Lessons I Learned From Info About Frs 102 Balance Sheet Format

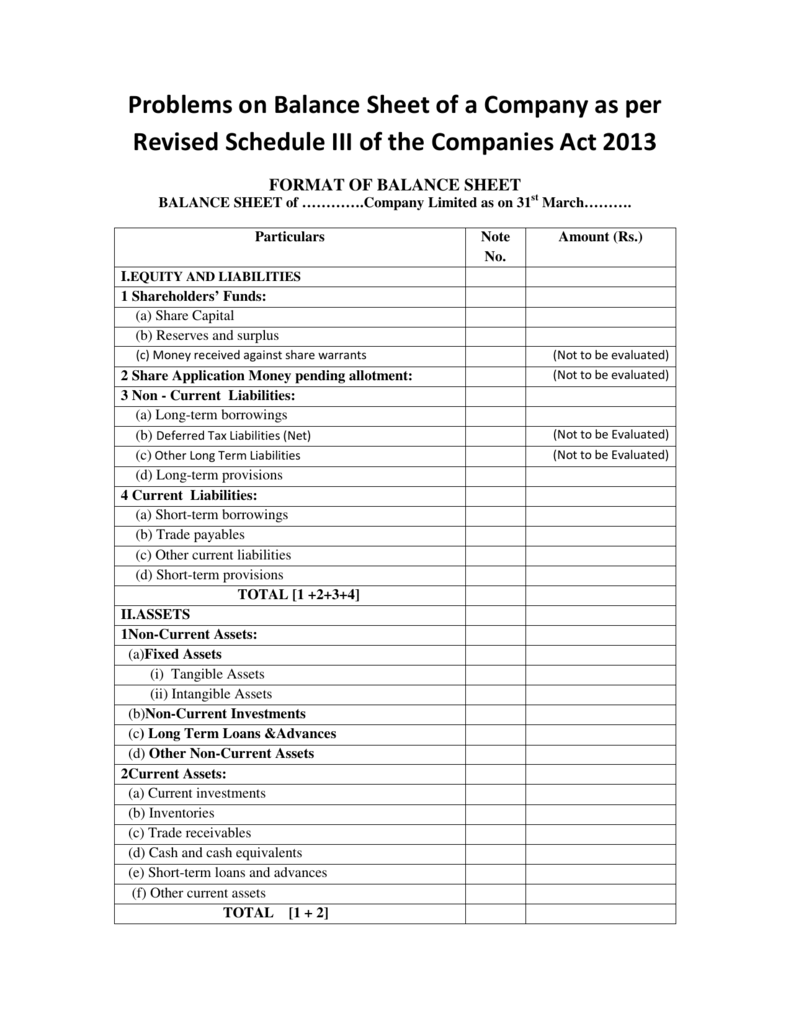

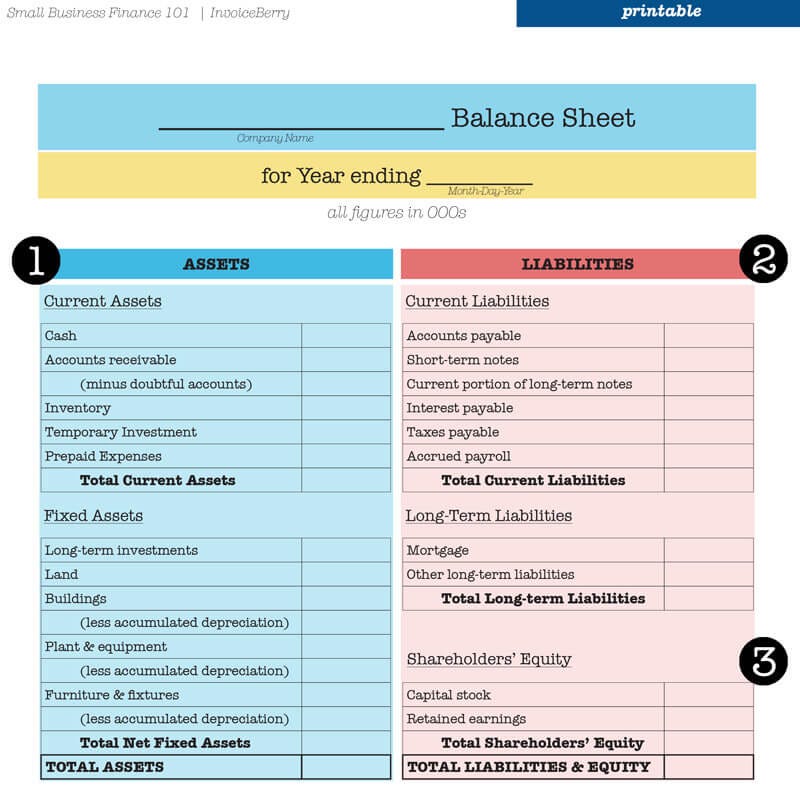

New standard for both the balance sheet at the ‘date of transition’ and the balance sheet for the last set of accounts prepared under current uk gaap, together with the profit and.

