Ace Tips About Reconciliation Of Cash Flows From Operating Activities

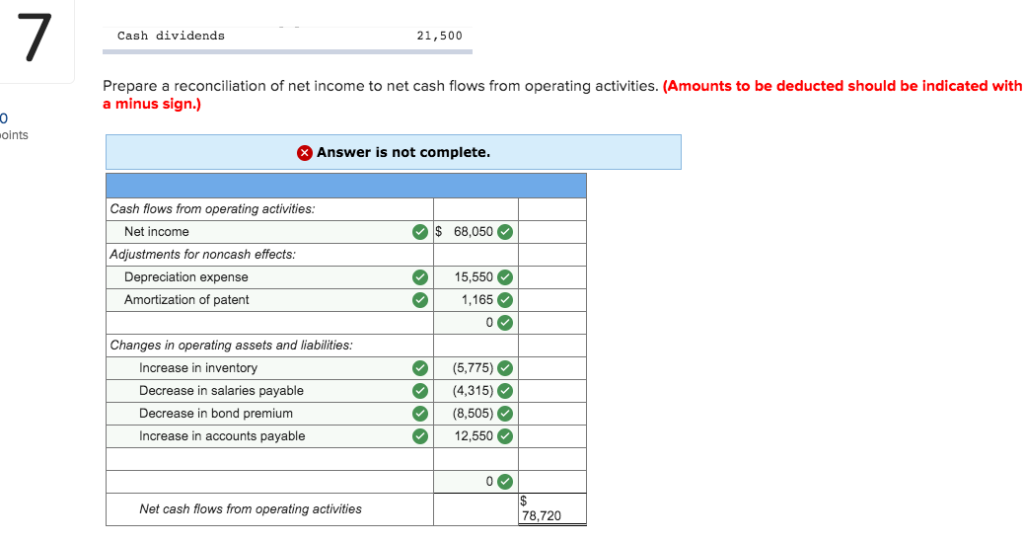

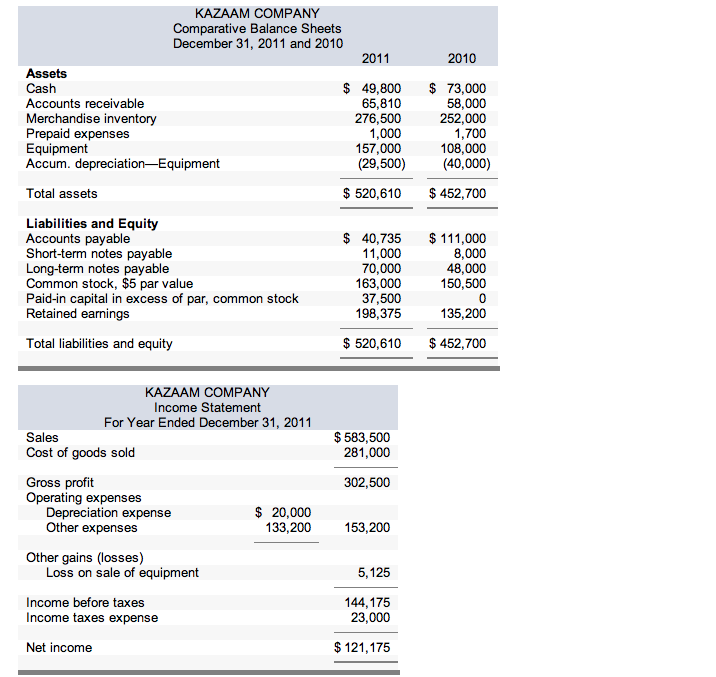

Start calculating operating cash flow by taking net income from the income statement.

Reconciliation of cash flows from operating activities. $81,750.00 loss on disposal of equipment: The core objective of cash reconciliation is to identify mismatches between the cash on hand and the sales transactions recorded, thereby safeguarding against financial inaccuracies in a company's records. Like ebitda, depreciation and amortization are added back to cash from operations.

