Nice Info About Pro Forma Expenses

A realistic forecast anticipates as many expenses as possible.

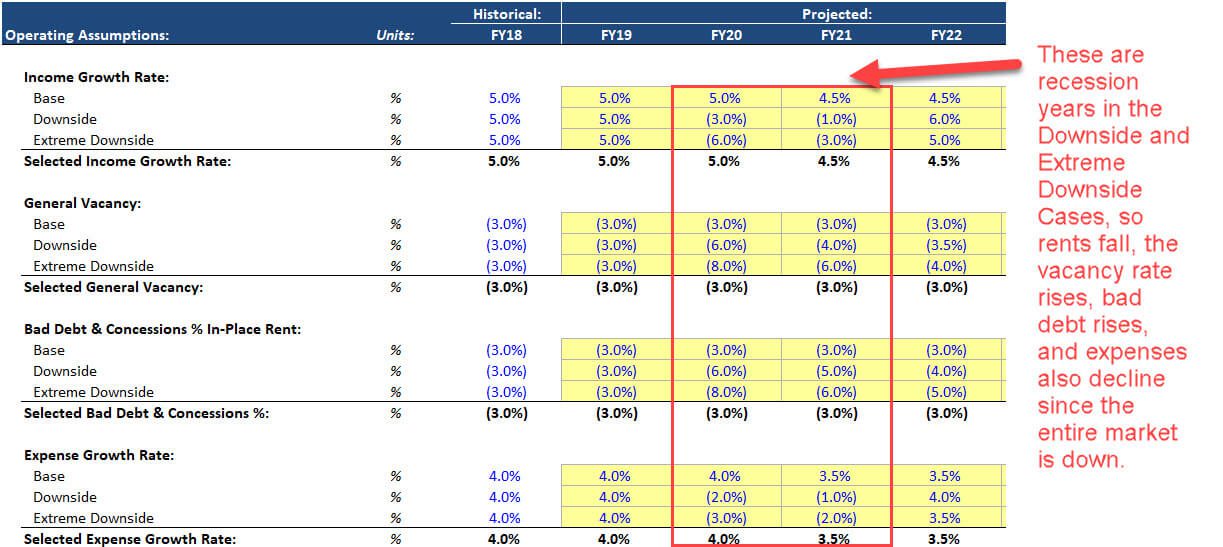

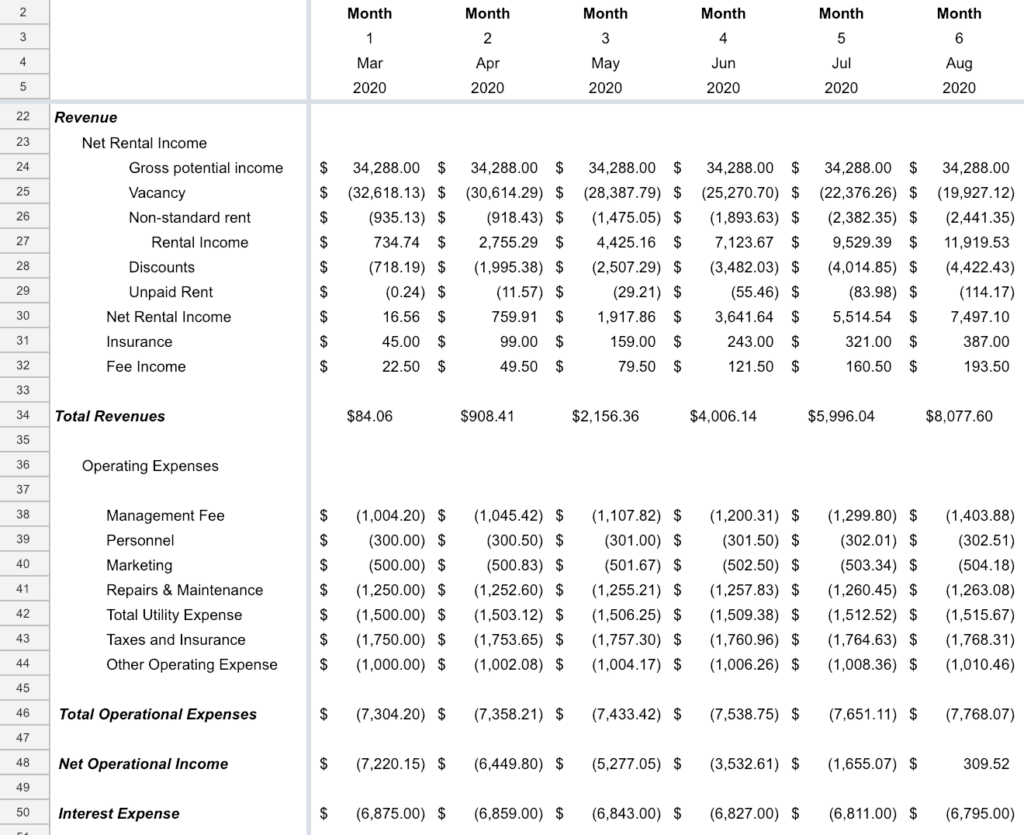

