Out Of This World Tips About Pro Forma Statements Are

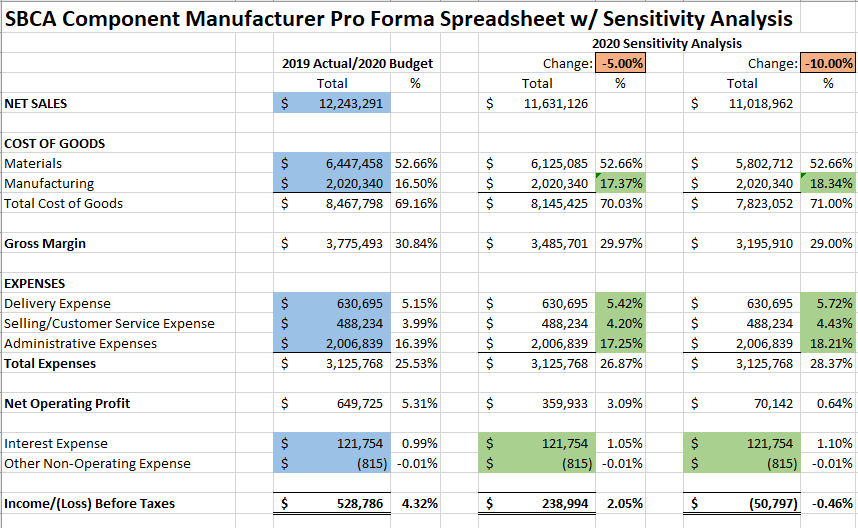

They are used for business planning, investment decision making, and to show the potential impact of a proposed transaction on the company’s financial health.

Pro forma statements are. Pro forma financial statements are valuable tools managers can use to plan for the future, anticipate and control risks and acquire funding for their business. And they’re not just for big corporations. Essentially, pro forma financial statements are financial reports based on hypothetical scenarios that utilize assumptions or financial projections.