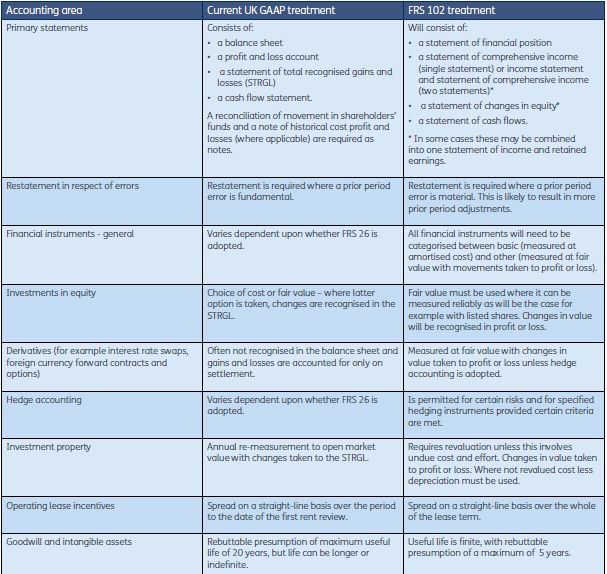

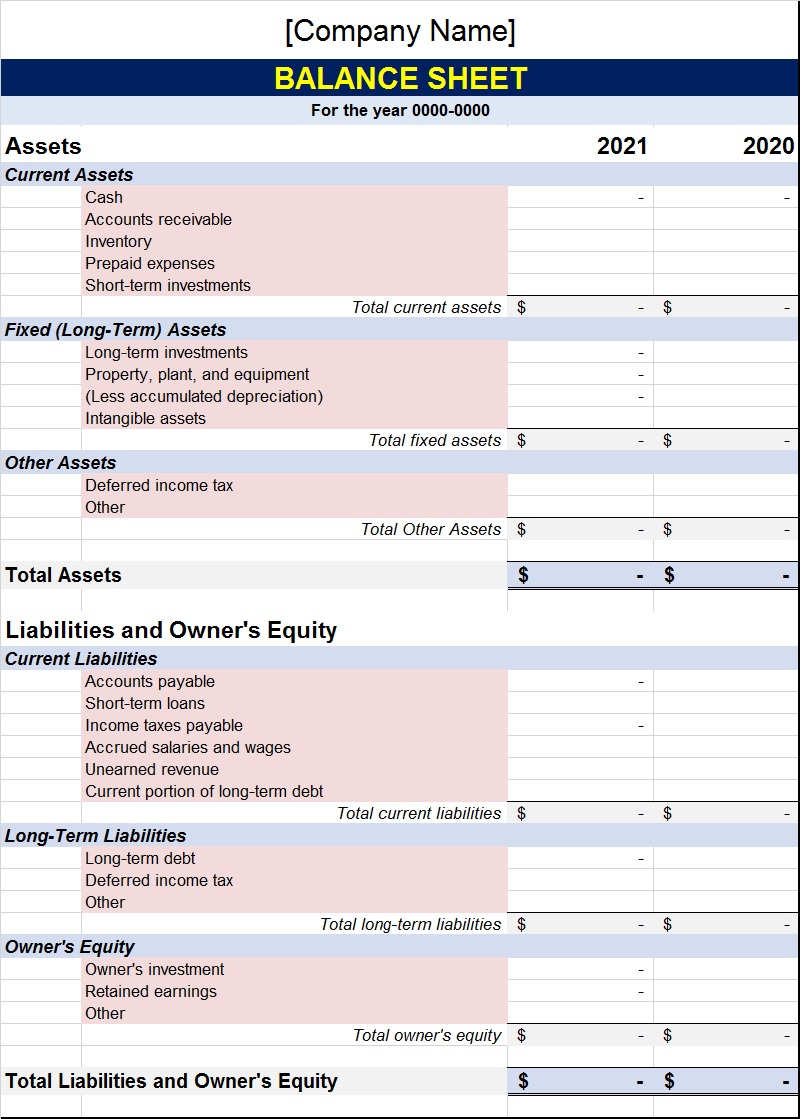

Frs 102 balance sheet format. Frs 102 the financial reporting standard applicable in the uk and republic of ireland 7 1 scope 8 1a small entities 13 appendix a: Find out the changes to the format and layout of. 14 rows frs 102.

