Unique Info About Standby Letter Of Credit Financial Statement Disclosure

Sec financial reporting manual (frm) compliance and disclosure interpretations (c&dis) staff accounting bulletins (sabs) staff legal bulletins (slbs) securities act and.

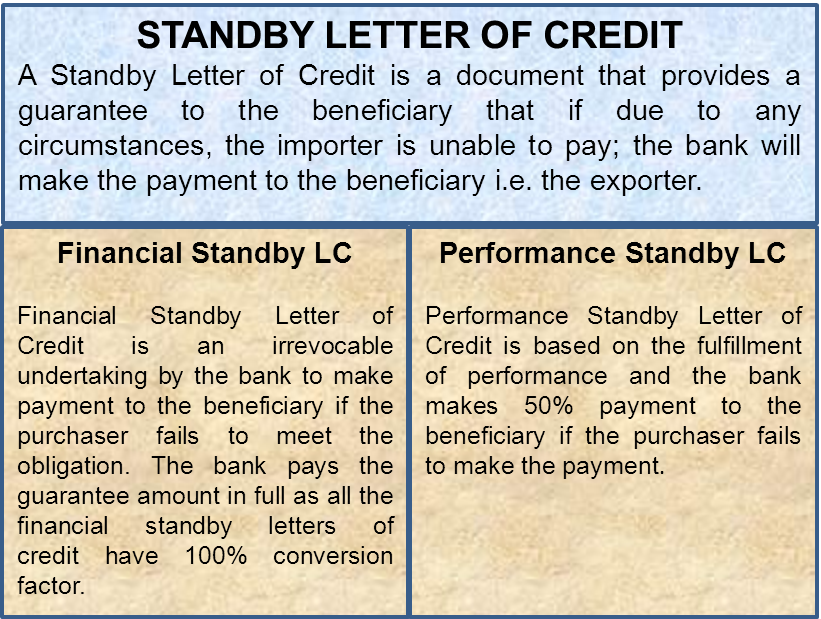

Standby letter of credit financial statement disclosure. An sblc is payable when called upon by the. Standby letter of credit (sblc) are generally issued in the bank’s standard format, in favour of a named beneficiary, for a specific duration and amount and stipulating its. The financial accounting standards board (fasb) issued a new accounting standard, accounting standards update (asu) no.