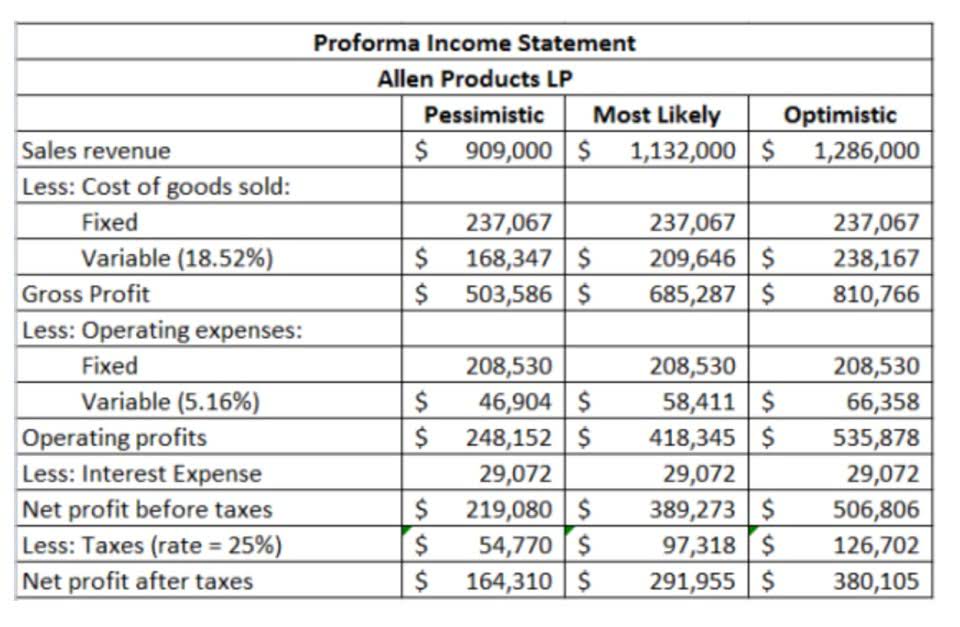

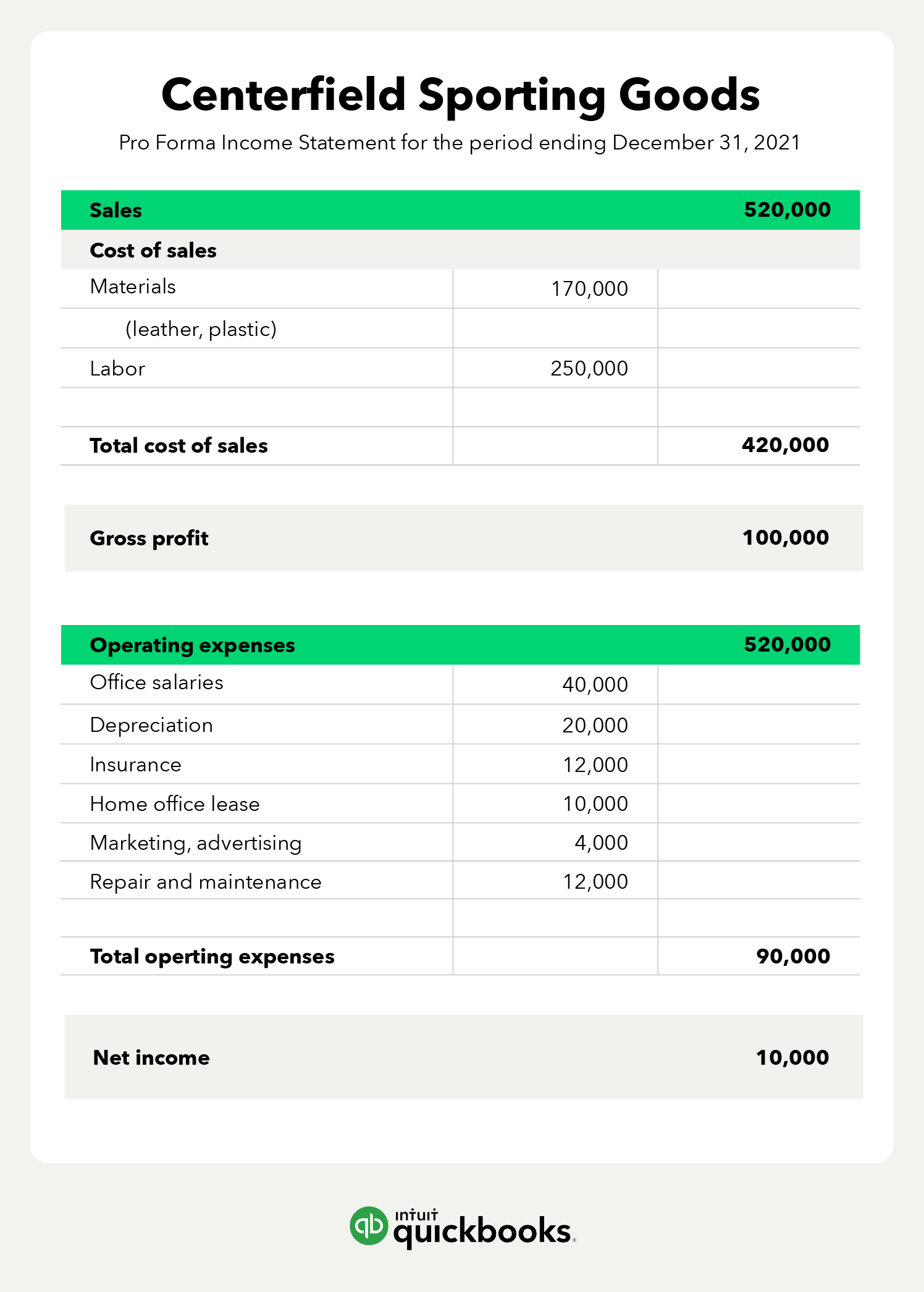

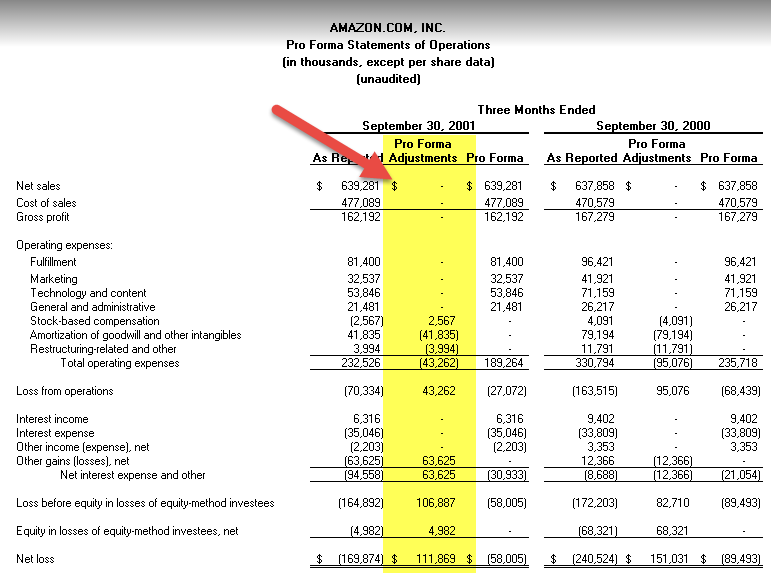

If you’re considering a major decision, such as a business merger or a new product launch, creating pro forma statements is important. Pro forma financial statements are a common type of forecast that can be useful in these situations. What are pro forma financial statements?

