Ideal Tips About Non Operating Income And Expenses

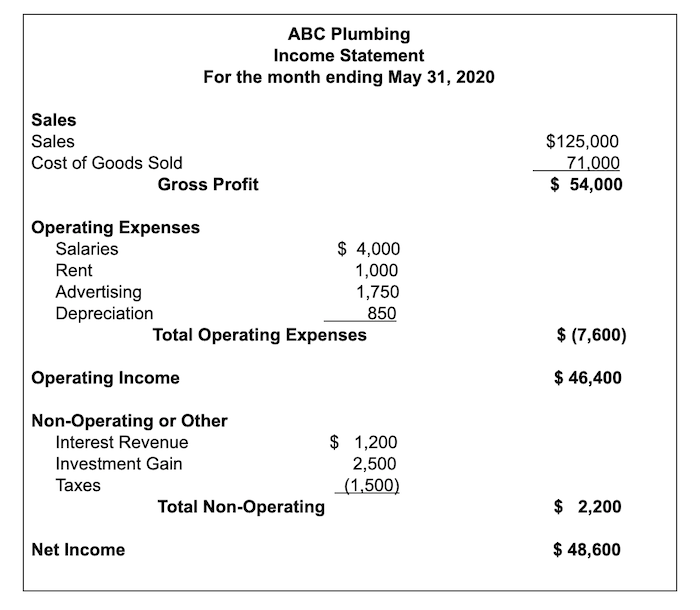

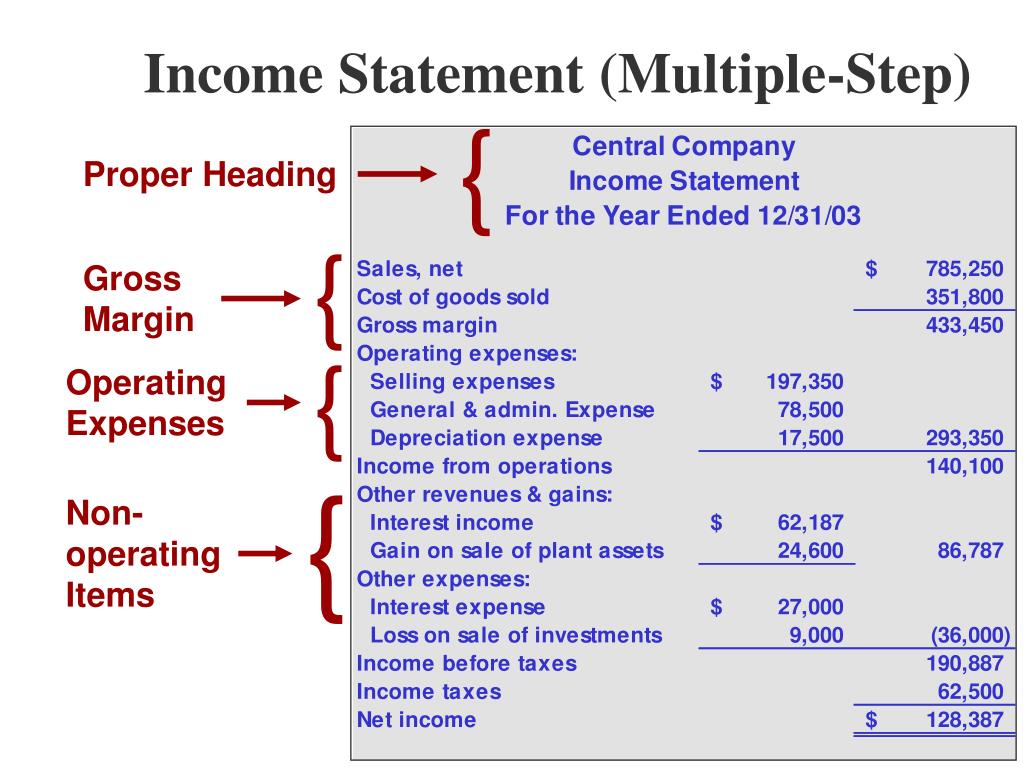

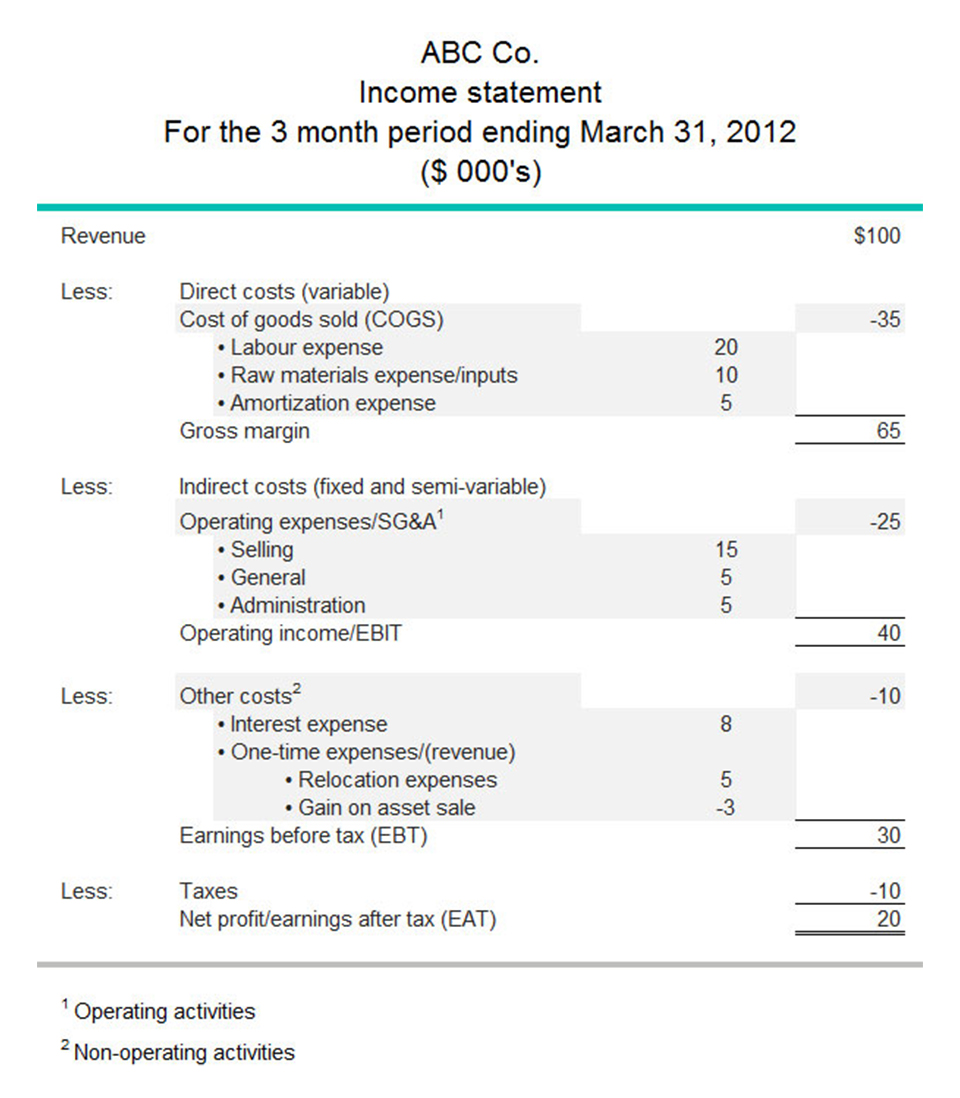

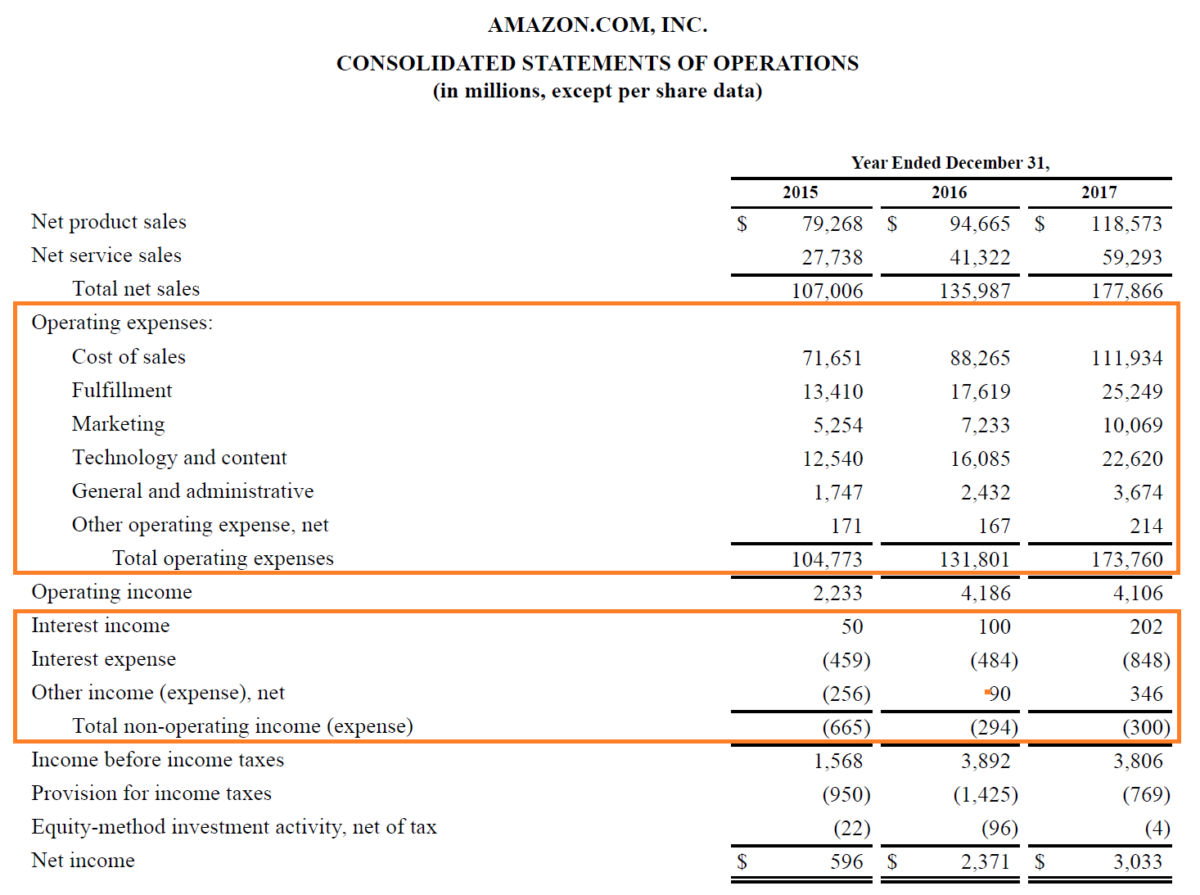