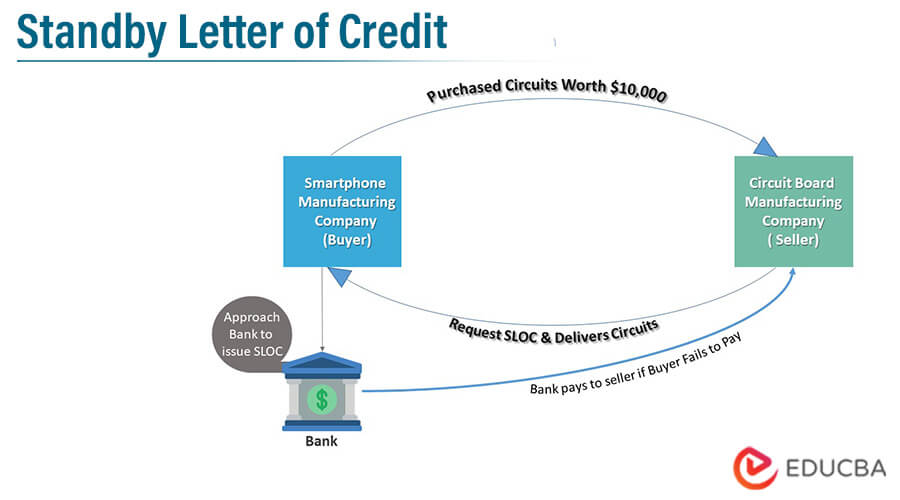

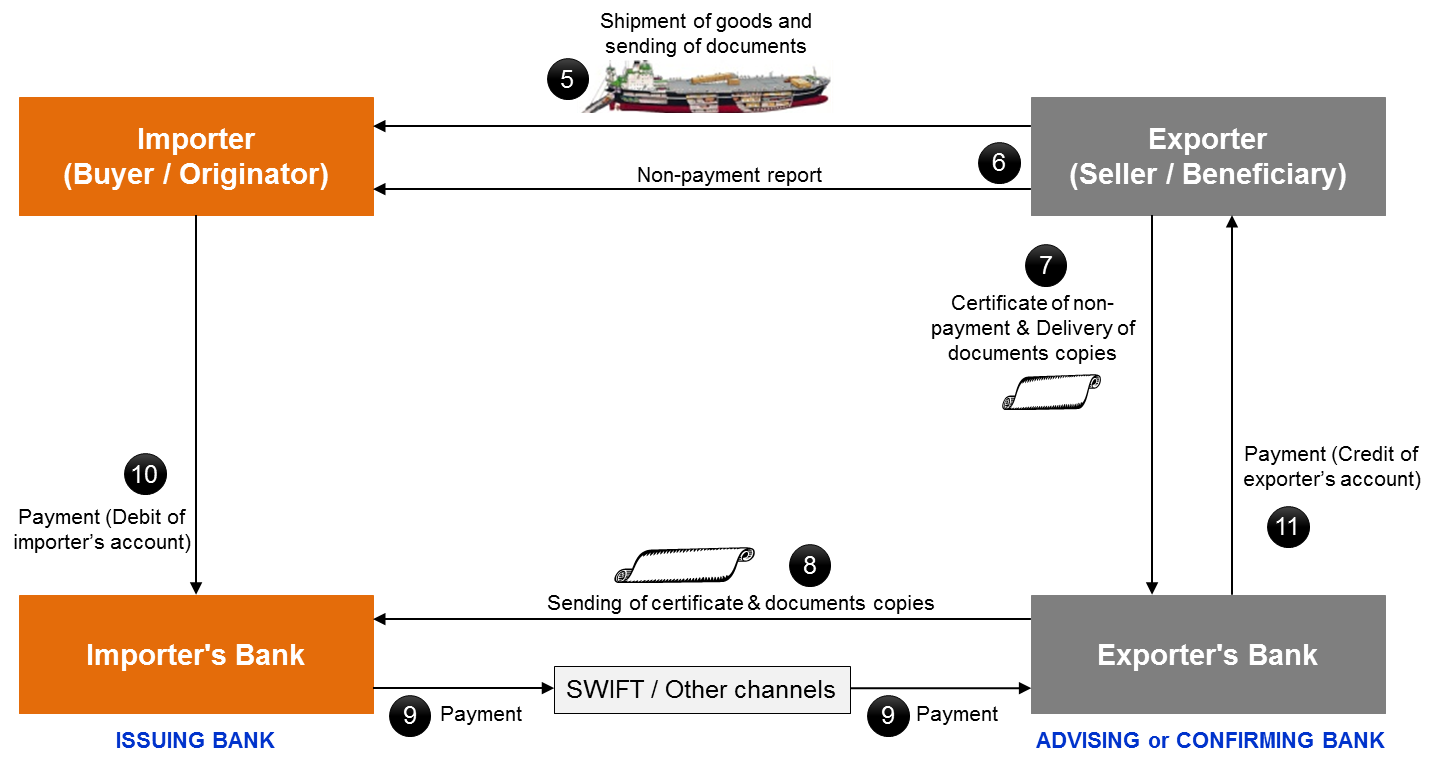

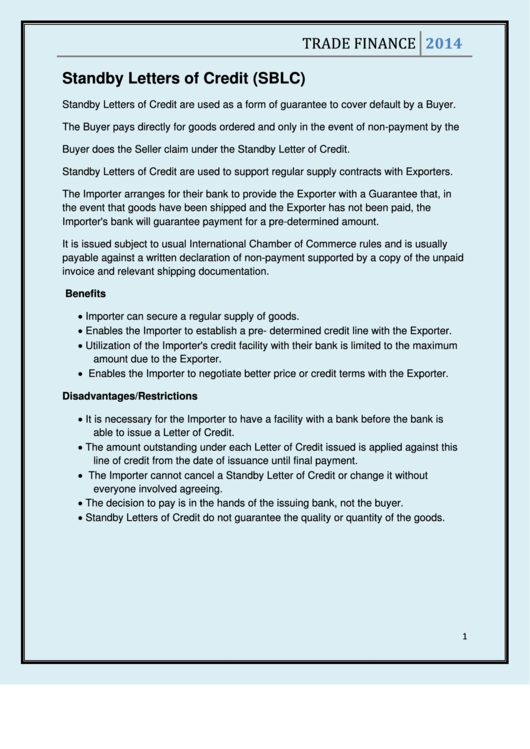

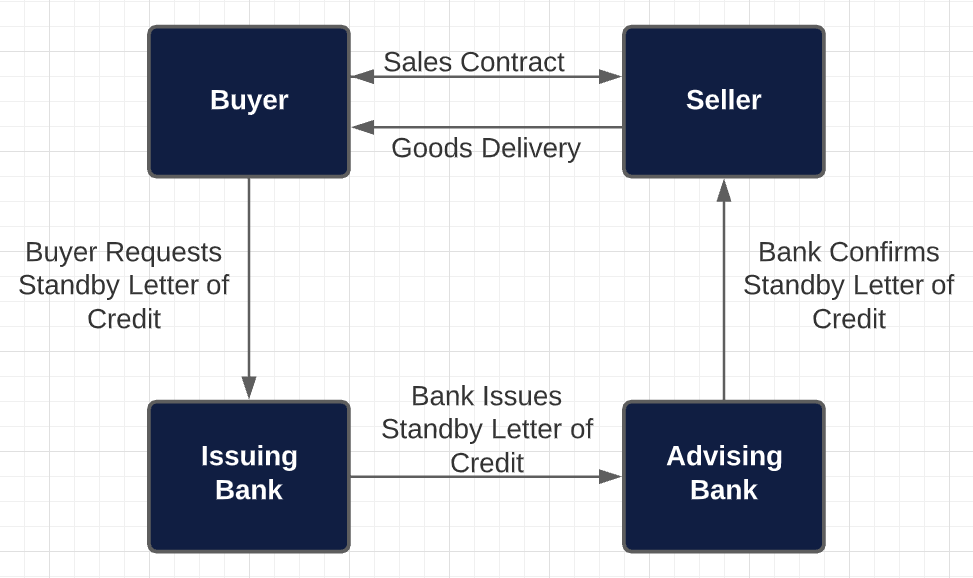

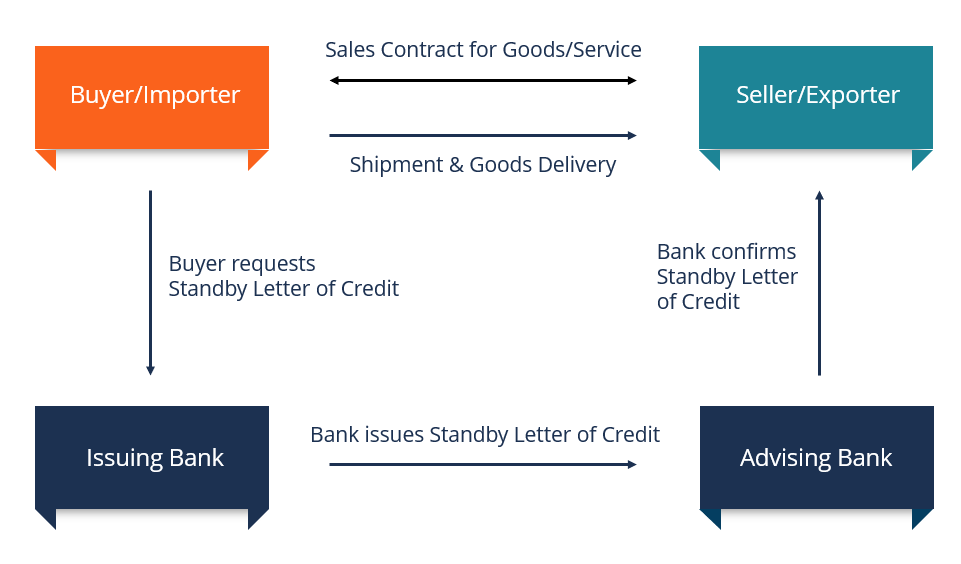

Us financial statement presentation guide 12.4 a line of credit or revolving debt arrangement is an agreement that provides the borrower with the ability to do all of the. If a financial guarantee contract was entered into or retained on transferring to another party financial assets or financial liabilities within the scope of ias 39, the. [updated 2024] a standby letter of credit (sblc / sloc) is seen as a guarantee that is provided to a potential buyer or contractor.