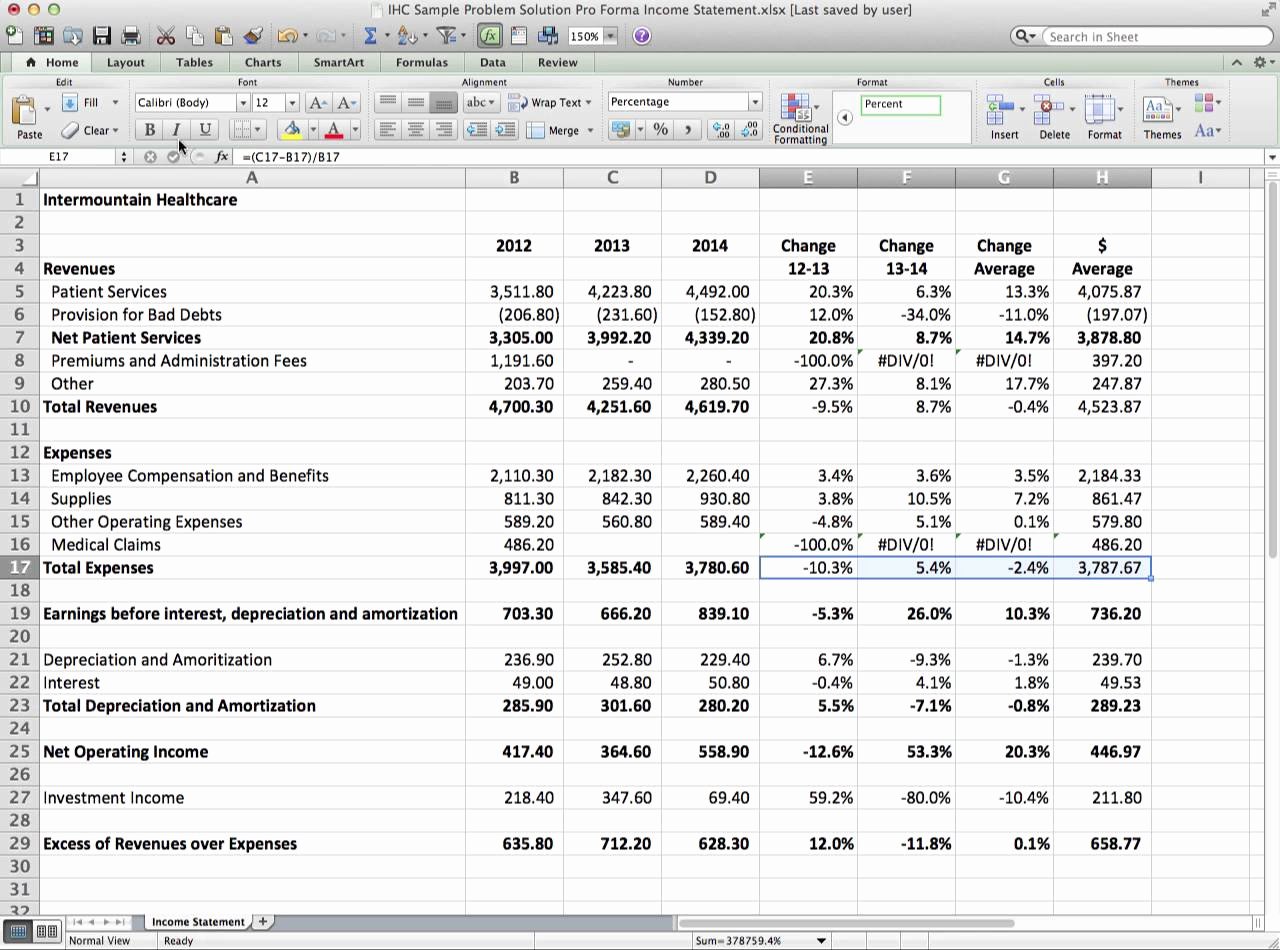

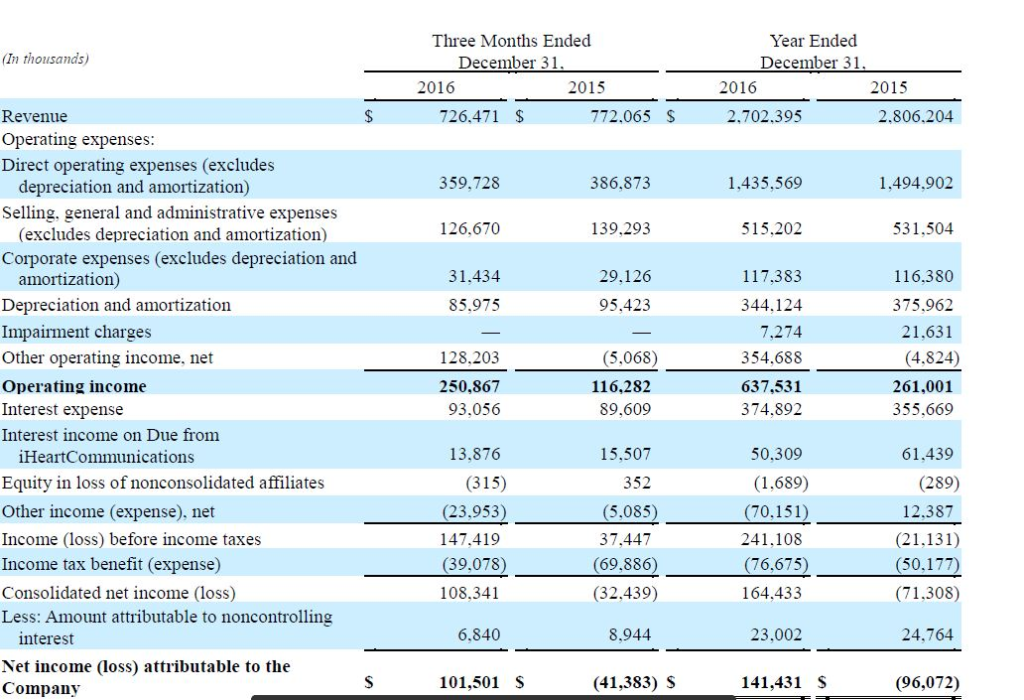

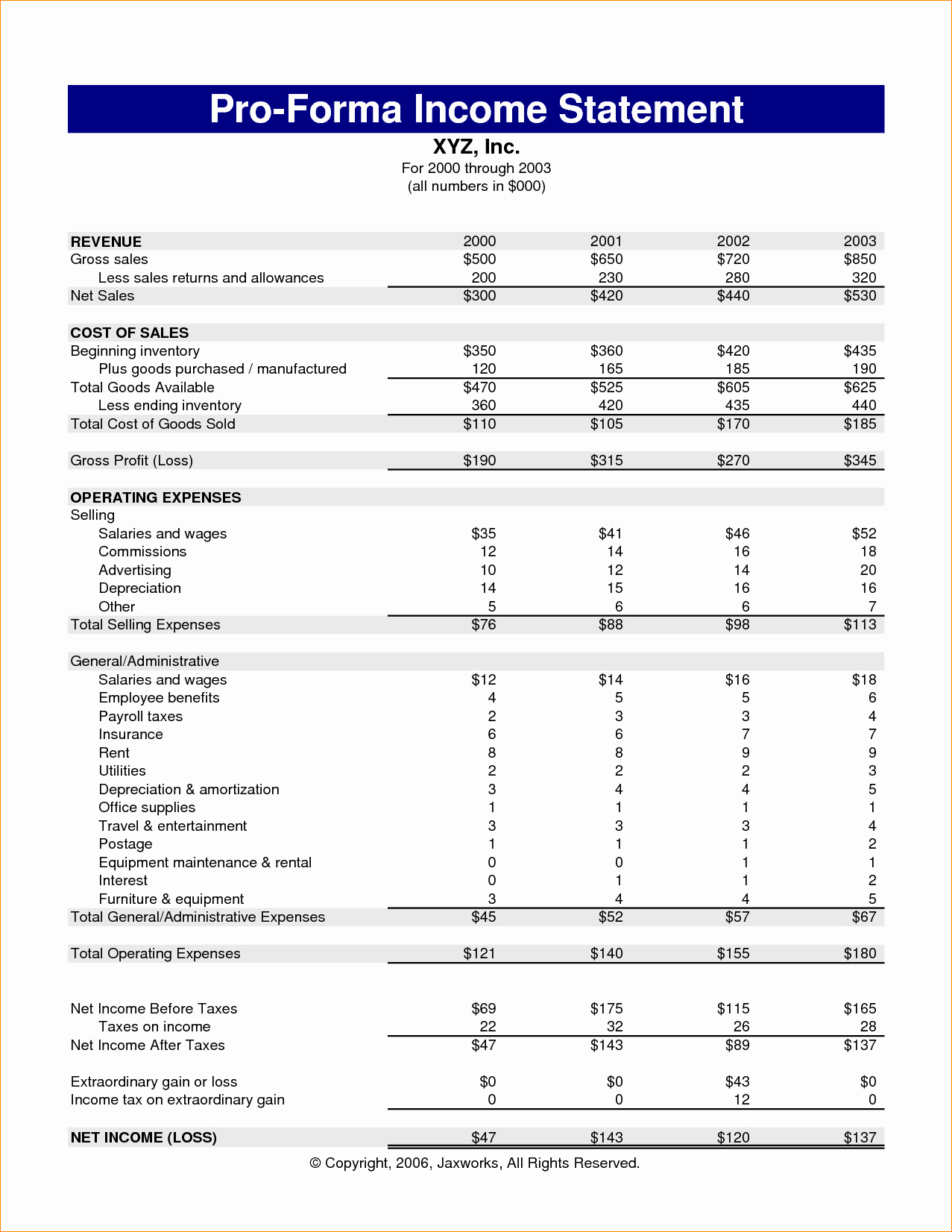

Pro forma income statements. Gaap eps of $6.71 and pro forma eps (1) of $5.59, representing 9% growth in pro forma eps over the prior year; Pro forma financial statements forecast estimated future financial performance rather than relying solely on historical data.