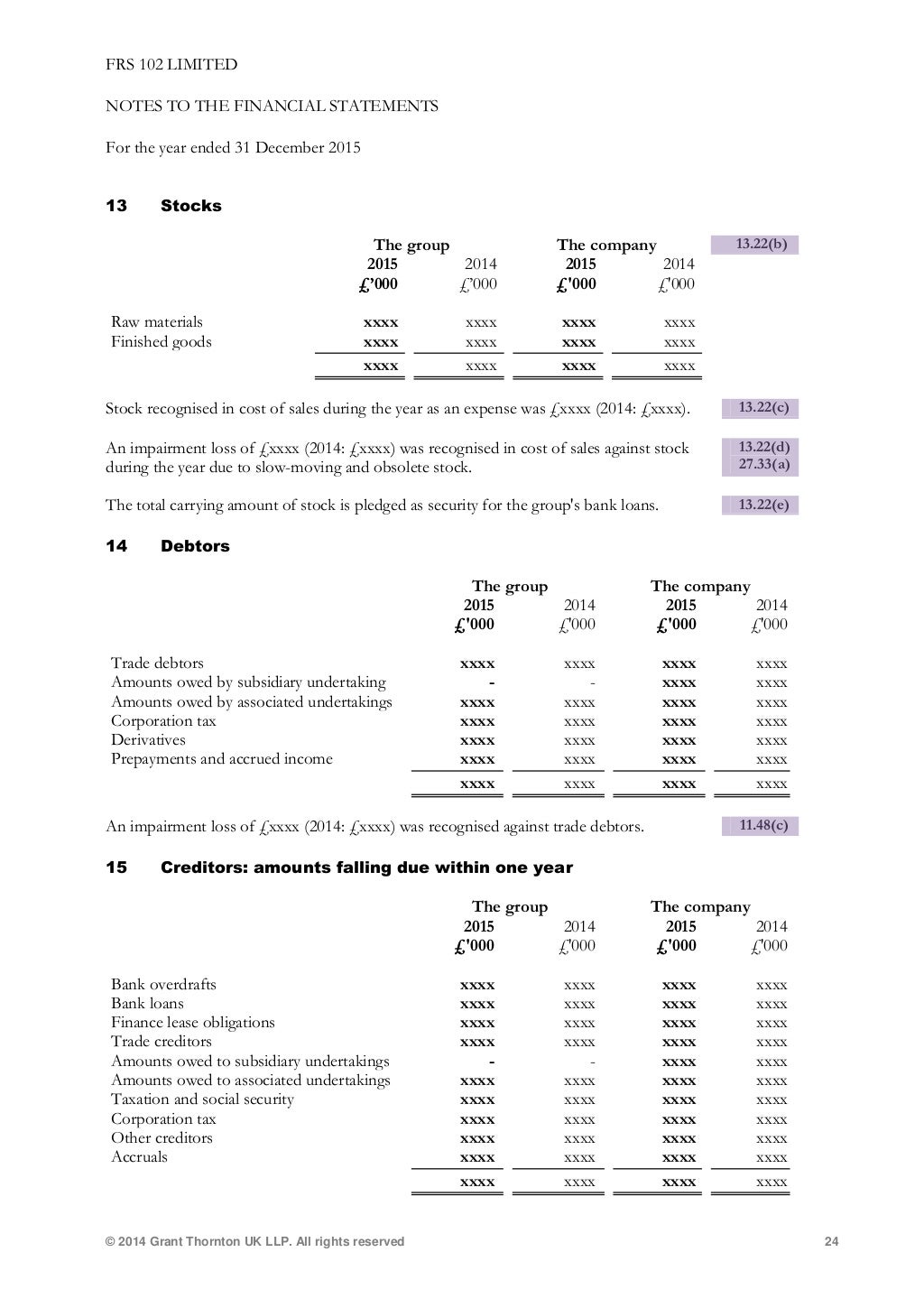

It requires the comparative and opening balance sheet at the date of transition to be restated in accordance with frs 102: The main section of this paper is split into 2 parts: Under frs 102 companies will be required to account for holiday and sick pay liabilities at each year end.

