Awesome Tips About Profit Before Tax Note Format

Profit before tax = revenue.

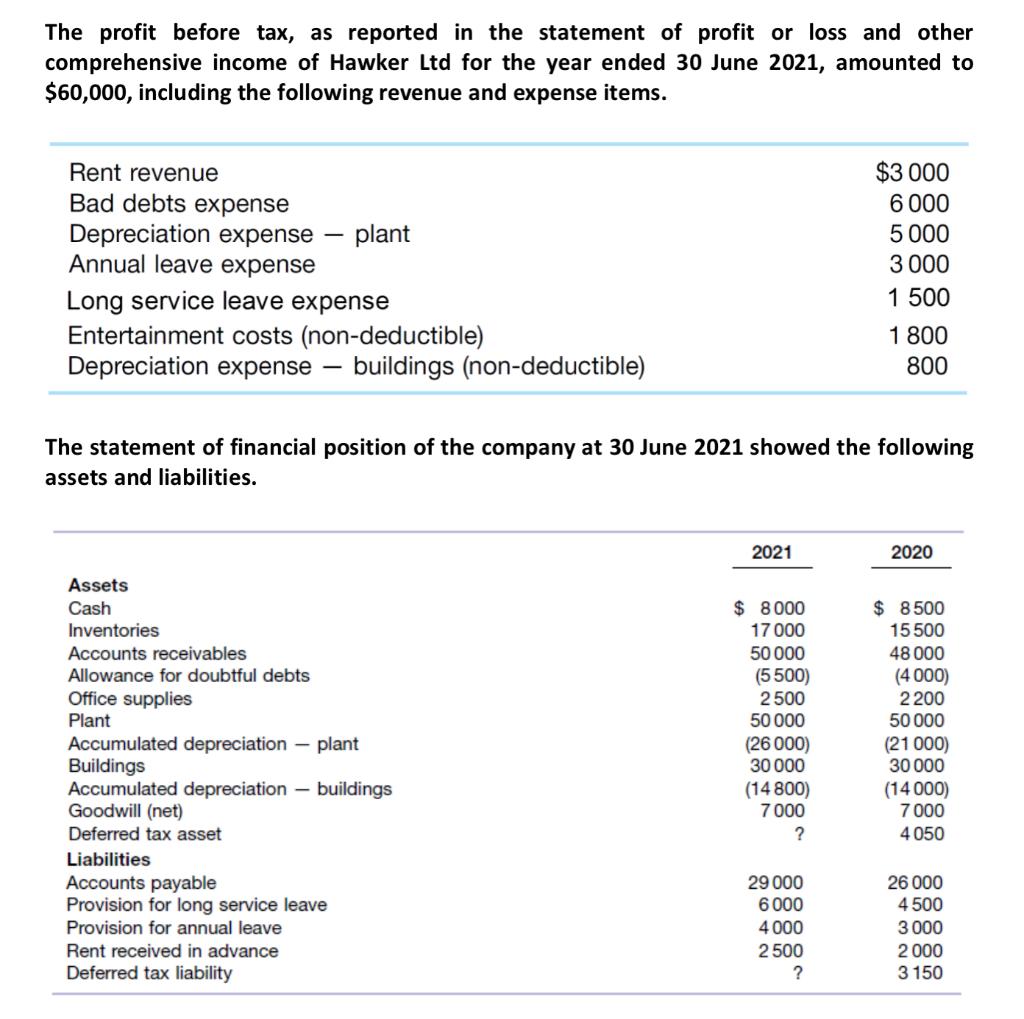

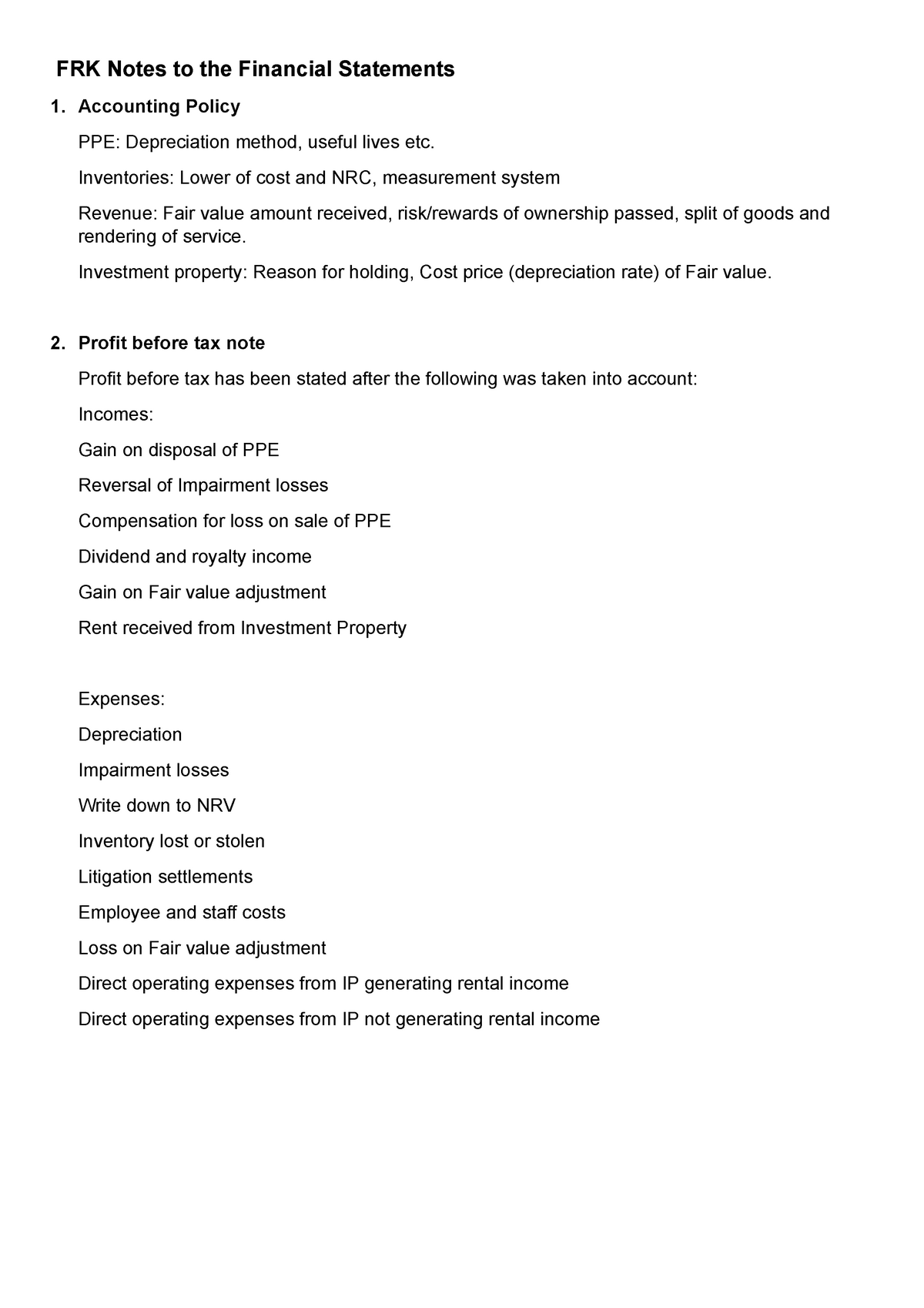

Profit before tax note format. Alternatively, the indirect method starts with profit before tax rather than a cash receipt. A statement of profit or loss and other comprehensive income for the period (presented as a single statement, or by presenting the profit or loss section in a separate statement of. Gain on disposal of ppe reversal of impairment losses compensation for loss on sale of ppe.

