Ideal Tips About Form 26as Pdf

Log in to your account using your user id (that is either your.

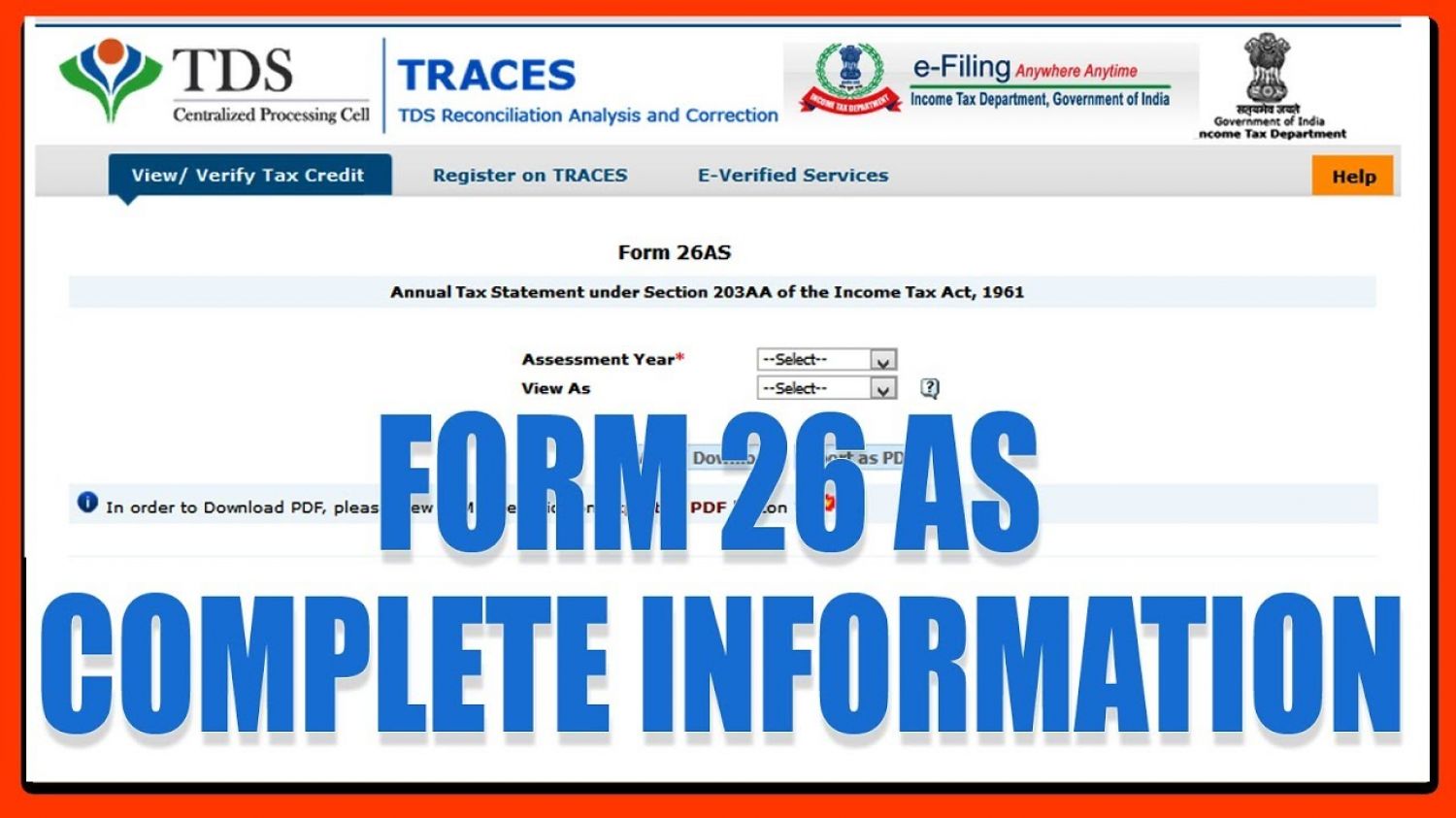

Form 26as pdf. Getty images to download form 26as in pdf format, select 'html' and click on view/download then click on 'export as pdf' tab. Post selection, click on the button ‘view/download’ step 7: The password of form 26as in pdf format is the same as your pan number.

