Top Notch Tips About Depreciation Expense Cash Flow Statement

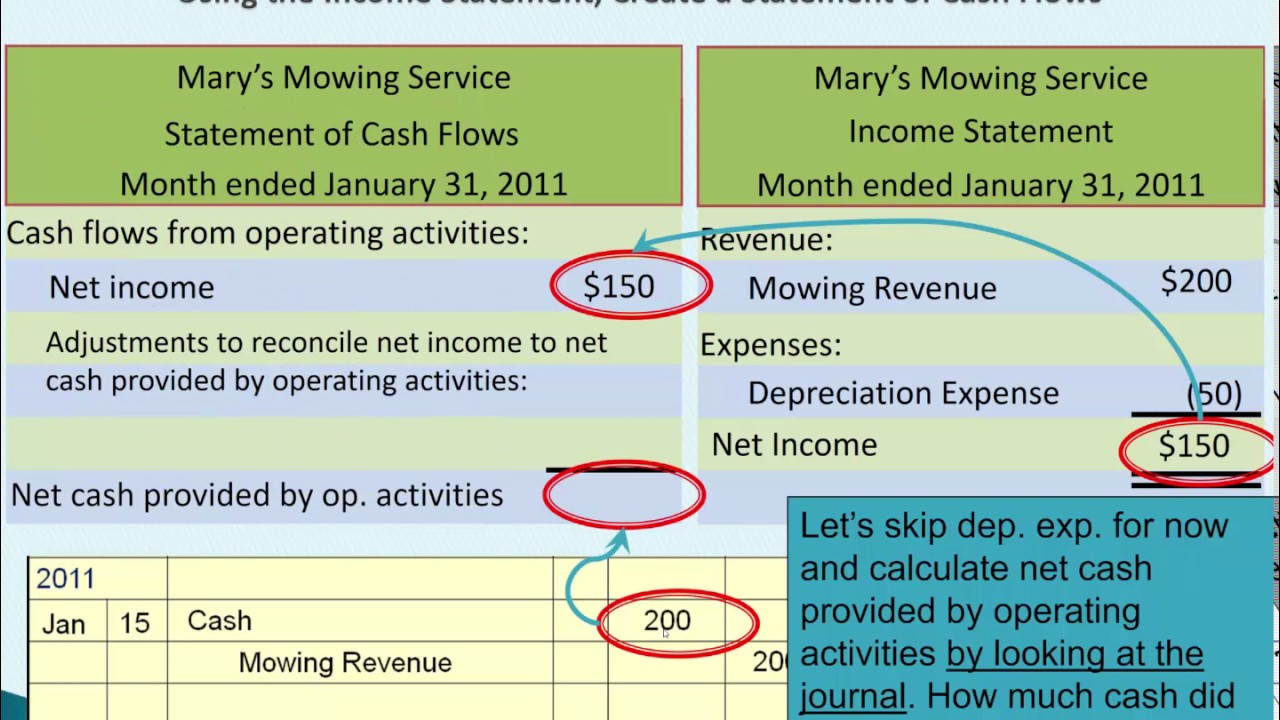

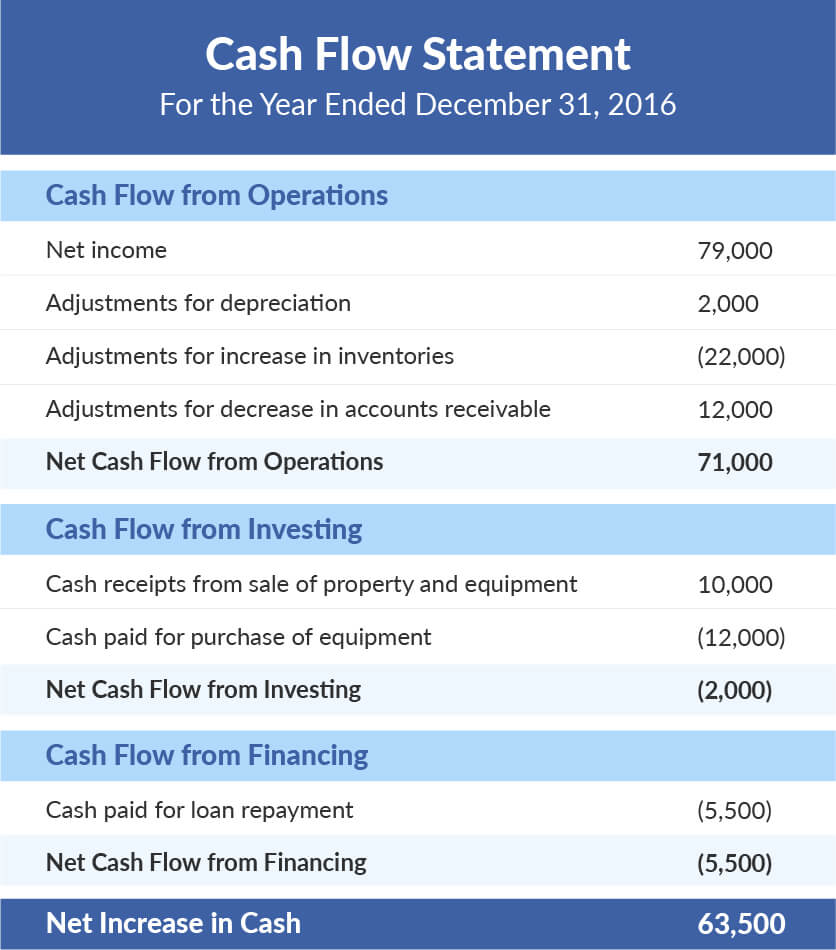

Add the depreciated asset amount applicable for the cash flow statement period to the net income after taxes to arrive at the total source of funds.