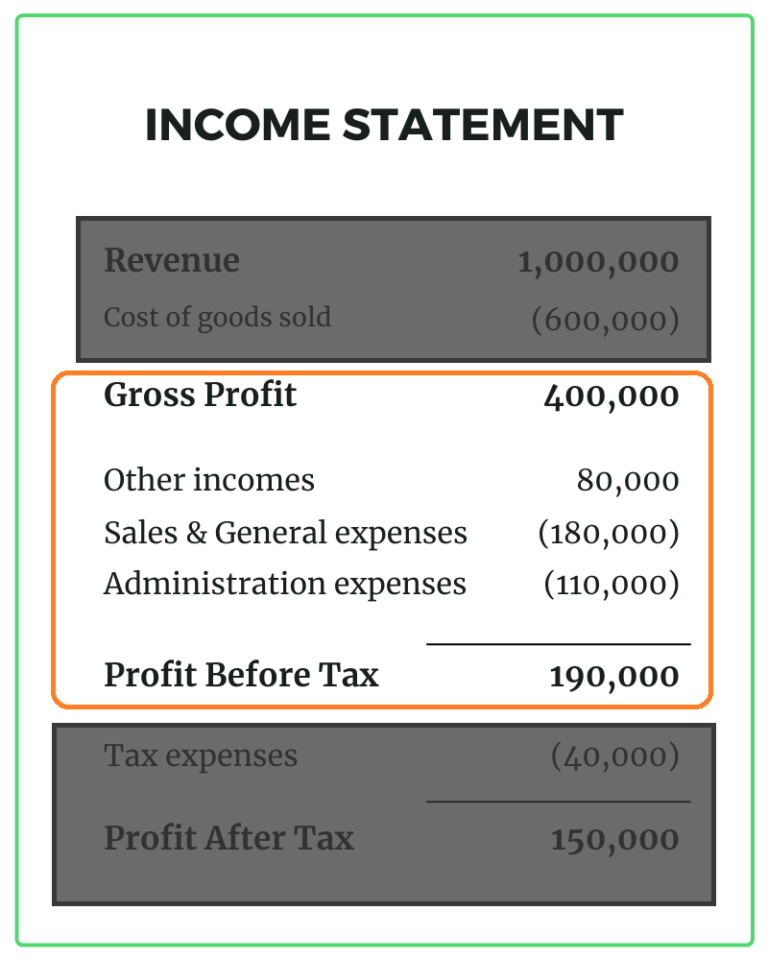

This summarises a firm’s trading results for a specific year and shows how the. Formula to calculate profit before tax. Profits before tax (without iva and ccadj) (a464rc1q027sbea) from q1 1947 to q3.