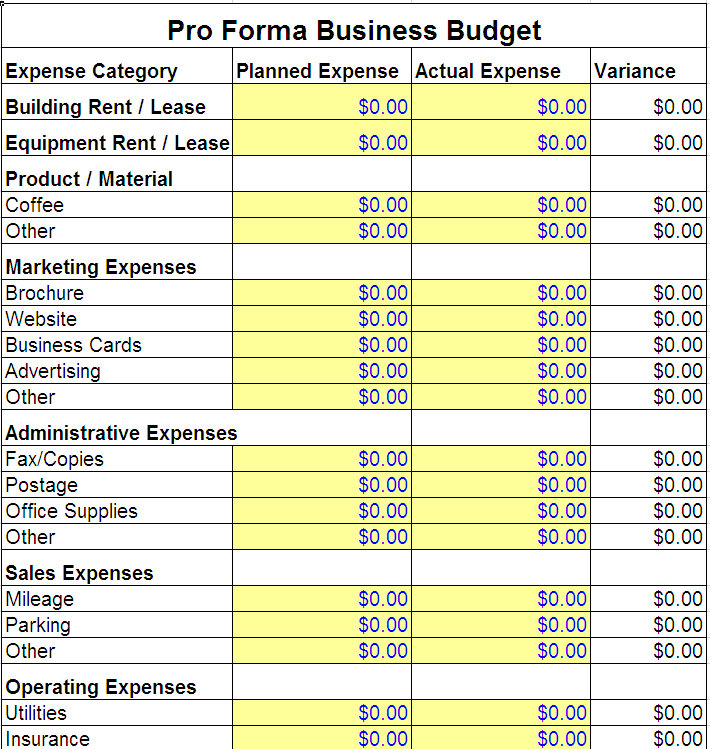

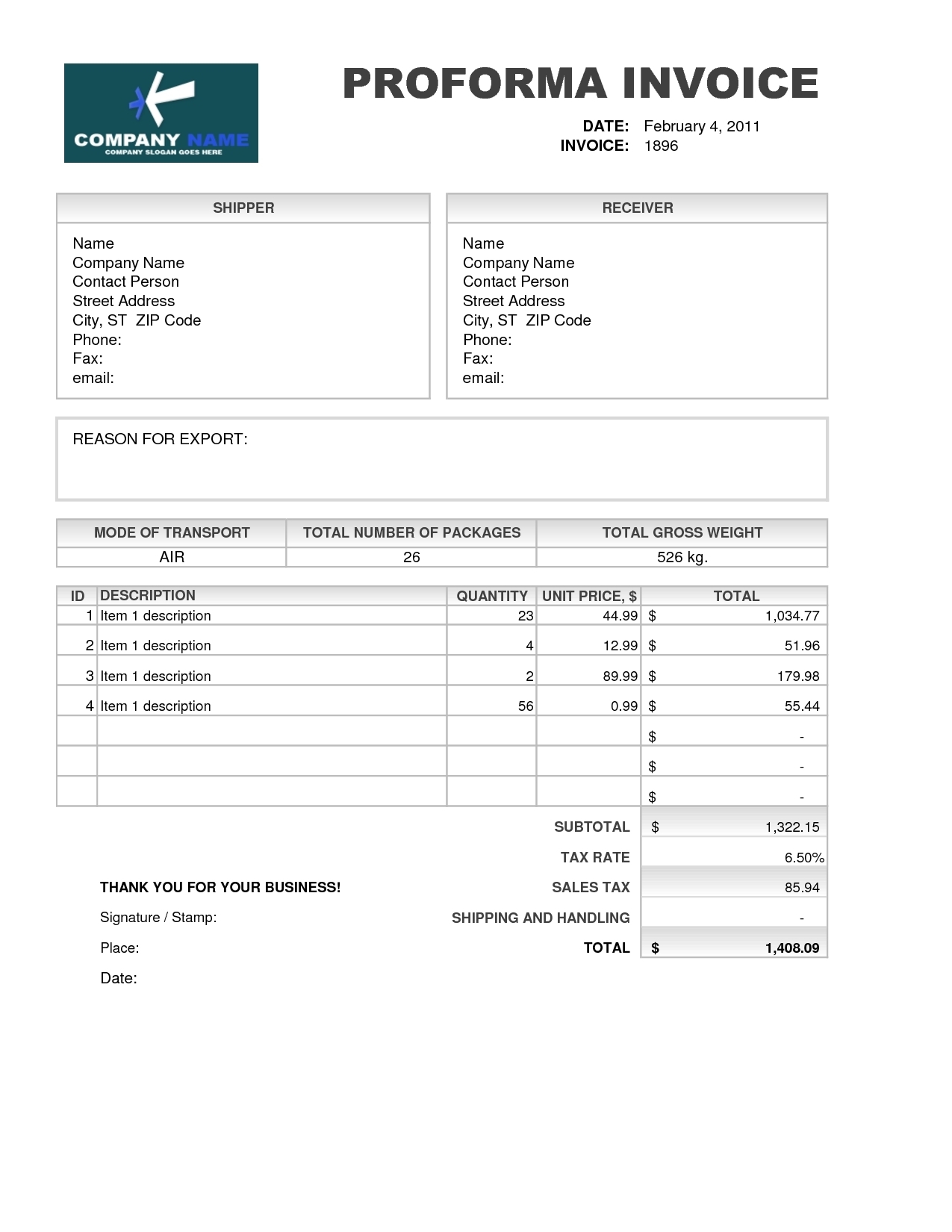

Pro forma expenses. Start by forecasting any expenses that scale with revenue. You can do this by referencing your order backlog for several. In the event that the projected numbers show that profits are likely to drop, the pro forma statement allows a company to see the need for.

