Amazing Tips About Revaluation Reserve On Balance Sheet

Money kept aside to redeem any debentures that are.

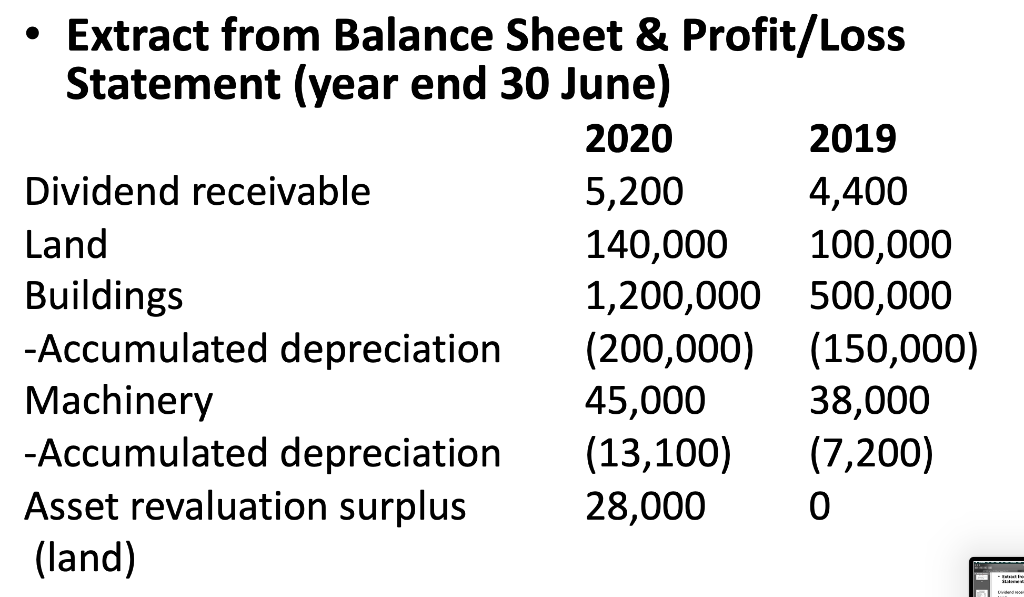

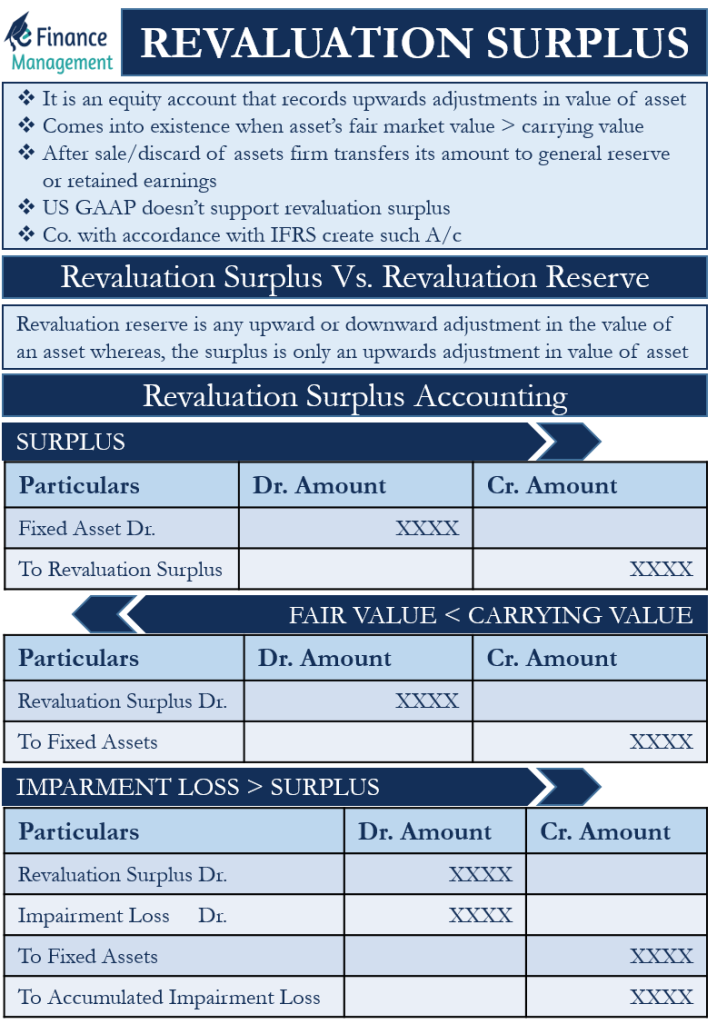

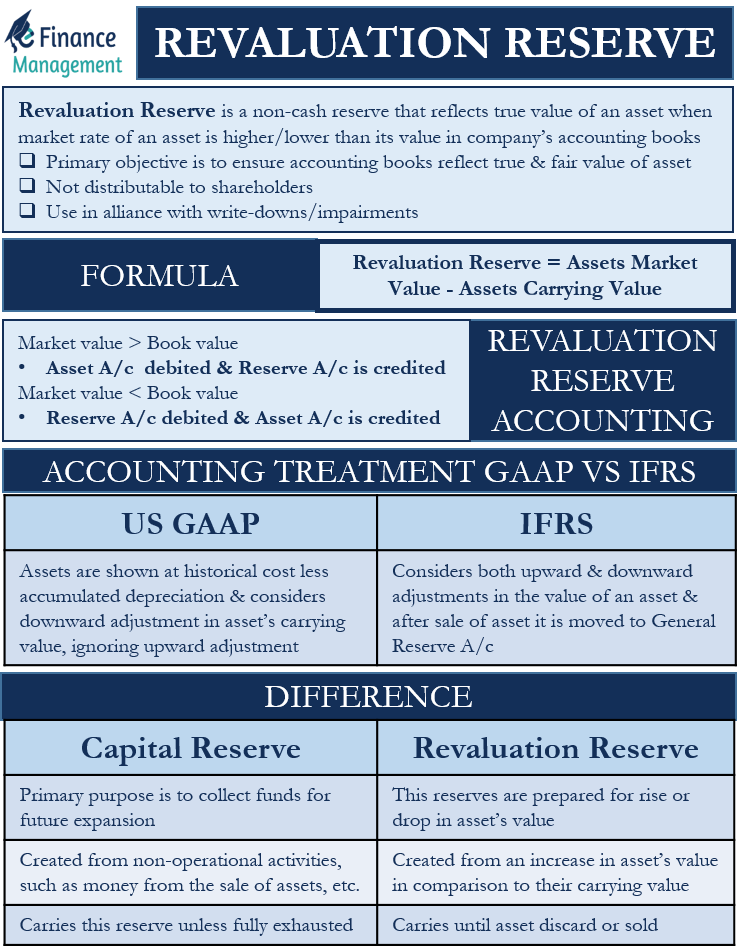

Revaluation reserve on balance sheet. Dr investment property £20,000. Revaluation fund is the accounting term utilised when a business establishes a line item on the balance sheet for the. Such a reserve is as a rule temporary in its existence and stands on the books pending a revaluation of the assets.

Any change does not go to the income statement or the. Meaning of revaluation reserve. Balance sheet reserves refer to the amount expressed as a liability on the insurance company's balance sheet for benefits owed to policy owners.

3.2 journal entries 3.3 revaluation a/c 3.4 partners’ capital a/c suggested videos revaluation reserve revaluation account in order to ascertain net gain or loss. A revaluation (fair value adjustment) of property, plant and equipment (used in the trade of the business) whereby the fair value movement is required to be. [ias 21.23] foreign currency monetary amounts should be reported using the closing rate;

Based on provisional unaudited data. Another use for reserves is that of serving as a bookkeeping. Revaluation reserves (or, more precisely, revaluation surplus reserves) arise when the value of an asset becomes greater than the value at which it was previously carried on.

Under frs 102, fair value gains and losses are taken to profit and loss and therefore a prior. This line item can be used when a revaluation assessment finds that the carrying value of the asset has changed. Hedging reserves:these can arise as a result of hedges a company has taken on to protect itself against volatility in certain input costs.

The revaluation reserve is also held in the balance sheet of the. The amount which appears to be as revaluation reserve in my previous years' account is actually the liabilities and they are already on my balance sheet. The annual accounts of all the eurosystem national central banks will be finalised by the end of may 2024, and.

Revaluation reserves allow businesses to adjust the. For accounting, it is a line item for the balance sheet only. At each subsequent balance sheet date:

:max_bytes(150000):strip_icc()/Revaluationreserve_color-9d361a05aa014fad95aae61c614e6a92.png)

:max_bytes(150000):strip_icc()/BalanceSheetReserves_Final_4201025-49fe811c4d2540a9b2fae7650ce4be8d.png)