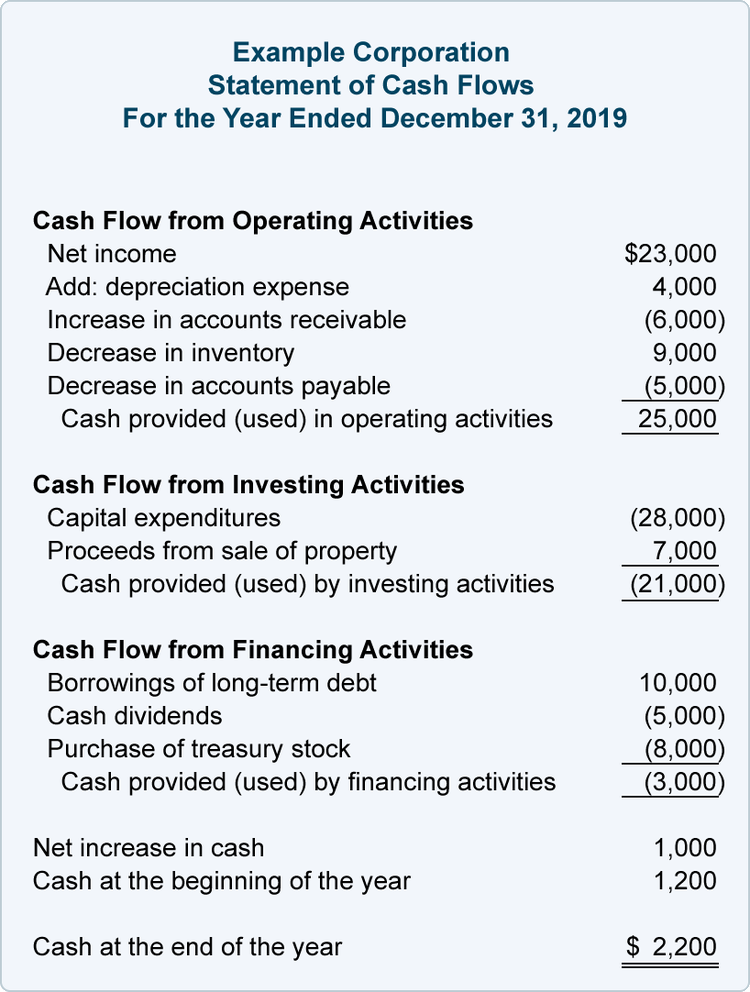

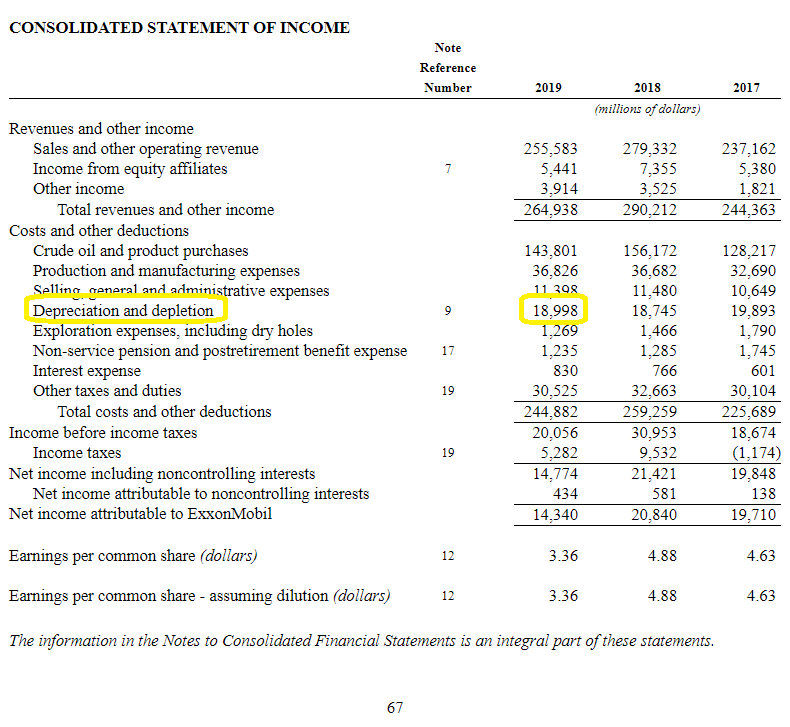

Depreciation expense cash flow statement. Let's review the cash flow statement for the month of july 2022: Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total. Did you get it ⬇️樂 question:

Depreciation expense on cash flow statement. Depreciation expense is similar to other expenses such. While depreciation does not directly impact cash flow, it indirectly affects cash flow from operations.