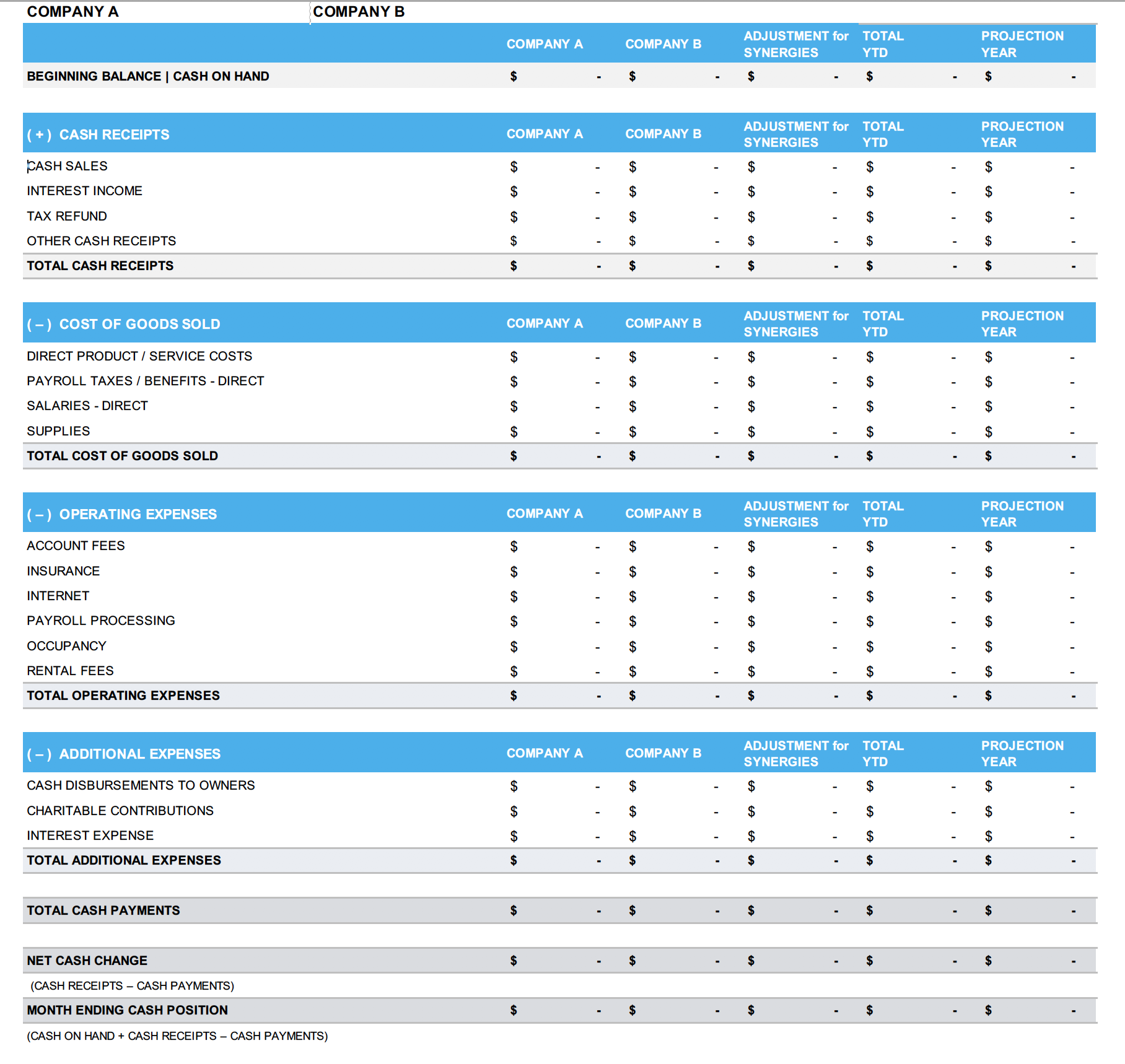

The pro forma models the anticipated results of the transaction, with particular emphasis on the projected cash flows, net revenues and taxes. Pro forma financials may not be. Pro forma financial statements are financial reports based on hypothetical scenarios that utilise assumptions or financial projections.

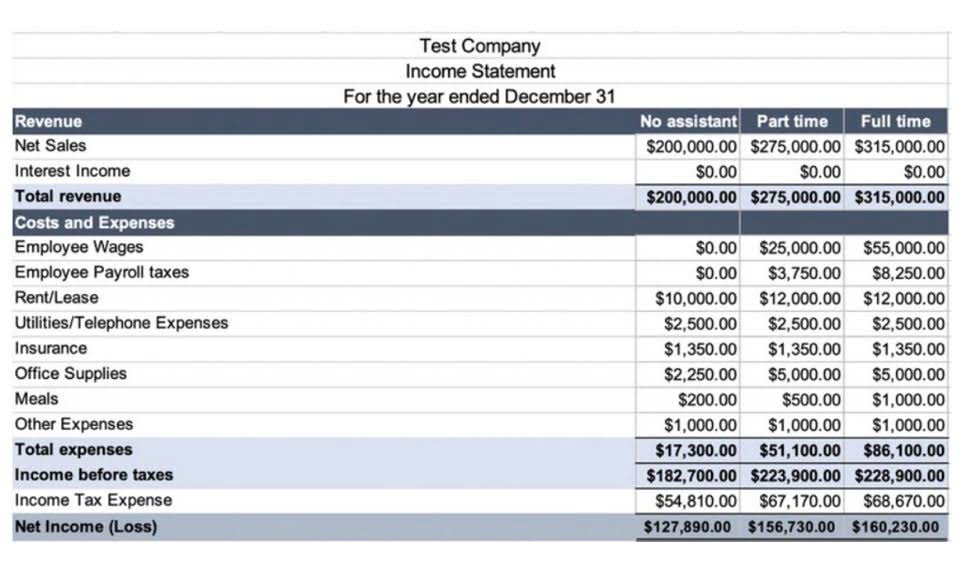

Such statements are based on management’s current expectations. Pro forma financial statements are hypothetical financial reports that project the future financial performance of a company, based on expected income, expenses, assets, and liabilities. These are conditions that have occurred in the past and/or conditions that may happen in the future.

