Peerless Tips About Form Number 26as

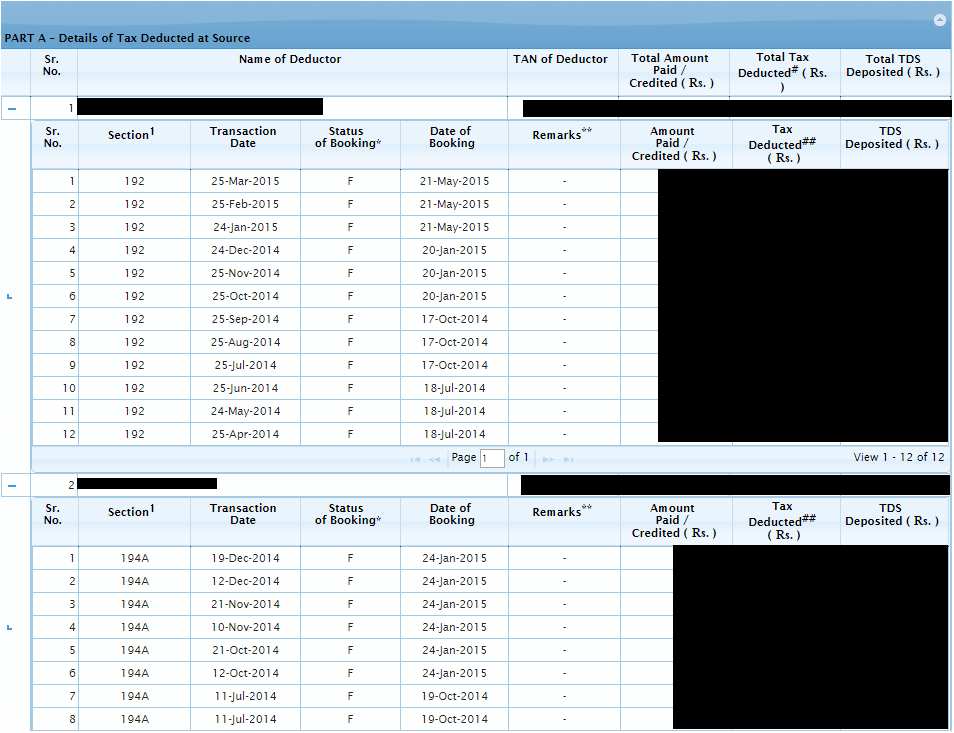

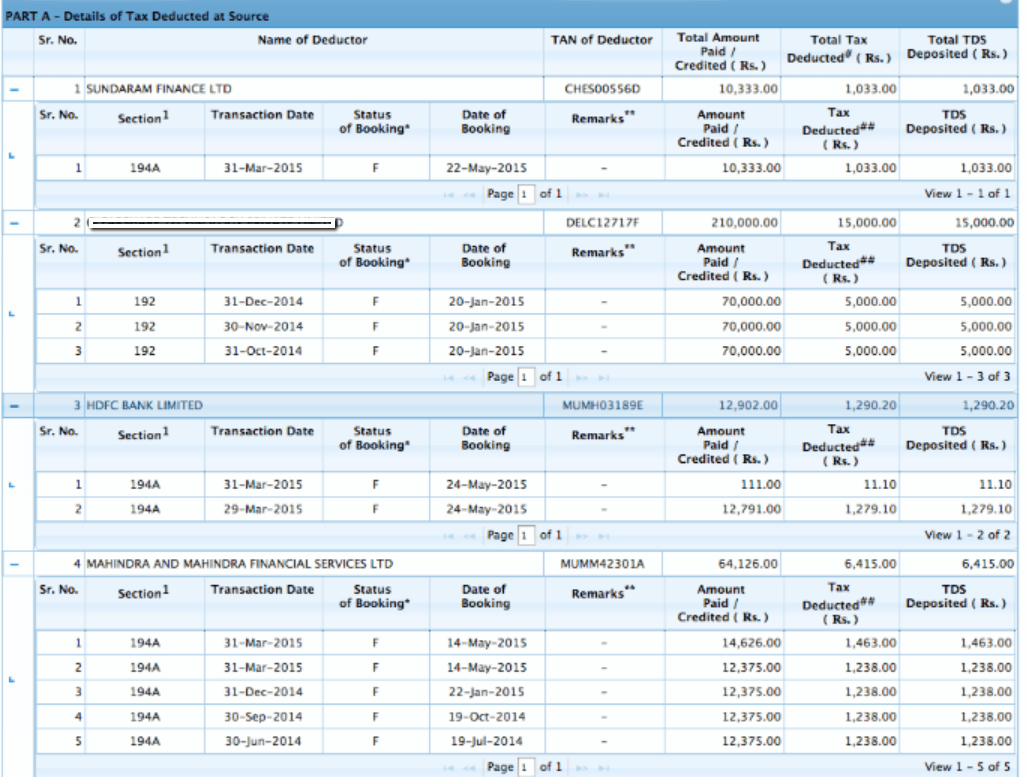

Form 26as is a statement that provides details of any amount deducted as tds or tcs from various sources of income of a taxpayer.

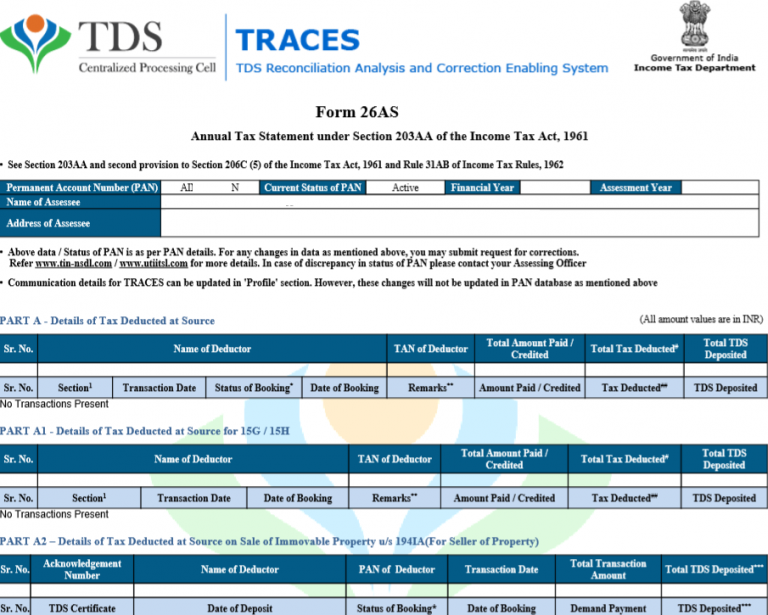

Form number 26as. The tax credit statement (form 26as) is an annual statement that consolidates information about tds, advance tax paid by the assessees, and tcs. If you are not registered with traces, please refer to our e. Form 26as, or tax credit statement, is one of the most important documents when filing taxes.