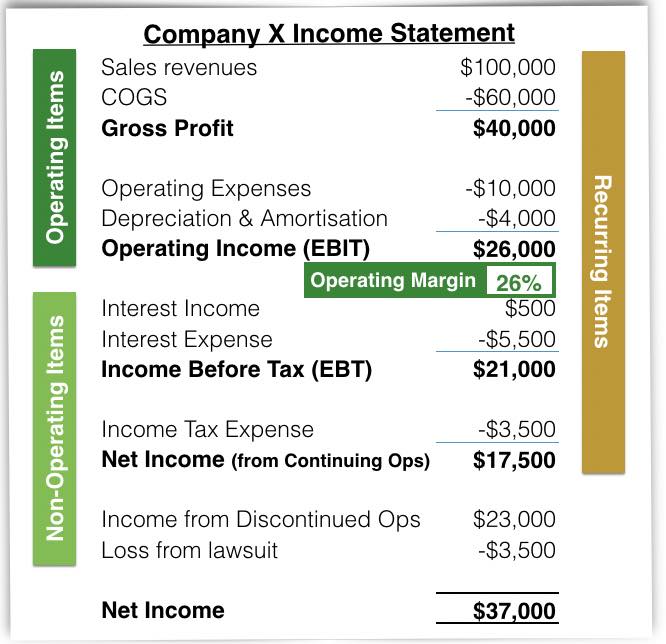

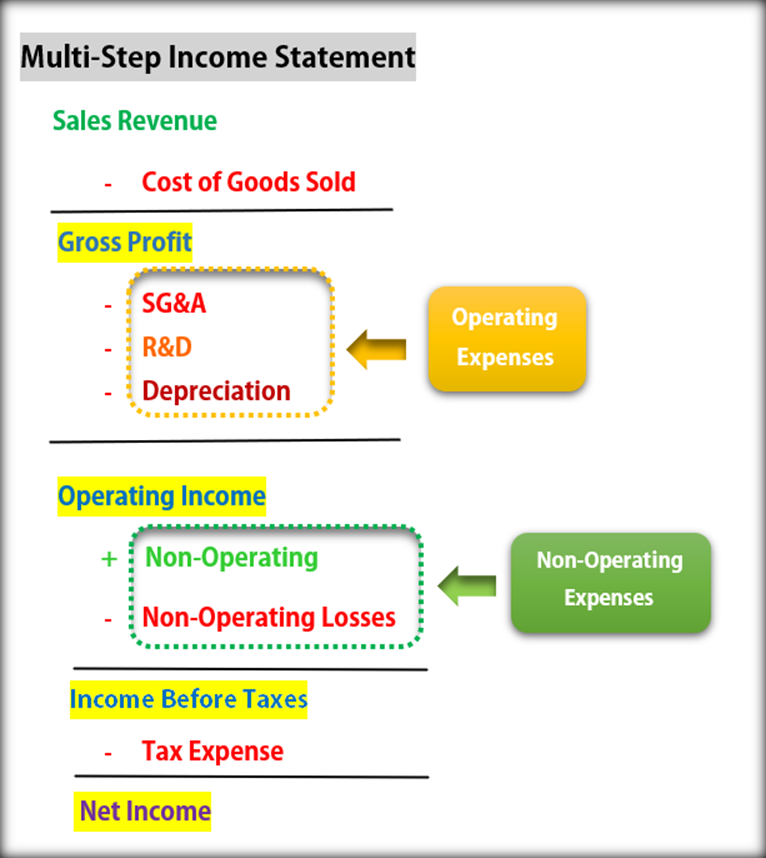

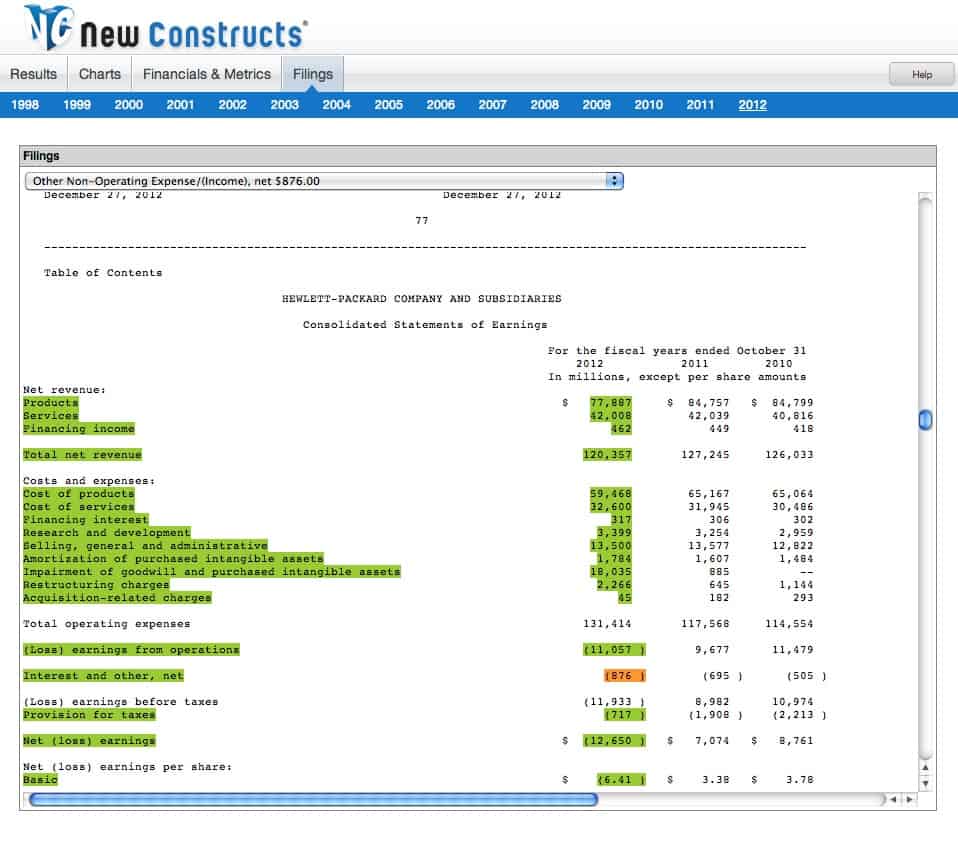

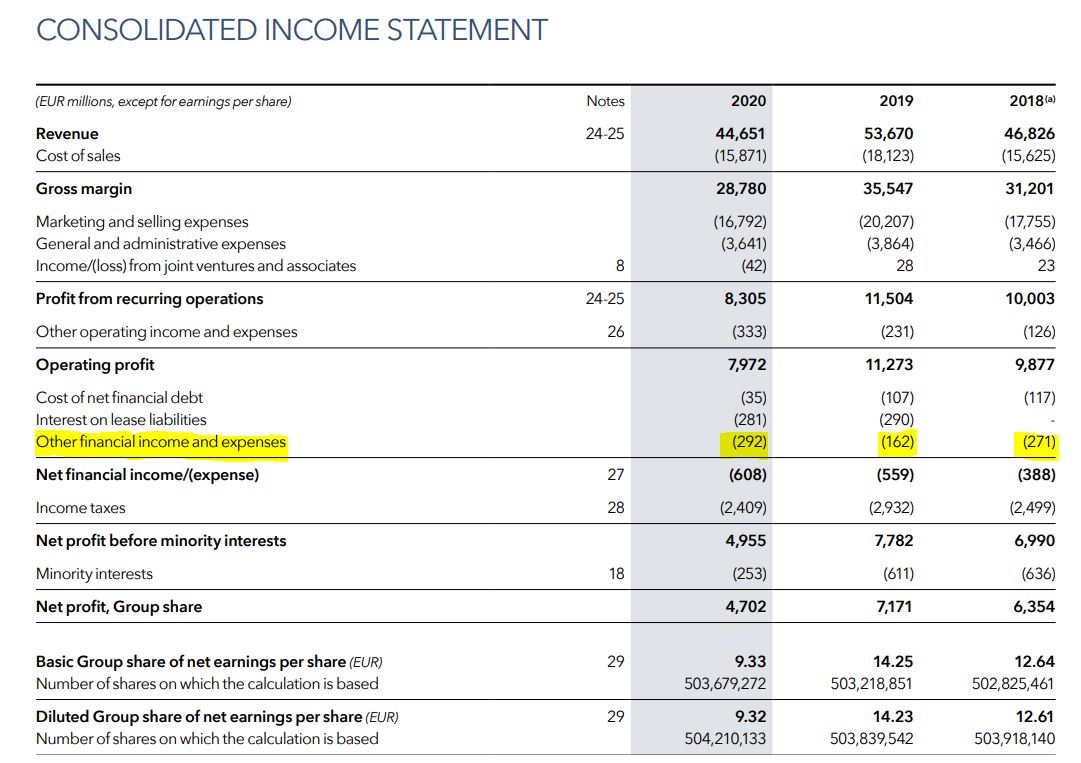

Common expenses of this sort can be interest fees, disposition of asset.