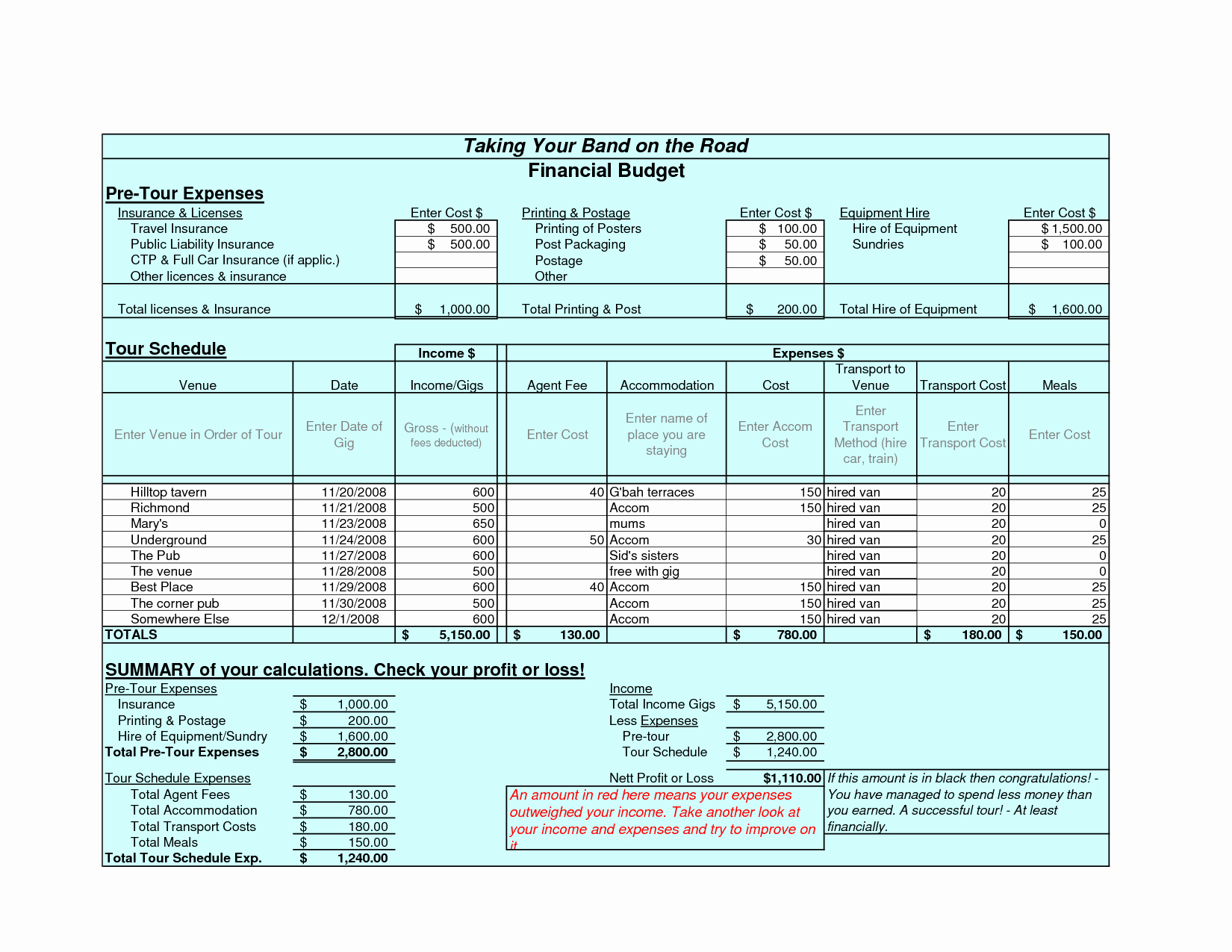

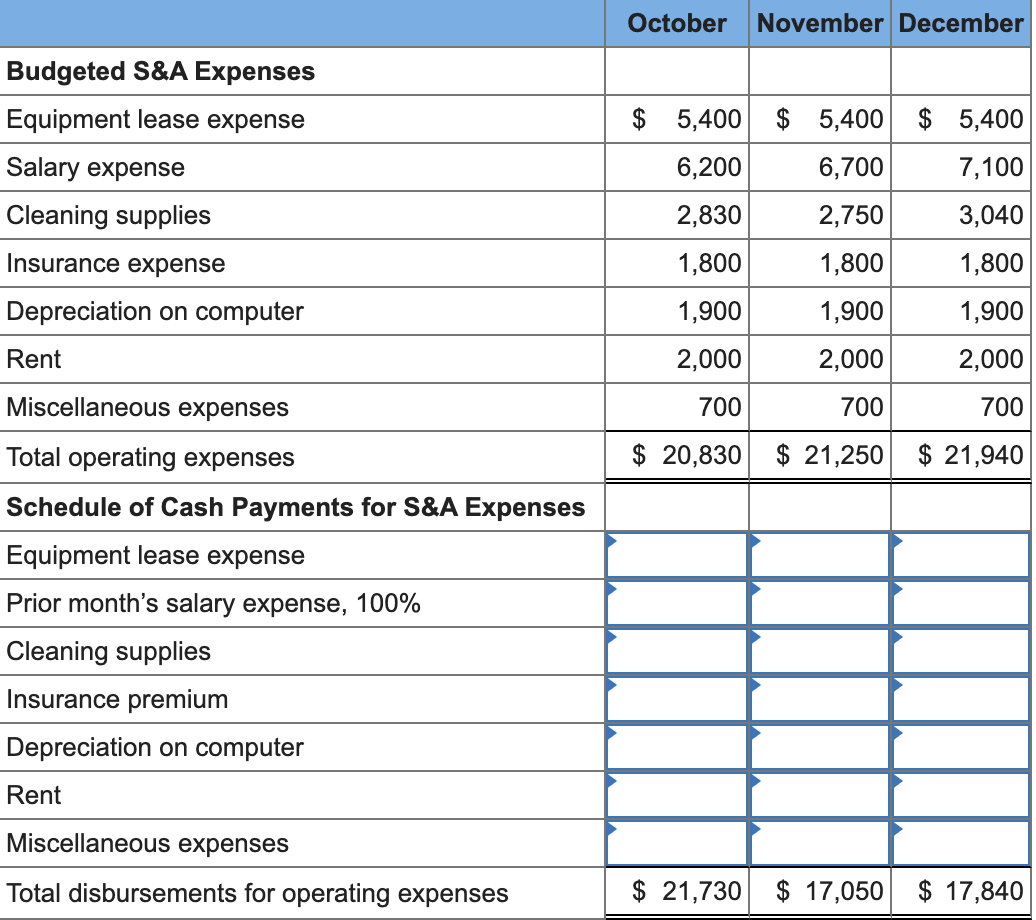

Over the past couple of years, supply chains have been totally redrawn, and businesses have been forced to evolve how and where they do business. Pro forma financial statements are a common type of forecast that can be useful in these situations. Your pro