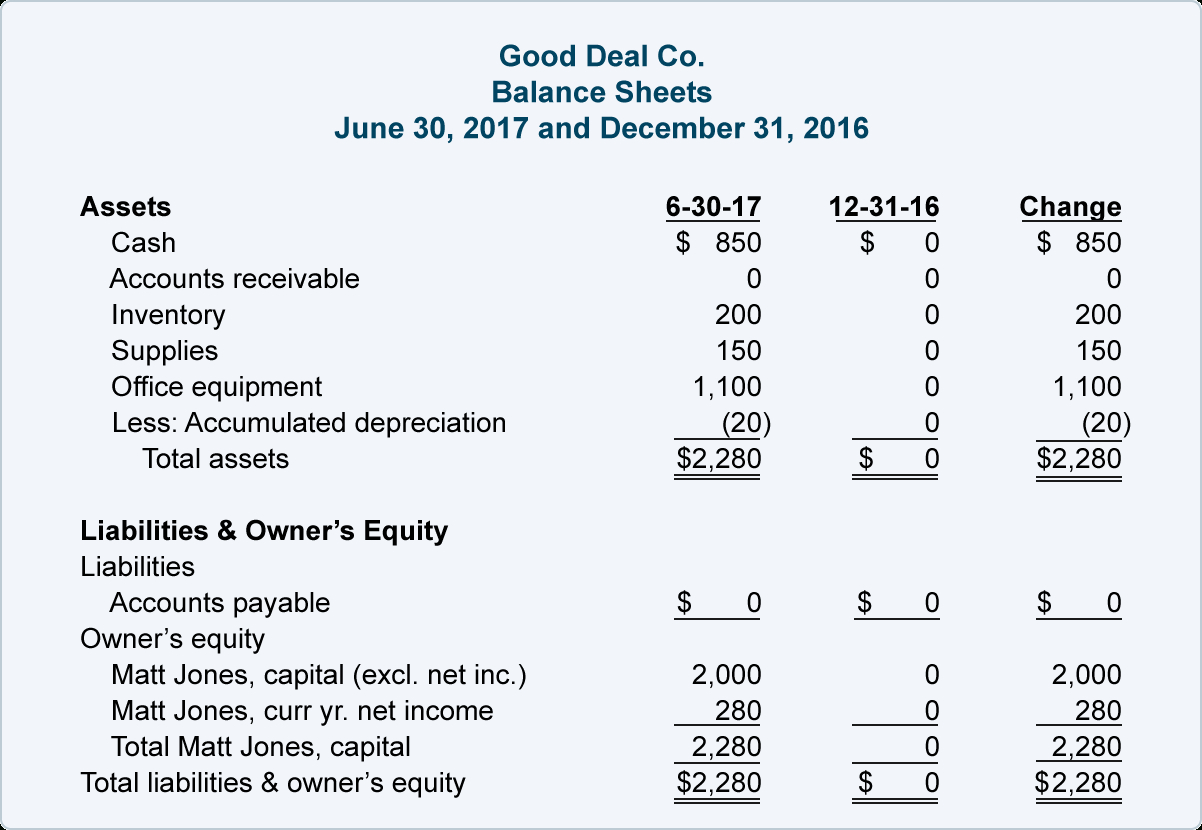

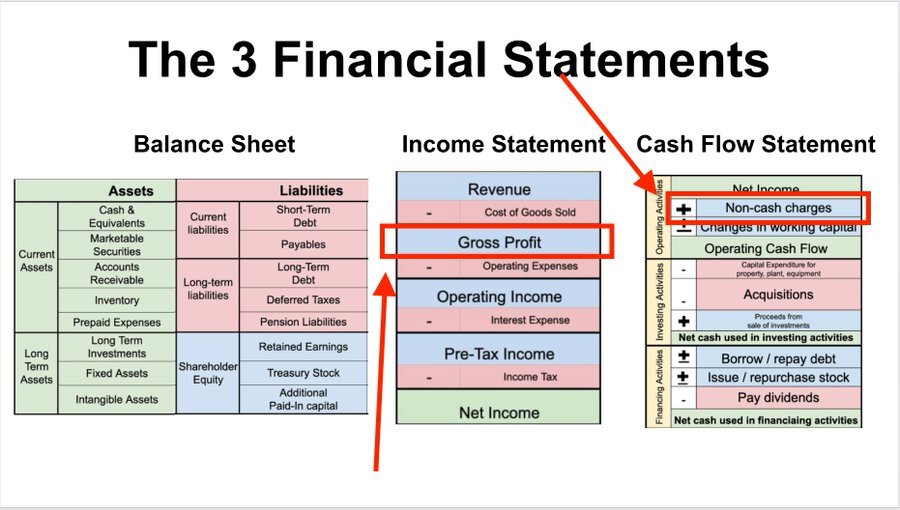

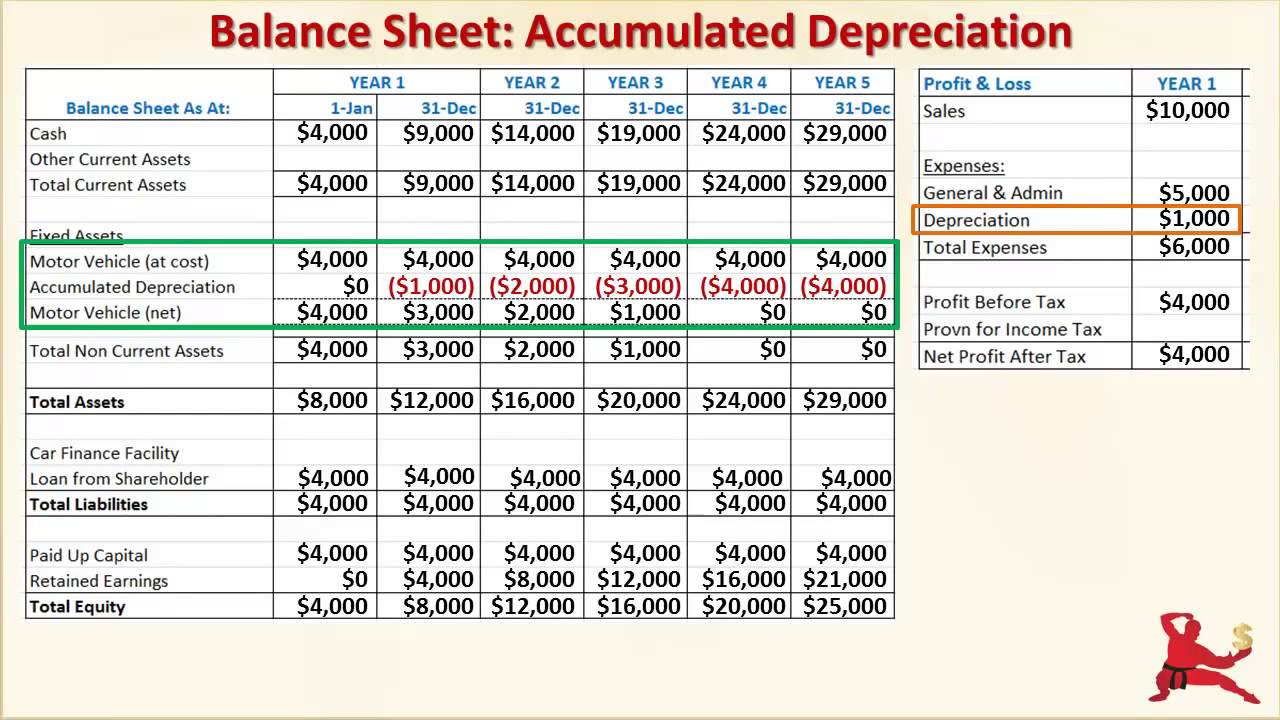

Depreciation moves the cost of an asset from the balance sheet to depreciation expense on the income statement in a systematic manner during an asset's useful life. Questions tips & thanks want to join the conversation? Depreciation is an expense, but an expense that never involves cash.