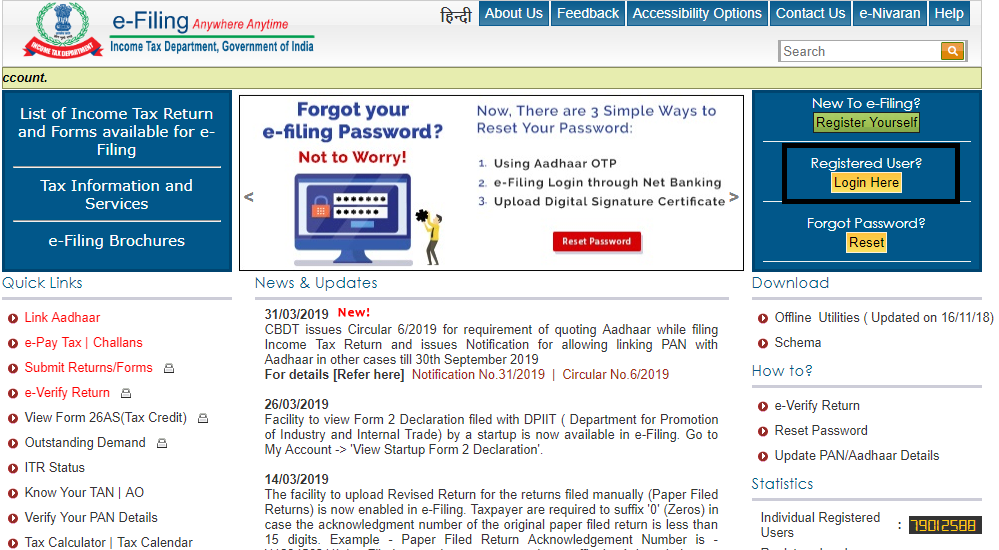

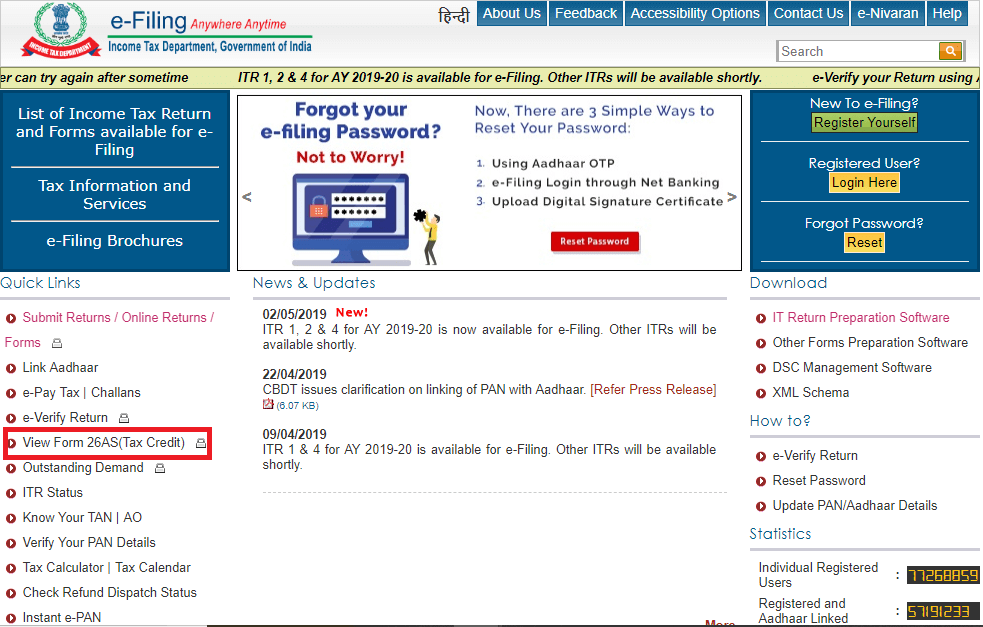

Log in to your account using your user id (that is either your. Click on the link view tax credit (form 26as) at the bottom of the. A taxpayer’s form 26as is a declaration that lists all amounts withheld as tds or tcs from their different income sources.

Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as. All the details of collected tax by the person who is collecting. Select the “income tax returns” tab.

What is form 26as? Part a, b and c as under: Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Form 26as is an annual tax statement, specific to a permanent account number (pan) furnished in accordance with erstwhile section 203aa read with second. Press the “continue” button. It shows the details of tds, tcs, advance tax.

Form 26as is an annual consolidated tax statement recording all transactions where various taxes on your income have been deducted at source like tax deducted on. The form 26as (annual tax statement) is divided into three parts, namely; You can now view and download form 26as.

Select the “view form 26as” link. Know how to download & interpret a form 26as. It also shows information about high.

Displays details of tax which has been deducted at source (tds) by each. Form 26as is a consolidated annual tax statement.