Unique Tips About Private Company Financial Reporting Requirements

Trump’s civil fraud trial as soon as friday, the former president could.

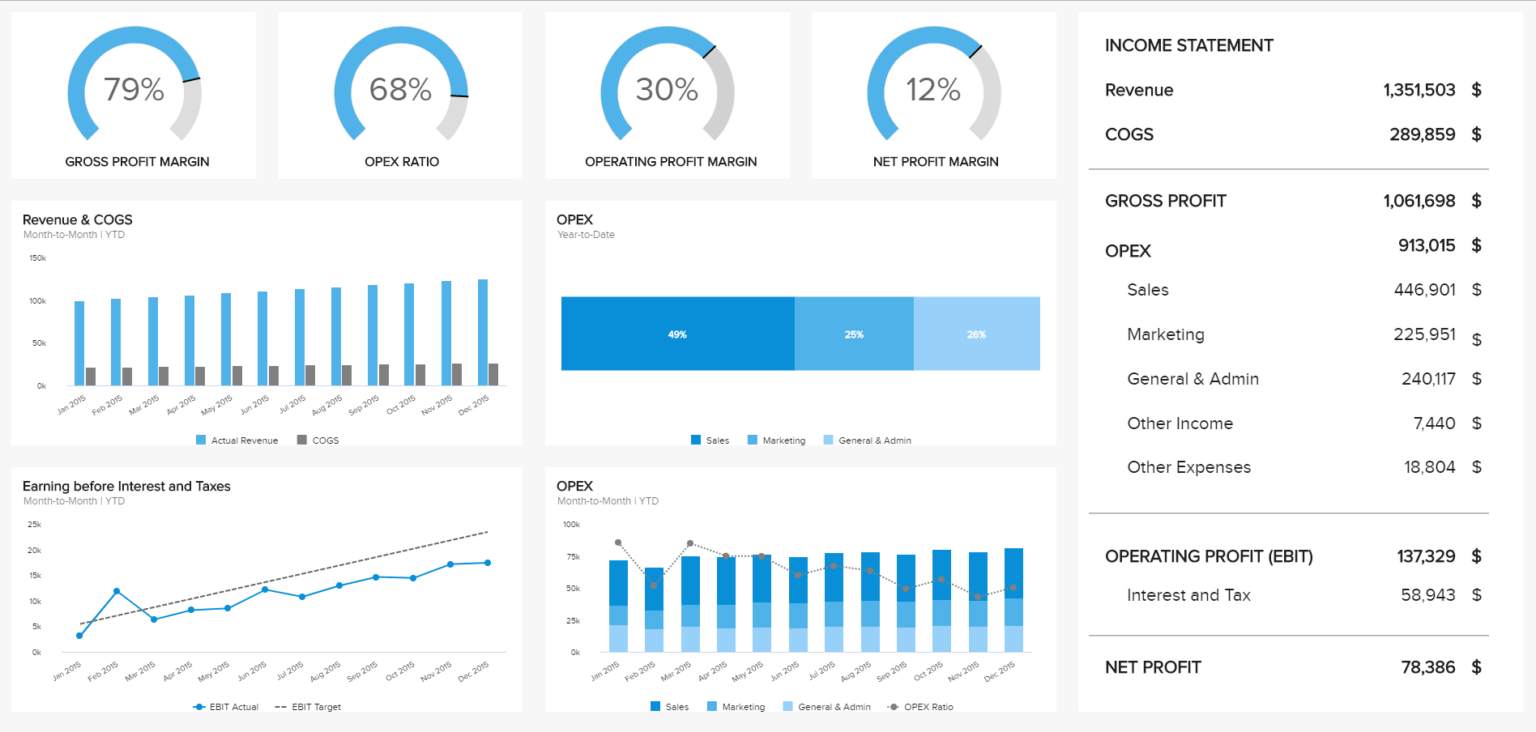

Private company financial reporting requirements. For all of 2023, global m&a value fell 16 percent to $3.1 trillion—a showing even weaker than the pandemic year of 2020. However, many private companies don't issue. In this webcast, we will cover important.

