Brilliant Strategies Of Info About Puma Financial Ratios

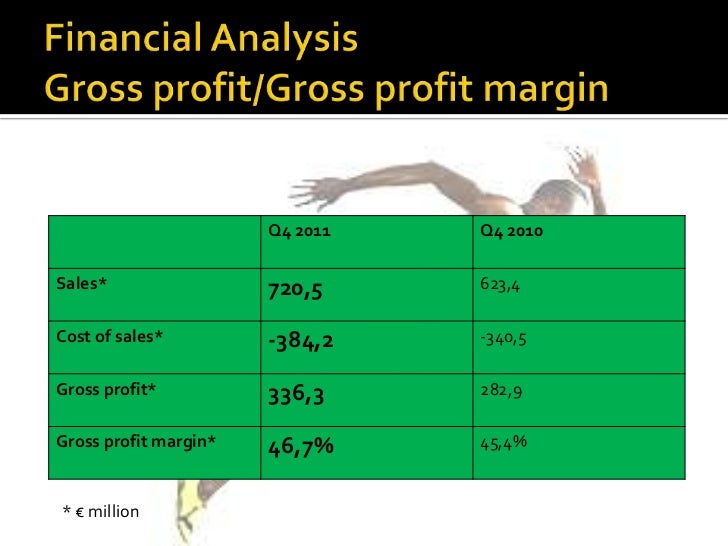

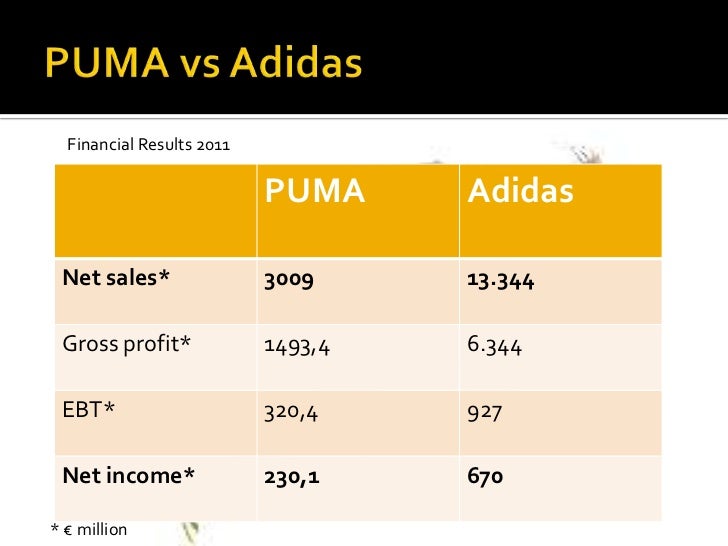

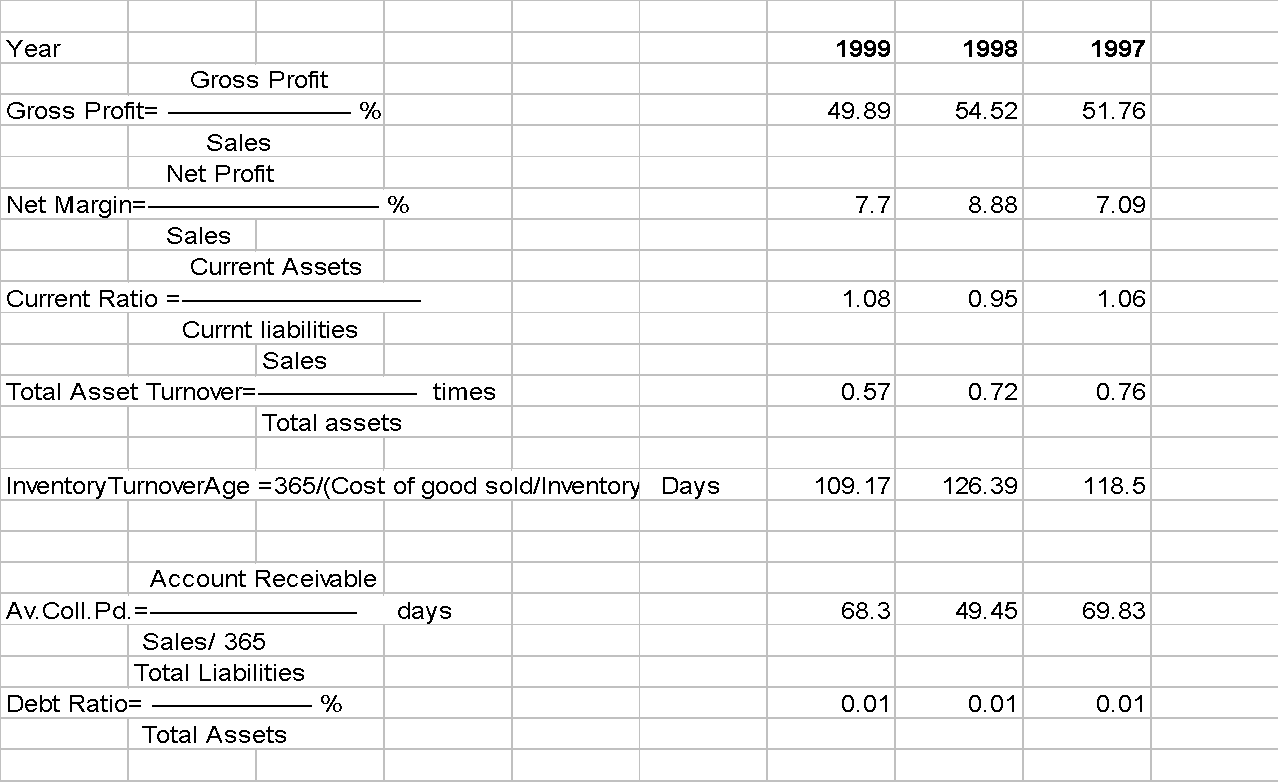

In this research paper, i collected the financial data from puma annual reports and analyzed the main ratios of liquidity, ef ficiency, le verage, and profitability.