forma salaries next year will be $25,750 and your expenses will be $5,150 for a total of $30,900 in pro forma expenses.

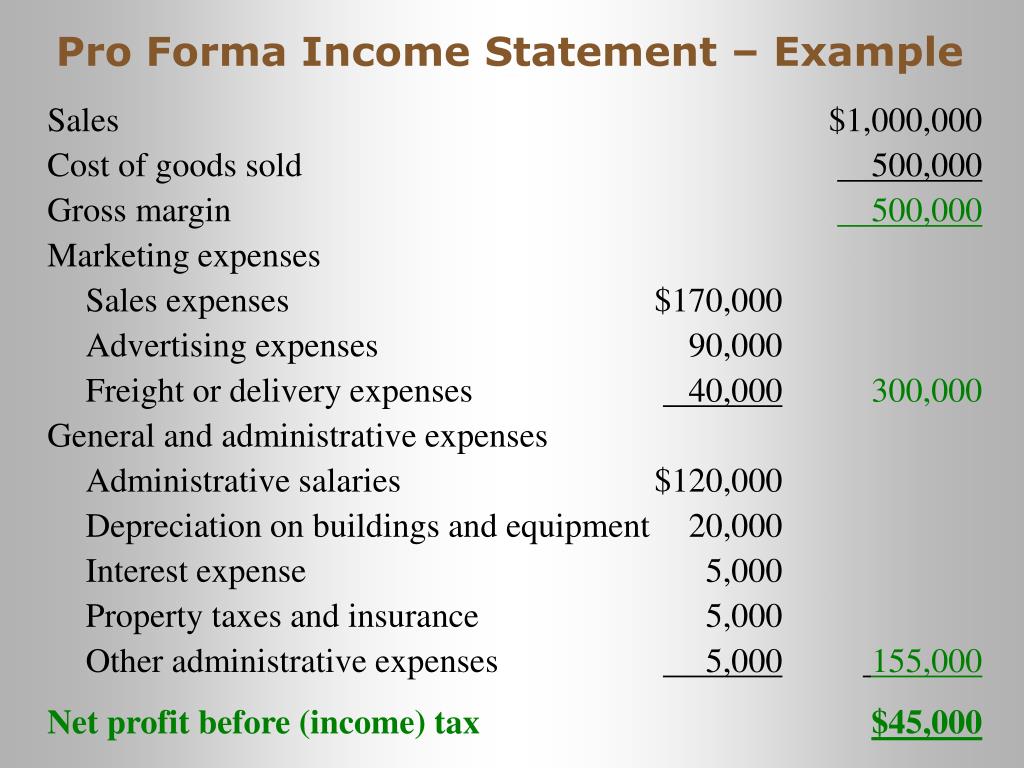

In our sample case, your pro forma total expenses will be $315,000. 1 overview we are pleased to present this publication, pro forma financial information: Pro forma total expenses:

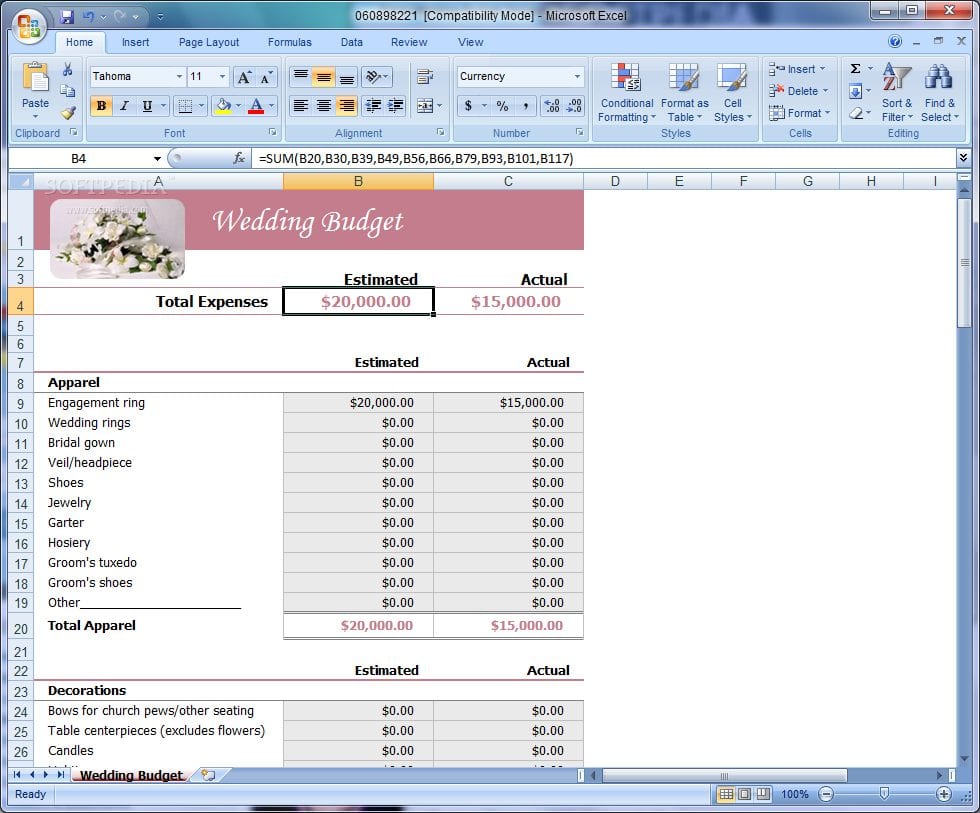

Your budget may be based on the financial information of your pro forma statements—after all, it. Pro forma is a latin term that means as a matter of form or for the sake of form. in business and accounting, it describes financial statements that are based on assumptions or estimates rather than actual historical data. Multiply your estimated tax rate by your net income