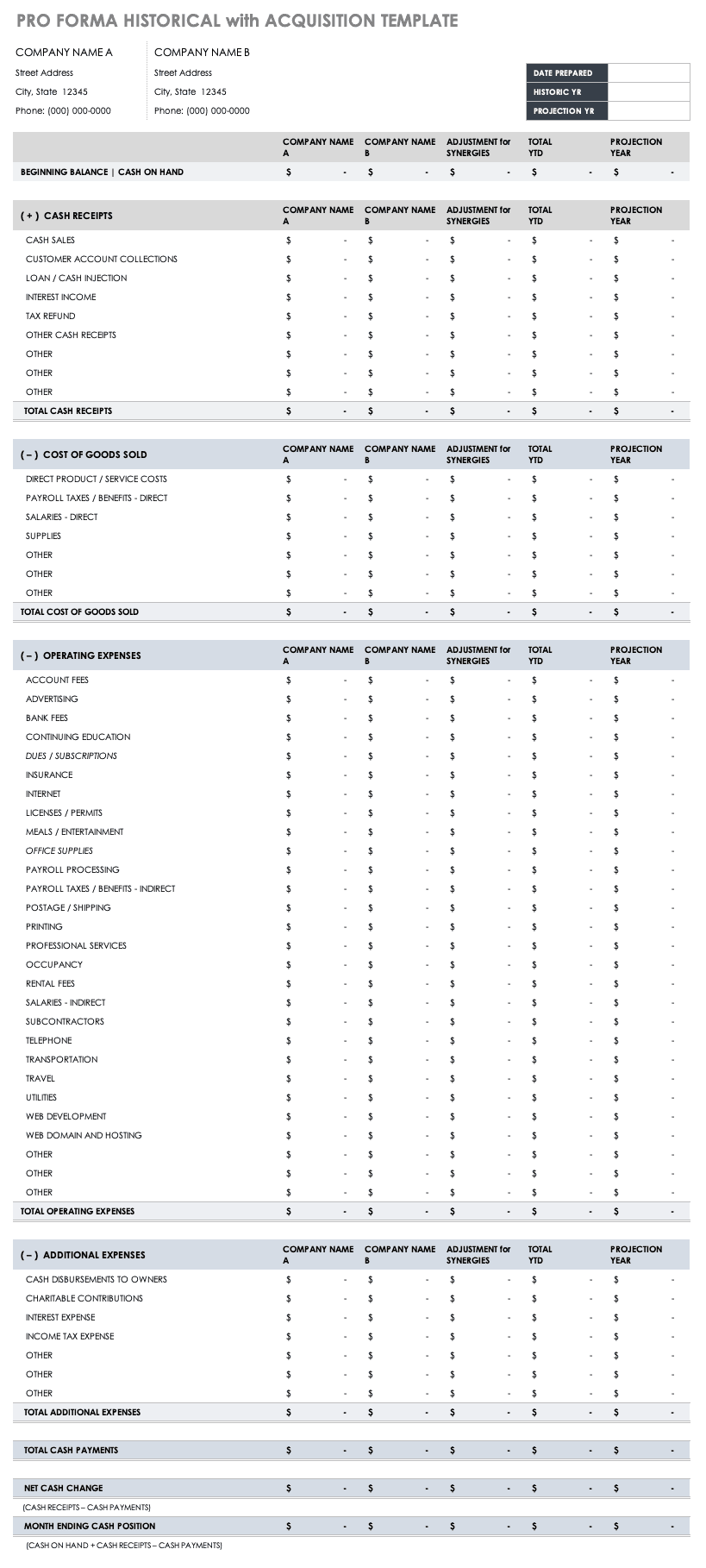

When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios. Occasionally, pro forma financial statements refer to a forecasting method under which financial numbers from the previous two or three years are used. They can look forward or backward, revealing insights that standard financial statements.

Por seis anos, leandro teve canal sobre a terra plana e acumulou cerca de 150 mil seguidores. Pro forma statements are useful with regard to tracking future financial direction and occurrences, often including some historical numbers to help account for what the projected outcomes should look like. 11 inches with a 2388x1668.