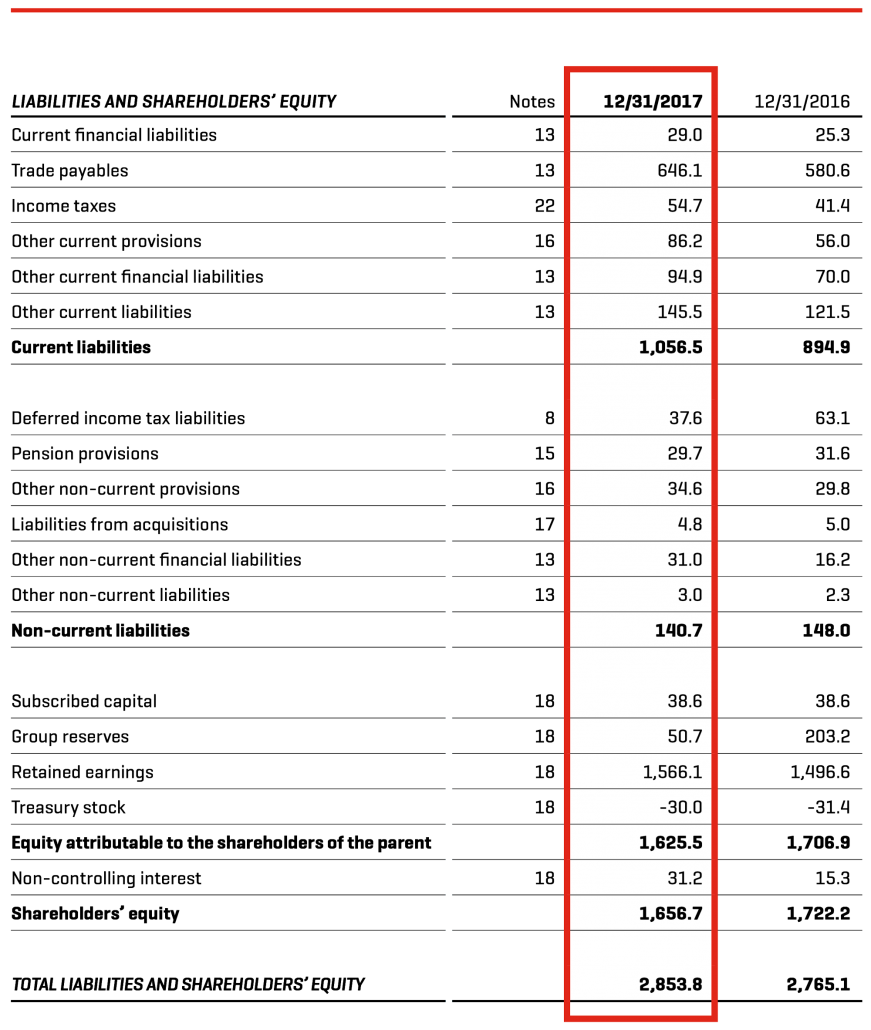

Puma financial ratios. This resulted in a decrease of the equity ratio, from 43.9% in the previous year to 37.7% as of december 31, 2020. He owes another $83m to carroll following a late january federal. Puma se reported earnings results for the third quarter and nine months ended september 30, 2023.

Founded in 1948, the company is engaged in the design and manufacture of both casual and. Is a small cancer biotech whose only marketed product, nerlynx (neratinib) was launched in the united statesfor the treatment of early stage her2. In this research paper, i collected the financial data from puma annual reports and analyzed the main ratios of liquidity, efficiency, leverage, and profitability.

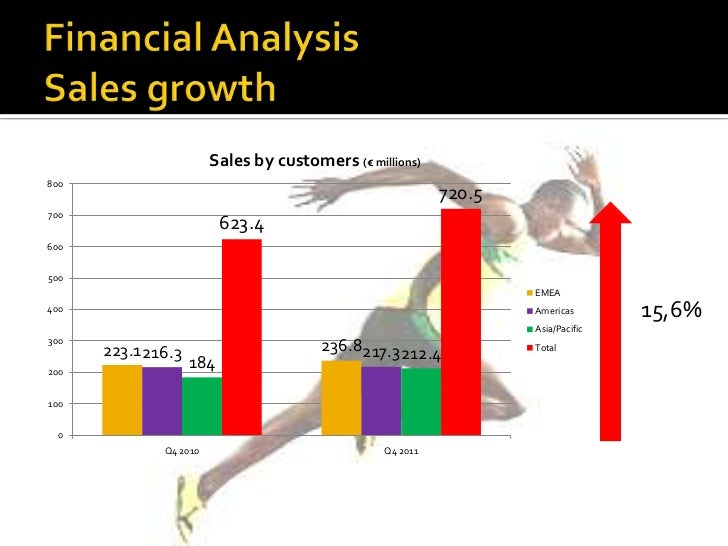

As of the balance sheet date, the equity of the puma group increased by 11.4%, from € 2,278.5 million in the previous year to € 2,538.8 million as of december 31, 2022. Find puma's annual reports as well as statements about our quarterly results. It also shows the relationship between the assets and sales.

