Awe-Inspiring Examples Of Info About Posting Closing Entries

Four entries occur during the closing.

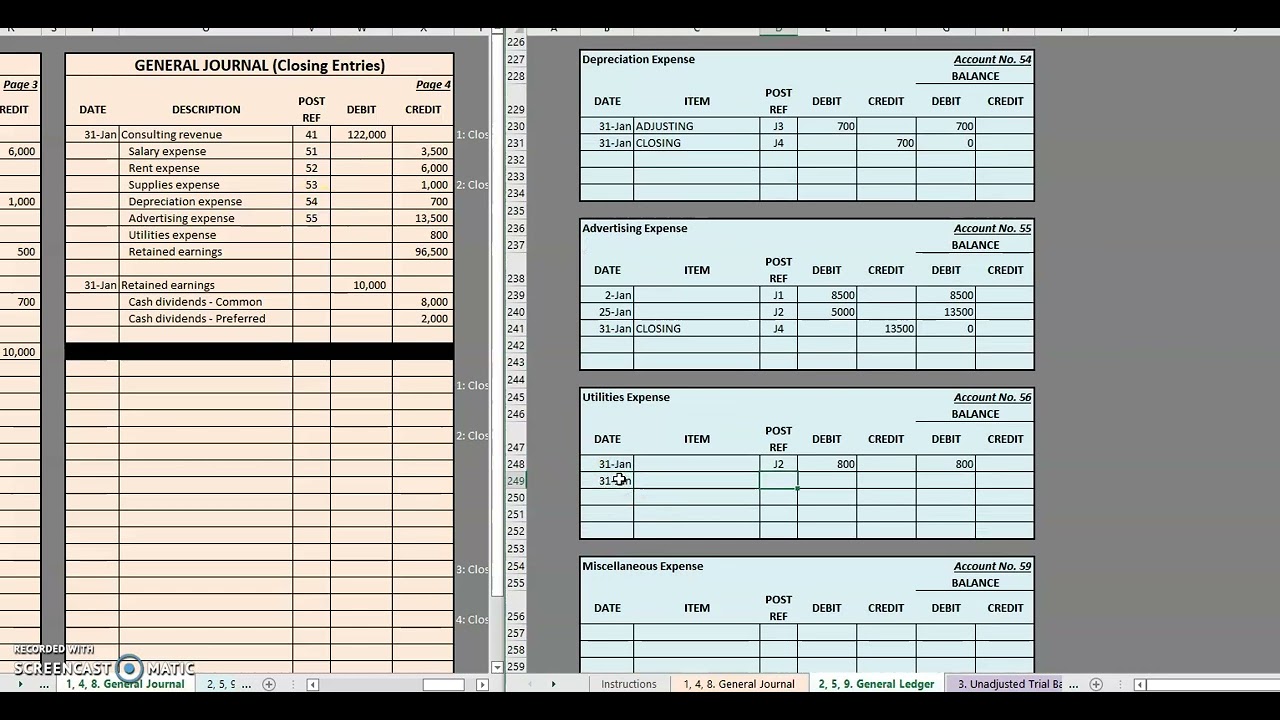

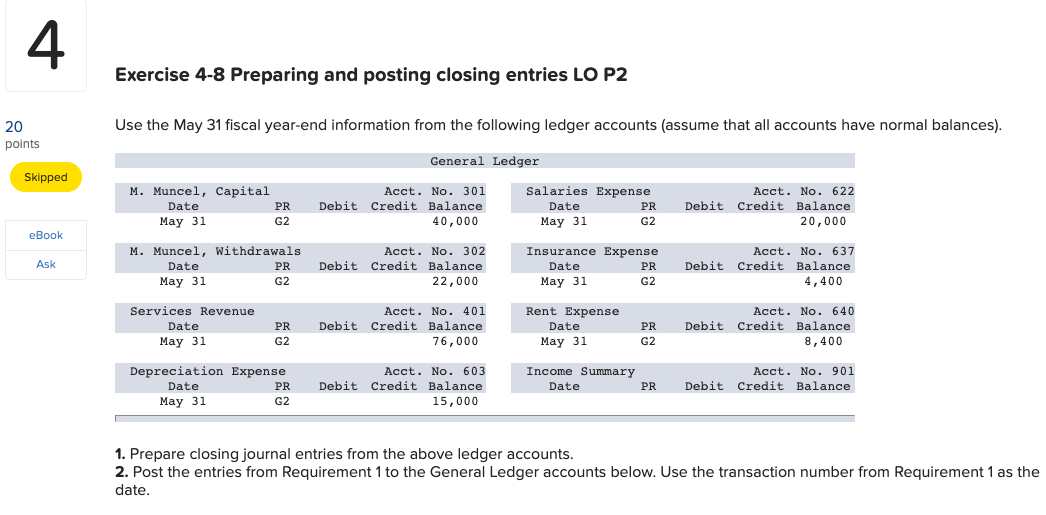

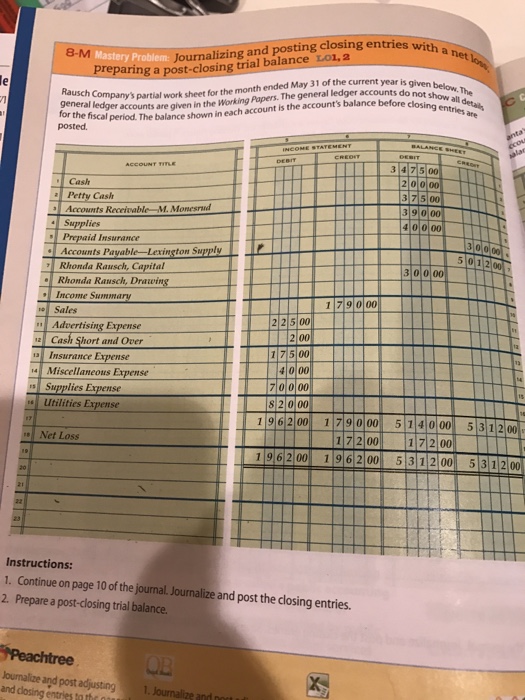

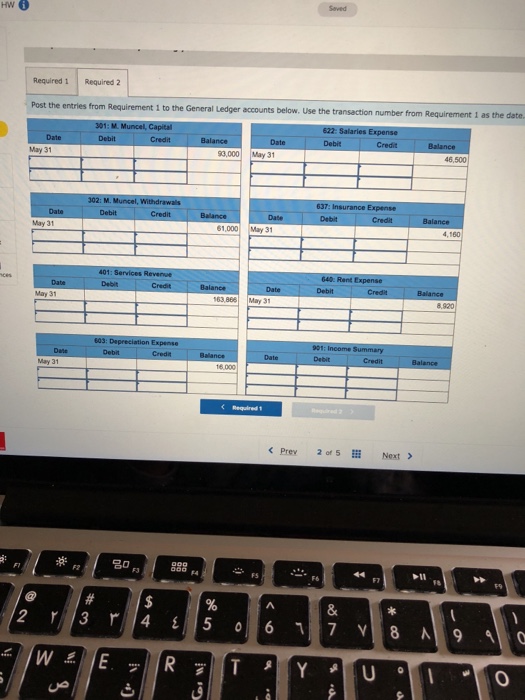

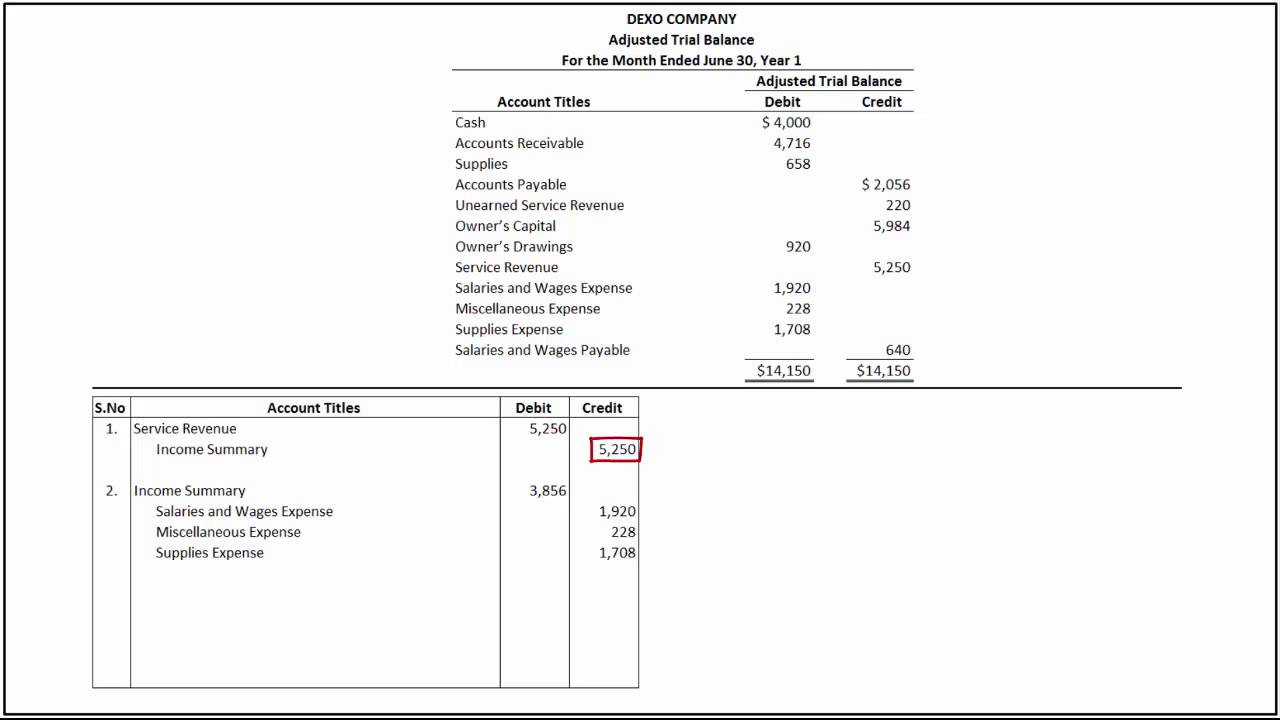

Posting closing entries. Closing entries are journal