Out Of This World Tips About Preparing Profit And Loss Account

Comprehensive guide to the profit and loss account:

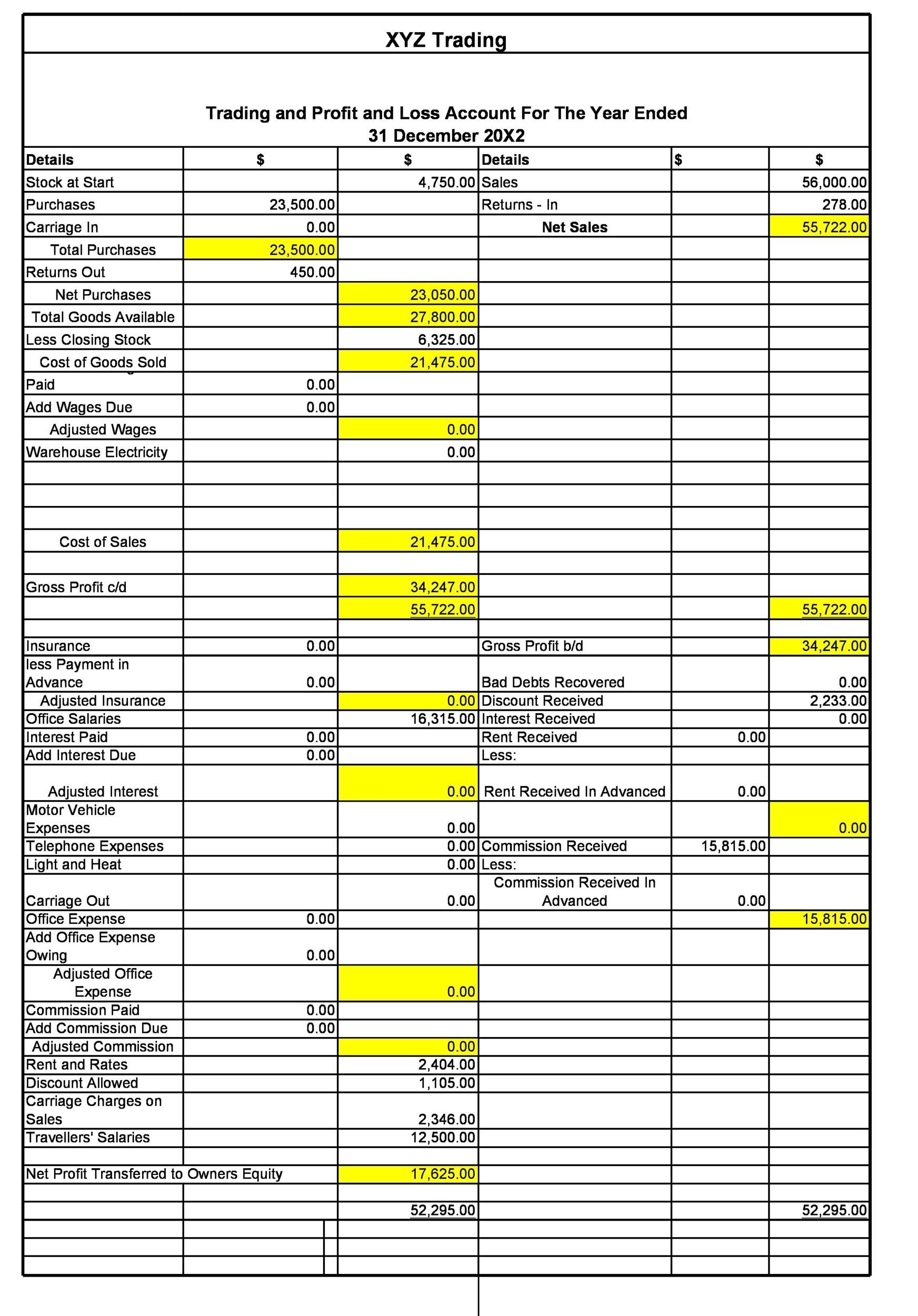

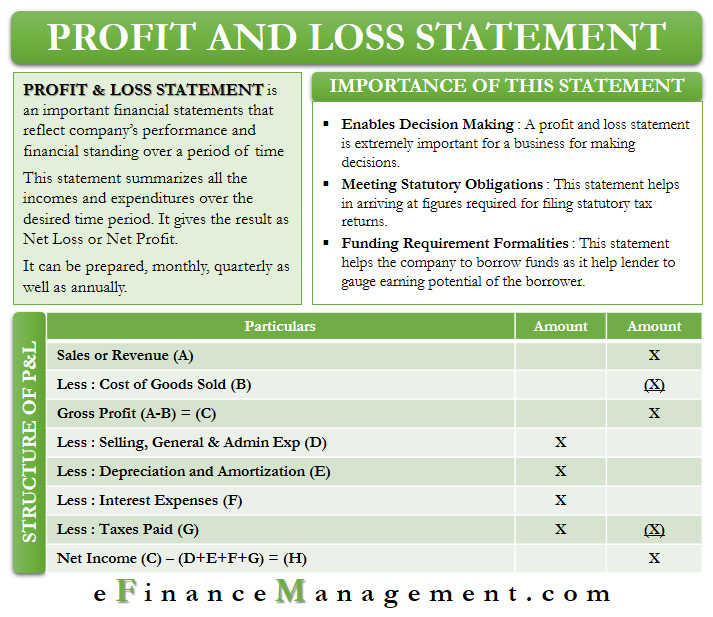

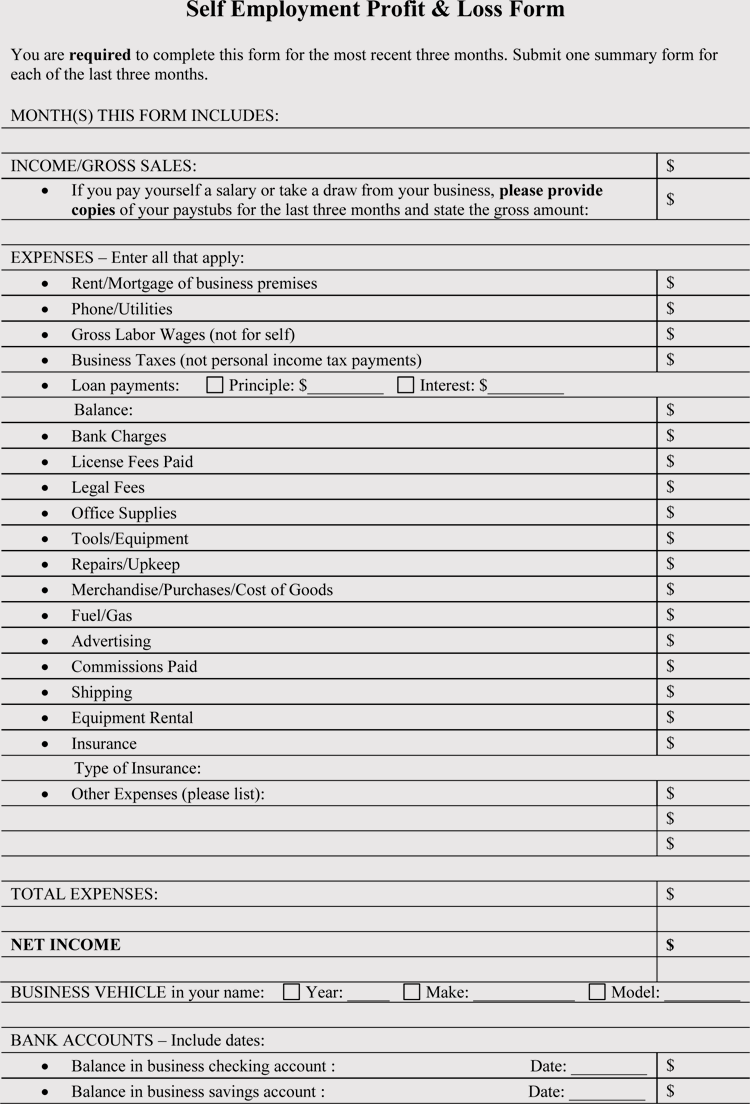

Preparing profit and loss account. Here is a list of advantages and disadvantages to know about accounting. The trading and profit and. The main objective of a profit and loss statement is to identify whether a company made a profit or lost money during a specified time, usually a month, quarter,.