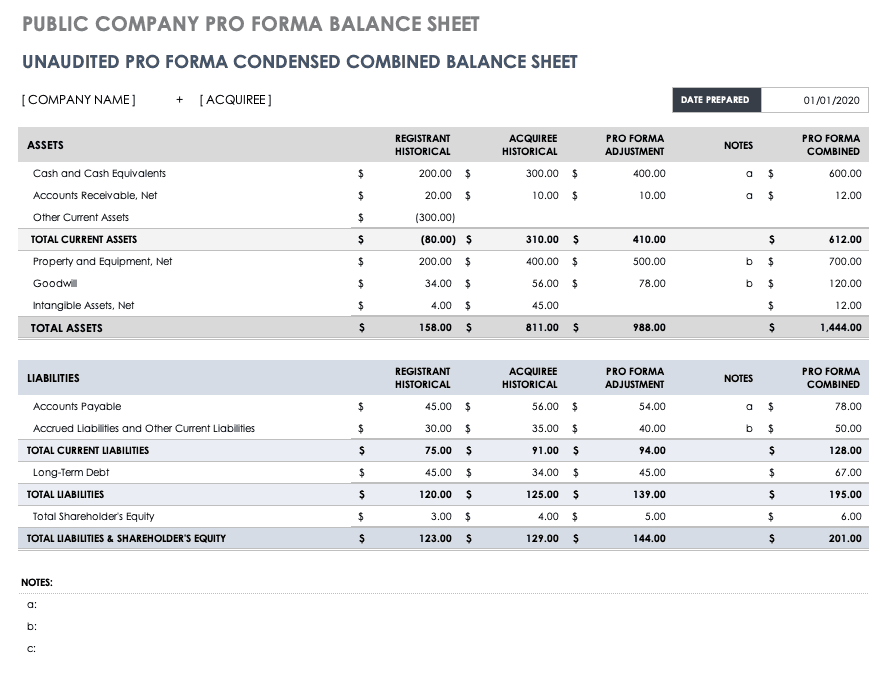

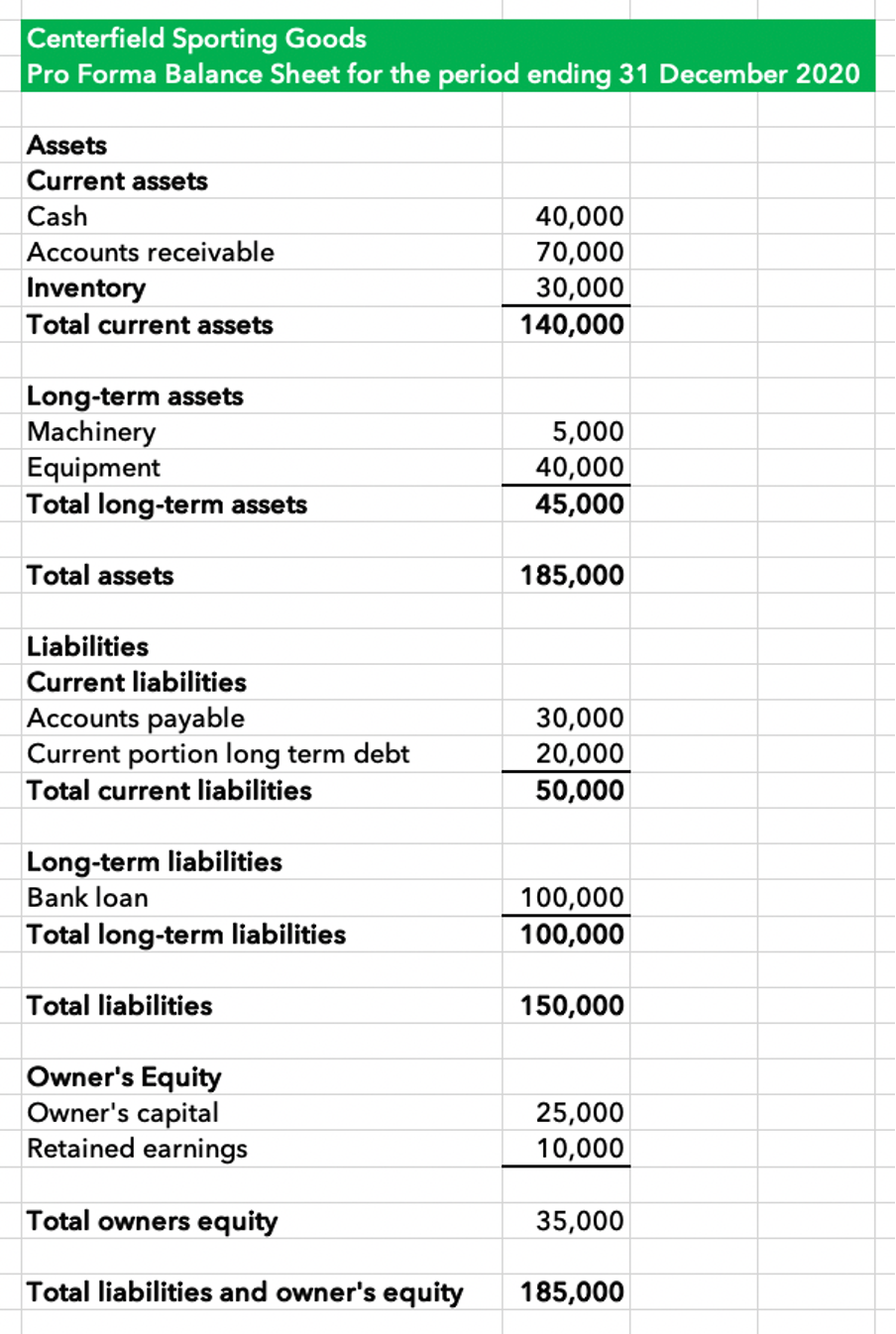

Learn about the components of pro forma statements like balance sheets, income statments and cash flow for a better understanding of financial projections. These statements are used to present a view of corporate results to outsiders, perhaps. Proforma income statement proforma balance sheet proforma cash flow statement estimated financial statements are prepared by the company based on assumptions regarding historical events or occurrences that may take place in the future.

In the event that the projected numbers show that profits are likely to drop, the pro forma statement allows a. Lg display is developing two types of hybrid oled panels: There are three important pro forma financial statements:

These statements also present assumptions based on financial calculations. Pro forma financial statements are a great tool for financial management, to assess your financial position in the current year, and for any future time period. Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.