entries made at the end of an accounting period which transfer the balances of temporary accounts to permanent accounts. Closing entries | closing procedure november 13, 2023 what are closing entries? The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

If you’re using a computerized accounting system, the software may. Closing entries reduce revenue, expense, and dividend accounts to zero and match the. If there are any temporary.

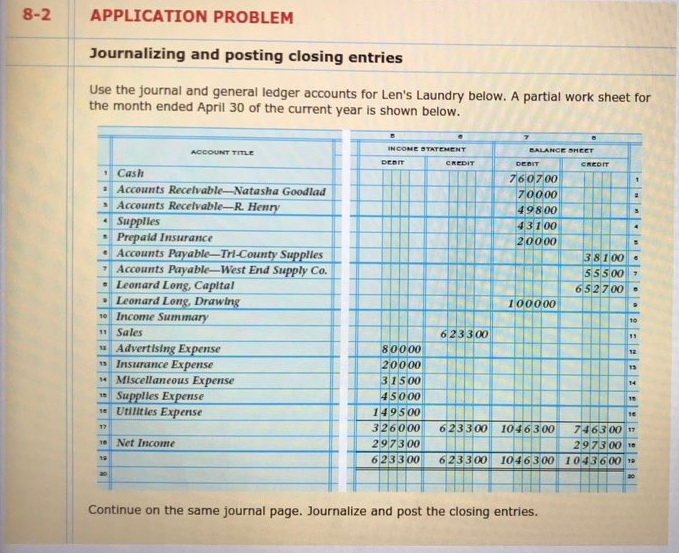

Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and. Journalizing and posting closing entries. A closing entry is a journal entry made at the end of accounting periods that involves shifting data from temporary accounts on the income statement to.