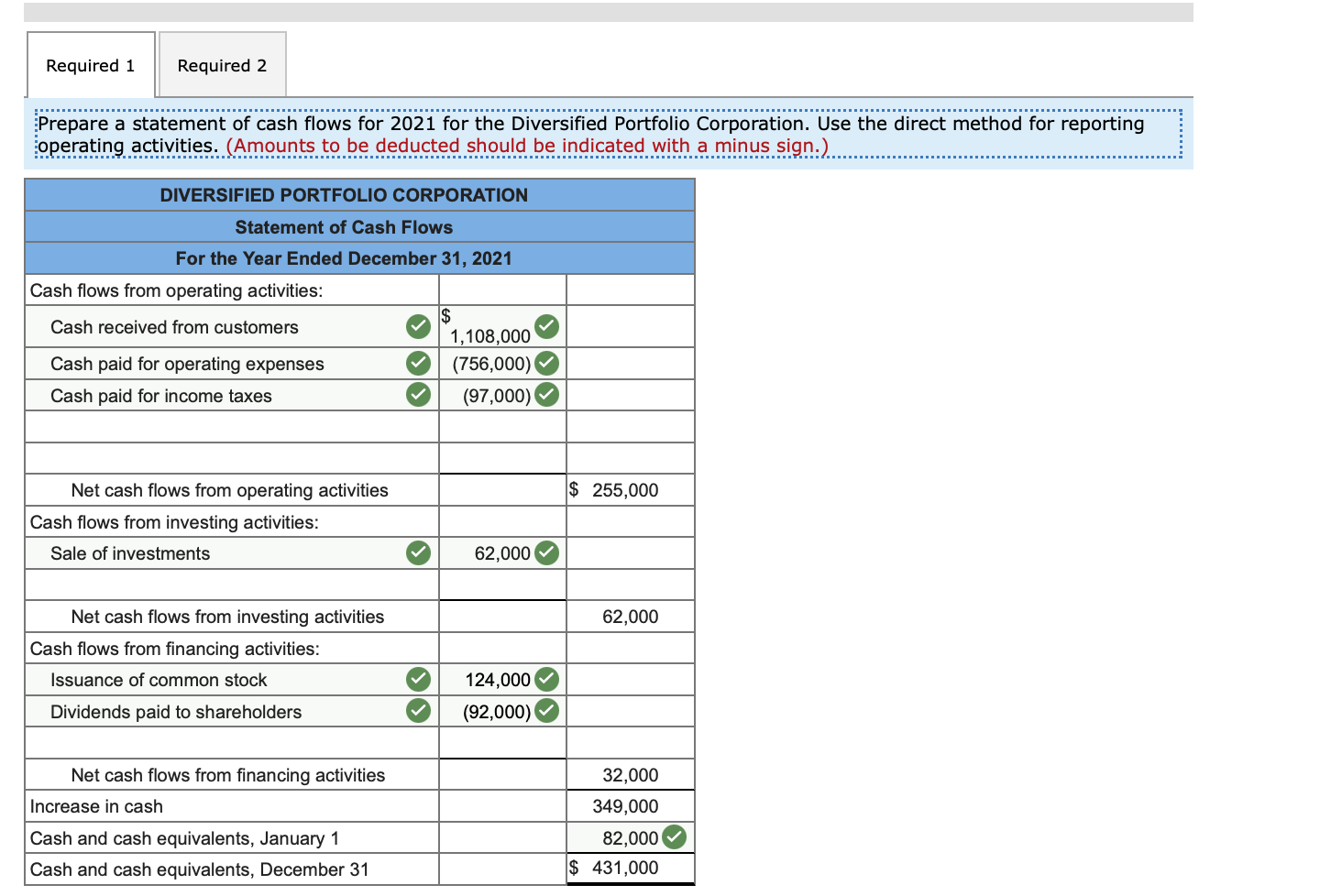

Below is an example of the cash flow from the operations segment of a cash flow statement prepared under ifrs using the indirect method: Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income,. Add back noncash expenses, such as depreciation, amortization, and depletion.

Operating cash flow is a measure of cash generated by a business from its normal operating activities. The sum of the cash flows from operating, investing and financing activities represents the total change in cash. Dec 31,2016 dec 31,2015 $ $ cash flow from operating activities net profit 3,457 4,256 taxation 1,200 1,189 net finance costs 536 245 operating profit (continued and discontinued operations) 5,193.

