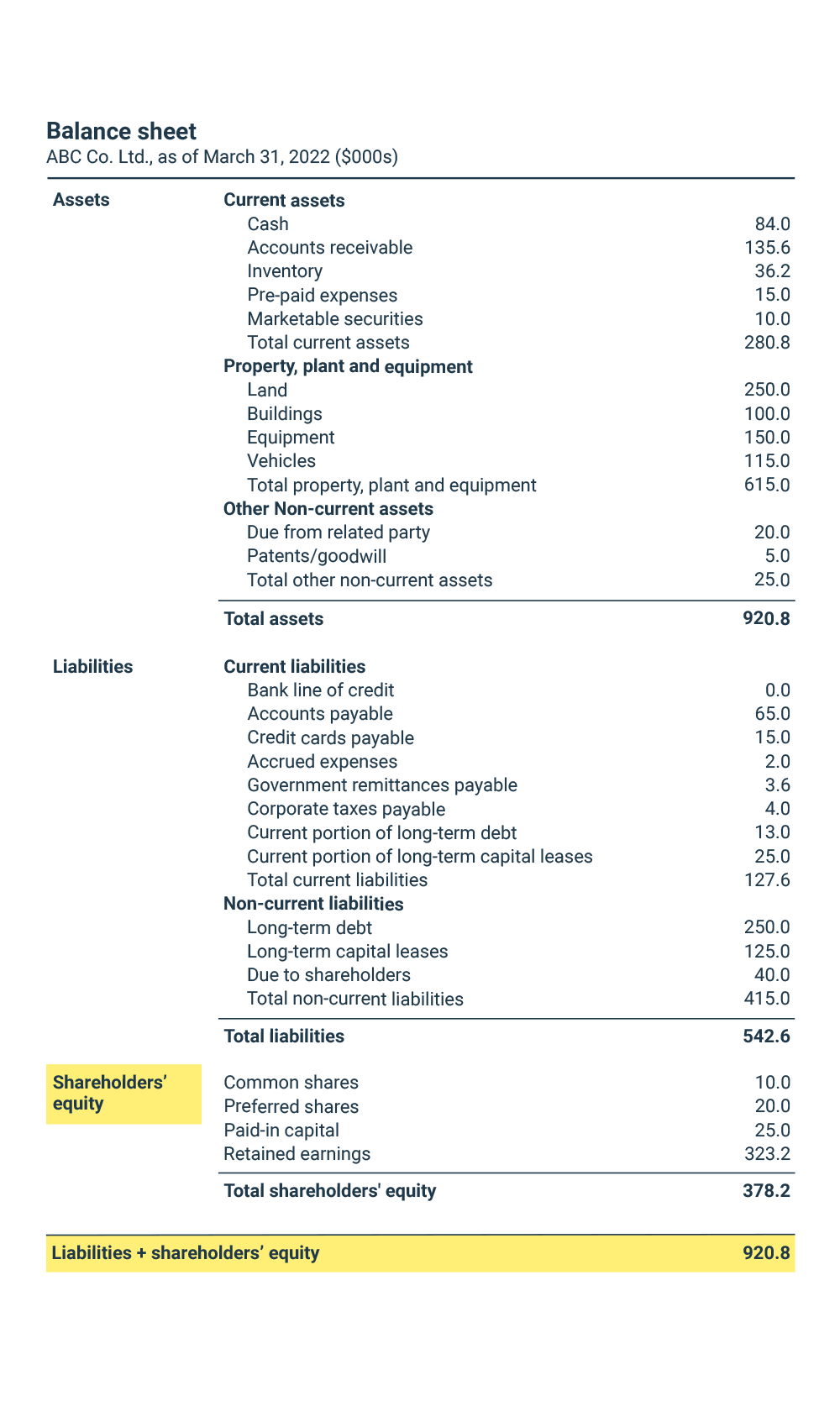

The classified balance sheet is thus broken down into three sections;

