Out Of This World Tips About Opening Stock And Closing In Trial Balance

The value of total purchases is already included in the trial.

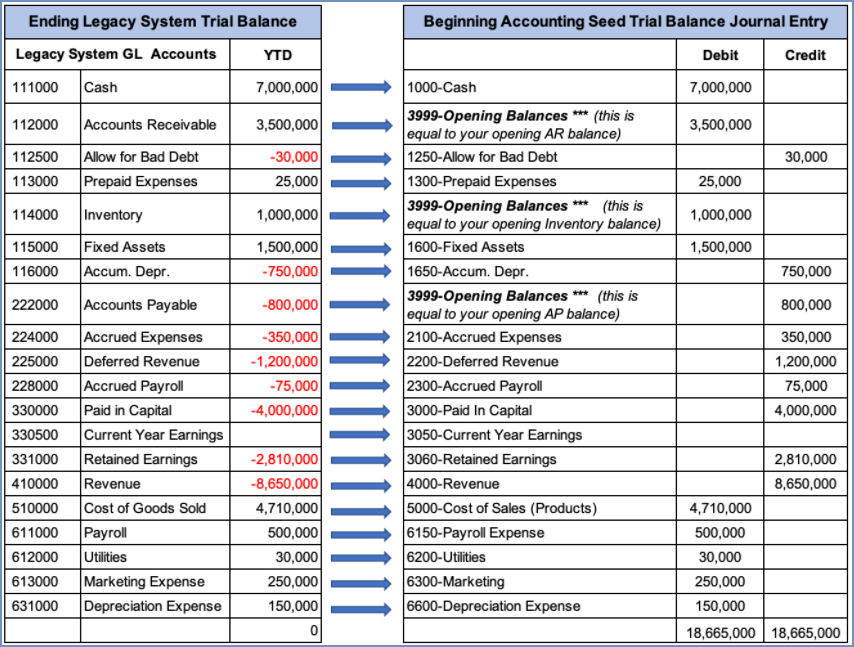

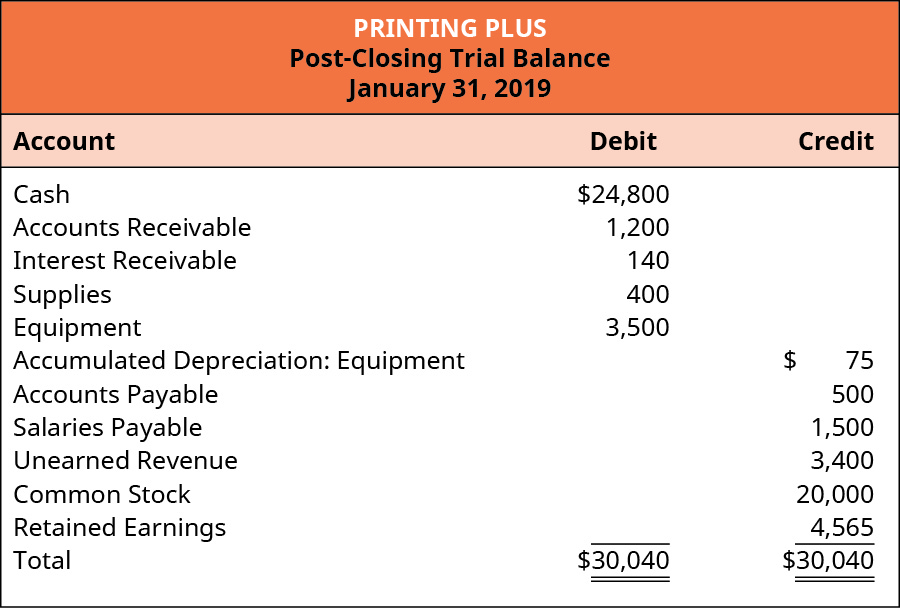

Opening stock and closing stock in trial balance. In this situation, the trial balance must show the. This statement comprises two columns:. At the start of any period (not including month 1) the balance on the stock asset account is moved to the closing.

