Real Info About Indian Accounting Standards 7

Today we have brought you good quick summary of accounting standard 7 or as 7 in short, this indian accounting standard 7 is mandatory as of july 1 2017.

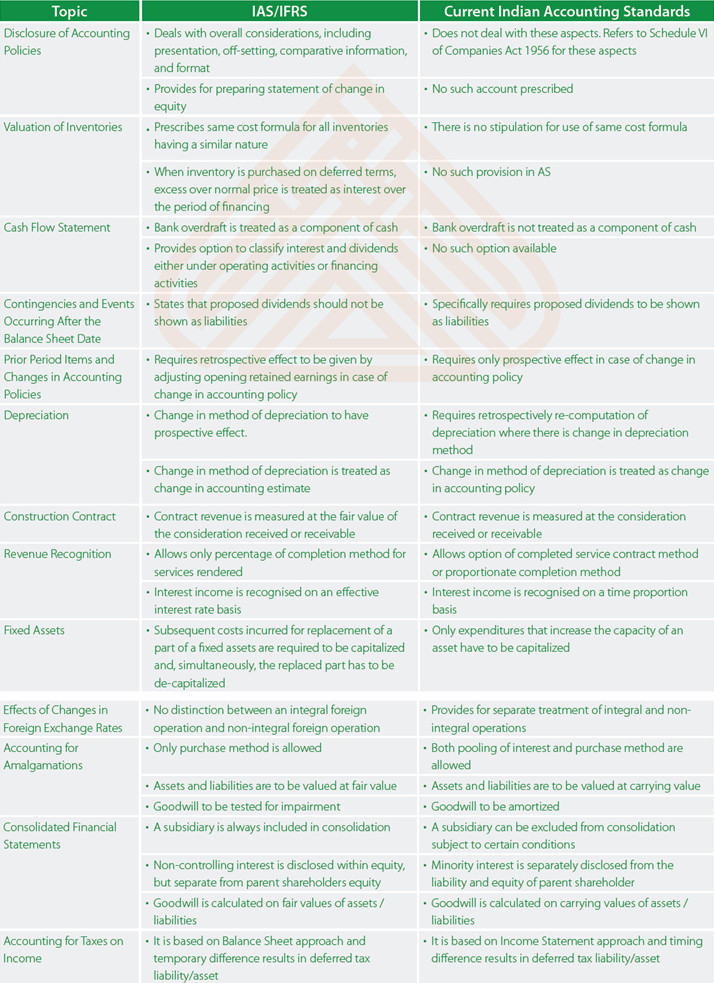

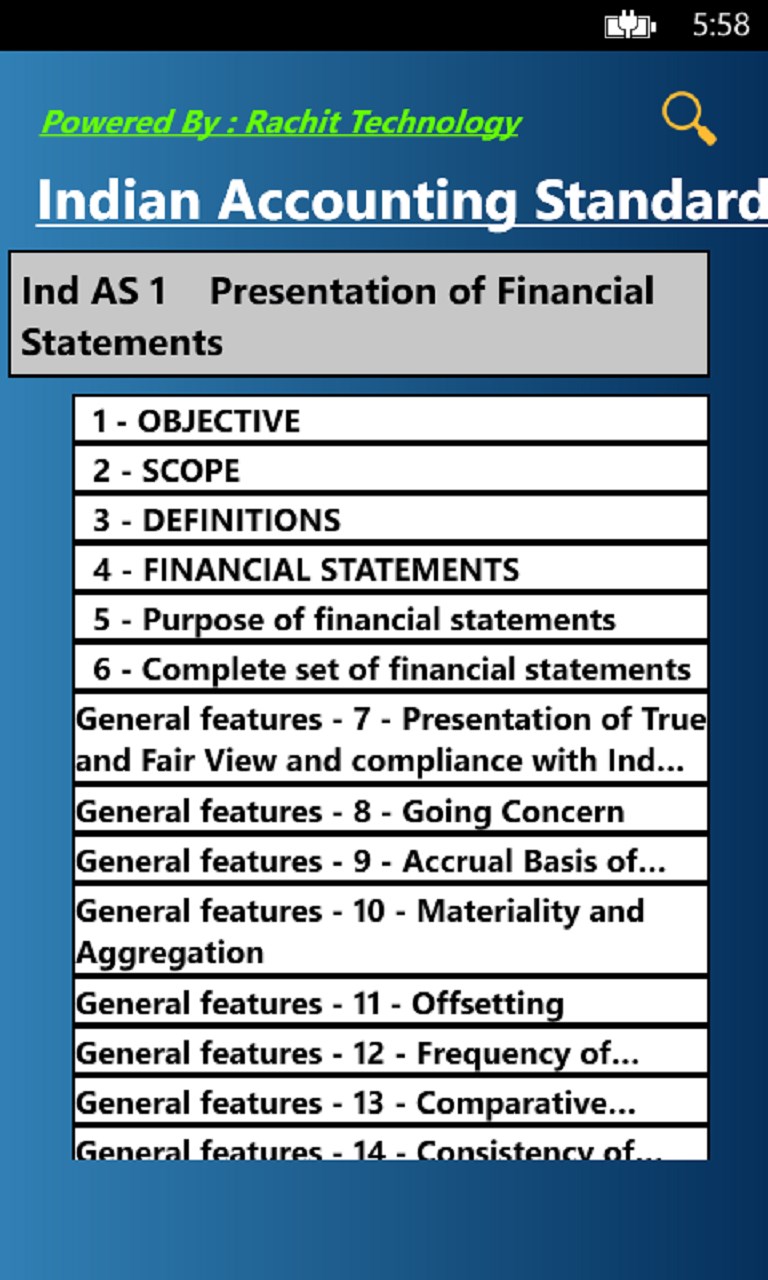

Indian accounting standards 7. Presently, the institute of chartered accountants of india (icai) has issued 39 indian accounting standards (ind as) which have been notified under the companies (indian. For the purpose of preparation of proforma ind as financial statements for the half year ending september 30, 2016, the notional date of transition to ind ass shall. Name of indian accounting standard.

The indian accounting standards (ind as), as notified under section 133 of the companies act 2013, have been formulated keeping the indian economic & legal. Ind as 7 prescribes the requirements for preparation of statement of cash flows which shall be presented as an integral part of the financial statements. Indian accounting standard (ind as) 103 business.

The standard prescribes rules and suggestions on preparation and. Adoption of indian accounting standard. As 5 net profit or loss for the period, prior period items and changes in accounting policies;

In case of other than financial entities, ias 7 gives an option to classify the interest paid and interest and dividends received as item of operating cash flows. Accounting standard (as) 7# construction contracts (this accounting standard includes paragraphs set in bold italic type and plain type, which have equal authority. Accounting standards for local bodies;

Indian accounting standard number. Part of a series on accounting historical cost constant purchasing power management tax major types key concepts selected accounts accounting standards financial. Statement of cash flows is an.

![Home > Blog > IFRS > Indian Accounting Standards [2021 Updated]](https://www.henryharvin.com/blog/wp-content/uploads/2020/03/resize-1508234143-Indian-Accounting-Standards-1024x509.jpg)