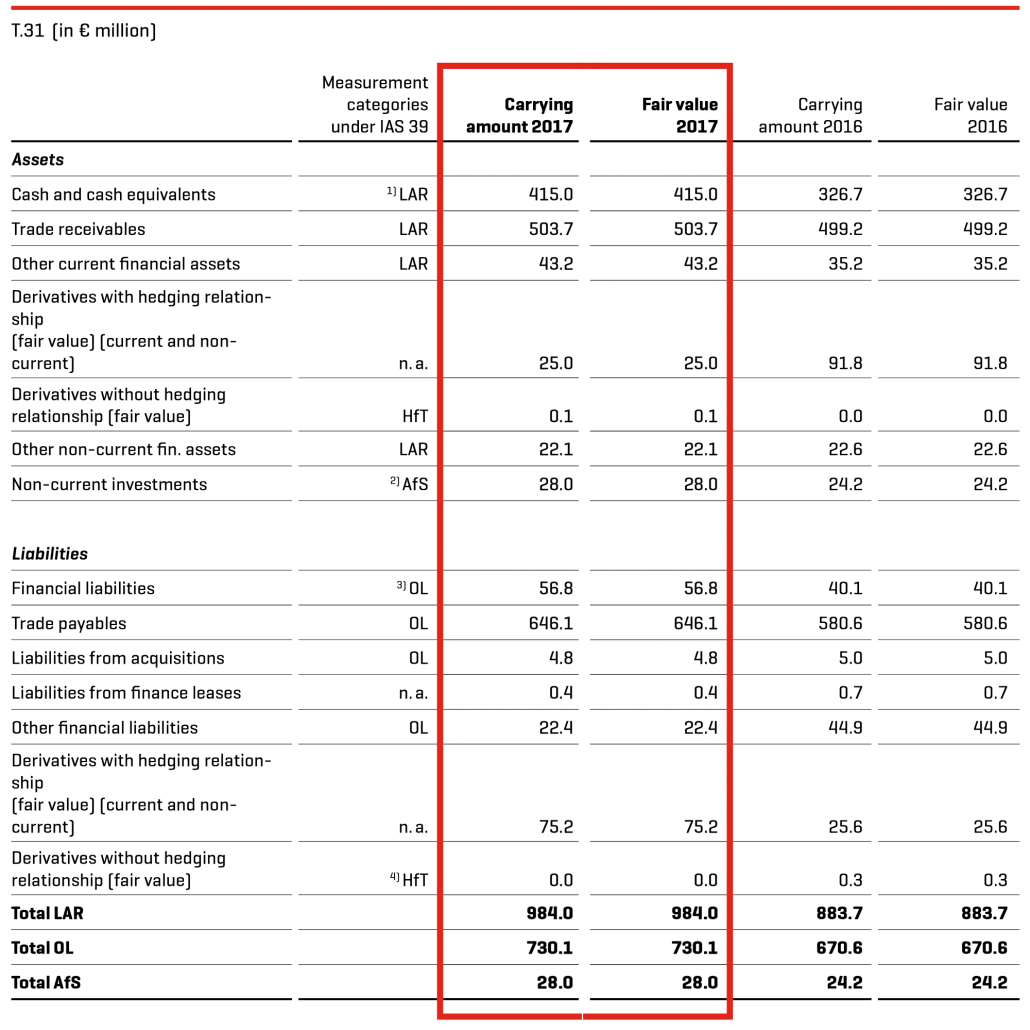

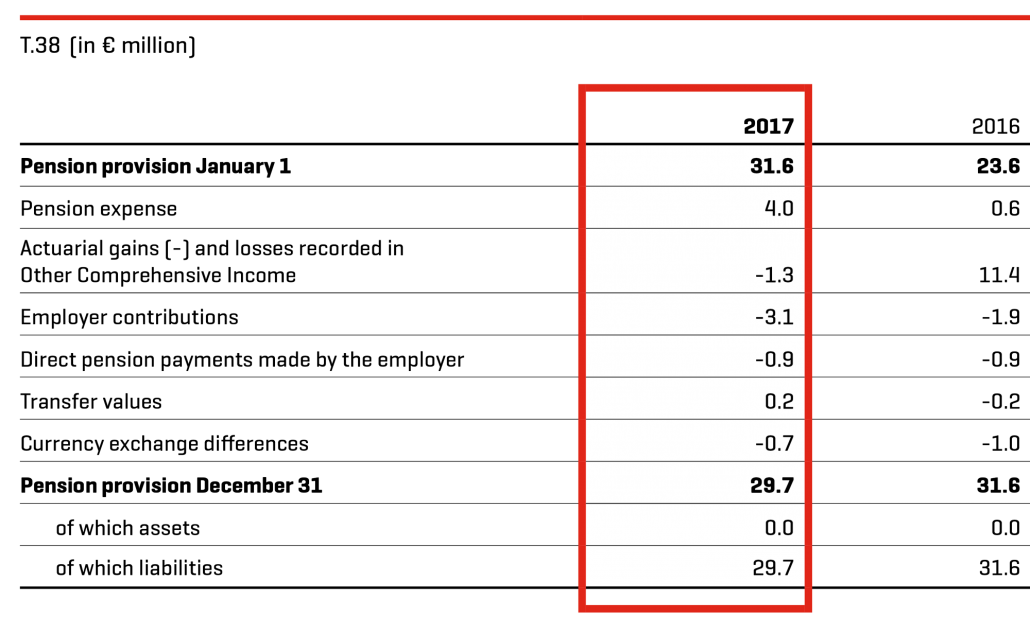

Debt ratios of (puma) ratio/year 2019 2018 2017 2016 debt ratio 0.56 0.463 0.419 0.377 times interest earned ratio 9.095 9.89 7.596 4.907 1.15 1.2 1.25 1.3 1.35 1.4 In relation to net sales in the respective financial year, this corresponds to an increase in the working capital ratio from 8.9% in the previous year to 10.7% at the end of 2021. The ev/ebitda ntm ratio of puma se is lower than the average of its sector (footwear):