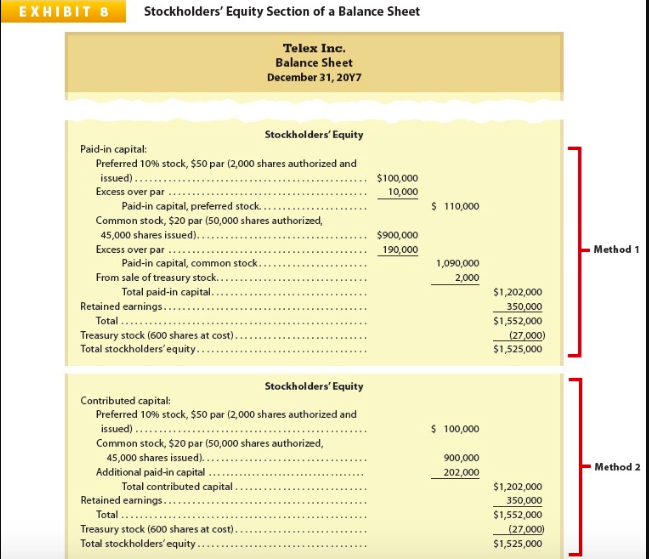

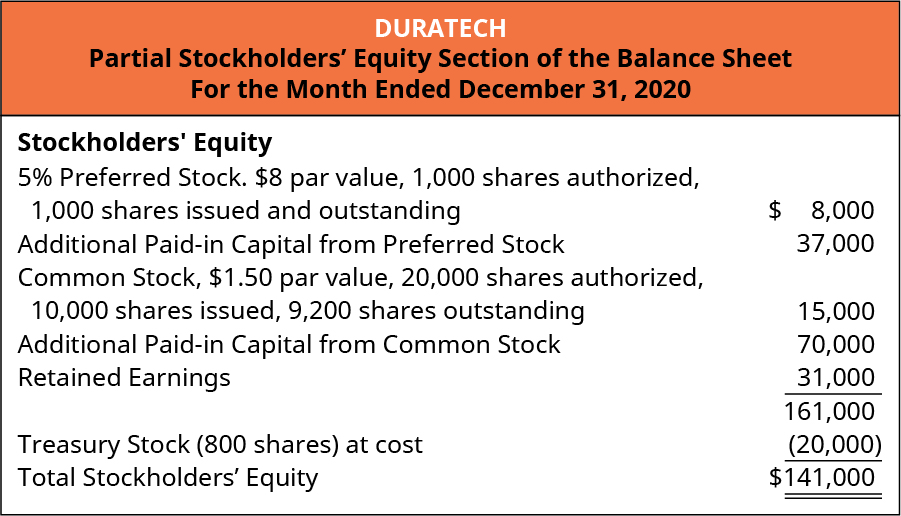

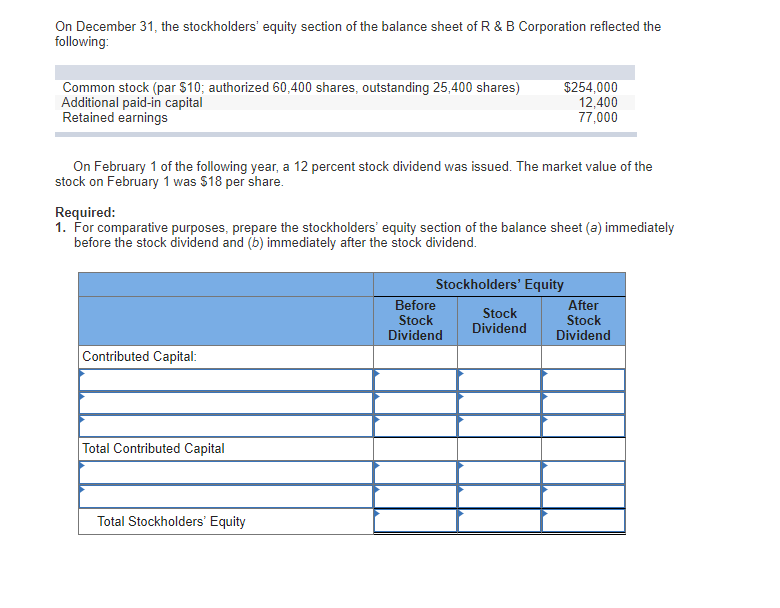

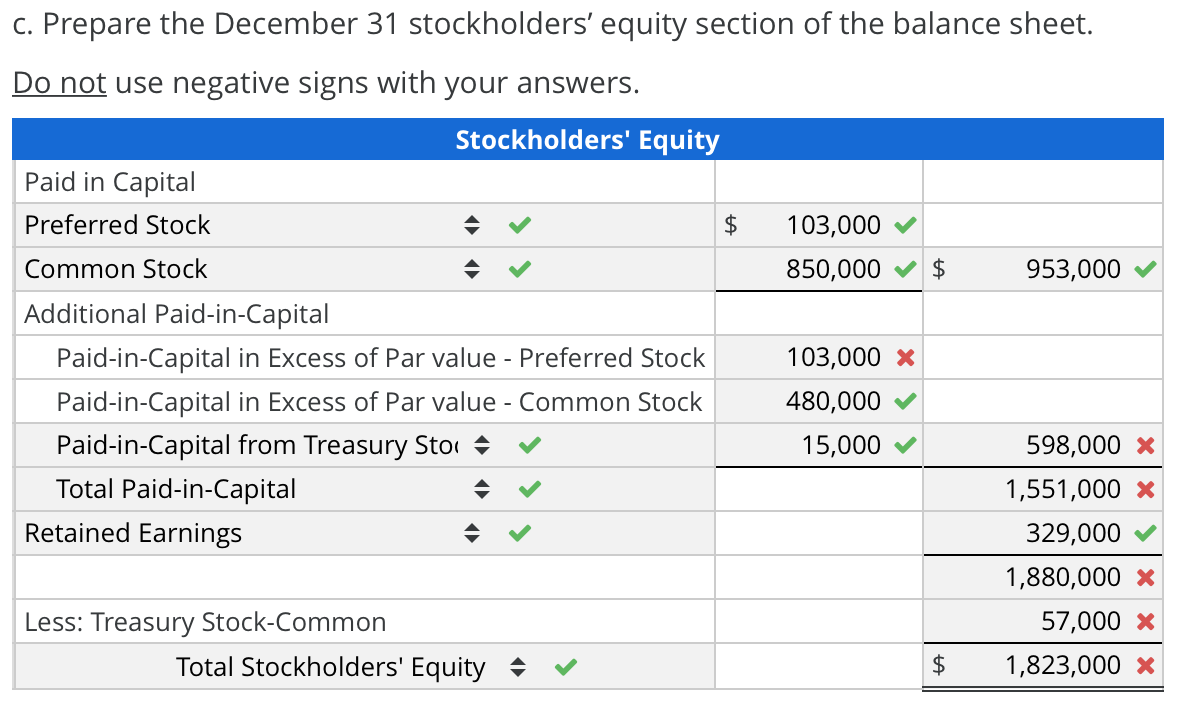

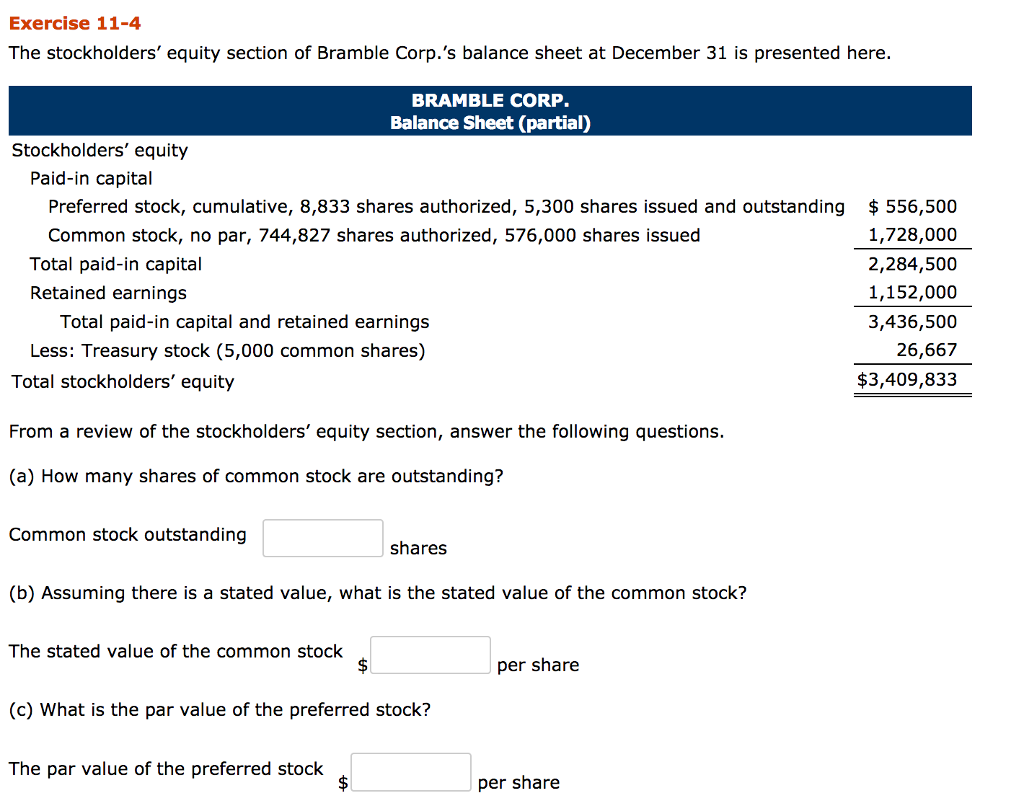

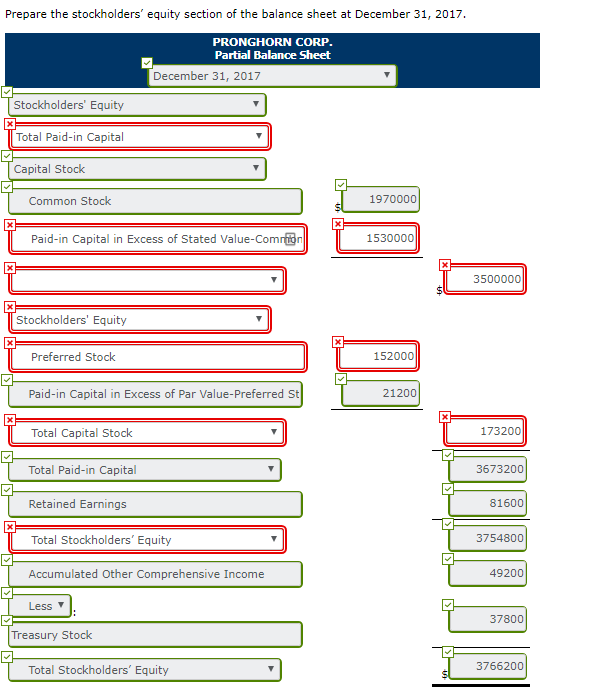

