Out Of This World Tips About Rsi Governmental Accounting

In governmental financial statements, the management, discussion, and analysis (md&a) is considered rsi.

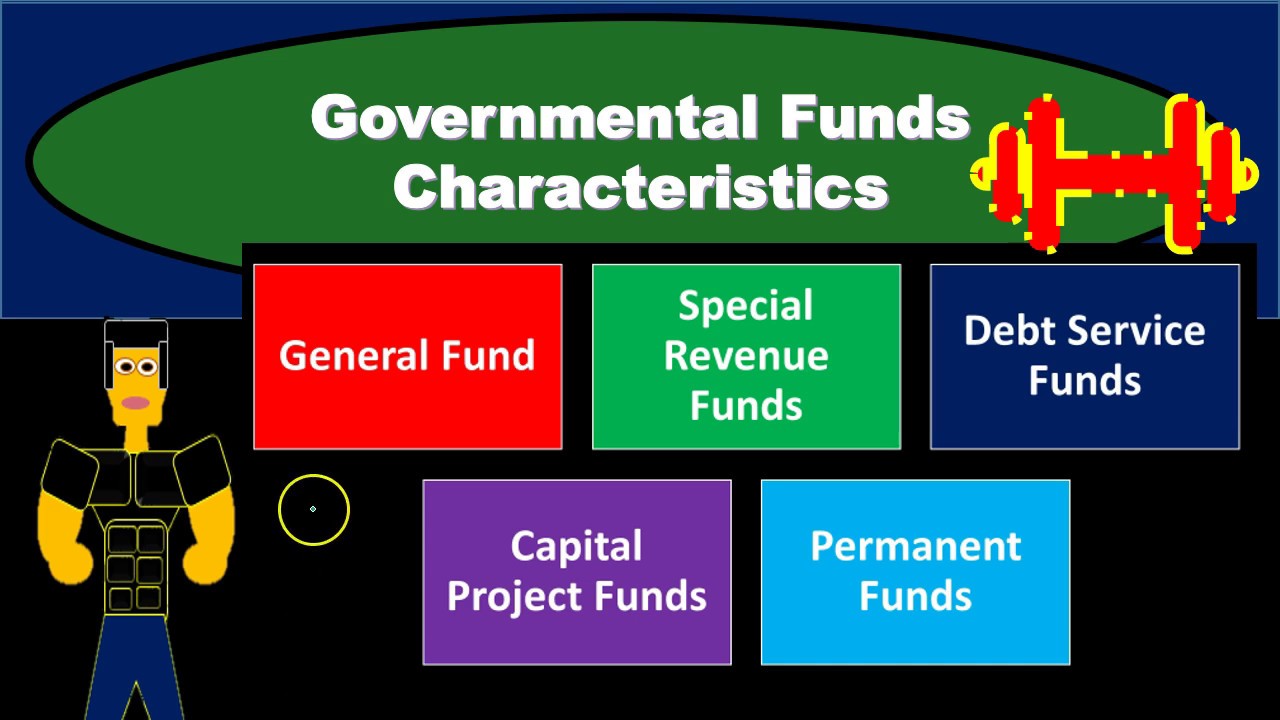

Rsi governmental accounting. Discussion of significant budgetary variances will be moved to. This section identifies select standards and guidance that are effective for (1) audits of financial statements for periods ending after september 30, 2021; Governments cannot include budgetary comparisons in the basic financial statements or required supplementary information (rsi) for any other fund, including debt service funds.

However, the presentation in the accompanying budgetary. 4.7 required supplementary information (rsi) 4.7.10 governments must present required supplementary information (rsi) to meet the minimum financial reporting requirements. Audits of financial statements for periods ending after september 30, 2022;

100, accounting changes and error corrections—an amendment of gasb statement no. Earlier adoption is not permitted. For pension (and other employee benefit) trust funds, there are additional required supplementary information (rsi) requirements.

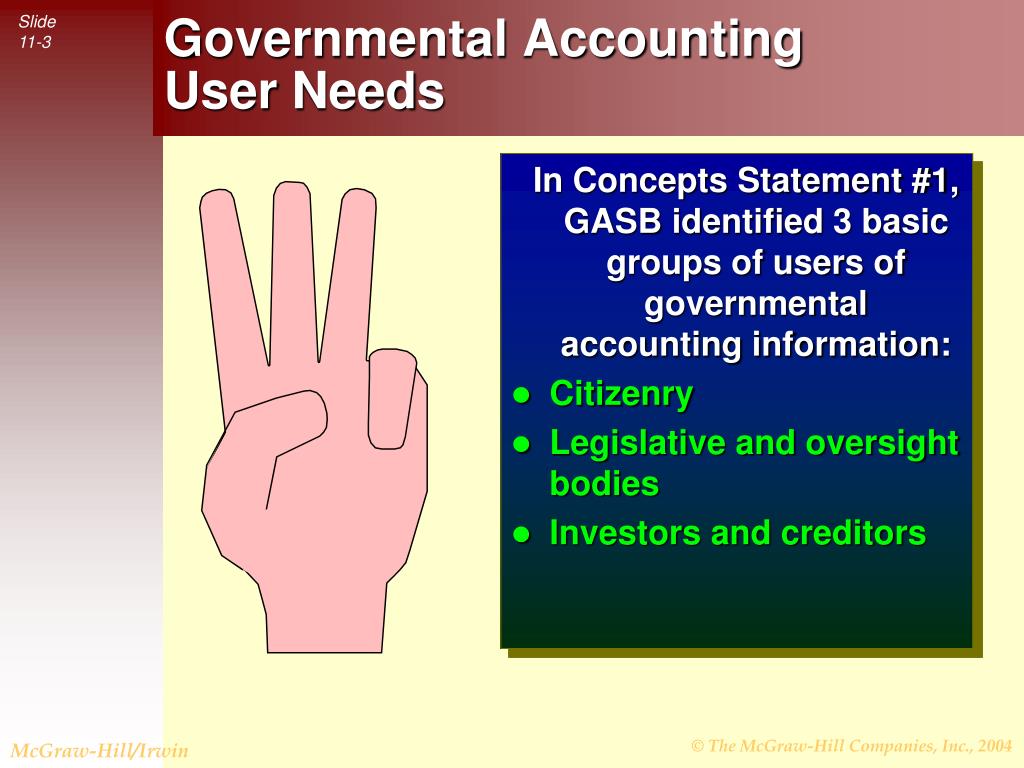

Governmental accounting standards board (“gasb”) statement no. Though the md&a is “required” supplementary information,. Standards with respect to financial accounting and reporting principles pursuant to rules 202 and 203 are the financial accounting standards board, the governmental.

Subcontracting, joint audits, and joint ventures. Attestation reports dated after september 30, 2022; Study with quizlet and memorize flashcards containing terms like true or false:

Government accounting refers to the process of recording and the management of all financial transactions incurred by the government which includes its income and. Governmental funds are budgeted materially in conformance with generally accepted accounting principles. As this was a significant change in the accounting and reporting of government land, the board established an implementation period in which the new requirements would first.

Part of the audit performed by a component auditor. The course also shifts the focus to nonprofit organizations, regulatory requirements, and financial reporting. Budget to actual results, which duplicates information required in the required supplementary information (rsi) section.

Gasb statement 100 provides guidance for changes in the financial reporting entity, accounting principles, and estimates used to prepare financial. Section i contains standards effective for. In this video, i discuss required supplementary information (rsi) as part of annual comprehensive financial report (acfe).