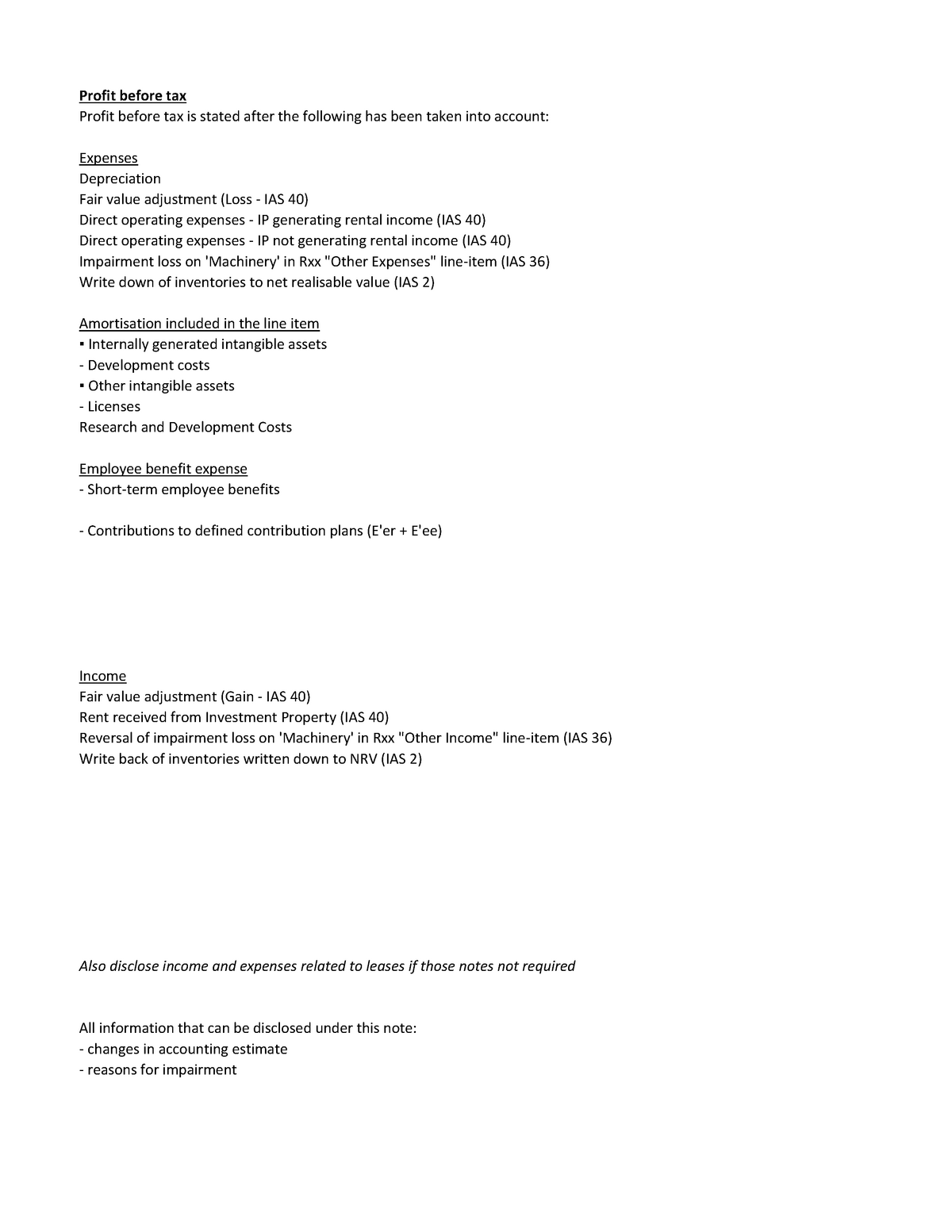

Earnings before tax formula. A vertical presentation of the. Profit before tax has been stated after the following was taken into account:

Exempt portion of fair value adjustment (ias 40). Here's an example and format of a profit and loss account that shows the. The profit before tax is then reconciled to the cash that it has generated.