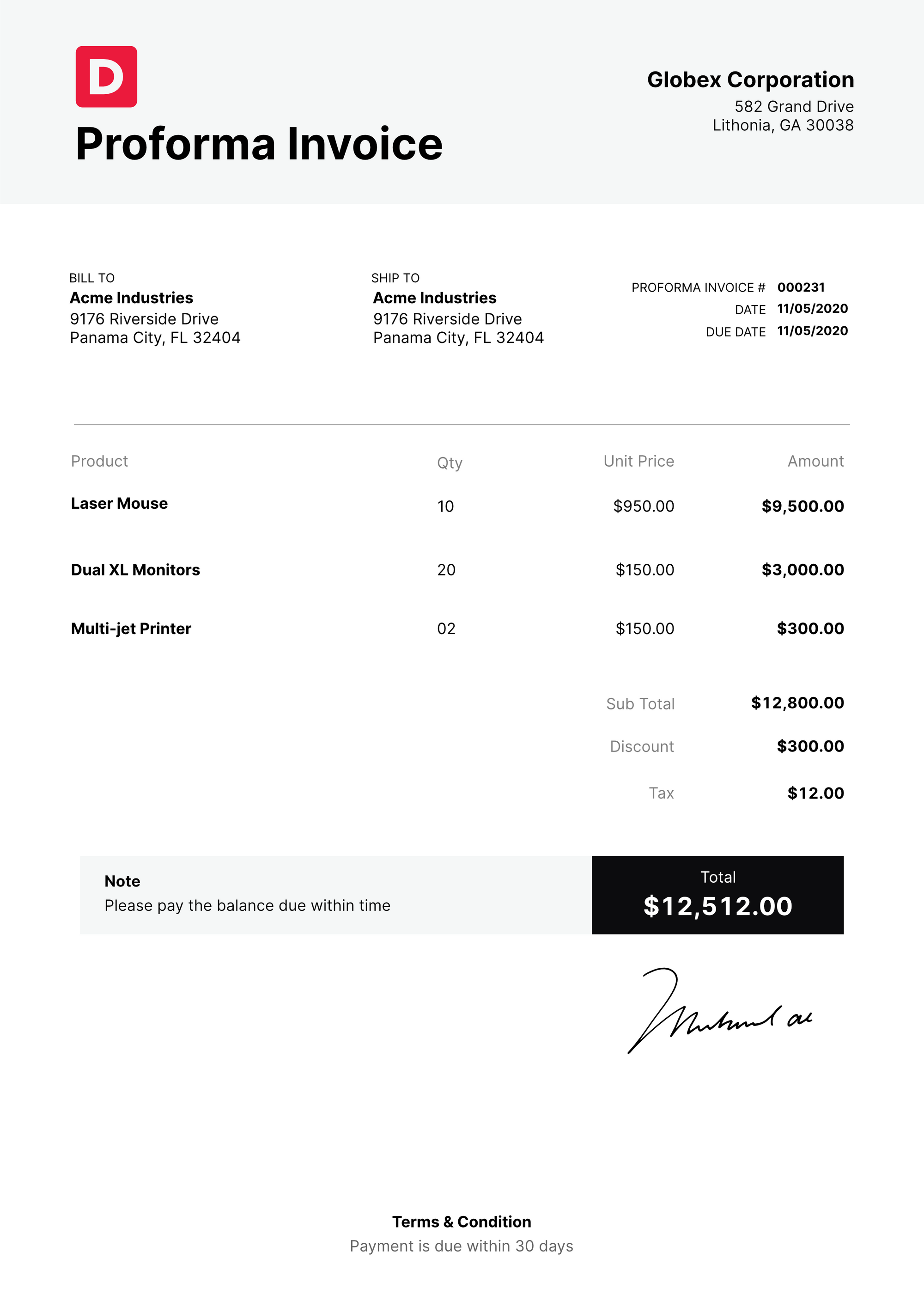

Pro forma statements are also valuable in external reporting. The term pro forma is latin for as a matter of form or for the sake of form. Pro forma statements are used to analyze the financial impact of a major business decision.