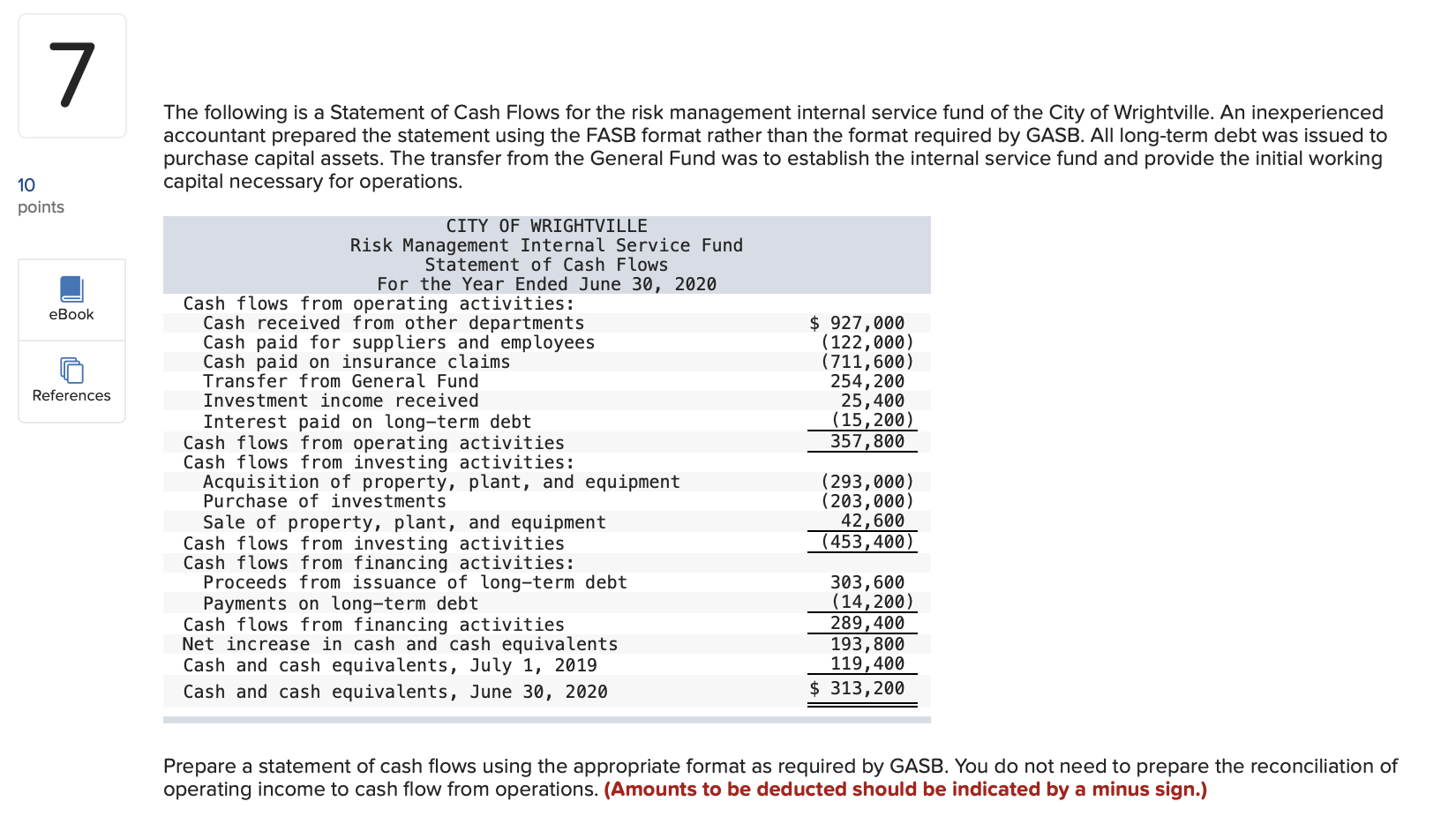

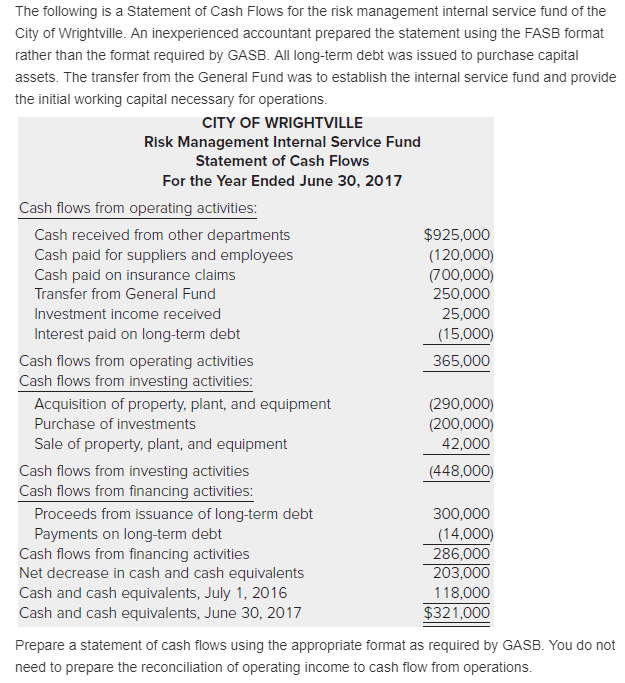

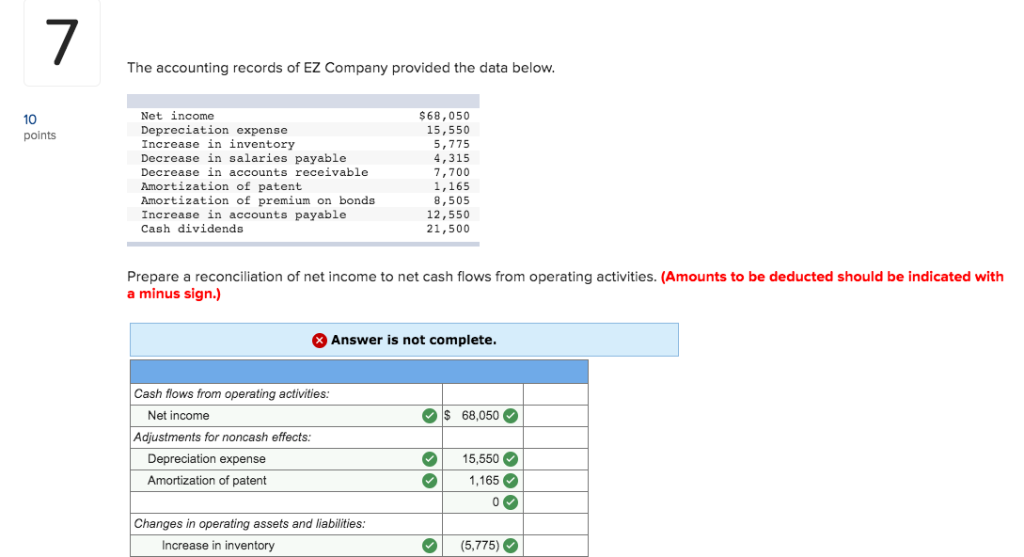

In this section, this equation is used to develop a model for reconciliation of net income to cash flow from operating activities. The statement of cash flows can be verified by adding the total change in cash to the beginning cash to arrive at the ending cash balance. The cash flows resulting from this transaction came from an investing activity and not an operating activity.

Reconciling net income to operating cash flow involves adding or subtracting these noncash items. The reconciliation process requires two types of adjustments to the operating income: Current assets consist of cash (cash), accounts receivables (acc_rec), inventory (inv) and prepaid expenses (pre_exp).

Cash flows arising from taxes on income are normally classified as operating, unless they can be specifically identified with financing or investing activities [ias 7.35] for operating cash flows, the direct method of presentation is encouraged, but the indirect method is acceptable [ias 7.18] Company a had net income for the year of $20,000 after deducting depreciation of $10,000, yielding $30,000 of positive cash flows. The boards noted that the iasb has recently considered requiring a reconciliation of net operating cash flow to profit or loss in the context of its financial statement presentation project.

In this case, depreciation and amortization is the only item. Using the indirect method, operating net cash flow is calculated as follows: The following analysis assumes a simple scenario about a firm.

Cash flow from operating activities (cfo) indicates the amount of cash a company generates from its ongoing, regular business activities. All adjustments made to reconcile the change in net assets to the net cash provided by or used in operating activities should be clearly identified as reconciling items. Begin with net income from the income statement.

In applying the indirect method, a negative is removed by addition; $4,710.00 net cash flows from operating activities. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

Adjust for changes in working capital. Adjustments to reconcile net income to net cash flows from (used for) operating activities: Figure 17.7 operating activity cash flows, indirect method—elimination of noncash and nonoperating balances