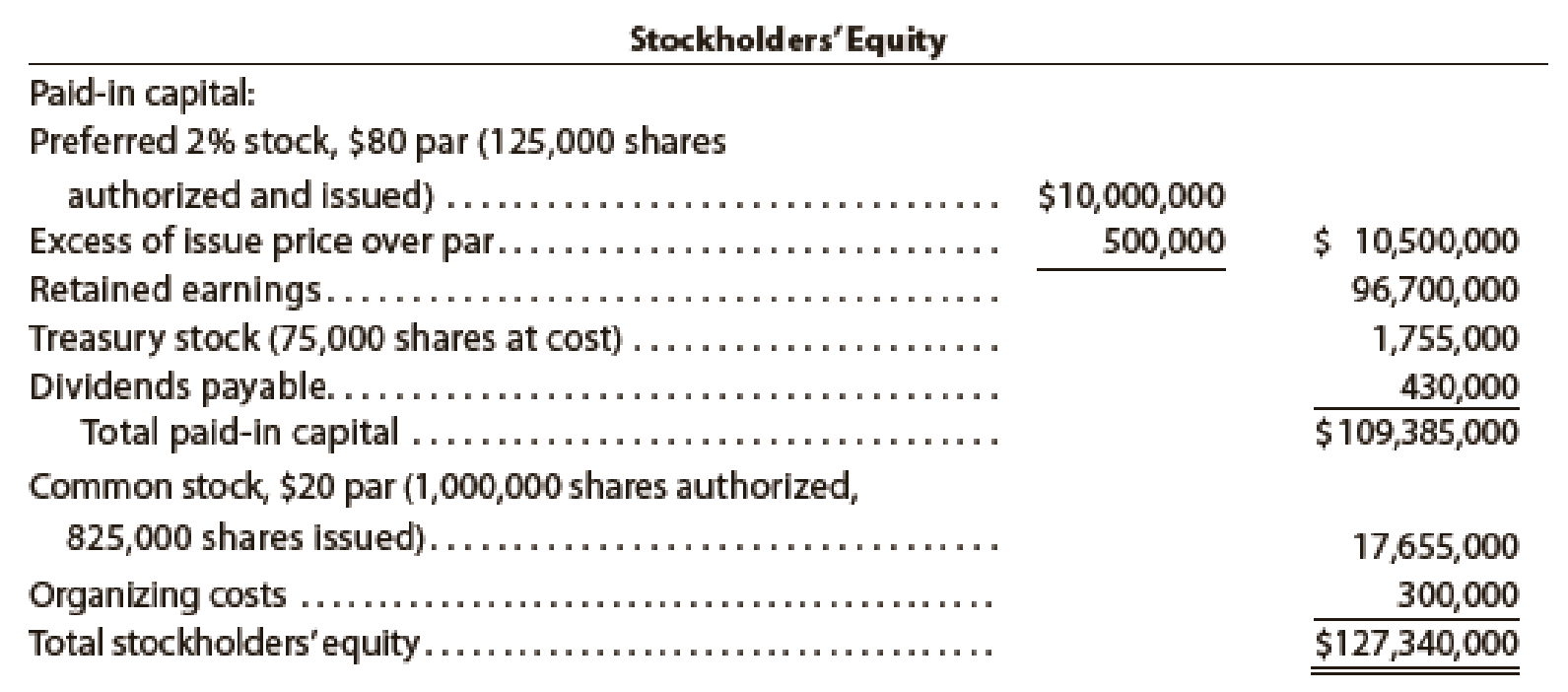

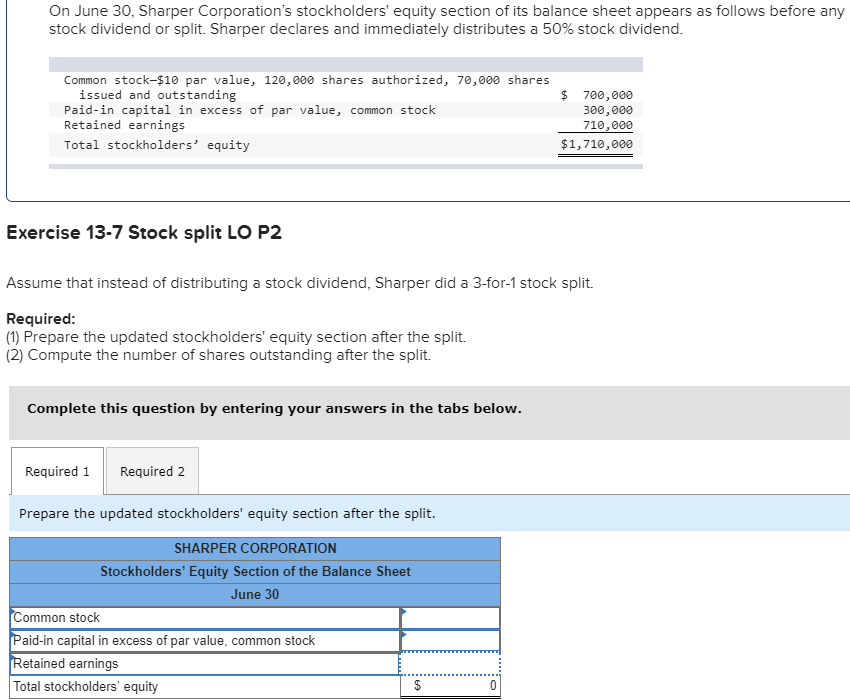

Equity section of balance sheet. The second category is earned capital, which is funds earned by the corporation as part of business operations. The total amount of this section is the amount of reported assets minus the amount of reported liabilities. Common line items in the equity section of the balance sheet include:

Equity section of the balance sheet definition. The part of a balance sheet with the heading stockholders' equity or owner's equity. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Common stock preferred stock treasury stock retained earnings The first is contributed capital, which is funds paid in by owners. It can also be referred to as a statement of net worth or a statement of financial position.