For the following steps to make sense and provide an. A profit and loss account is prepared for the period. A profit and loss statement tells you how much your business is making or losing.

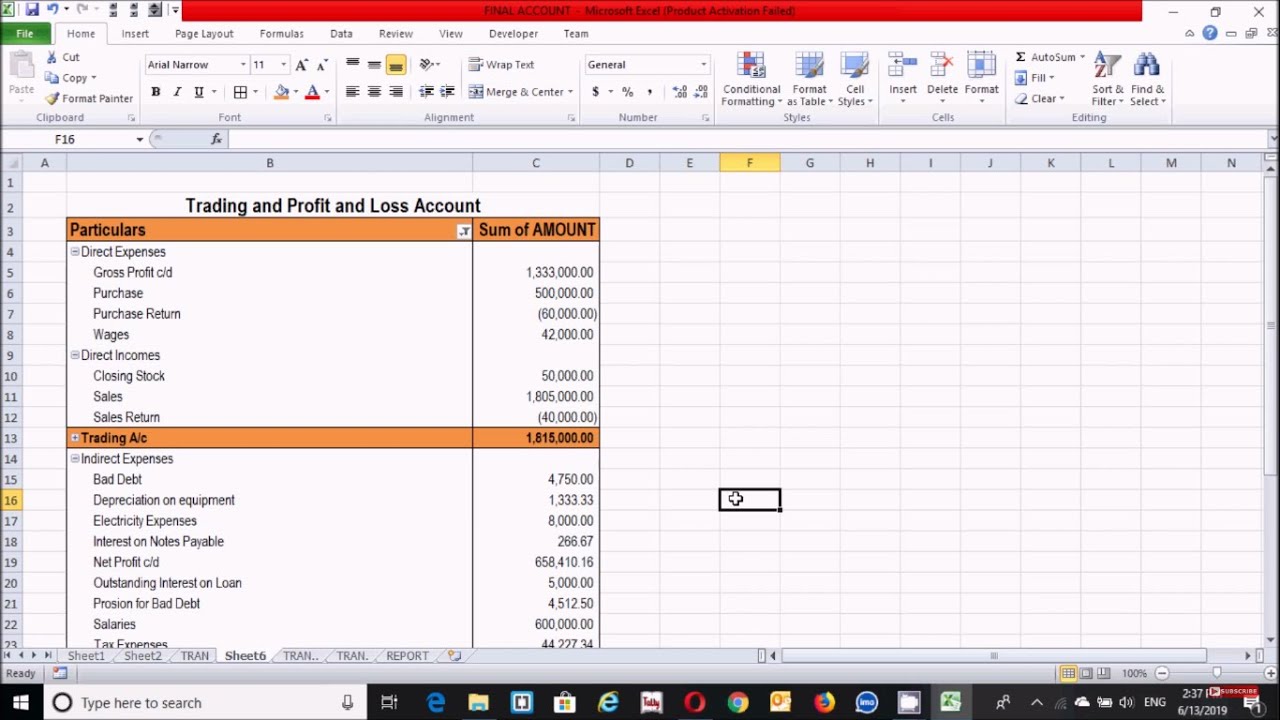

This account is prepared to arrive at the. A business may prepare its profit and loss account annually. Trading and profit and loss.

When preparing a profit and loss account, it is important to remember that closing entries are made at the end of eachaccounting period. In order to arrive at the balance sheet of a business, one needs to prepare the trading account and profit and loss account first. Learn how it helps you.