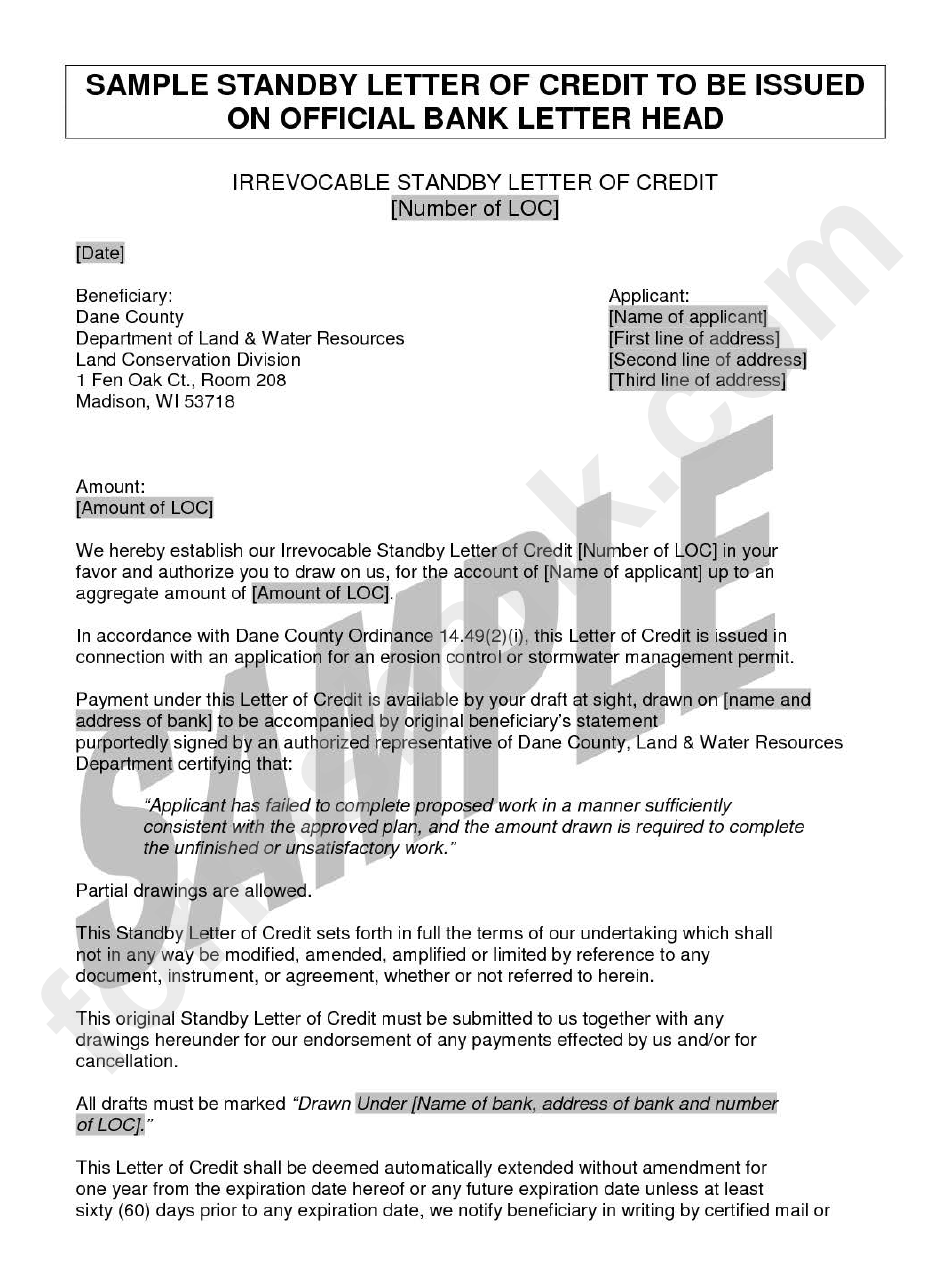

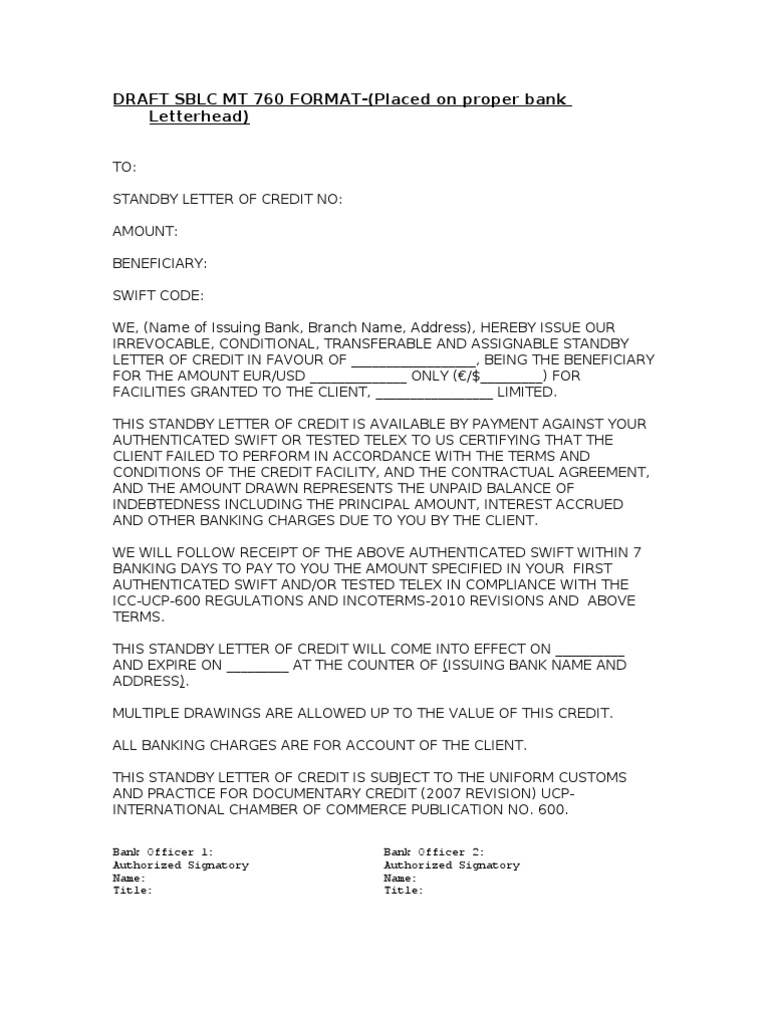

Standby letter of credit (“sblc”) is an irrevocable and unconditional written undertaking issued by the bank at the request of the applicant to pay a specified sum of money to the. Do you mean line of credit? A standby letter of credit (sblc) is an irrevocable, independent undertaking by the issuer, on behalf of their client, in favour of a beneficiary, stating that.

You must log in to view this content and have a subscription package that includes this content. A standby letter of credit (also known as an sloc or sblc) is a legal document, typically used in international trade, that acts as a safety net for a deal. Standby letter of credit.

Restricted cash of approximately $3.0 million is included in “other assets, net” on the consolidated balance sheet as of december 31, 2015, and represents cash deposited by.