Once all closing entries have been passed, only the permanent balance sheet and. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. What are closing entries?

As we approach the reentry, the uncertainty in the prediction decreases. Journalizing and posting closing entries. The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries.

Close withdrawals to the capital account. Businesses are required to close their books at the end of each accounting period. The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the.

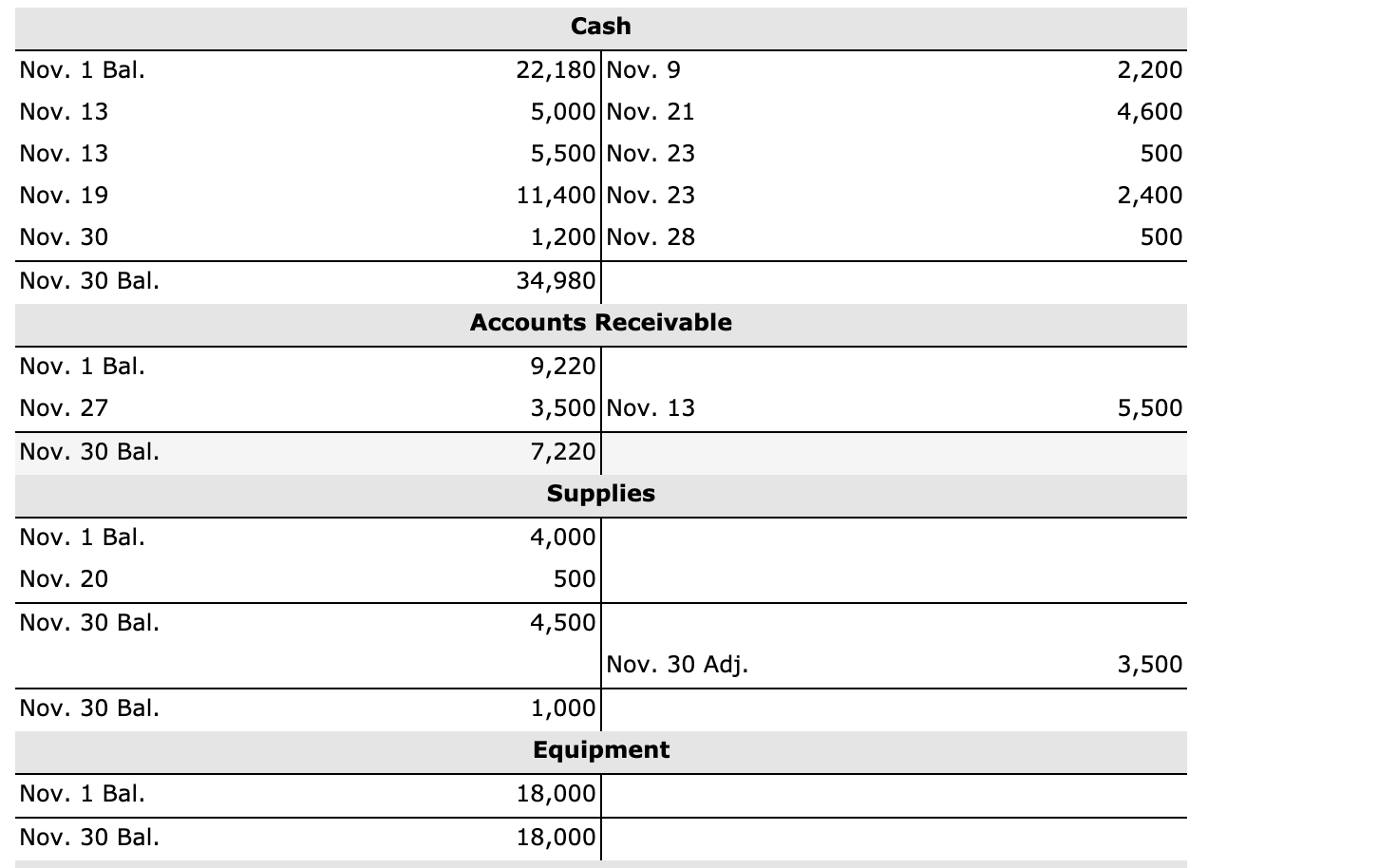

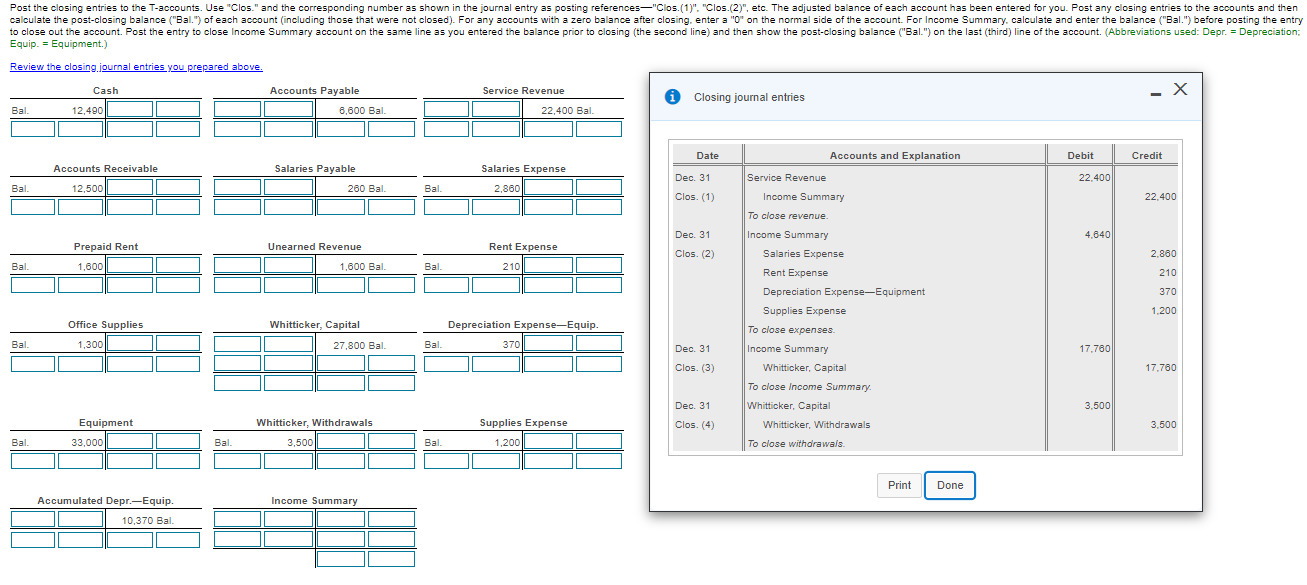

Its purpose is to test the equality between debits and credits after the. When entries 1 and 2 are posted to the general ledger, the balances in all revenue and expense accounts are transferred to the income summary account. As similar to all other journal entries, closing entries are posted in the general ledger.

When closing expenses, you should list them individually as they appear in the trial balance. Learn how to prepare closing entries for the final column of the accounting cycle. Closing entries are journal entries posted at the end of an accounting period to reset temporary accounts to zero and transfer their balances to a permanent.

The above closing entries are recorded in both the general journal and the general ledger. Closing entries prepare a company for the next accounting period by clearing any outstanding.

![[Solved] Problem 6.3A (Algo) Journalizing and posting clo](https://media.cheggcdn.com/media/737/737814eb-2d6e-464a-b493-afb178d330ee/phprqceFk)