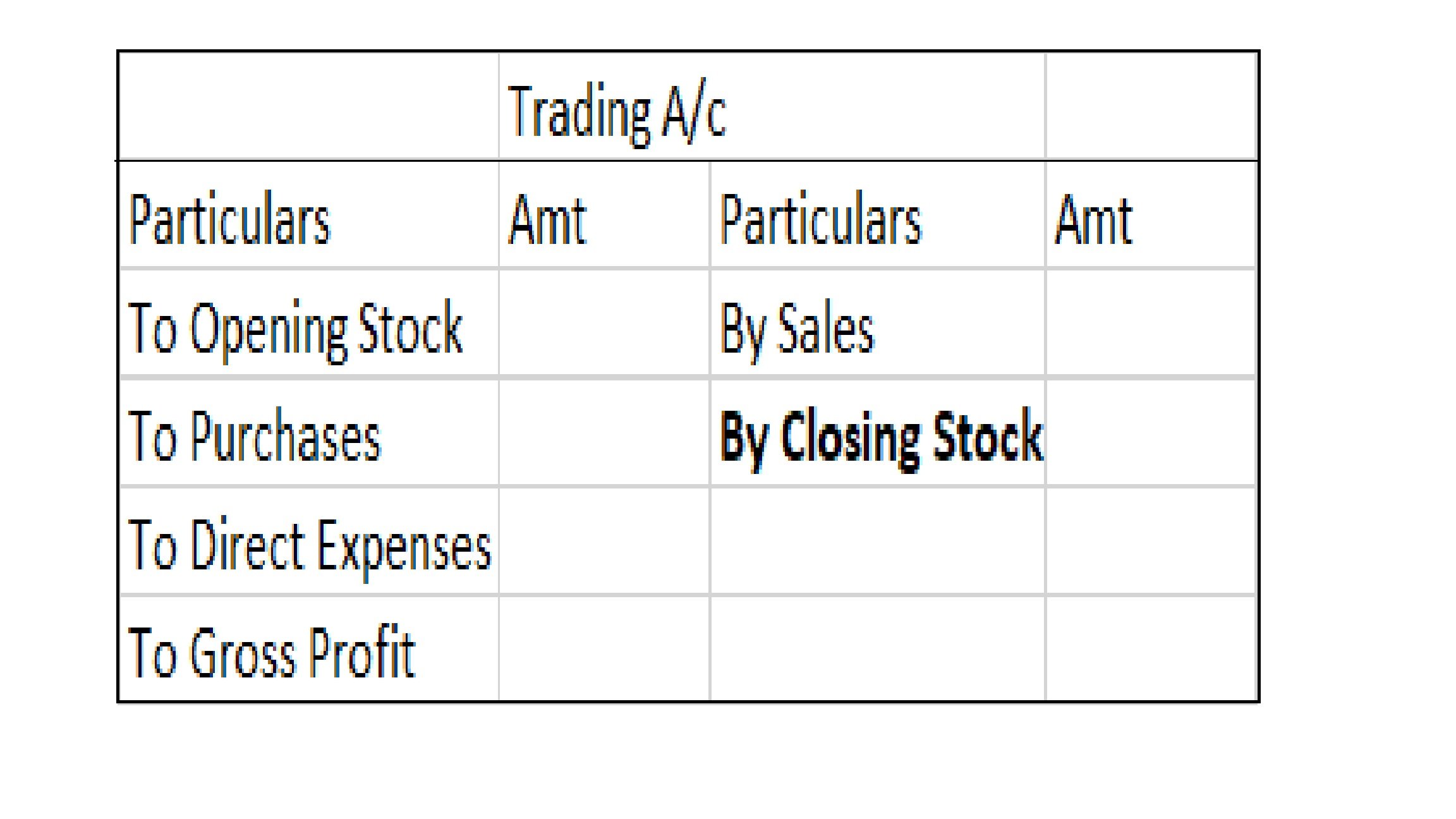

How do i record opening and closing stock? Here, the closing stock on a given date is 22 nos. Closing stock is the leftover balance out of goods which were purchased during an accounting period.

£0 = cost of sales: This will be carried forwarded to the next period or the next day as an opening balance. Closing stock is not shown in the trial balance.

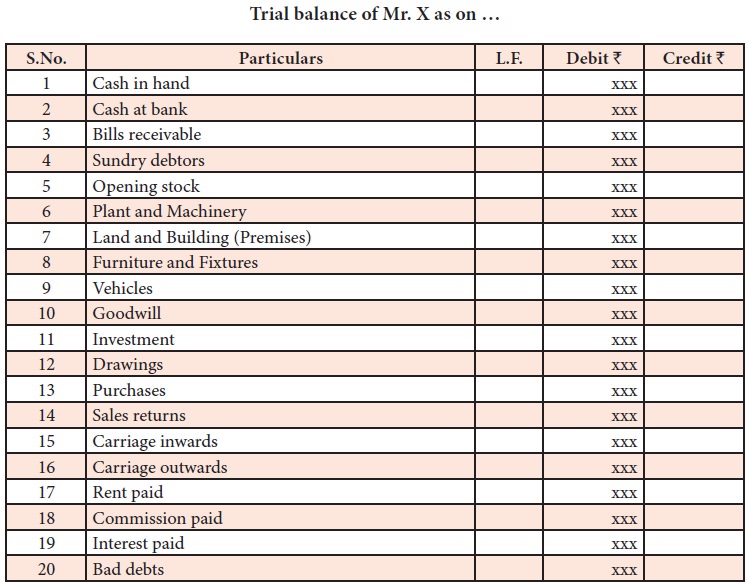

A trial balance is a list of all accounts in the general ledger that have nonzero balances. A trial balance is an important step in the accounting process, because it helps identify. What figure is normally entered into a trial balance, the opening stock value or the closing stock value?

Example 1 at the end of 2024, suppose that closing stock appears in the books at a cost price of $25,000, but the market price at that time is $30,000. This is a profit and loss account. Sometimes, closing stock is recorded in the books of accounts before preparation of trial balance.

The calculation with opening and closing stock is: Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. To me, the logical thing would be to enter the closing stock.

Closing stock or ending inventory is the stock of inventory which a business has left over at the end of its accounting period, and it includes merchandise that was. Because the closing stock a/c appears but both the purchases a/c and the trading a/c do not appear in the trial balance, we may assume that the closing stock has been recorded by crediting an account that was used to ascertain the cost of goods sold like the cost of goods sold a/c. At the beginning of the year had an opening inventory of 20,000.

The simple definition of what is closing stock is the number of unsold products that are left after closing the balance sheet inventory. Description if you need the profit figure on your profit and loss report to take into account any unsold stock, you can do this either. In such cases, we need to adjust the purchases for both opening and closing.

Total purchases are already included in the trial balance, hence. Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period. Opening stock account which has a debit balance is recorded in the debit column of the trial balance.

Its purpose is to test the equality between debits and credits after the.