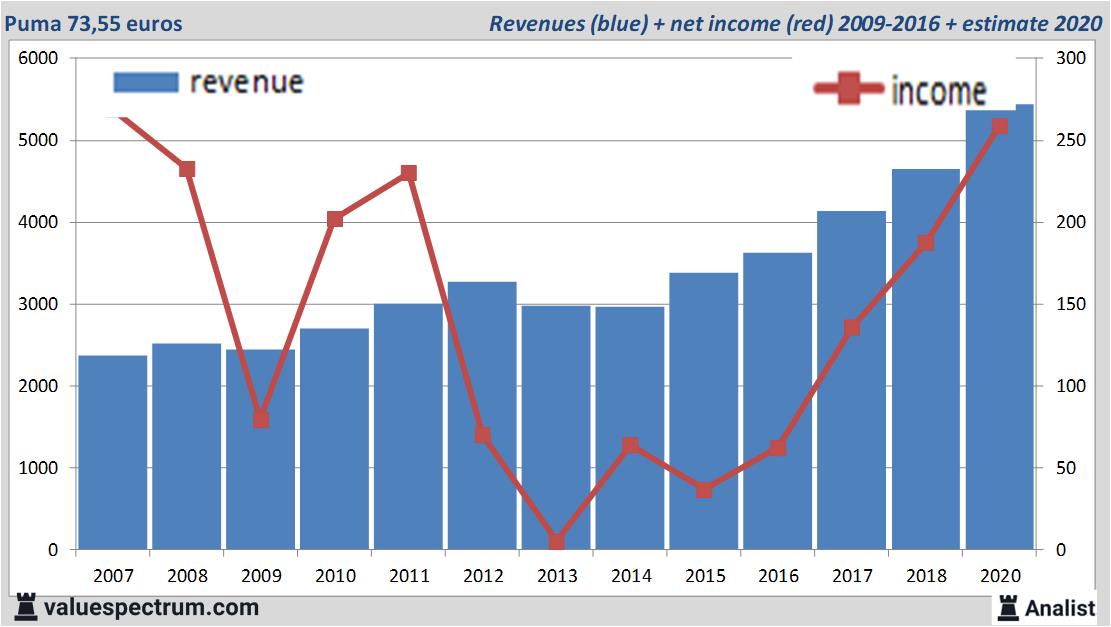

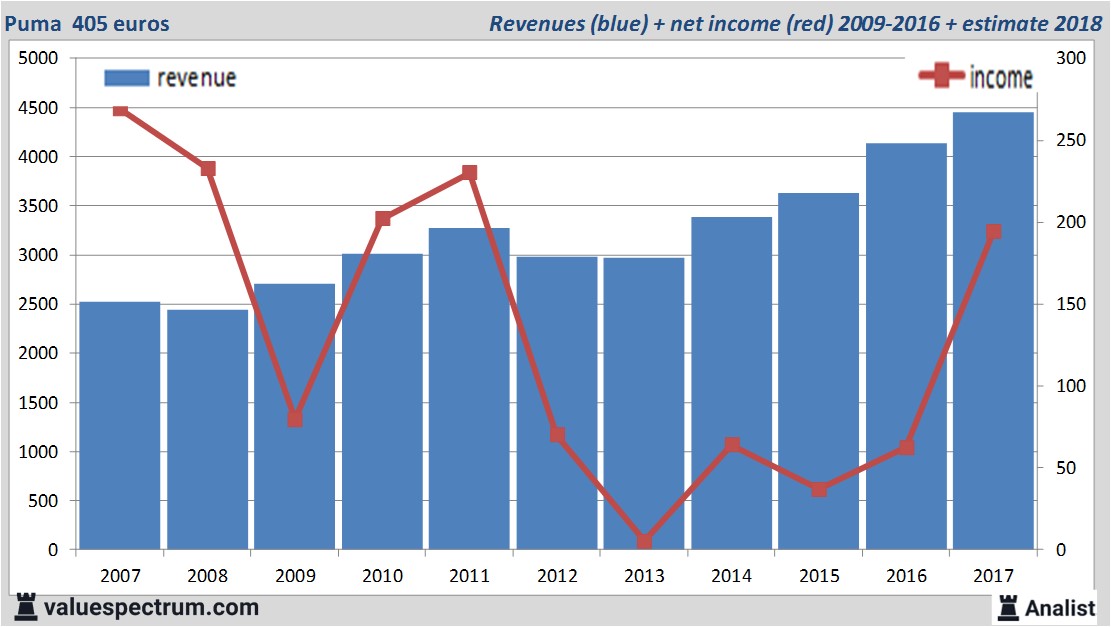

This section also provides graphical representation of puma se's key financial ratios. Hubert hinterseher is responsible for finance, legal, it and business solutions. Horizontal analysis, vertical analysis, trend analysis and mainly ratio analysis has been used to examine the financial performance and to make suggestions to improve finance flow, improve dividend and to reduce liabilities of puma.

As of the balance sheet date, the balance sheet total rose by 7.0%, from €4,378.2 million in the previous year to €4,684.1 million. Our operational flexibility in dealing with a wide range of challenges contributed significantly to puma's strong sales development and financial performance in 2021. The ev/ebitda ntm ratio of puma se is lower than the average of its sector (footwear):

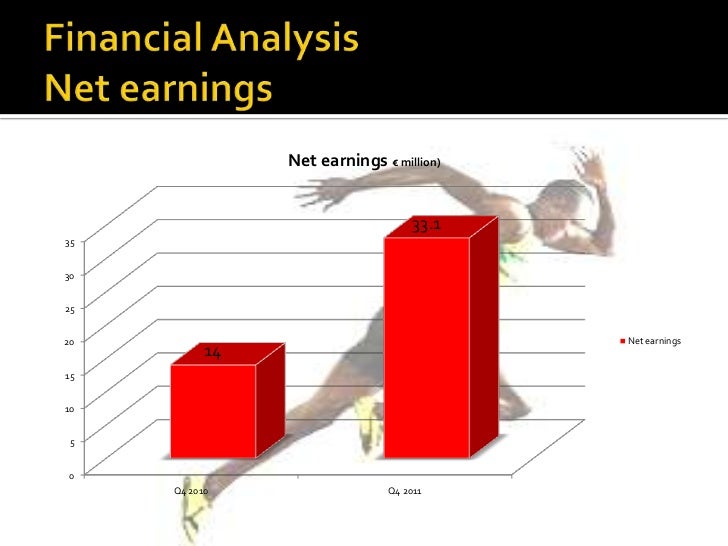

According to these financial ratios puma se's valuation is below the market valuation of its sector. Net income was eur 131.7 million compared to eur 146.4 million a year ago. Puma's operated at median current ratio of 1.6x from fiscal years ending december 2018 to 2022.

Puma has a very solid capital base. Discover details on puma se’s annual and quarterly financial performance covering key metrics like revenue, net income, growth ratios, equity ratios, profitability ratios, cost ratios, liquidity ratios, leverage ratios and so on. Puma biotechnology current ratio from 2010 to 2023.

According to these financial ratios puma se's valuation is below the market valuation of its sector. Ten years of annual and quarterly financial statements and annual report data for puma biotechnology (pbyi). Income statements, balance sheets, cash flow statements and key ratios.

The activity ratio shows you how you can manage your revenue and how to manage items in the balance sheet. For the third quarter, the company reported sales was eur 2,311.1 million compared to eur 2,354.4 million a year ago. Ten years of annual and quarterly financial ratios and margins for analysis of puma biotechnology (pbyi).