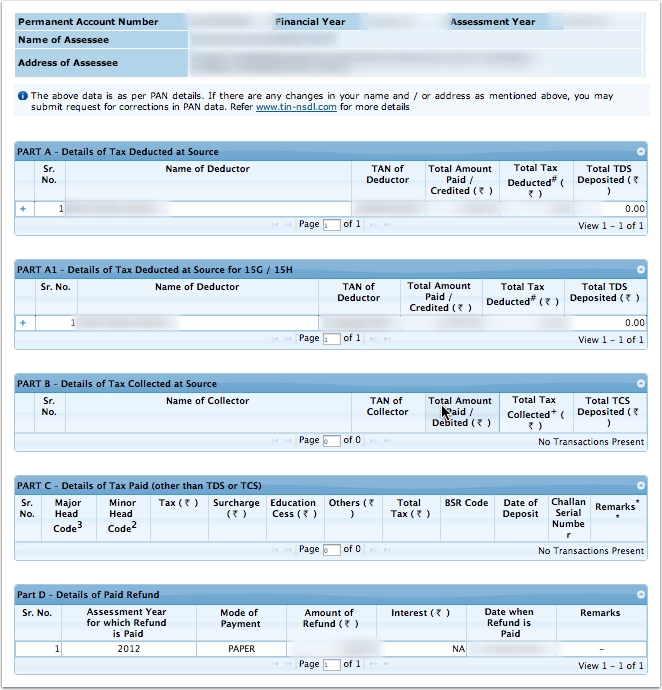

Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf) click ‘view / download’ note to export the tax credit. Form 26as download can also be done in pdf format. Please contact your tax consultant for an exact calculation of your tax liabilities.

Click the export pdf button to download it as a pdf. Form 26as means. With the deletion of rule 31ab of.

Firstly visit the official website of the. You can download the form by entering your pan number and password in the. Tax benefits are subject to changes in tax laws.

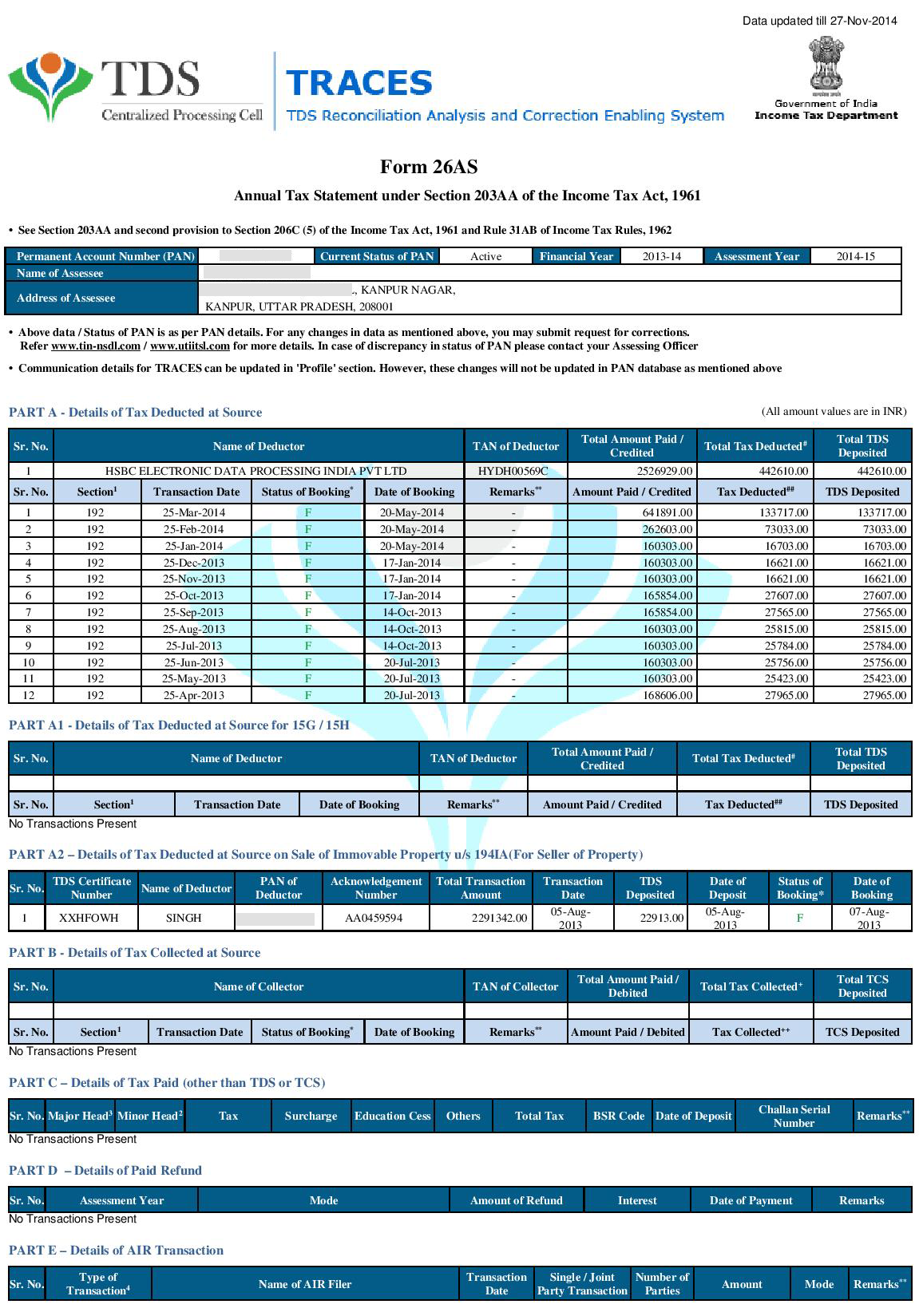

On the traces website or via net banking facility of authorized banks. The days of manually filing it returns by downloading. Form 26as, often known as the tax credit statement, is a crucial record for filing taxes.