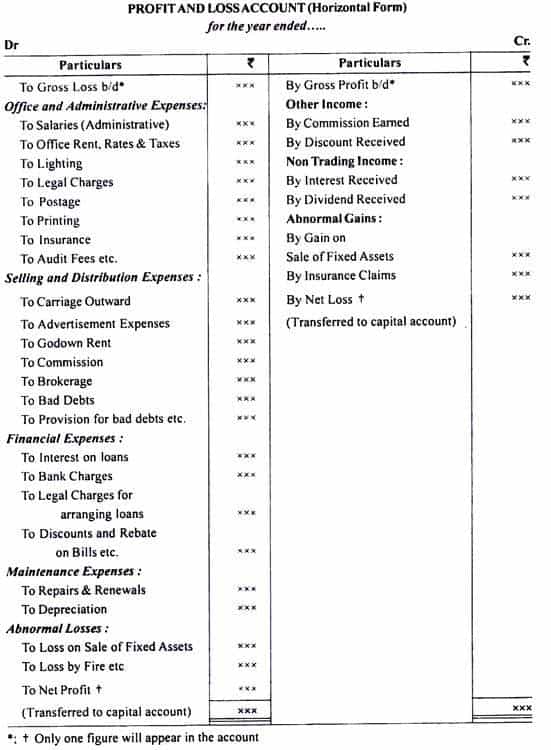

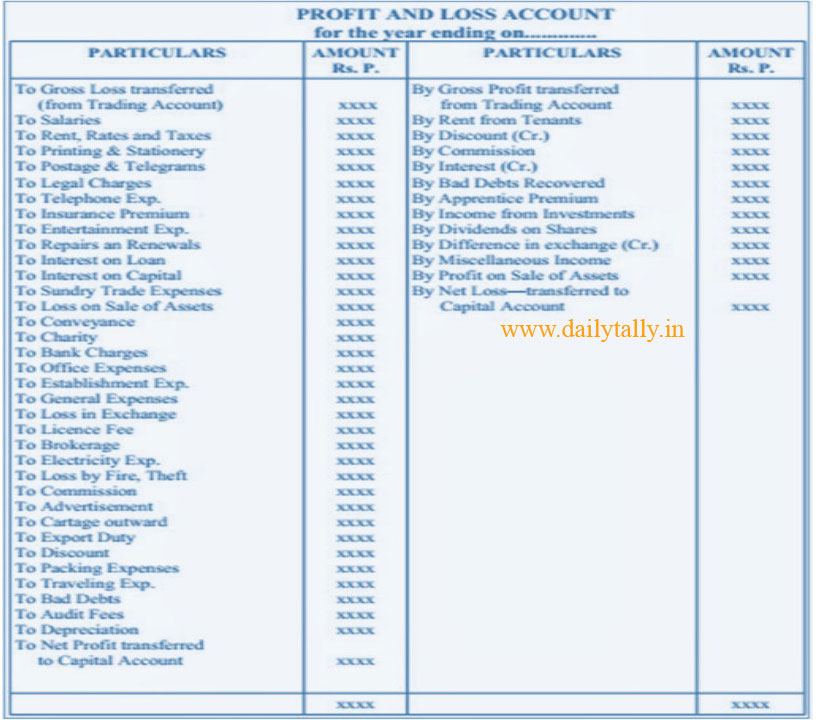

The motive of preparing trading and profit and loss account is to determine the revenue earned or the losses incurred during the accounting period. It meant, the preparation of : The profit and loss account is reviewed from time to time to understand the profit trajectory of the business and avoid any potential losses or excess expenditure.

When preparing your business profit and loss statement, decide which time period you want to assess. For preparing a trading and profit and loss account we need complete information regarding expenses, incomes, assets and liabilities of the concern. These closing entries are made in the general journal (journal.

The profit and loss account is the second part of the final account that is used to determine the net profit of the business concern. Use our template to set up your profit and loss statement, so you can better. Tracks the net profit or net loss:

A profit and loss statement helps you see exactly how money flows into your business, where you spend that revenue, and what adjustments you need to. The aim is to transfer the indirect expenses and indirect revenue accounts to the profit and loss account. The most important benefit of preparing.