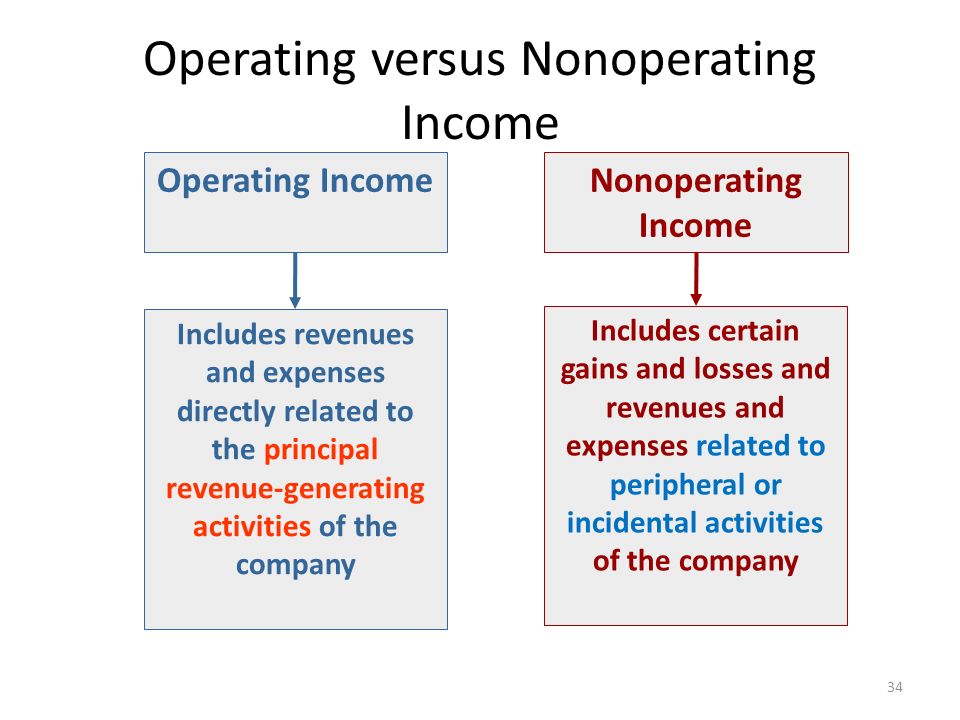

Non operating income and expenses. Revenue is a company’s total income without subtracting any expenses (more on this later). But there is a floor. Understanding the impact of non.

These expenses come from the above categories, including lawsuit costs, reorganizing. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). For example, if you itemize,.

Cogs refers to the direct costs of. At the top the income statement, the cost of goods sold is. Net income is the profit that remains after all.

It refers to the revenue and.

:max_bytes(150000):strip_icc()/non-operating-income-final-d3154875b2944bd8b6592741aa791f1c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)