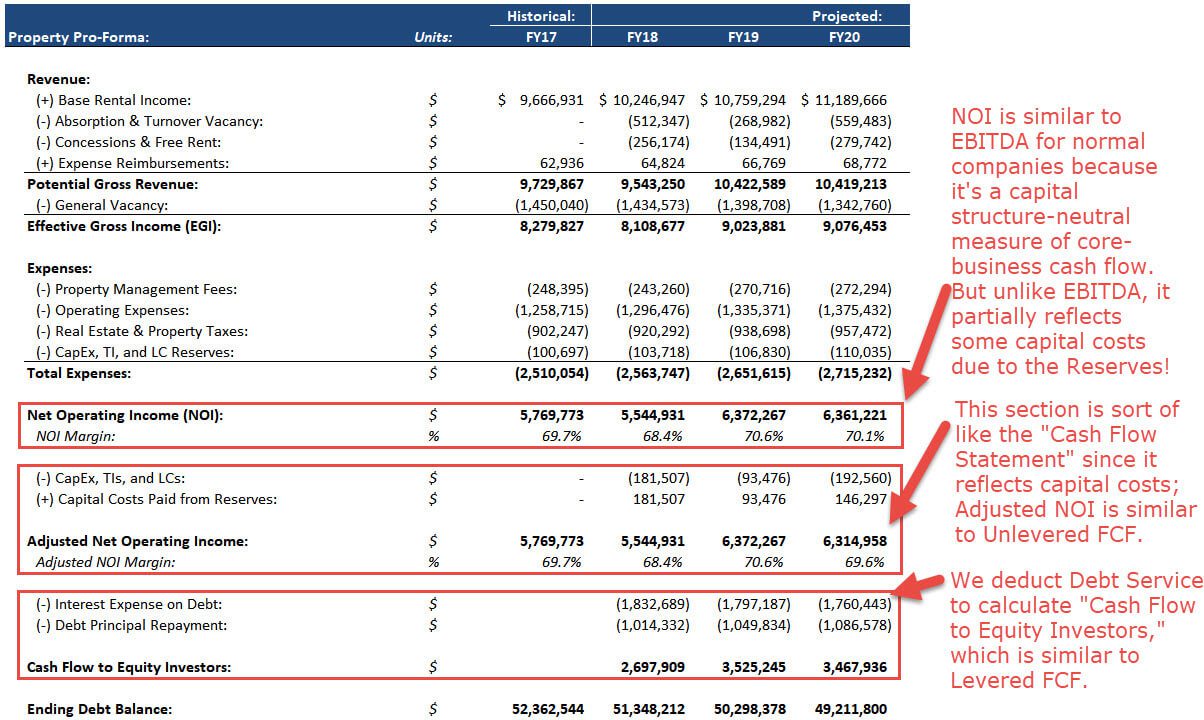

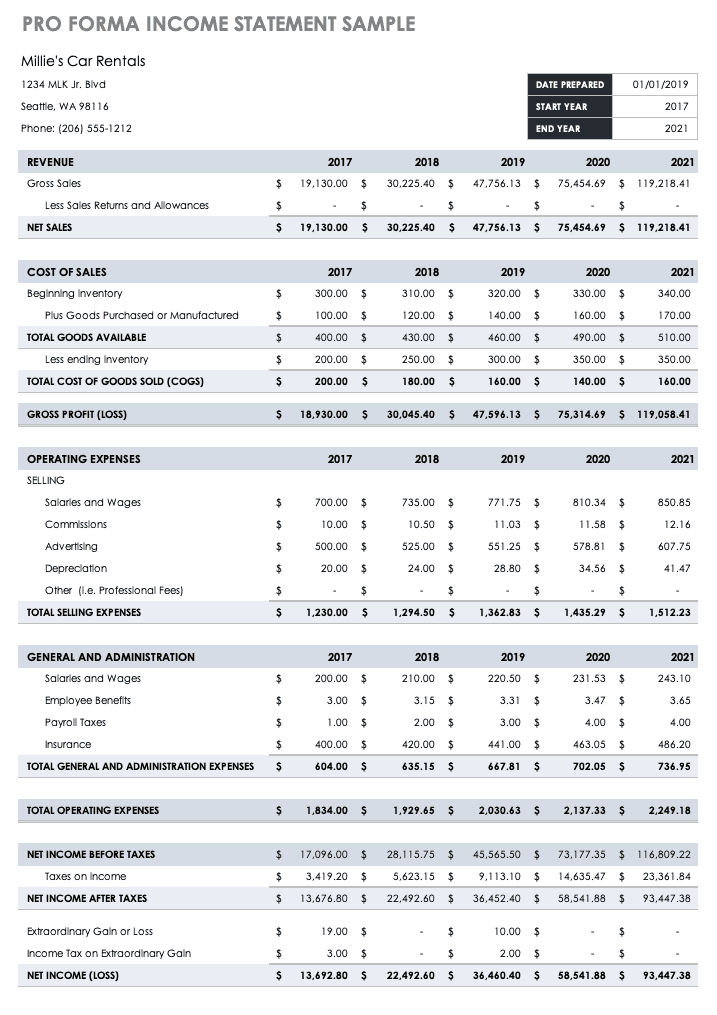

Net your gross profit and total operating expenses; Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. A pro forma income statement in business plan is the statement prepared by the business entity to prepare the projections of income and expenses, which they expect to have in the future by following certain assumptions such as competition level in the market, size of the market, and growth rate, etc.

Reflects the company’s projected financial position, including assets, liabilities, and equity. Pro forma balance sheet : Potential investors need a pro forma income statement to assess a firm’s ability to generate increased sales and profits.

Some startup costs and investments should also be entered as assets instead of expenses. Pro forma statements are an integral part of business planning and control. Calculate pro forma net income before taxes.

Pro forma statements are useful with regard to tracking future financial direction and occurrences, often including some historical numbers to help account for what the projected outcomes should look like. Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an earlier time. You then figure your pro forma total expenses by adding pro forma salaries and pro forma other expenses together.

Purposes of pro forma statements. Pro forma financials may not be. This allows you to predict how your operating expenses will change in the year ahead.