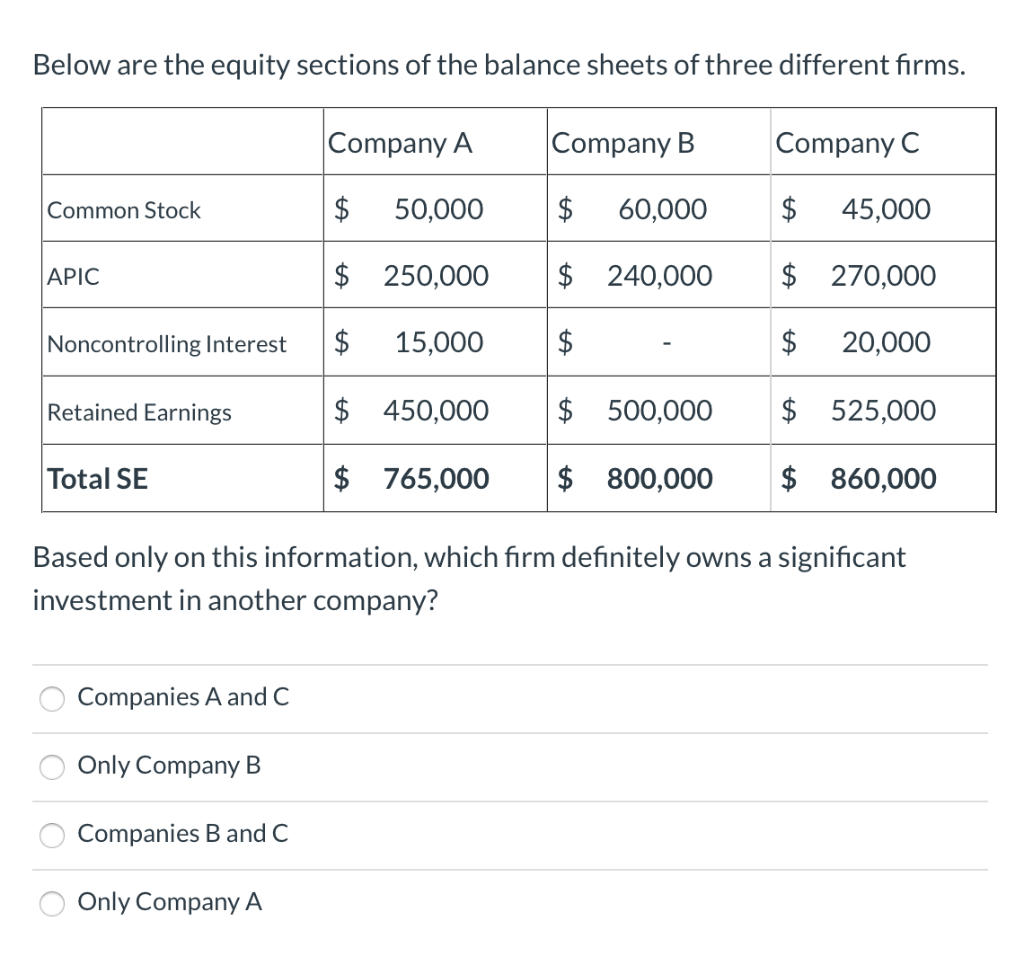

The stockholders’ equity section of the balance sheet for corporations contains two primary categories of accounts. Balance sheets provide the basis for. Six potential components that comprise the owners’ equity section of the balance sheet include:

Comes from the statement of retained earnings financial statement. The balance sheet is based on the fundamental equation: Comes from the statement of retained earnings financial statement.

Assets = liabilities + owner’s equity assets = liabilities + owner ’ s equity. The video explains we have 3 sections in stockholder’s equity: Includes common stock, preferred stock, and any paid in capital accounts including paid in capital for treasury stock.

The video explains we have 3 sections in stockholder’s equity: Includes common stock, preferred stock, and any paid in capital accounts including paid in capital for treasury stock. Stated differently, every asset has a claim against it—by creditors and/or owners.

The stockholders’ equity section of the balance sheet reports the worth of the stockholders. Assets, liabilities, and owner’s equity.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)