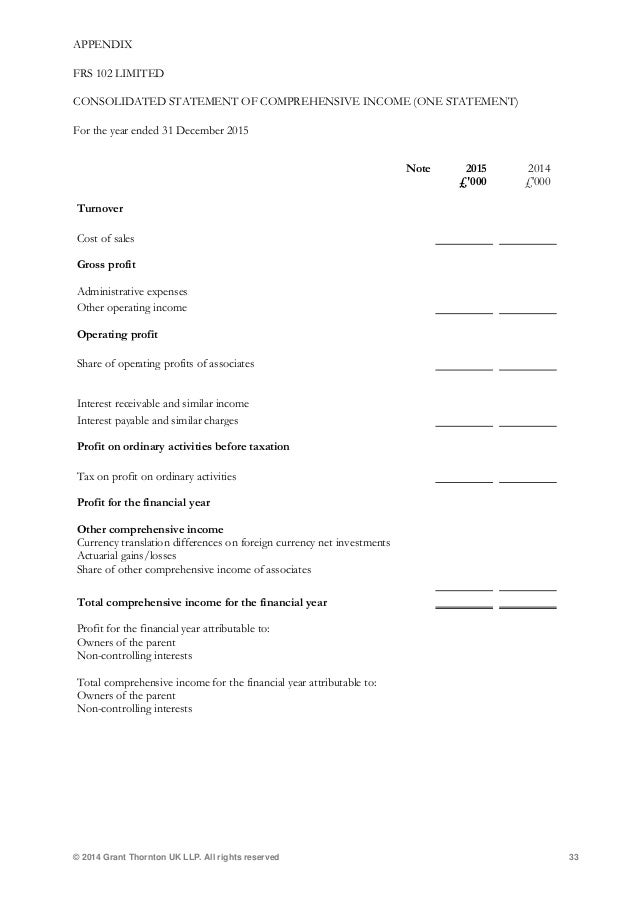

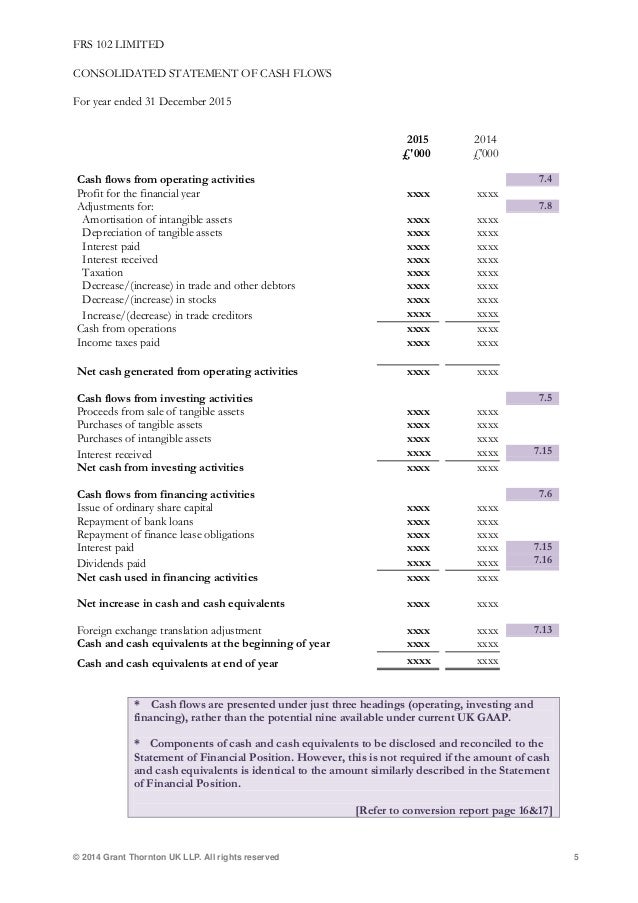

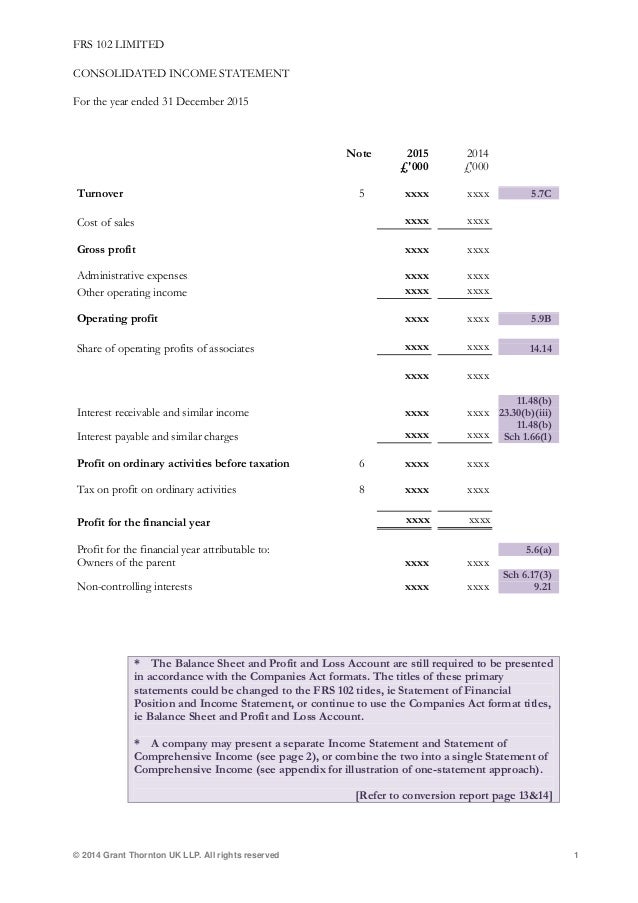