If you are not registered with traces, please refer to our e. Form 26as from the income tax department. Form 26as can be downloaded:

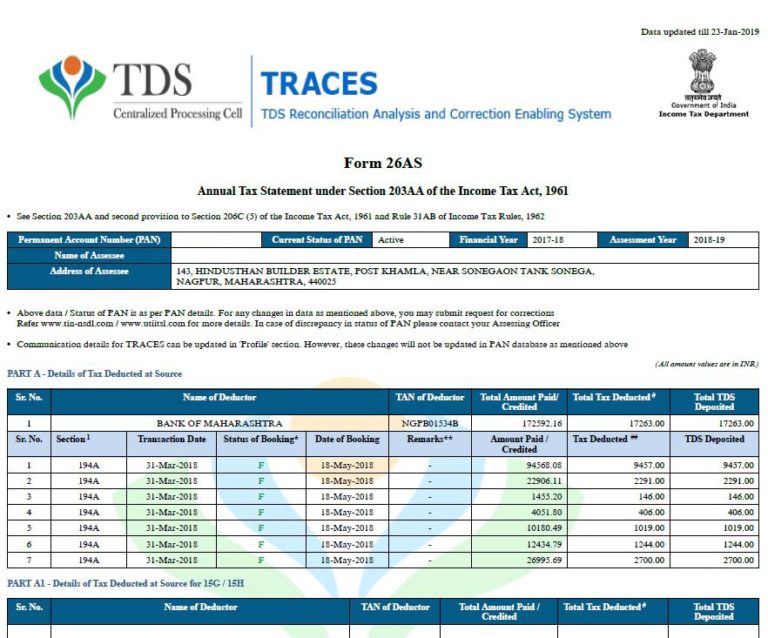

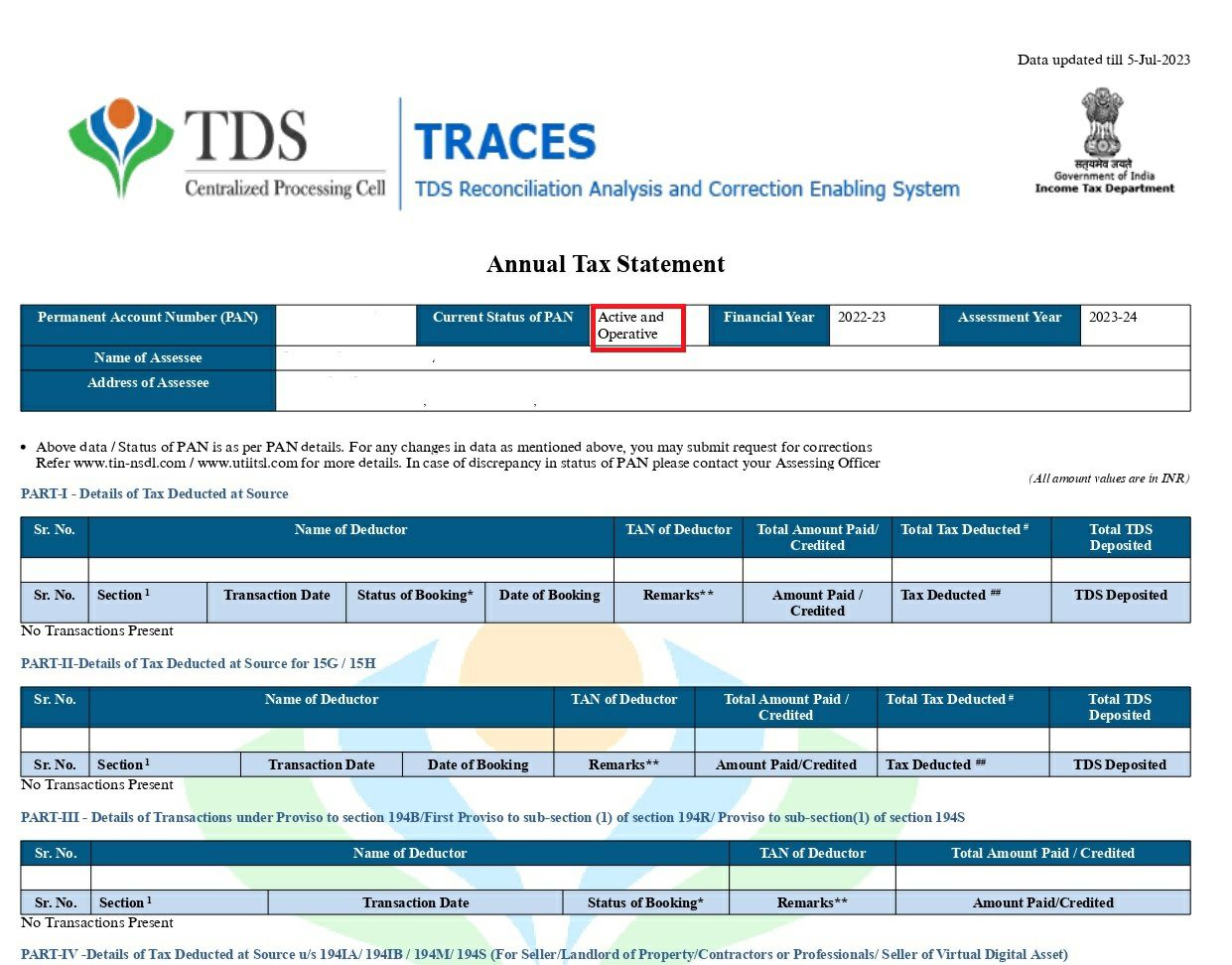

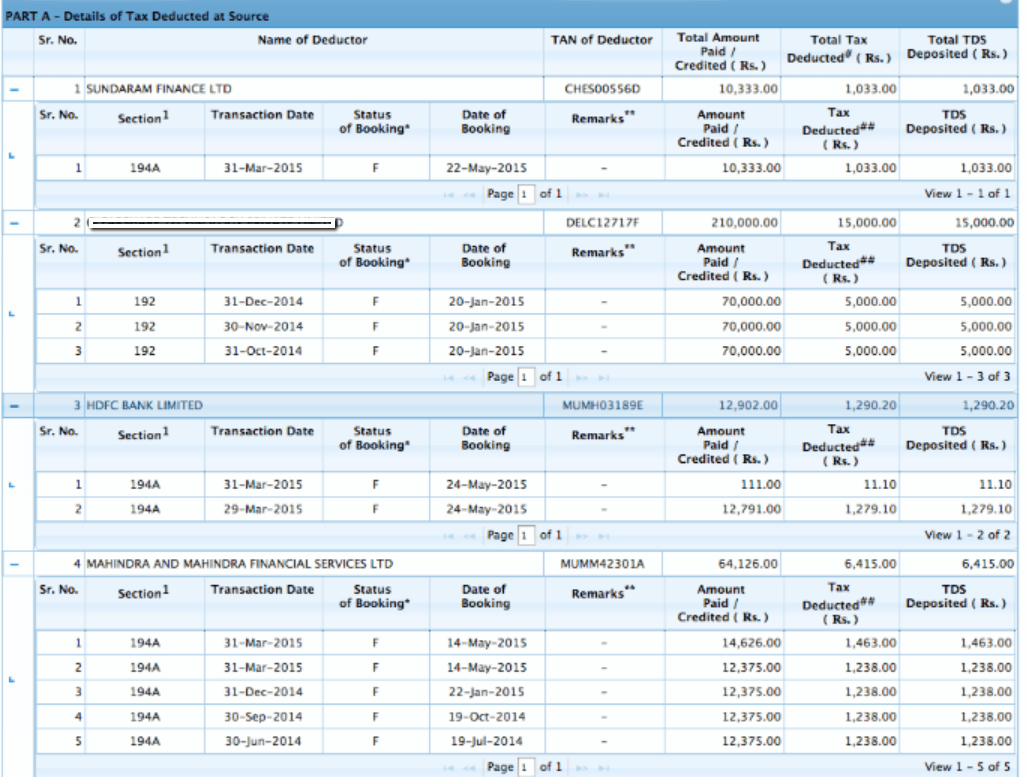

Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. Taxpayer can download form 26as through. Locate the downloaded form 26as pdf file on your computer or device.

The website provides access to the pan holders to view the details of tax credits in form 26as. To open the document you will be required to. Important information for “downloading form 26as”.

Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your. Form 26as is an annual. The form 26as holds the ‘tax credit’ details of a taxpayer as per the records of the income income tax department.

How do i view form 26as using.

![[PDF] Revised 26AS Form PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/revised-26as-form-3463.jpg)

![[PDF] Tax Credit Statement Form 26AS DCSD.IN](https://i0.wp.com/pdfcity.in/wp-content/uploads/2021/11/Tax-Credit-Statement-Form-26AS.png?ssl=1)