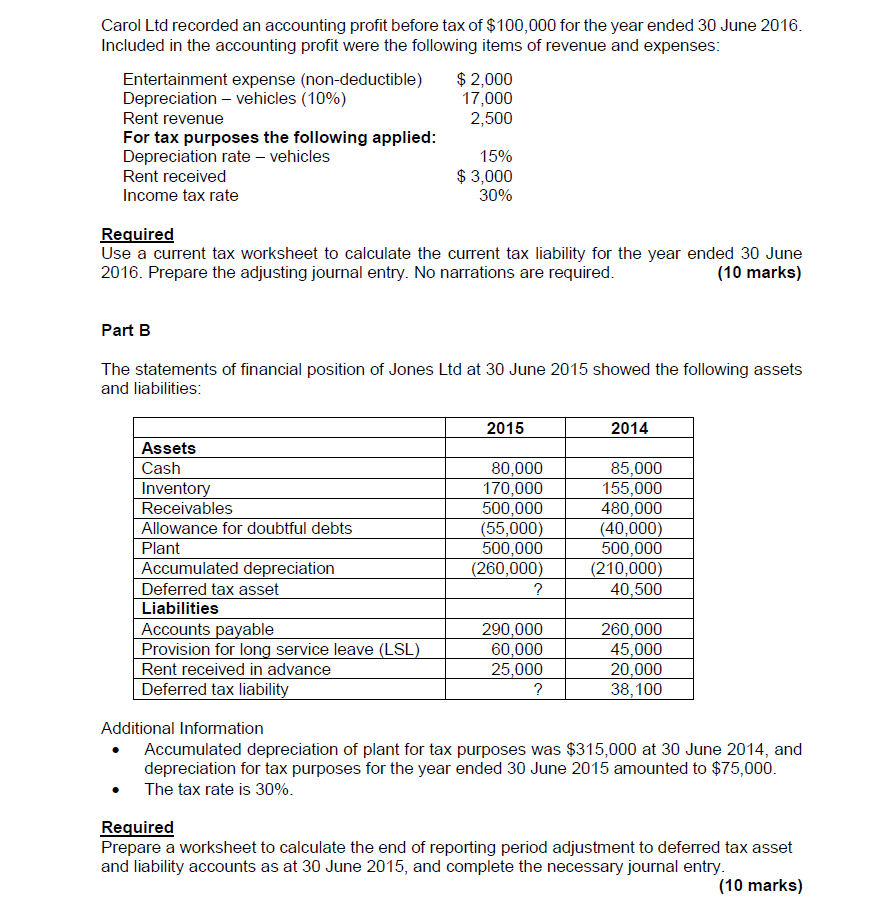

It is a measure of a company’s profitability before it pays its income tax. By excluding the tax factor, pbt minimizes the potential impact of taxes on the. Accouting profit before tax tax at the applicable rate of tax effects of expenses not deductible for income tax purposes:

There are three formulas that can be used to calculate earnings before tax (ebt): Profit before tax (pbt) is a crucial financial metric that assesses a company's profitability before accounting for tax obligations. Income tax expense for the year cu 270,250 in 20x2 (cu 189,559 in 20x1) differs from the amount that would result from applying the tax rate of 40 per cent (both 20x2 and 20x1).

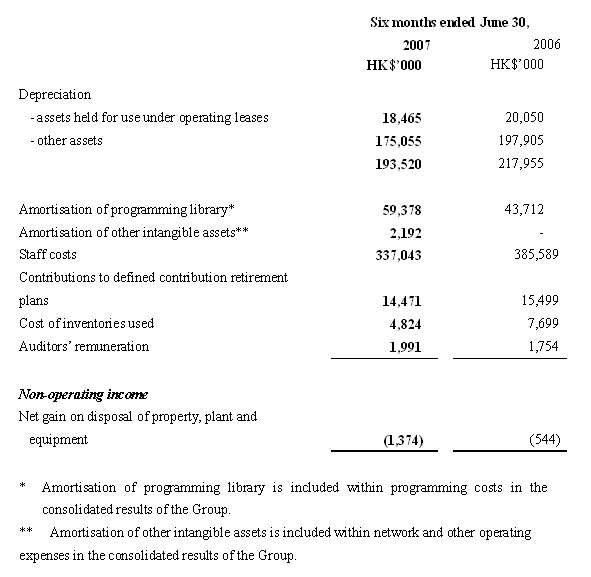

This metric helps stakeholders understand the. (1) cost of sales included in the cost of sales are: The key headings include sales, expenses, and profit before tax.

Example profit and loss and notes. Rm’000 depreciation of plant and equipment 1,400 royalty fees (refer to the details. The profit before tax formula is as follows.

The profit and loss account is shorthand for the full title of the trading and profit and loss account. (ii) the amount of the deferred tax income or expense recognised in profit or loss for each period presented, if this is not apparent from the changes in the amounts. 120 pwc holdings ltd and its subsidiariesreference notes to the financial statements for the financial year ended 31 december 2010 notes to the financial statements 3.1.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/GettyImages-1129810557-5263b289f1684f139c190de020969370.jpg)