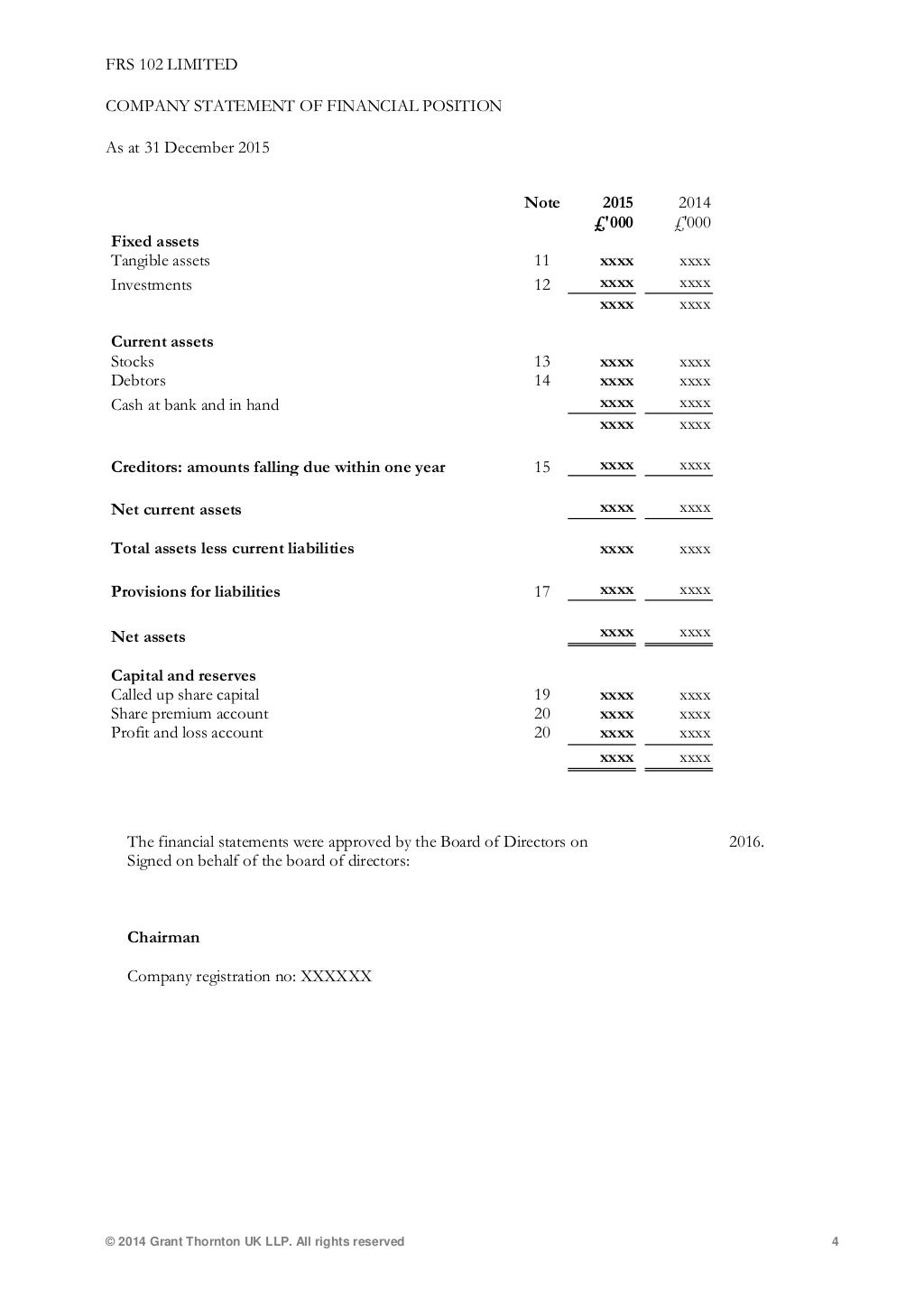

Statement of comprehensive income 102 balance sheet 103. Frs 102 is the principal accounting standard in the uk financial reporting regime. Statements under the frs 102 adapted formats in appendix 2.