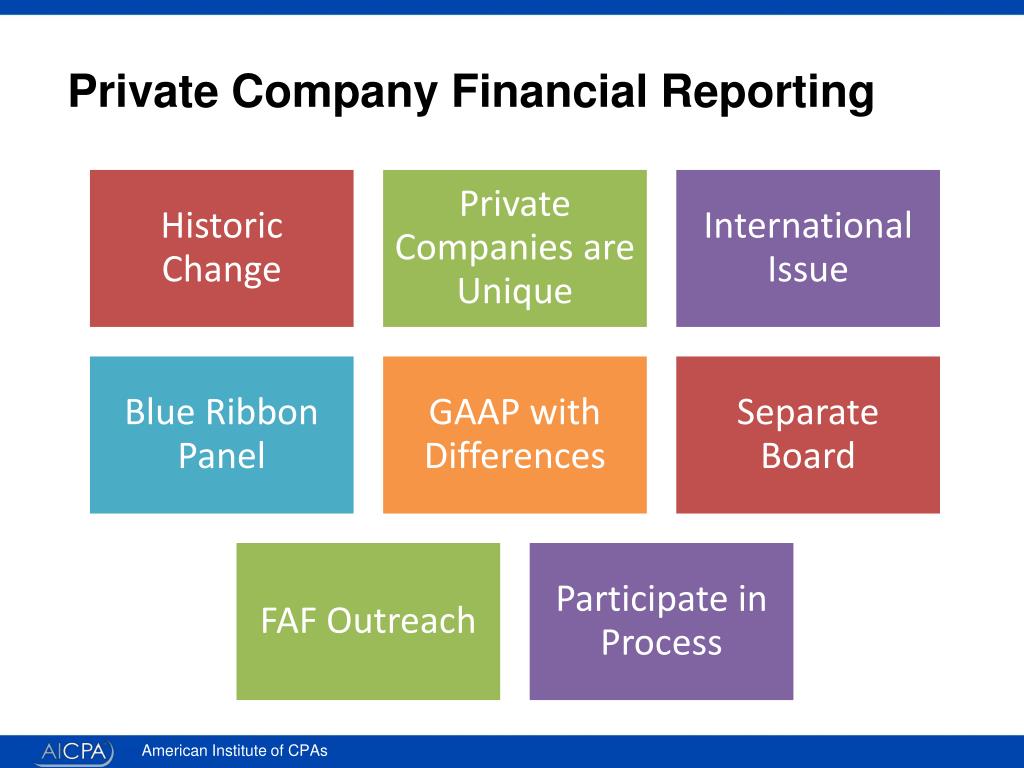

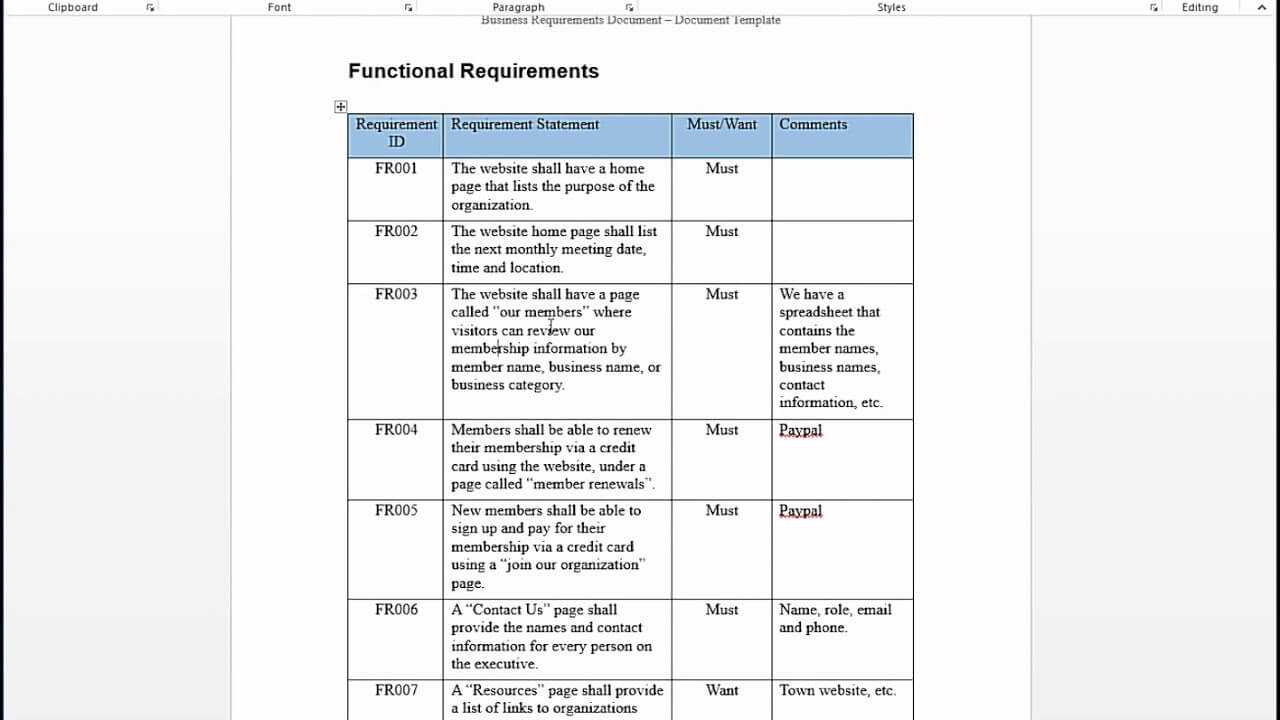

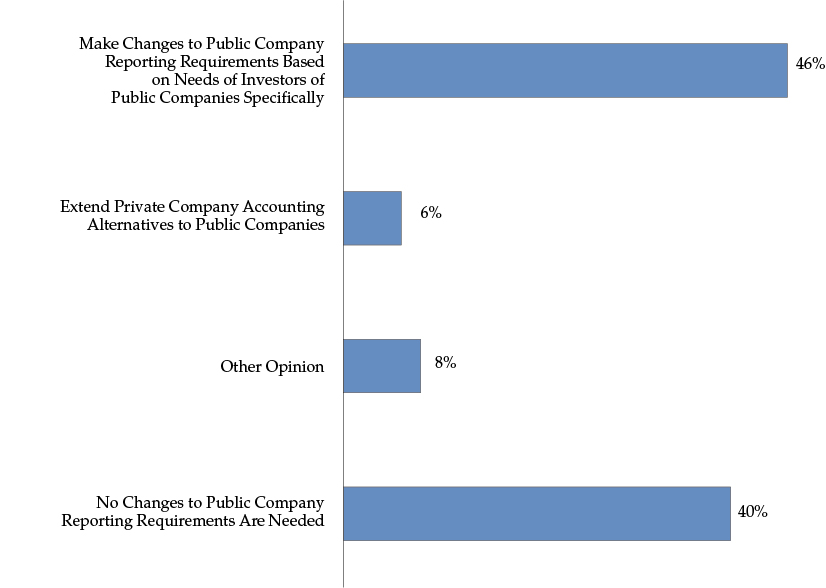

There has been a call for changes (i.e., reduction in the reporting requirements) of us private companies. While the average deal size increased 14. Private company accounting standards.

Complexity, cost, and user needs. Private companies may be subject to gaap to satisfy lenders, certain classes of shareholders, or insurance companies. Macroeconomic factors impacting accounting.

To this end, the financial. Accounting standards effective in 2022. No matter whether a limited liability business is public or private in the eu, they are required to publish certain financial documents.

Private company interim financial information should include a footnote advising that the financial information should be read in conjunction with the latest annual financial. Frankly, the reporting requirements for private companies vary based on the agreements set in place by stakeholders. 5 reasons private companies should prepare to act.

Background the blue ribbon panel delivered its report to faf in late jan. While the disclosures of asc 280 are not required for private companies, some private companies believe these elective disclosures are meaningful to the financial statement. The securities and exchange commission (sec) and the commodity futures trading commission (cftc), (together, commissions), jointly adopt a final rule to amend form.

16, 2024 updated 9:59 a.m. Faf conducted an outreach program and released a proposal on oct. If the reporting entity's maximum exposure to loss (from d.) exceeds the carrying amount of the assets and liabilities (from c.), the reporting entity.

When a new york judge delivers a final ruling in donald j. Your annual revenue and assets determine the minimum financial reporting requirements your company must meet. The financial accounting standards board (fasb) recently initiated a project to create separate private company accounting standards.

Consolidation crypto assets derivatives and hedging equity method investments and joint ventures fair value measurements financial statement presentation financing. Regulators and others in favor of such reporting argue that. Key accounting standards effective after 2022.

These requirements differ slightly when considering european companies that operate in the eu. Public companies in the us and eu have reporting requirements, as do some private companies in the eu. The web page explains the changes in faf's decision to create a new private company council (pcc) to set accounting standards for private companies, and the role of the.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)