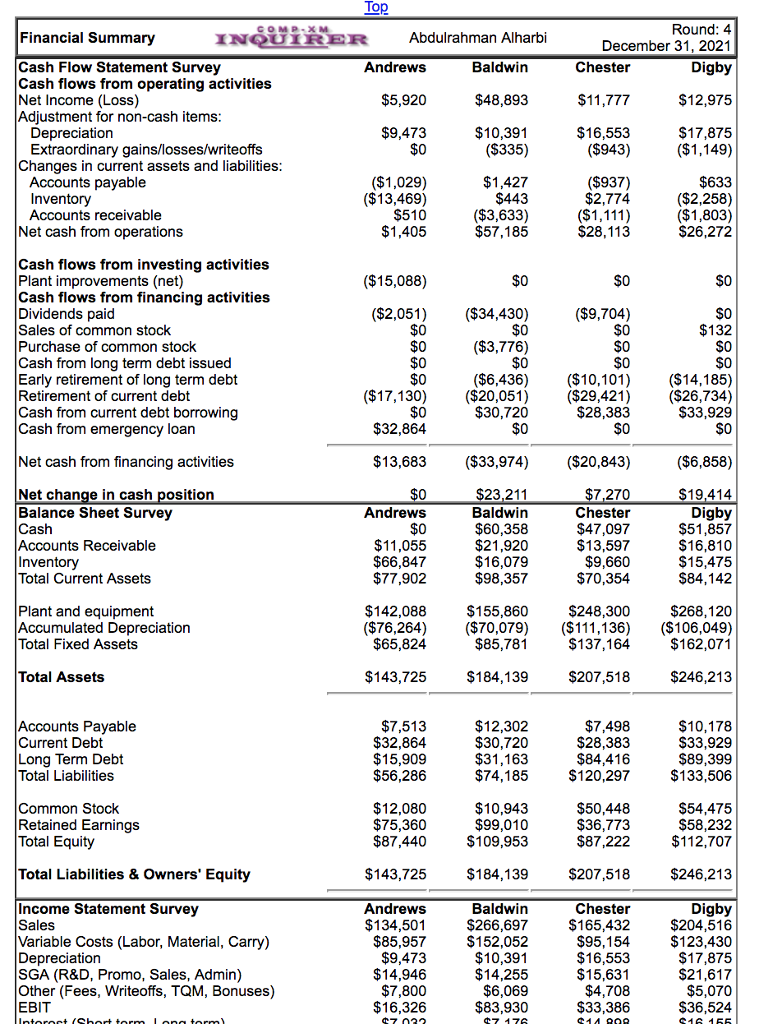

Depreciation in cash flow. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. Top voted gene chuang 12 years ago i don’t understand why.

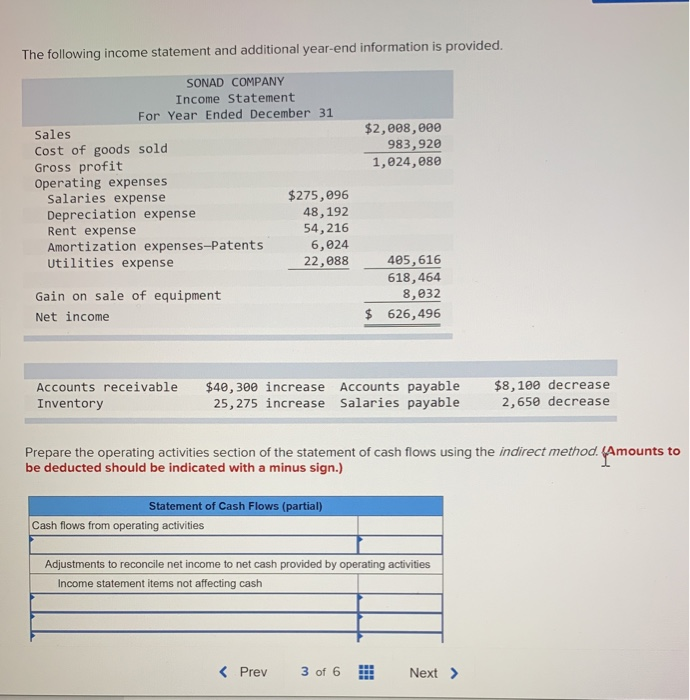

Due to this depreciation does not. When creating a budget for cash flows, depreciation is typically listed as a reduction from expenses, thereby implying that it has no impact on cash flows. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

In a nutshell, depreciation is an accounting measure and added back to revenue or net sales while calculating the company’s cash flow. There were no revenues, expenses, or gains, but there was a loss of. Labor = $40 overheads = $60 depreciation = $40 if the company sells the product at $280, then it will make a profit of $80 per unit.

In this video, learn why depreciation expense is excluded from the computation of operating cash flow, including how to deal with depreciation on the statement of cash. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash. Depreciation expense on cash flow statement introduction.

Begin with net income from the income. Depreciation, depletion, and amortization (dd&a) are accounting techniques that enable companies to gradually expense resources of economic value. Depreciation expense is a fundamental concept in finance and accounting that represents the systematic allocation of the cost of a tangible asset over its estimated.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)