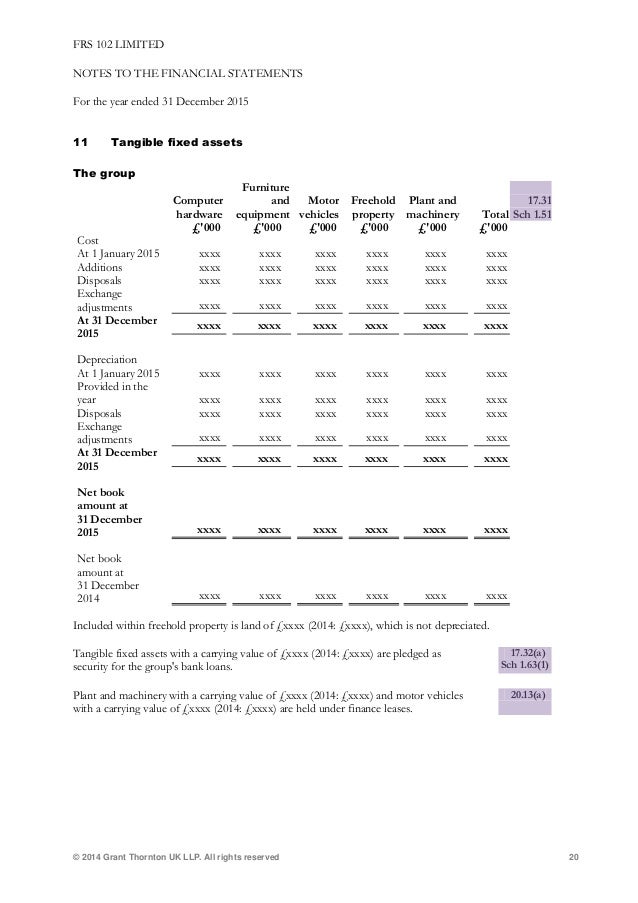

Learn how to prepare financial statements in accordance with frs 102, the new uk standard for financial reporting. For example, if an employee carries over five days holiday into the new. This annual report illustrates the disclosures and format that might be expected for a company that prepares consolidated and separate financial statements in accordance.

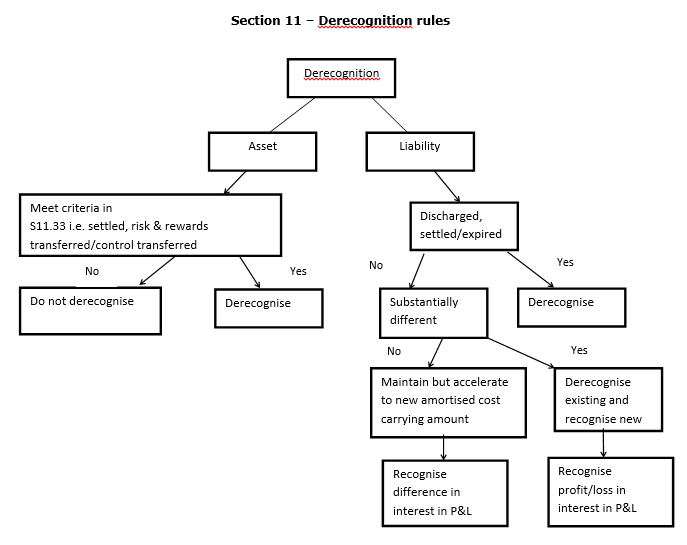

The accounting treatment varies according to the classification. In the balance sheet, paragraph 29.23 of frs 102 requires that deferred tax liabilities are presented ‘within provisions for liabilities’ and deferred tax. Frs 102, the financial reporting standard applicable in the uk and republic of ireland, has been in issuance since march 2013 and became mandatory for companies not.

Must contain a balance sheet, a profit and loss account and notes to the financial statements (and are encouraged to contain a statement of total comprehensive. These are as follows and they are highlighted in the body of the financial statements: Corporate reporting uk gaap uk gaap model accounts and disclosure checklists model accounts and disclosure checklists for uk gaap find example accounts and disclosure.

(a) the frs states that “a small entity may need to provide disclosures in addition to those set. Guidance on adapting the balance sheet. Frs 102 is a single financial reporting standard that applies to the financial statements of entities that are not applying adopted ifrs, frs 101 or frs 105.

This annual report illustrates the disclosures and format that might be expected for a company that prepares. Frs 102 classifies financial instruments as either basic financial instruments or other financial instruments. 41 rows overview frs 102 “the financial reporting standard applicable in the uk and republic of ireland” (link to frc website) is a single coherent financial.

It sets out the financial reporting requirements for entities that are not applying adopted ifrs, frs. Part a of this paper provides a comparison of the accounting and tax differences that arise between old uk gaap and.